Once you get pre-approved for a mortgage, comparing rates is important. However, what’s even more important is how you compare mortgage rates. You can do that with a loan estimate.

When it comes time to get a loan, every lender will provide you with a loan estimate. These estimates will help you decide which loan to choose. Don’t rely on banks to make the best decision for you.

Since everyone is different, we will break it down section by section and show you what is essential and how to compare rates. Understanding Loan Estimates [and How to Get the Best Mortgage Rates]

Getting pre-approved for a mortgage is an important first step when buying a home. It shows sellers that you are a serious buyer and gets the loan process started early. But pre-approval on its own doesn’t give you all the details you need about your potential mortgage. A Loan Estimate fills in those details, providing estimated costs for the loan you are considering. So do you get a Loan Estimate with pre-approval?

The short answer is – not automatically. While a pre-approval letter states the loan amount you qualify for, a Loan Estimate gives you mortgage terms, projected payments, interest rates, and closing costs. To get this detailed estimate, you need to take an extra step and request a Loan Estimate from your lender.

Below we will explain exactly what a pre-approval letter entails, when you can request a Loan Estimate, and how having both sets you up for success as a homebuyer:

What Is Mortgage Pre-Approval?

Pre-approval is when a lender reviews your finances and confirms you meet the basic requirements to qualify for a home loan. Getting pre-approved involves:

-

Providing personal and financial documents like bank statements, tax returns, and pay stubs to verify income and assets.

-

Allowing the lender to check your credit history and score.

-

Submitting basic information on the loan amount property and down payment you seek.

Once the lender runs this initial evaluation, they issue a pre-approval letter. This letter states the maximum home loan amount you can qualify for based on your financial profile. It shows home sellers you are qualified and ready to move forward.

What the Pre-Approval Letter Contains

While pre-approval is an important first step, the letter itself doesn’t give specific mortgage details. Here’s what is typically included:

-

Your name and basic personal information

-

The maximum loan amount you qualify for

-

The type of loan you are pre-approved for – conventional FHA VA, etc.

-

Conditions you still need to meet for full approval, like providing appraisal and title paperwork

-

An expiration date, often 90 days from issue

-

Signature of authorized lender representative

The pre-approval letter doesn’t list estimated costs like interest rates, monthly payments, or closing fees. It also doesn’t lock in a rate with the lender. To get these specifics, you need to take the next step and request a Loan Estimate.

When Can You Get a Loan Estimate?

Under the TILA-RESPA Integrated Disclosure (TRID) rule, you are entitled to receive a Loan Estimate within three business days of submitting a mortgage application.

This means you can request a Loan Estimate as soon as you complete the full application with a lender, including after getting pre-approved. The Loan Estimate must be based on the specific loan amount, term, interest rate, and other details you apply for.

Some key points about getting a Loan Estimate:

-

You don’t need a property under contract yet. The Loan Estimate can use estimated property taxes and insurance costs.

-

Your credit will likely be checked again as part of the full application. Multiple checks in a short timeframe minimize damage to your score.

-

Loan Estimate terms may change if your application is delayed or denied. You would get a revised Estimate in that case.

-

An Estimate isn’t a guarantee of final loan approval or costs. But it lets you compare options.

-

Lenders have 3 days to issue your Estimate. Shop around and compare multiple Loan Estimates.

What Is Included in the Loan Estimate?

While a pre-approval states the loan amount you qualify for, the Loan Estimate breaks down the costs and terms of that loan. Details provided include:

Loan terms

- Interest rate

- Length of the loan (term)

- Monthly principal and interest payments

Closing costs

- Origination charges

- Appraisal fees

- Credit check fees

- Taxes and other assessments

- Homeowner’s insurance

- Prepaids like homeowner’s insurance

- Escrow account deposits

Other costs

- Projected property taxes

- Homeowner’s insurance

- Mortgage insurance

Sections are also included breaking down your projected payments over the life of the loan. Having all these estimated costs and terms in writing helps you evaluate and compare different mortgage offers.

