A 40-year mortgage is like a traditional 15- or 30-year mortgage, but it offers an extended repayment term. Having ten more years to pay off a loan can give you lower monthly payments, but in the long term you’ll pay far more interest.

40-year mortgages can be a more affordable way to purchase a home in today’s increasingly expensive housing market, but that’s not the most common way they’re used. More often, lenders modify an existing loan’s repayment term to 40 years in order to help struggling homeowners avoid foreclosure.

When buying a home, one of the most important decisions is choosing the right mortgage. Most home loans come with 15- or 30-year repayment terms. But some lenders also offer 40-year mortgages.

A 40-year home loan stretches out your repayment period by an additional 10 years compared to a 30-year mortgage. This results in a lower monthly payment which can make buying a home more affordable. However 40-year mortgages also have some potential drawbacks.

In this comprehensive guide, we’ll explain everything you need to know about 40-year home loans, including:

- What is a 40-year mortgage?

- How does a 40-year mortgage work?

- Pros and cons of 40-year mortgages

- How to qualify for a 40-year mortgage

- Where to get a 40-year mortgage

- Alternatives to 40-year mortgages

What Is a 40-Year Mortgage?

A 40-year mortgage is a home loan with a repayment term of 40 years. The most common mortgage terms are 15 and 30 years.

With a 40-year mortgage, you’d make 360 monthly payments over 40 years to pay off the loan (assuming you make all payments on time and don’t make any extra payments).

40-year mortgages can be fixed-rate or adjustable-rate. The interest rate remains unchanged for the life of a fixed-rate loan. With an adjustable-rate mortgage (ARM), the rate starts out fixed for a certain period, then adjusts periodically.

How Does a 40-Year Mortgage Work?

A 40-year mortgage works similarly to 30-year and 15-year home loans, just with a longer repayment timeline. Here’s a quick rundown:

-

Interest rate – The interest rate on a 40-year fixed-rate mortgage stays the same for the full 40 years Rates for 40-year loans may be slightly higher than for 30-year mortgages.

-

Monthly payments – By spreading payments over 40 years instead of 30, your monthly payment is lower. However, you pay more interest over the life of the loan.

-

Amortization – Like other mortgages, 40-year loans amortize, meaning part of each payment goes toward interest and part pays down the principal balance. Equity builds slowly over 40 years.

-

Prepayment – 40-year mortgages allow prepayment, so you can pay extra each month or make a lump sum payment to pay off the loan early. There are rarely prepayment penalties.

Pros and Cons of 40-Year Mortgages

Before committing to a 40-year home loan, weigh the advantages and disadvantages:

Pros

- Lower monthly payments

- Increased buying power

- Smaller down payment needed

Cons

- You pay more interest over the loan term

- Slower buildup of home equity

- Potentially higher interest rates

- Limited lender options

The lower monthly payment is the main appeal of 40-year mortgages for most borrowers. By stretching out the repayment period, the payment decreases, making an expensive home more affordable.

However, because you’re paying interest for longer, you end up paying significantly more over the life of the loan. You also gain equity at a slower pace.

How to Qualify for a 40-Year Mortgage

40-year mortgages aren’t as widely available as 30-year loans. Here are some tips for getting approved:

-

Check your credit score – You’ll need a credit score in at least the mid-600s. The higher your score, the better your chances of approval.

-

Lower your debt-to-income ratio – Lenders will review your DTI to ensure you can afford the monthly payments. Paying down debts can help lower your DTI.

-

Make a down payment – You’ll likely need at least 10% down for a 40-year mortgage. The larger your down payment, the better.

-

Find a lender that offers 40-year loans – Only some lenders provide 40-year mortgages, so you may need to shop around.

Meeting the lender’s eligibility requirements is key. Work on improving your credit, debt, and down payment funds before applying.

Where to Get a 40-Year Mortgage

Not all lenders offer 40-year mortgage options. Large banks and mainstream lenders like Chase, Wells Fargo, and Bank of America typically don’t provide them.

