Generally speaking, a large inheritance is an amount that is much greater than your average annual income. It varies from person to person. Inheriting $100,000 or more is often considered sizable. This is a substantial amount of money, so managing it carefully is crucial to achieving your financial objectives. A financial advisor or wealth manager can guide you on how to handle this.

Protection for You and Your Family: Discover how to combine annuities and trusts in an estate plan that works well.

Professional writers and leaders in the field, these reviewers frequently contribute to respected journals like The New York Times and The Wall Street Journal.

To make sure we are maintaining our high standards for accuracy and professionalism, our knowledgeable reviewers examine our articles and suggest revisions.

Our knowledgeable reviewers have years of experience with investments, retirement planning, and personal finances. They also possess advanced degrees and certifications. How to Cite Annuity. orgs Article.

APA Annuity. org (2023, November 10). Average Inheritance and 5 Tips for Leaving Inheritance Money. Retrieved April 9, 2024, from https://www. annuity. org/retirement/estate-planning/average-inheritance/.

MLA “Average Inheritance and 5 Tips for Leaving Inheritance Money. ” Annuity. org, 10 Nov 2023, https://www. annuity. org/retirement/estate-planning/average-inheritance/.

Chicago Annuity. org. “Average Inheritance and 5 Tips for Leaving Inheritance Money. ” Last modified November 10, 2023. https://www. annuity. org/retirement/estate-planning/average-inheritance/. Why You Can Trust Annuity. org.

Giving your heirs inheritance money is a thoughtful and charitable gesture. But if not managed properly, it can be upsetting and problematic. According to a study by Ameriprise Financial, only 2064% of people believe they are on track to leave an inheritance, despite the fact that 20%83 percent of people want to do so.

This is mostly because of how difficult the task is and how it makes you feel. First, there’s a lot of debate over whether it makes more sense to give the money away right away or leave it as a bequest. There’s also the pressure from within to leave at least a mediocre inheritance. A source of stress for many is determining how to distribute the assets among several heirs.

Inheriting money can be a life-changing event, regardless of the amount. While some may dream of receiving a large inheritance, any amount of money received from a loved one can be considered a blessing. However, understanding what constitutes a small inheritance and how to manage it effectively is crucial for maximizing its potential benefits.

Defining a Small Inheritance

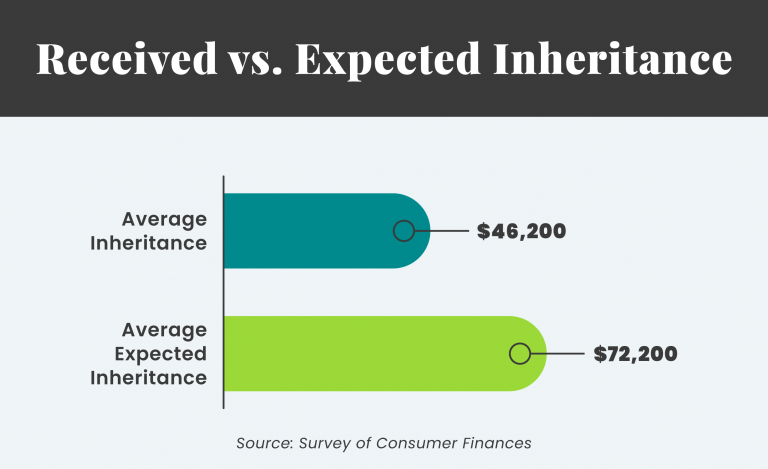

The definition of a small inheritance can vary depending on individual circumstances and perspectives. However, based on the data provided by the Federal Reserve, an inheritance falling below the average of $46,200 can be categorized as a small inheritance. This means that an inheritance of $20,000, $10,000, or even $5,000 would fall under this category.

It’s important to remember that even a small inheritance can be a significant financial boost, especially for individuals struggling with debt, unexpected expenses, or limited savings.

Making the Most of Your Small Inheritance

While a small inheritance may not seem like a life-changing sum, it can still be used to make a positive impact on your financial future. Here are some ways to make the most of your small inheritance:

1. Pay Off Debt:

If you’re burdened with high-interest debt, using your inheritance to pay it off can save you money in the long run. Eliminating debt can free up your monthly budget and improve your credit score, leading to better financial opportunities in the future.