Shop Around with Loan Estimates

To find your best mortgage deal, experts recommend getting Loan Estimates from 3 lenders. Comparing the Estimates side-by-side lets you see:

- Which lender offers the lowest interest rate and fees?

- Which loan term and type saves more over time?

- Which lender provides the best customer service?

Narrow down your options using the Loan Estimates, then submit your full application and paperwork to your top lender choice.

Just remember, the terms and figures on the Loan Estimate aren’t guaranteed or locked in until your loan is formally approved. So shop and compare quickly rather than drawing the process out.

How Pre-Approval and Loan Estimate Work Together

Getting pre-approved first, then requesting Loan Estimates from lenders you are serious about, covers all your bases as a home buyer. Here’s how it works:

-

Get pre-approved: Gives you an idea of your maximum affordable loan amount and shows sellers you are qualified.

-

Find a home and make an offer: Include your pre-approval letter with the offer to strengthen your position.

-

Request Loan Estimates: Compare mortgage terms from multiple lenders once your offer is accepted.

-

Choose your lender: Select the lender and loan option that best fits your needs based on the Loan Estimates.

-

Submit full application: Work with your chosen lender to complete the application and approval process.

Other Key Questions About Pre-Approval and Loan Estimates

If you are just starting the home buying process, you likely have lots of questions about pre-approval letters, Loan Estimates, and what they mean for your mortgage application. Here are answers to some common questions:

How long are pre-approvals and Loan Estimates valid?

-

Pre-approval letters usually expire after 60-90 days.

-

Loan Estimates are valid for 10 business days from when you received it. You can accept, reject, or negotiate the offer within this time.

When should I get pre-approved?

Ideally 2-3 months before you want to make an offer, so you are ready to move fast when you find the perfect home. Avoid getting pre-approved too early, as your financial profile could change.

Do I need a property under contract to get a Loan Estimate?

No, you can provide estimated details on the property. You just need to complete a full mortgage application with the lender.

Can I negotiate my Loan Estimate?

Yes, you can negotiate the interest rate and certain fees if you see opportunities for savings. Locking your rate early can also help secure a lower rate.

How do I know which lender to get pre-approved with?

Shop around and compare options from banks, credit unions, and online lenders. Consider interest rates, fees, customer service and reviews. Get pre-approved with 3-5 lenders.

What credit score is needed for pre-approval?

Each lender sets score requirements, but you typically need a FICO score of at least 620 for conventional loans or 580 for FHA loans to qualify for pre-approval and a Loan Estimate.

The more you understand about pre-approval letters and Loan Estimates, the smoother your home buying experience will be. If you have additional questions, the knowledgeable loan officers at various lenders are there to help. Reach out to multiple lenders early to discuss your specific situation and get the ball rolling. With pre-approval and Loan Estimates in hand, you will be set up for success through each step of your home purchase.

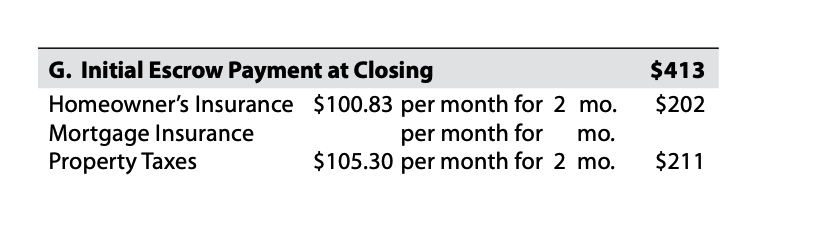

Other Costs – G. Initial Escrow Payment at Closing

The Initial Escrow at Closing section is money due at closing, similar to the Prepaids in the previous section.

However, these are different than Prepaids because they go towards setting up your escrow account, which allows you to pay these costs monthly as part of your mortgage payment.

