Note from the Editor: This article’s content is solely based on the author’s opinions and suggestions. It might not have received approval from any of our network partners through reviews, commissions, or other means.

When you are rejected for a loan, it can be difficult to not take it personally. But if your loan application was rejected, it’s crucial to understand why. Once you comprehend what occurred, you can take action to increase your chances the following time.

Low credit scores, a high debt-to-income ratio, or insufficient income are some frequent causes of loan denials. Therefore, if you need a loan but keep getting turned down, read on for a look at seven potential reasons and six suggestions on how to fix it.

How Does LendingTree Get Paid?

Companies on this website pay LendingTree, and this pay may have an impact on where and how offers appear on this website (such as the order). Not all lenders, savings products, or loan options are offered by LendingTree in the market.

Note from the Editor: This article’s content is solely based on the author’s opinions and suggestions. It might not have received approval from any of our network partners through reviews, commissions, or other means.

When you are rejected for a loan, it can be difficult to not take it personally. But if your loan application was rejected, it’s crucial to understand why. Once you comprehend what occurred, you can take action to increase your chances the following time.

Low credit scores, a high debt-to-income ratio, or insufficient income are some frequent causes of loan denials. Therefore, if you need a loan but keep getting turned down, read on for a look at seven potential reasons and six suggestions on how to fix it.

In this guide…

Why you may have been declined for a personal loan

There are a number of reasons why a personal loan application may be rejected, but fortunately you don’t have to speculate. Lenders are required to send you an adverse action notice explaining why you were denied a loan within 30 days. You can get more details by calling the lender and asking what transpired if necessary.

The following factors could be to blame if you apply for a loan but are rejected:

Your credit score was too low

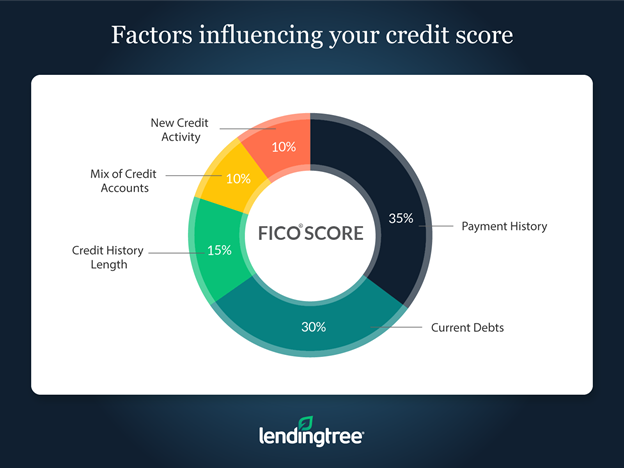

Your FICO credit score is frequently taken into account by lenders when reviewing your personal loan application, along with other elements like your income. Lenders can determine how financially responsible you are based on your credit score. Your credit score gives a significant amount of weight to elements like your payment history and total debt.

Lenders typically have stricter lending criteria if you’re looking for an unsecured personal loan—a loan without collateral attached.

Some lenders publish their minimum credit requirements. If your income is below a lender’s minimum, it will probably be difficult for you to obtain one of its loans. Lenders will charge you a higher rate even if you are approved for a loan despite having a low credit score to account for the possibility that you won’t be able to repay the loan.

Your debt-to-income ratio was too high

A DTI ratio that is too high could be an additional issue you face. This ratio contrasts your total monthly debt with your gross monthly income. Your DTI ratio would be 60%, for instance, if your monthly debt payments are $3,000 and your monthly income is $5,000. A high ratio like this might indicate to lenders that you might find it difficult to pay back debt.

Because of this, it is recommended to strive for a DTI ratio of 35% or less, which is generally regarded as good. That way you’d increase your chances of loan approval.

You tried to borrow too much

A lender could turn down your request for a personal loan if you try to borrow more money than you can afford to repay. This is due to the fact that the lender bases the loan amount it approves for you on your income and other debts. The lender may determine that you are not eligible to borrow a certain amount after reviewing your financial situation.

Consider attempting to obtain a personal loan for $100,000 while aware that your income is insufficient to cover the loan’s monthly repayments. You’re asking for an unreasonable amount, so the lender will undoubtedly say no.

Your income was insufficient or unstable

Lenders consider your income in addition to your credit score and DTI ratio to determine whether you can afford to repay the loan. In essence, they want to ensure that you can afford your monthly payments and won’t let them down by not paying them back on time. The lender may reject your application if they determine that your income is insufficient for the amount you want to borrow or if it shows signs of fluctuating from month to month.

