The Home Loan Guarantee for Rural Kansas (HLG) helps financial institutions guarantee the gap under a loan used for land and building purchases, renovation, and new construction costs that may be capitalized or financed within rural Kansas counties. HLG will guarantee the amount of the loan that exceeds 80% of the appraised value of the home, up to 125% of the appraised value of the home subject to the loan. Each amount of guarantee shall not exceed $100,000.

The Home Loan Guarantee for Rural Kansas serves financial institutions that serve existing and prospective homeowners in rural Kansas counties. Eligible financial institutions include banks, trust companies, savings banks, credit unions, savings and loan associations, or any other lending institution.

$2 Million in Non-Recourse Guaranty through the Kansas Rural Home Loan Guarantee Act. The amount of each guarantee shall not exceed $100,000.

Living in rural Kansas has its benefits – beautiful, wide-open spaces, tight-knit communities, and room to grow. However, securing financing as a rural Kansan can be challenging. That’s where rural development loans come in. These specialized loan programs through the USDA aim to improve infrastructure, services, and quality of life in America’s small towns and rural places.

In this article, we’ll break down the key rural development loan programs available in Kansas Whether you’re looking to buy, build, or improve housing, start a business, or invest in your community, there are options to fit your needs

An Overview of Rural Development in Kansas

The state office for USDA Rural Development is located in Topeka. This office oversees rural development initiatives across the state of Kansas. Its mission is to increase economic opportunity and quality of life for rural Kansans.

Some key focus areas for the Kansas rural development office include:

- Increasing economic opportunities for small businesses and cooperatives

- Improving infrastructure for rural communities – water, electric, broadband, etc.

- Promoting affordable housing opportunities

- Supporting value-added agriculture

- Fostering innovation in bioenergy and local food systems

Rural development programs are available to individuals, businesses, nonprofits, cooperatives, tribes, and government entities in eligible rural areas

Kansas Rural Development Loan Programs

Let’s take a closer look at some of the most popular rural development loan programs offered in Kansas.

Single Family Housing Loans

The Section 502 Direct Loan Program provides affordable financing to low and very-low income applicants who want to purchase homes in rural areas.

- Loans of up to 100% of market value plus the upfront guarantee fee

- 33 year fixed interest rate

- Applicants must be unable to obtain traditional financing but still have reasonable credit history

Section 504 Home Repair program provides loans to very-low income homeowners to repair, improve, or modernize their homes.

- Loans up to $20,000

- 1% fixed interest rate

- 20 year repayment term

Multi Family Housing Loans

Section 515 Rural Rental Housing Program provides affordable financing for developers building rental housing in rural areas,

- Up to 102% of total development costs

- 1% fixed interest rate

- 50 year loan term

Section 538 Rural Rental Housing Guaranteed Loan Program guarantees loans from private lenders.

- Guarantees up to 90% of the loan amount

- Encourages new construction or acquisition and rehab of existing properties

Community Facilities Loans

Community Facilities programs provide affordable loan and grant financing for rural infrastructure projects.

- Funds used for healthcare, education, public safety, community support, recreational amenities

- Direct loans, guaranteed loans, and grants available

Water & Environmental Loans

Water & Waste Disposal loan and grant programs finance drinking water, stormwater drainage, and waste disposal systems for rural communities.

- Up to 100% project financing

- Feasibility studies, design, construction costs eligible

- May be used in conjunction with other federal/state funding

Business & Industry Loans

The B&I loan guarantee program provides financing to business owners through commercial lenders.

- Lender loans up to 80% guaranteed by Rural Development

- Use funds to convert, enlarge, repair, modernize facilities

- Both startup and existing businesses are eligible

Rural Energy for America Program (REAP) provides guaranteed loan financing for renewable energy systems and energy efficiency improvements.