Escrow accounts ensure you won’t be surprised by significant lump-sum payments and make for easy budgeting.

Some of the line items you’ll see here include:

- Homeowner’s Insurance protects the home and its contents against unexpected damage and events. Flood insurance is separate from homeowner’s insurance and will also show up in this section.

- Mortgage Insurance allows you to buy a home with less than 20 percent down

- Property Taxes are the taxes paid to the county or state for owning your home

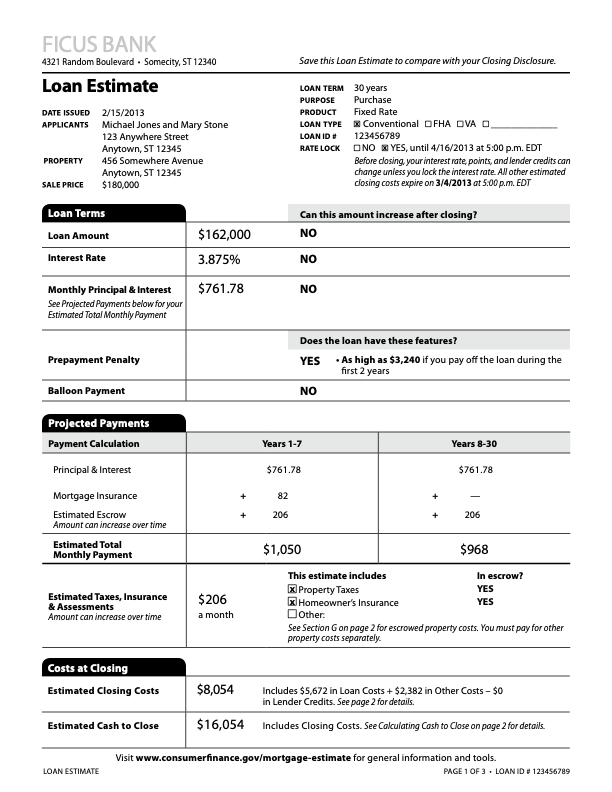

How to Read a Loan Estimate

Below is a screenshot of a loan estimate sent to everyone. The sample we’re using exists on the CFPB website.

Tip: Before you start, ensure that your loan estimate has the same fields as the example above. You should request a new one from your lender if it does not.

We’ll start right at the top.