Here are some possible sources for 40-year home loans:

- Small local and regional banks

- Credit unions

- Online mortgage lenders

- Mortgage brokers who work with niche lenders

Mortgage brokers can be helpful for finding lenders that offer 40-year loans. You can also check with lenders you have existing accounts with.

Alternatives to 40-Year Mortgages

If you need a lower monthly payment but are hesitant about a 40-year term, consider these options:

-

30-year mortgage – The payment is higher than a 40-year loan but much more affordable than a 15-year mortgage.

-

FHA loan – FHA loans allow low down payments and have lenient credit requirements.

-

VA loan – For veterans and military members, no down payment is required for a VA loan.

-

USDA loan – USDA loans don’t require a down payment and have below-market interest rates. You need to meet income limits and purchase in an eligible rural area.

-

ARM – Adjustable-rate mortgages start with a low fixed rate for several years before becoming variable.

-

Buy a less expensive house – Opting for a lower-priced home can make a 30-year loan payment manageable.

Carefully compare all your home financing options before deciding if a 40-year mortgage is right for you.

The Bottom Line

40-year mortgages allow you to stretch out your home loan repayment over 40 years instead of the standard 30 years. While this results in a lower monthly payment, you pay significantly more interest over time and build equity slower.

These loans aren’t very common, but may make sense if you want a lower payment and don’t mind paying more interest long-term. Be sure to shop around, as not every lender offers 40-year mortgages.

How does a 40-year mortgage compare to a 30-year mortgage?

A 40-year mortgage can lower your monthly payments, but it’ll also greatly increase how much you’ll pay in interest. To see what this could look like in the real world, choose the example below that applies to your situation. If you’re only interested in how a longer loan term can affect your ability to build home equity, head to the final example.

Below, we compare two hypothetical loan options for a $430,000 home with a 13% down payment. As a best-case scenario, we’ll give both loans the same interest rate.

| Loan amount | Interest rate | Monthly payment | Total cost | |

|---|---|---|---|---|

| 30-year mortgage | $374,100.00 | 7.79% | $2,690.45 | $968,560.64 |

| 40-year mortgage | 374,100.00 | 7.79% | $2,542.39 | $1,220,346.21 |

Takeaways: While you’d save $148.06 per month on your mortgage payments by going with a 40-year loan, you would end up spending about $251,800 more for the privilege.

Here we look at both 30- and 40-year loan options for a home with $300,000 still owed to the lender. In our example, there is no difference in the interest rate because a loan modification doesn’t alter the interest rate of the existing loan. The monthly payment amounts reflect principal and interest only.

| Loan amount | Interest rate | Monthly payment | Total cost | |

|---|---|---|---|---|

| 30-year mortgage | $300,000.00 | 6.27% | $1,851.06 | $666,380.04 |

| 40-year mortgage | $300,000.00 | 6.27% | $1,707.45 | $819,576.04 |

Takeaways: In this example, you would have paid $153,196 more in interest by choosing to modify your loan. But, on the other hand, if this was the only way to prevent foreclosure, it may very well have been worth it.