- Loan guarantees up to 75% of total project costs

- $25 million maximum guarantee cap

- Eligible entities: small businesses, farmers, tribes, co-ops

Spotlight on the Home Loan Guarantee Program

One innovative rural development loan program to highlight is the new Home Loan Guarantee program in Kansas, launched in 2023. This program aims to improve access to home financing and encourage new construction in rural counties.

Here’s how it works:

- Collaborates with local lenders to provide guarantees on mortgages

- Guarantees up to 125% of the home’s appraised value

- Caps guarantees at $100,000 per loan

- Must be for primary residence in a rural county

By providing the guarantee, the program helps lenders finance loans for new construction, renovations, or home purchases in rural Kansas. This helps creditworthy borrowers secure financing even if they don’t meet strict underwriting criteria.

Over $2 million is available in guarantees through this pilot initiative. It’s an exciting opportunity to grow homeownership and housing availability across rural Kansas.

Applying for a Rural Development Loan

Interested in applying? The first step is to contact your local rural development office or partner lender.

You can check your property’s eligibility using the USDA’s eligibility tool. Applications involve submitting:

- Personal and business financial information

- Proposed project information

- Estimated costs and project timeline

- Purpose and need for the loan

The rural development office will review your application and work with you directly if it is a direct loan or provide a guarantee to your lender if it is a guaranteed loan.

Be sure to review the specific program requirements and application guides to confirm your eligibility before applying.

Accessing capital is a hurdle for many small towns and rural communities in Kansas. However, rural development loans through the USDA provide affordable financing options tailored to rural needs.

Whether you want to invest in housing, infrastructure, businesses, or agriculture, there is likely a program that can help fit your needs. Work with your local rural development office or lender to find the best loan program and financing package.

Rural development loans enable individuals, businesses, and communities to thrive. With sound financing and strategic investment, rural Kansas will continue growing and innovating for years to come.

Yes! You can own a home!

The Home Loan Guarantee for Rural Kansas (HLG) helps financial institutions guarantee the gap under a loan used for land and building purchases, renovation, and new construction costs that may be capitalized or financed within rural Kansas counties. HLG will guarantee the amount of the loan that exceeds 80% of the appraised value of the home, up to 125% of the appraised value of the home subject to the loan. Each amount of guarantee shall not exceed $100,000.

The Home Loan Guarantee for Rural Kansas serves financial institutions that serve existing and prospective homeowners in rural Kansas counties. Eligible financial institutions include banks, trust companies, savings banks, credit unions, savings and loan associations, or any other lending institution.

$2 Million in Non-Recourse Guaranty through the Kansas Rural Home Loan Guarantee Act. The amount of each guarantee shall not exceed $100,000.