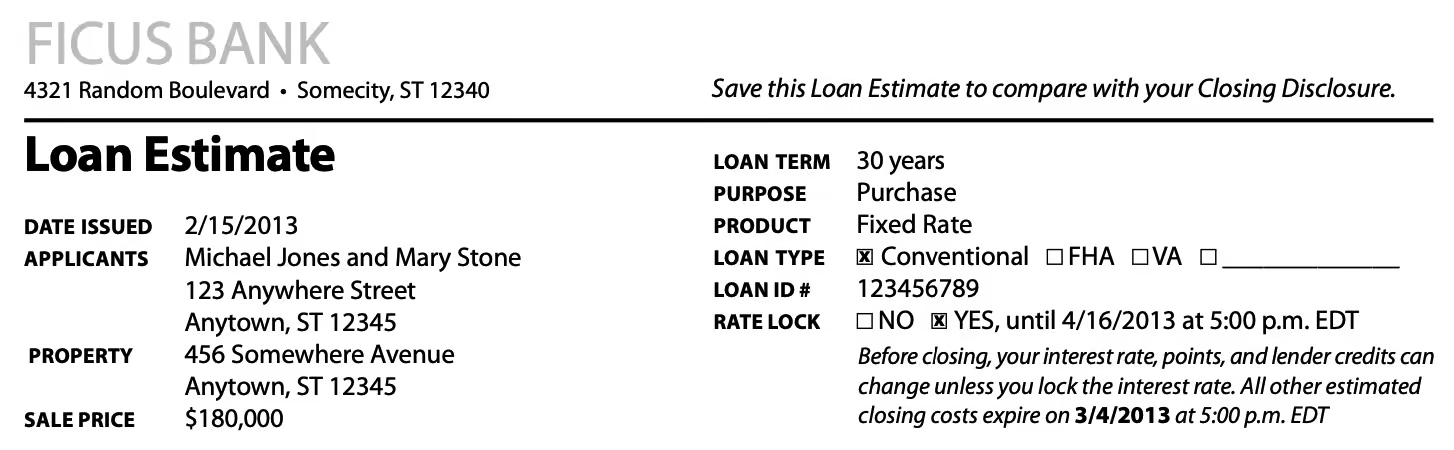

There is general borrower information at the top of the loan estimate. Ficus Bank is a fictitious bank with a fake address.

Below that, on the left, you’ll find your name. Then the address of the property you’re looking to buy.

On the right, you’ll see the loan term, or how long it will take you to pay it back. The loan term will typically be 15 – 30 years.

Here’s what each of the items means:

- Loan Term is how long it takes to pay off the loan with regular monthly payments.

- Purpose is what you’re using the loan to do (buy a home)

- Product refers to if the loan has a fixed rate or an adjustable rate

- Loan Type is the type of loan used

- Loan ID # is a reference number used by the lender in their systems

- Rate Lock is whether the interest rate has been secured or is still subject to daily market changes

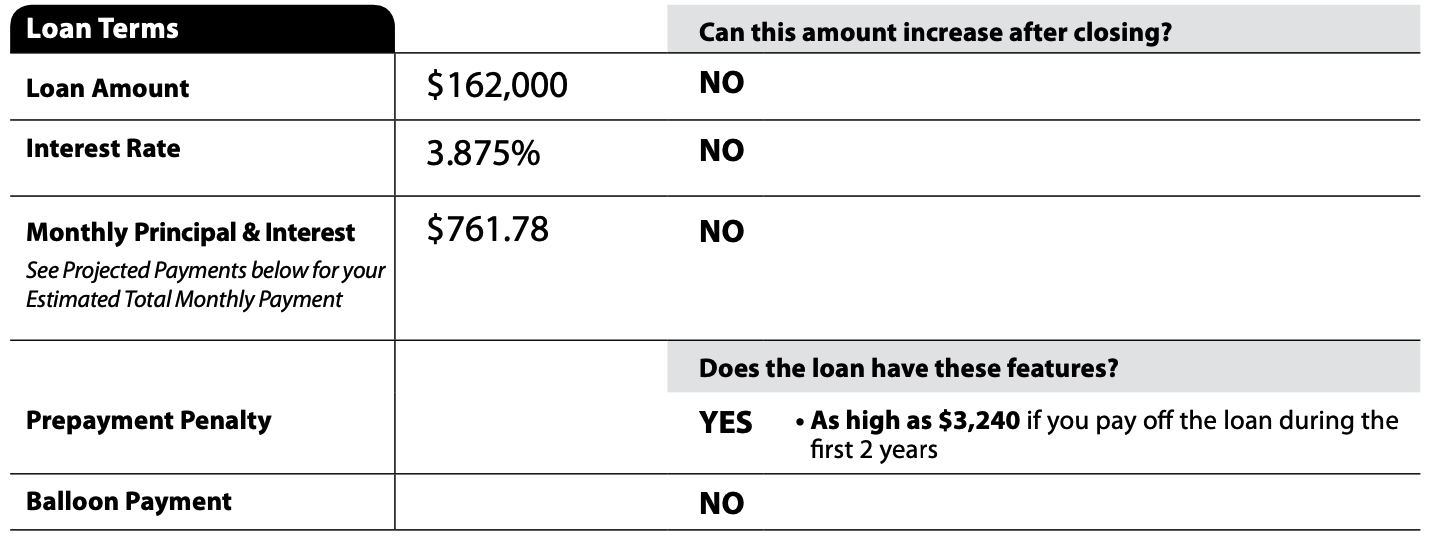

Below the opening section, you’ll see your loan terms.

