[Updated in April 2021]

^ This post’s screenshots and walkthrough date back a few years. I have stopped updating this post since TaxAct increased its prices in the last few years. Please consider switching to TurboTax, H&R Block, or FreeTaxUSA.

I provide an explanation of how to report backdoor Roth in TaxACT per a reader’s request.

Your contribution to a traditional IRA *for* that year and your conversion to a Roth IRA *during* that year are reported on your tax return.

For instance, you report the contribution you made *for* last year on your tax return, regardless of whether you made it last year or between January 1 and April 15 of this year. Additionally, you report that you converted to a Roth *during* the previous year, regardless of whether the contribution was made for that year, the year prior, or any earlier years. As a result, a contribution made the year before goes on the tax return for that year. A conversion that you completed this year following your 2018 tax contribution is included in your 2018 tax return, which you will file the following year.

By completing your conversion in the same year that you make your contribution for the current year, you save a great deal of confusion and do yourself a great favor. Contribute for this year and convert it before December 31. This way everything is clean and neat. See Make Backdoor Roth Easy On Your Tax Return.

The screenshots below are taken from TaxACT desktop software. If you use TaxACT Online, the screens may be similar. Hereâs the scenario used in the example:

Should your situation differ from this one, you will need to make some modifications to the screens displayed here. The images were captured in order to complete a 2014 return in 2015. In a different year you just advance the year. Wherever the screenshot says 2014, think last year. Wherever it says 2015, think this year.

This guide will help you understand how to report backdoor Roth contributions in TaxAct, a popular tax preparation software. We’ll cover the steps involved, along with helpful tips and insights to ensure accurate and efficient reporting.

What is a Backdoor Roth?

A backdoor Roth is a strategy used by individuals with high incomes who are ineligible to contribute directly to a Roth IRA. It involves making a non-deductible contribution to a traditional IRA and then converting it to a Roth IRA. This allows individuals to enjoy the tax-free growth and tax-free withdrawals of a Roth IRA, even if they are above the income limit for direct contributions.

Reporting Backdoor Roth in TaxAct

To report your backdoor Roth contributions in TaxAct, follow these steps:

1. Non-Deductible Contribution to Traditional IRA

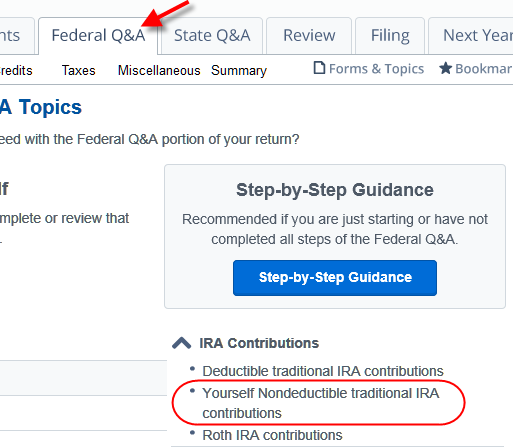

- Go to the “Federal Q&A” section.

- Under “IRA Contributions,” select “Yourself Nondeductible traditional IRA contributions.”

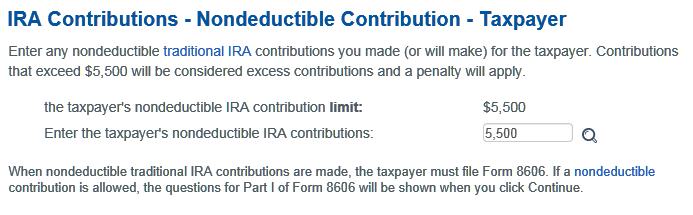

- Enter your contribution amount for the year.

- Enter your prior years’ basis from line 14 of Form 8606 in your previous year’s tax return, or check the box for no basis.

2. Convert Traditional IRA to Roth

- Go back to “Federal Q&A.”

- Under “Retirement Plan Income,” select “IRA, 401(k), and pension plan distributions (Form 1099-R).”