You didn’t meet the basic requirements

Each lender establishes its own requirements, but the majority look for a few fundamental standards, such as,

Review the minimum requirements before applying to make sure you meet them.

Your application was missing information

If important details or supporting documents are absent from your application, a lender might automatically reject it. Before submitting your application, review it carefully, and upload any supporting documents that the lender requests. To make sure the lender has everything it needs to process your application, you could also give it a call.

Your loan purpose didn’t meet the lender’s criteria

Although almost anything can be paid for with a personal loan, there are some limitations you must follow. For instance, it’s typically not advised to use a personal loan for college expenses. A lender might also prohibit you from using the funds for gambling or investing. Your application might be rejected if you stated a loan purpose that is prohibited by the lender’s policies.

How to improve your chances of getting a loan

You can take steps to increase your chances the next time once you’ve determined the reasons why your loan application was rejected. Here are some strategies that could help:

Build your credit score before you apply

The best thing you can do to prevent being rejected for a personal loan due to having a low credit score is to build or repair your credit score before applying. Here is an explanation of how your debt and credit usage affect your credit score:

You can take the following steps right away to raise your credit score:

Look for ways to increase your income and pay down debt

You have two choices to lower your debt-to-income ratio: either increase your income or pay off your debt. If you do both simultaneously, you’ll improve it faster. Although increasing your income isn’t simple, there are other methods you can use to eliminate your debt.

For example, you could try the debt snowball repayment method. With this strategy, you pay off the debt with the lowest balance first before tackling the one with the next-smallest balance. The debt avalanche method, on the other hand, calls for paying off the debt with the highest interest rate first before tackling the next debt with the same high interest rate. The avalanche method is best if you want to reduce interest costs when paying off debt, but a debt snowball can keep you motivated over time by providing frequent, small victories.

Consider increasing your monthly income from $5,000 to $6,500 while lowering your monthly debt payments to $2,000 using the example from the previous section as a guide. Your DTI ratio would be just over 30%, increasing your chances of getting a loan approval.

Request a more realistic loan amount

Requesting a more reasonable loan amount will solve this issue. To do this, look at your spending plan and run the numbers through a personal loan calculator to determine how much you can afford to pay back each month on your personal loan.

By doing this, you’ll increase your chances of getting approved. Furthermore, you won’t run the risk of taking on more debt than you can manage.

Apply with a cosigner

You might also think about getting a cosigner for a personal loan. Your chances of getting turned down for a personal loan can be decreased, and you may be able to get a better interest rate, if you have a cosigner with good to excellent credit.

If you can find a cosigner, make sure they understand that they’ll be responsible for paying back the loan if you’re unable to. However, you should also warn them that their credit score could be impacted if they make a late payment.

Put up collateral

Try applying for a secured personal loan if you’re having trouble getting approved for an unsecured one. A secured loan is one that is supported by collateral, such as a car title or cash deposit, as opposed to an unsecured loan. The benefit of doing this is that it may increase your chances of being approved; however, the drawback is that the lender may take your collateral if you default on the loan.

Prequalify with several lenders

Numerous lenders allow you to prequalify for a loan without having your credit score affected. Prequalification is a convenient way to determine your chances of being approved for a personal loan without jeopardizing your credit score because each lender sets its own borrowing requirements.

It’s important to remember, though, that being accepted during the prequalification process does not guarantee that you will receive a loan. Although it isn’t a guarantee, it is a helpful way to assess your chances and compare interest rates from different lenders.

![]()

How to get a personal loan with bad credit

Though they will help, establishing credit and lowering your DTI ratio can take a long time. There are other steps you can take to get a loan when you have bad or no credit if you need money from a personal loan right away and can’t wait to improve your credit score to apply again.

Check with your local credit union

Check to see if your neighborhood credit union will provide you with a personal loan as one of your first options. Credit unions, which are non-profit institutions, can provide personal loans at lower rates than national banks. Check there first as your employer may have a credit union for its staff. You may be eligible to join some credit unions if you are a family member of someone who belongs to a particular club or association.

Look into local credit unions for personal loans if you don’t already have access to one through your employer or a relative. In order to join some credit unions, you may need to have military experience or belong to a specific service organization.

Additionally, if you join a federal credit union, you might be able to apply for a payday alternative loan (PAL). These unsecured loans have a maximum interest rate of 18% (or 28% on some short-term, small loans) and were created to help consumers avoid the high interest rates of payday loans. The short terms of these loans, which typically have a repayment term of one to twelve months, are a drawback.