- Loan Amount is the amount you’re borrowing or the amount you’re pre-approved for

- Interest Rate is how the amount of interest you pay to the lender

- Monthly Principal & Interest is your mortgage payment, not including property tax or insurance

- Prepayment Penalty is if there is a fee for paying off the loan early

- Balloon Payment is if there is an outstanding amount to be paid at the end of the loan term

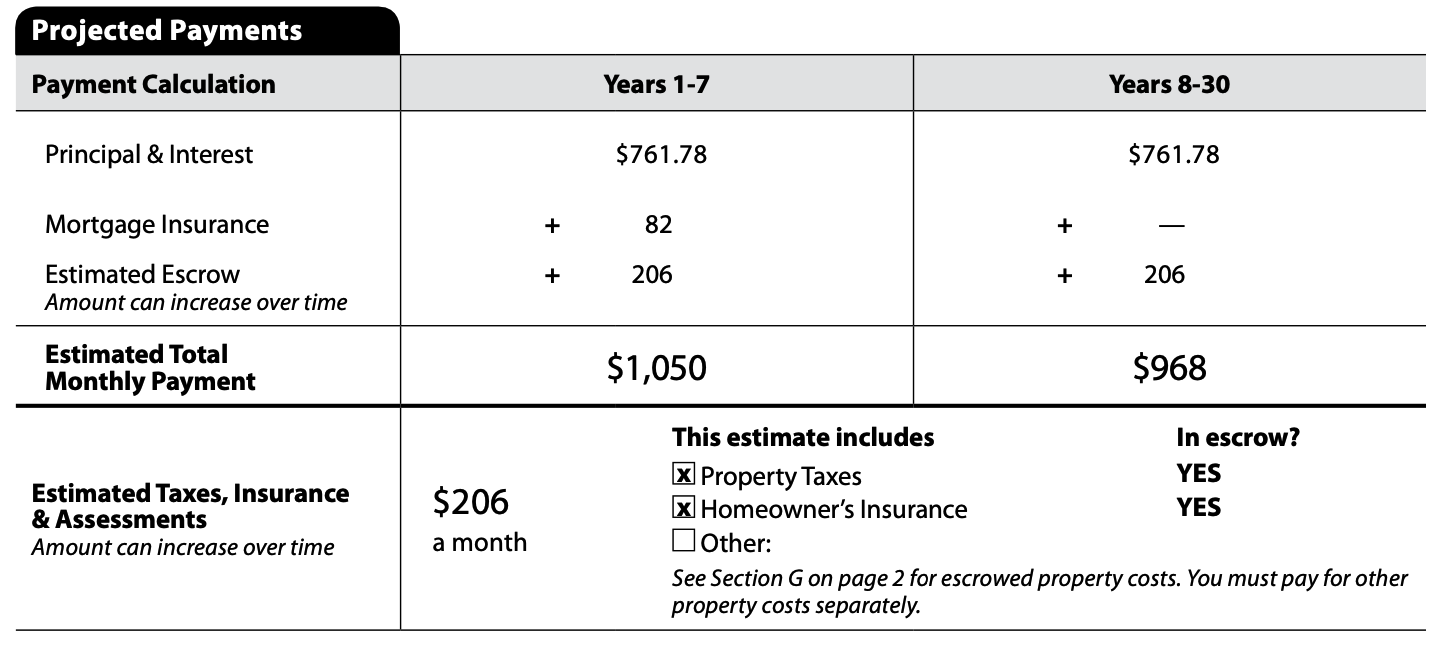

Next is the Projected Payments section. This section gets broken into two sub-sections, Years 1-7 and 8-30. It is in two parts because it can vary based on whether or not a mortgage insurance payment is involved.