- Click “Add” to add a 1099-R.

- Click “Quick Entry” and fill out the 1099-R as you received it.

- Scroll down and fill in your conversion amount.

- Leave the “Prior Year Nondeductible Contributions” box blank if you don’t have any carryover basis. Check it and enter the amount if you do.

3. Verify Form 8606

- Review Form 8606 to ensure it accurately reflects your contributions and conversions.

- Pay attention to lines 8, 13, and 16, which should reflect your non-deductible contributions, basis, and conversion amounts, respectively.

4. Check Form 1040

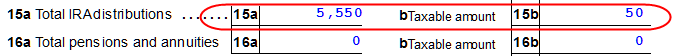

- Open Form 1040 and scroll down to line 15.

- This line should show your Roth conversion amount and any taxable earnings.

Additional Tips

- If you have any questions or uncertainties, consult a tax professional for guidance.

- Keep detailed records of your contributions, conversions, and any related documents for future reference.

- Be aware that tax laws and regulations may change, so stay informed about any updates that may affect your backdoor Roth contributions.

Reporting a backdoor Roth in TaxAct is a straightforward process. By following the steps outlined above, you can ensure accurate and compliant reporting of your contributions and conversions. Remember to consult a tax professional if you have any questions or require further assistance.

Non-Deductible Contribution to Traditional IRA

The non-deductible contribution to the Traditional IRA *for* the previous year is entered first. Fill out this section if you made a contribution before the end of the previous year, if you did it this year before April 15, or if you plan to do it this year. Make sure you included your contribution on your prior year’s tax return if it was made for the prior year. If not, fix your return for the previous year first.

As per Federal Q

Enter your contribution amount for last year.

In your previous year’s tax return, enter your prior year’s basis from line 14 of Form 8606, or select the option for no basis.

You get this quick summary. Repeat for spouse if applicable.

Taxable Income from Backdoor Roth

Let’s confirm how you are taxed on the backdoor Roth after going over everything.

Click on Forms on the top and open Form 1040.

Proceed to the right and scroll down to locate line 15. It displays a $5,550 Roth conversion with $50 taxable.

That’s right—you aren’t allowed to make direct contributions to a Roth IRA, but you managed to get money into one through a backdoor. If you held off on making contributions until after conversion, you will have to pay tax on a small amount of earnings. That is insignificant in comparison to the years of tax-free growth on your contributions.

You are paying 5–10 times too much if you are paying an advisor a percentage of your assets. Find an impartial advisor, pay for advice, and use that advice alone.

Backdoor Roth IRA – TurboTax

FAQ

How do I report backdoor Roth IRA on my tax return?

Where do you put Roth conversion on tax return?

How to enter Form 8606 in TaxAct?

How do I report a backdoor Roth IRA?

Form 8606 is the key to reporting backdoor Roth IRAs successfully. The tax form, which is filed as part of your overall return, reports to the IRS that the Traditional IRA contribution you made to start the process of the backdoor Roth IRA was not deductible. In other words, you are not taking a tax deduction for the Traditional IRA contribution.

How do I file taxes on a backdoor Roth IRA?

To file taxes for your backdoor Roth IRA, fill out and file IRS Form 8606 when you file your annual tax return. This form is used for all deductible IRA contributions, IRA distributions, and IRA conversions. When do you pay taxes on a Roth IRA?

Are backdoor Roth IRA contributions tax deductible?

A backdoor Roth IRA can be an excellent way for taxpayers who may not otherwise be eligible to contribute to a Roth IRA. However, there are a few tax implications to be aware of. Contributions to a traditional IRA are tax-deductible, while those to a Roth IRA aren’t.

Is a backdoor Roth IRA a tax dodge?

The backdoor Roth IRA strategy is not a tax dodge. When you transfer the assets of a traditional IRA to a Roth IRA, you owe taxes on any funds—the principal, earnings, and appreciation—that have not been taxed previously. If the IRA was funded solely with tax-deductible contributions, then the entire value of the transferred assets is taxed.