Shop around for a loan

You don’t need to put all of your eggs in one basket because each lender establishes its own requirements. Instead, shop around and talk to multiple lenders. If one lender has more lenient loan requirements than another, they might approve you.

Prequalification can be used to your advantage to compare loan offers without harming your credit score, as was previously mentioned. You can, for instance, send your information to several lenders at once using a loan marketplace.

Your information will be verified through a soft credit inquiry, which has no negative effects on your credit. If you take the time to look around, you might find better options than if you just focused on one lender.

Beware of predatory lenders

You might come across lenders who promise approval for everyone when searching for a personal loan with bad credit. For instance, many payday lenders will disburse a loan with no credit check at all.

These no credit check loans have a problem in that they frequently have exorbitant interest rates and fees. Payday loans, for instance, can have APRs of nearly 400%, whereas personal loan rates typically top out at 36% and, for some borrowers, may even be in the single digits.

Avoid lenders that offer loans without credit checks because they might charge you exorbitant interest rates and fees or, worse yet, turn out to be frauds.

These responses to some frequently asked questions may help you understand why you keep getting denied for personal loans if you’re still unsure of the reason why:

What are the reasons a personal loan application gets declined?

When determining whether to approve you for a personal loan, personal loan lenders consider a number of factors, including your credit score and history, debt-to-income ratio, income and employment, and the purpose of your loan.

Low credit scores or thin credit profiles, a high DTI ratio, insufficient income, unstable employment, or a discrepancy between what you want to use the loan for and the lender’s loan purpose requirements are some factors that could cause your loan application to be rejected.

It’s also possible that you filled out your loan application incorrectly or with missing information. If so, speak with the lender to resolve the situation.

What should you do if your personal loan is denied?

Finding out why your loan application was rejected should be your first priority. Read your adverse action notice to learn what transpired. You can also call the lender for an explanation.

Once you’ve identified the issue, you can take action to fix it. For instance, you can attempt to raise it if your credit score is too low before reapplying. You could also eliminate debt to reduce your DTI ratio.

Additionally, it might be worthwhile to look around with various lenders to see if you can find one with more lenient requirements. Other choices to think about include getting a cosigner for a personal loan or choosing a secured loan over an unsecured loan.

How can you avoid having your loan application rejected?

If you’re concerned that your loan application will be denied, try to learn about the requirements of a lender before submitting your application. You may be able to find this information online or by calling the lender to inquire about its requirements.

Once you are aware of what a lender is seeking, assess your own financial situation and make any necessary adjustments. You can consider applying with a cosigner if your credit score is insufficient.

Finally, use online prequalification to determine your likelihood of approval without affecting your credit score. You can compare your offers from various lenders at once when you prequalify for a loan using the LendingTree marketplace, as was previously mentioned.

How long should you wait to apply again after your loan application was declined?

If you repeatedly apply for loans but are rejected, you might want to wait a few months before trying again. One reason is that having a lot of hard credit inquiries can damage your credit and make you appear unreliable to lenders. Another is that enhancing your personal finances, whether it be by increasing your credit score or lowering your debt-to-income ratio, takes time.

However, if you find that you made a mistake on your loan application and it was rejected, it might make sense to get in touch with the lender right away to fix the mistake and resubmit your application. And if you haven’t yet submitted an application, be sure to avert these 13 common personal loan errors.

Receive personal loan offers in minutes from up to 5 lenders Loan type:

Each lender establishes its own credit requirements for borrowers, including the minimum credit score needed to apply for a loan.

Different loan types are appropriate for various borrowers, whether they are financing a college education, a wedding, or the purchase of a home or car.

It may be simpler to be approved for a joint personal loan if you include a co-borrower on your application. Here are some pros and cons to this approach.

FAQ

Why would Wells Fargo deny my loan?

Your credit score is too low. Work on managing your credit. If you have missed payments, get up-to-date and stay current. You have too much debt relative to your income.

What disqualifies you from getting a personal loan?

The most frequent causes of denial are a low credit score or poor credit history, a high debt-to-income ratio, a history of unstable employment, a low income for the desired loan amount, or the absence of critical information or supporting documentation in your application.

How can I get a personal loan after being denied?

- Improve Your Credit Score. Improving your credit score is one of the best ways to make sure you qualify for a personal loan.

- Ask Someone To Co-Sign. …

- Compare Lenders. …

- Prequalify For A Personal Loan.

Can you still get denied after pre approval personal loan?

Your final loan application may still be turned down even though you were preapproved if your financial situation or credit reports changed.