2. Build an Emergency Fund:

Financial experts recommend having at least six months of living expenses set aside for emergencies. If you don’t already have an emergency fund, your inheritance can be a great way to start building one. This will provide you with a financial cushion in case of unexpected events like job loss, medical emergencies, or car repairs.

3. Invest for the Future:

Investing your inheritance can help you grow your wealth over time. Consider investing in a diversified portfolio of stocks, bonds, and mutual funds to spread your risk and maximize your potential returns. Remember, the power of compounding interest can significantly increase your wealth over the long term.

4. Seek Professional Advice:

If you’re unsure how to manage your small inheritance, consider seeking guidance from a financial advisor. A professional can help you develop a personalized financial plan based on your individual goals and circumstances.

5. Use it for Personal Growth:

Your inheritance can also be used to invest in yourself. Consider using it for educational purposes, career development, or personal growth opportunities that can enhance your earning potential and overall well-being.

Additional Considerations

Taxes:

Most inheritances are not subject to taxation. However, it’s important to check with a tax professional to ensure you understand any potential tax implications associated with your specific inheritance.

Timing:

Deciding when to use your inheritance depends on your individual circumstances. If you have immediate financial needs, it may make sense to use it right away. However, if you have time to plan, consider investing it or using it for long-term goals.

Communication:

If you’re receiving an inheritance along with other beneficiaries, it’s important to communicate openly and honestly with them. Discuss your plans for the inheritance and ensure everyone is on the same page to avoid any potential conflicts.

Gratitude:

Remember, receiving an inheritance is a privilege, regardless of the amount. Be grateful for the generosity of your loved one and use the money wisely to honor their memory and improve your financial future.

A small inheritance can be a valuable financial tool when used responsibly. By understanding what constitutes a small inheritance, exploring various management options, and seeking professional guidance if needed, you can maximize the benefits of your inheritance and achieve your financial goals.

Manage Your Heirs’ Expectations

When your heirs believe they could inherit any kind of asset, it’s simple for them to get overexcited. However, if you don’t establish clear expectations beforehand, this could lead to disappointment and annoyance.

Have an open discussion with each heir, taking into account any expectations they might have. It’s not necessary to reveal exactly how much you give to charity organizations and what you give to each individual. However, it is important to set realistic expectations.

After you’re gone, clear communication can prevent misunderstandings and animosity among loved ones. It is up to you how and to whom you allocate your financial resources. However, you might want to give them some explanation if you are leaving different heirs with different inheritance amounts. Providing some context for your choice can be very beneficial.

Average Inheritance in the U.S.

Based on a Federal Reserve survey from 2016 to 2019, the typical inheritance received in the U.S. S. was $46,200. The average for the wealthiest one percent of those surveyed was $719,00, while the average for the lowest-income group was only $9,700.

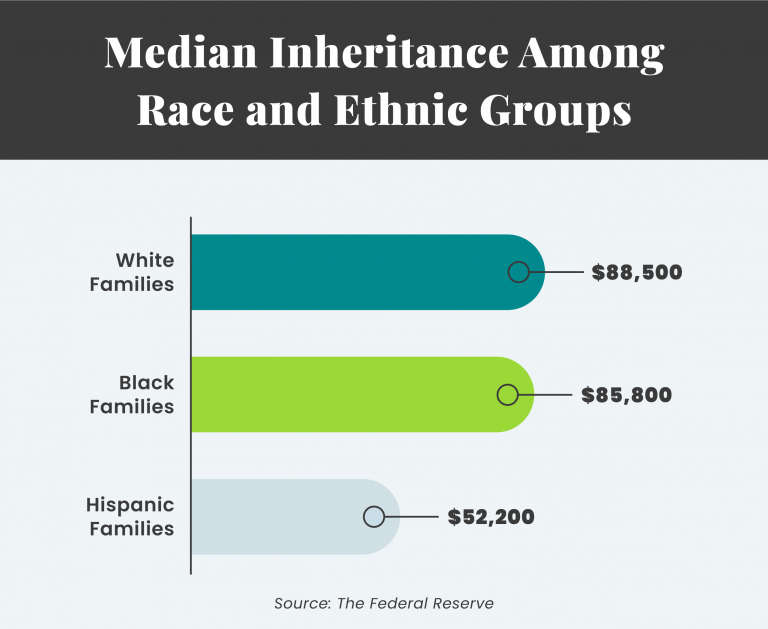

With regard to race and ethnicity, the survey produced the following data points:

- The mean inheritance among white families was $88,500, meaning that 30% of the participants got an inheritance.