It is listed 8-30 because this example is a 30-year loan, as shown in the section above.

Let’s take a look at some of the terms in this section:

- Principal covers the amount of your monthly payment that goes towards paying down your loan balance

- Interest covers the amount that goes towards paying interest fees to the lender

- Mortgage Insurance is a monthly payment needed that allows buyers to purchase a home with a down payment of less than 20%

- Estimated Escrow is your monthly payment for property taxes and homeowners insurance

- Estimated Taxes, Insurance & Assessments account for property taxes, homeowner’s insurance, and homeowner’s association dues

The payment structure gets broken down into estimated monthly payments, including the mortgage insurance of $82. This fee will get paid every month until paid enough for you to have 20 percent equity or an 80 percent loan to value in your property. In this case, it would be every month for seven years.

Then you’ll see the total of years 1-7 and the 8-30.

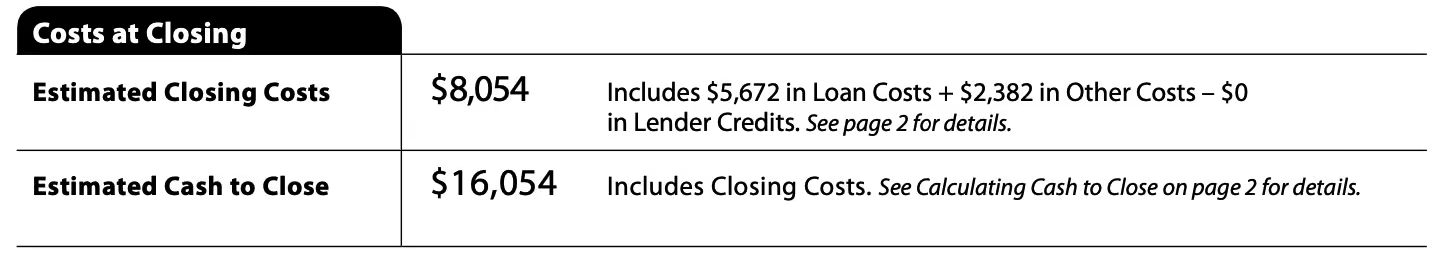

These estimate closing costs and cash to close refer to totals listed on page two. The Estimated Closings Costs include loan costs, other costs, and lender credits.

The Estimated Cash to Close total refers to the amount of cash you will need up-front when closing on your home. This includes your lender fees, third-party charges, and down payment.

Tip: The majority of page one is estimated. Moving forward, we’ll point out what is most important.

The second page is a breakdown of all closing costs and prepaids. We’ll start at the top left.

How loan officers TRICK YOU (and how to prevent it)

FAQ

Do you get a loan estimate after pre-approval?

When must a loan estimate be provided?

What is the difference between a pre approval and a mortgage estimate?

How do you get an official loan estimate?

Can I get a non-binding preapproval loan estimate?

However, you can request a nonbinding preapproval loan estimate from lenders you’re interested in working with. This may help you determine how much home you can afford and feel out your loan options. You can always comparison-shop again later, once you’ve accepted a contract.

What is a preapproved loan?

A **preapproved loan** refers to two different types of offers.Let’s break it down: 1.**Mortgage Pre-Approval**: – When you’re serious about buying a home, getting a mortgage pre-approval is crucial.It

What is a mortgage pre-approval?

A mortgage pre-approval is documentation that shows you’re a good candidate for receiving a home loan. To get pre-approved, you’ll complete an application and the lender will review your financial information, which includes pulling your credit.

Does a mortgage preapproval require a credit check?

These might include bank statements and pay stubs. A preapproval will also require a hard credit check so your lender can see your credit score and other debt. Typically, you can apply for both a mortgage preapproval and a mortgage prequalification online. Home Loan Preapproval Vs. Approval A preapproval is helpful when you’re shopping for a home.