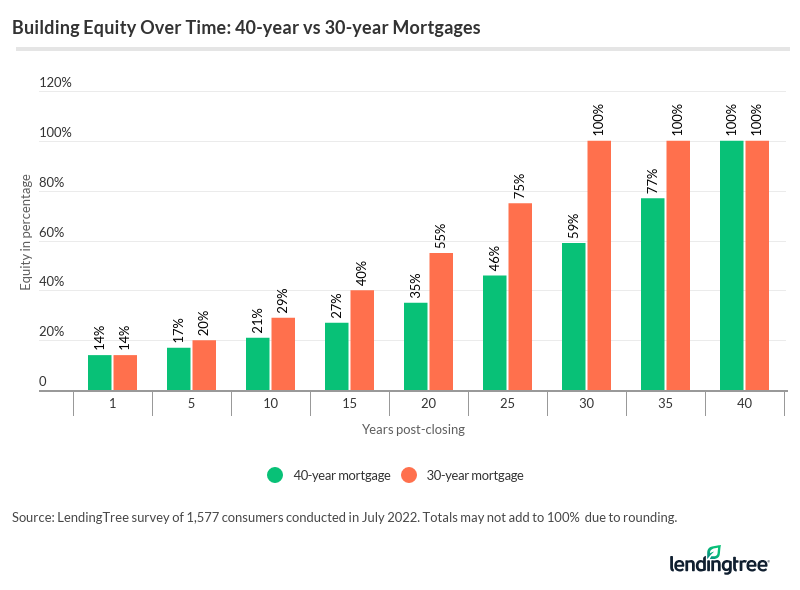

It’s worth taking a look at how much more slowly you’ll build equity with a 40-year loan, because it can affect your ability to get other loans or sell your home in the future. The chart below compares the equity-building timelines for 30- and 40-year mortgages.

As you can see, with a 30-year loan, you would build 20% equity in just five years — but with a 40-year loan, you’d have to wait nearly nine years to build that much equity. And depending on other terms of the loan (e.g., an interest-only period), it could take even longer to build equity.

Beware: 40-year loans are seen as risky The CFPB considers all of these loan types to be risky for borrowers. 40-year fixed mortgage rates may also be higher than loans with shorter terms. But even if they don’t carry a higher interest rate, the 10-year difference in the two loan terms can cost borrowers a huge amount in interest over the life of the loan (more on this below).

| Pros | Cons |

|---|---|

|

Lower monthly payments. The payment on a 40-year mortgage is more affordable than a 30-year mortgage with the same loan amount. Increased buying power. The extended payment term and lower monthly payments of a 40-year mortgage may allow some buyers to purchase more expensive homes. More flexibility. Loans with an initial period in which you only pay interest can allow a little more flexibility at the beginning of your loan term. This can be a nice feature if you find yourself grappling with the high costs of moving into, furnishing or fixing up a new home. |

Higher interest rates. Mortgages with longer terms can have higher interest rates than loans with shorter terms. Harder to find. Not all lenders offer 40-year home loans because they’re not a mainstream mortgage product. Can be risky. If the 40-year loan has unusual components, such as an interest-only period, negative amortization or a balloon payment, you could be taking on significant risk. Can negatively affect credit. A mortgage modification can affect your credit. Equity builds slowly. With a 40-year mortgage you’ll build equity at a slower pace because the loan term is drawn out. Higher total loan costs. A 40-year mortgage will have a higher total cost than shorter-term mortgages. |

The (shocking) Truth Behind 40 Year Mortgages

FAQ

Are 40-year mortgages still available?

Can a qualified mortgage be 40 years?

Why not get a 40-year mortgage?

Are there 40 or 50-year mortgages?

What is a 40 year mortgage?

A 40-year mortgage allows you to repay your loan over 40 years instead of the more common 30 or 15 years. This extended term comes with a lower monthly payment, but at the cost of a higher interest rate and more paid toward interest over the life of the loan. Forty-year mortgages are a type of non-qualified mortgage (non-QM loan), however.

Should I get a 40-year mortgage?

The most common mortgage loan terms are 15 and 30 years, but if you need a lower monthly payment, a 40-year mortgage may be an option. While this longer loan payoff period could reduce your mortgage payment and bring home affordability within reach, a 40-year mortgage comes with limitations that should give you pause.

How long does a 40 year home loan last?

Traditionally, mortgages come in loans anywhere between 8 – 30 years. In some cases, 40-year loans may have other features. For example, there might be interest-only periods for a certain timeframe at the beginning of the loan before switching to payments of principal and interest for the remainder of the term. How Does A 40-Year Home Loan Work?

Where can I get a 40-year home loan?

You can do an online search to find lenders who offer 40-year home loans. We found 40-year mortgage options at NewFi Lending, an online mortgage lender, and Metro Credit Union and Needham Bank, both headquartered in Massachusetts.