- The median inheritance among Black families was $85,800, meaning that 10% of the participants got an inheritance.

- The median inheritance among Hispanic families was $52,200, or 7% of the participants’ inheritances.

- There was a median inheritance among other families of $59,400%(18% of participants received an inheritance).

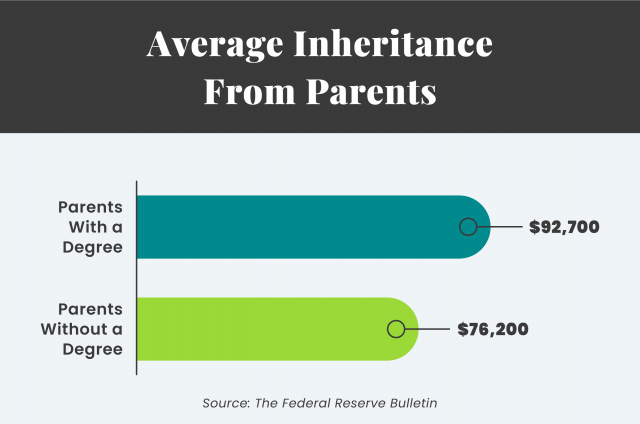

According to the most recent data available from the Federal Reserve, for individuals who received an inheritance, the median value received from families with a parent with a college degree was $92,700. This is $16,500 higher than the median value received from families that did not have a parent with a degree. Fast Fact

Information from the Organization for Economic Cooperation and Development (OECD) indicates that inherited wealth has contributed approximately 2050 percent to 2060 percent of the total amount of U.S. S. private wealth since the early 1900s.

In a similar vein, kids who have college degrees are more likely to anticipate inheriting something. Only 9. A mere 5% of people whose parents did not complete their college education anticipate inheriting something, while in 2023 Six percent of people with parents who have a degree expect to receive bequeathed assets.

Depending on the type of inheritance, taxes vary. Most of the time, inheritances are not subject to taxation. This is due to the $12 million lifetime gift and estate tax exemption allowed by the Internal Revenue Service. 92 million as of 2023.

There is an annual gift tax exclusion in addition to the lifetime exemption. This clause allows a $17,000 annual gift exclusion per person starting in 2023. The recipient of the gift is exempt from paying taxes on it. Any amount over $17,000 is deducted from the donor’s lifetime gift tax cap, and they must file a gift tax return.

See a financial advisor or a tax expert if you’re having trouble deciding whether to give or leave assets to your loved ones. He or she can help you choose the best course of action by running some scenarios.

Improve Your Estate Planning with Annuities Learn how annuities can provide unmatched tax efficiency, seamless asset transfers, and seamless integration with trusts. It’s time to redefine your estate’s future.

The Smartest Thing To Do With An Inheritance

FAQ

What is the average amount of inheritance?

What is a good size inheritance?

Do I have to pay taxes on a $10 000 inheritance?

Is 500k a big inheritance?

What is the difference between a large and a small inheritance?

The distinction between a large inheritance and a small inheritance varies widely from person to person. That said, an inheritance of $100,000 or more is generally considered large. This is a considerable sum of money, and receiving such a windfall can be intimidating, especially if you have limited experience managing excess funds.

What is a large inheritance?

A large inheritance is generally an amount that is significantly larger than your typical yearly income. It varies from person to person. Inheriting $100,000 or more is often considered sizable. This sum of money is significant, and it’s essential to manage it wisely to meet your financial goals.

What is an inheritance tax?

An inheritance tax is a state tax on the estate of a decedent. In most cases, inheritance taxes are higher according to the size of the inheritance and the beneficiary’s relationship to the deceased.

What is an inheritance in a will?

Inheritance refers to the assets that an individual bequeaths to their loved ones after they pass away. An inheritance may contain cash, investments such as stocks or bonds, and other assets such as jewelry, automobiles, art, antiques, and real estate. A person may name beneficiaries in their will who will receive an inheritance.