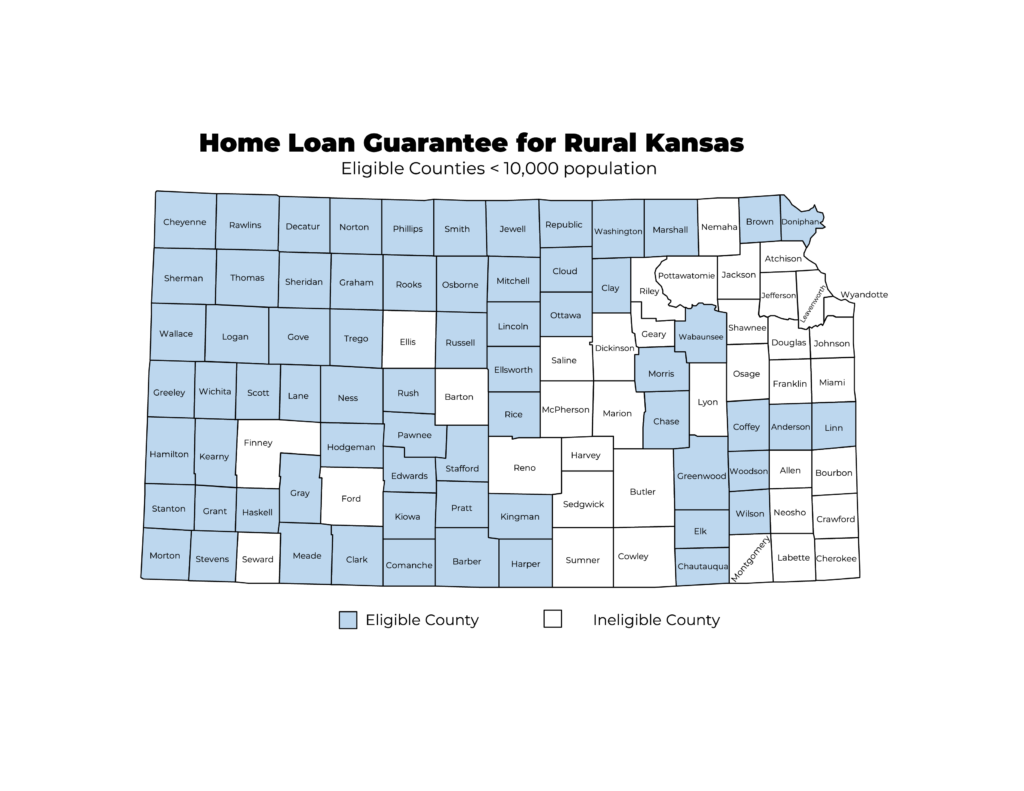

Rural counties are defined as those with populations under 10,000, as certified by the Secretary of State on July 1 of the preceding year.

HLG provides from 80% of the appraised value up to the loan amount or 125% of the appraised value, whichever is less, subject to an overall limit of $100,000.

- If the loan amount is $225,000, the guaranty is $65,000 (80% of the appraisal up to the loan amount because the loan amount is less than 125% of the appraisal)

- If the loan amount is $250,000, the guaranty is $90,000 (80% of the appraised value up to the loan amount because the loan amount is equal to 125% of the appraisal)

Seeking assistance covering your home’s appraisal gap? Find a lender serving your area here.

Want to partner with us as a participating lender?

Prospective lenders must first complete the lender enrollment form. Once approved, KHRC and the lender will jointly complete an MOU. The lender may then submit each new loan to KHRC along with a completed loan enrollment application.

The following entities are eligible to participate as lenders: banks, trust companies, savings banks, credit unions, savings and loan associations, or any other lending institution located in Kansas. All must have an active NMLS and provide mortgage loans.

The HLG program opened January 3, 2023. View the HLG Fact Sheet here.

Questions? Email our Home Loan Guarantee team at [email protected]

Buying a House Using USDA Rural Development Loan ($1,000 DOWN)

FAQ

What is the income limit for a USDA loan in Kansas?

Is a rural development loan the same as a FHA loan?

Is a USDA loan the same as rural development?

Are hud and USDA the same thing?

How do I get a home loan with rural development?

If you would like information about obtaining a home loan with Rural Development, contact your local service center. If you have an account with us and you would like to view your mortgage account information, you must first obtain a USDA level 1 Customer ID and Password, which you can do by registering below.

What is the home loan guarantee for rural Kansas (HLG)?

The Home Loan Guarantee for Rural Kansas (HLG) helps financial institutions guarantee the gap under a loan used for land and building purchases, renovation, and new construction costs that may be capitalized or financed within rural Kansas counties.

What is the Rural Economic Development Loan and grant program?

What do these programs do? The Rural Economic Development Loan and Grant program provides funding for rural projects through local utility organizations. USDA provides zero-interest loans to local utilities which they, in turn, pass through to local businesses (ultimate recipients) for projects that will create and retain employment in rural areas.

Where can I find information on rural development loan payment assistance?

Visit www.rd.usda.gov/coronavirus for information on Rural Development loan payment assistance, application deadline extensions, and more. Questions about Multifamily Housing Programs? Call 1-800-292-8293 USDA Rural Development Community Facilities Disaster Assistance Eligible KS…