Buying a home is an exciting milestone, but it also requires careful budgeting. Determining how much you can afford is crucial before house hunting. VA loans offer unique benefits that can stretch your budget compared to conventional mortgages. Using a VA loan calculator to estimate your purchasing power helps set realistic expectations.

What is a VA Loan?

VA loans are mortgage loans guaranteed by the US Department of Veterans Affairs. They allow eligible borrowers to purchase a home with no down payment and no monthly mortgage insurance. VA loans feature competitive interest rates and flexible underwriting.

To qualify, you must be an active duty service member veteran reservist, National Guard member or surviving spouse. VA loans can be used to buy a primary residence or refinance an existing mortgage. These government-backed loans provide an affordable home financing option for military families.

Benefits of VA Loans

There are several advantages to VA loans that improve affordability:

-

No down payment required – 100% financing means you can buy sooner without saving a large lump sum for a down payment. Closing costs can also be rolled into the loan in many cases.

-

No monthly mortgage insurance – Avoiding this added cost saves $50-150 or more each month compared to conventional loans.

-

Competitive interest rates – VA mortgages typically have lower average rates, saving money over the loan term.

-

Relaxed credit guidelines – VA underwriting looks at overall credit health, not just credit scores. Lower scores can be offset by other positive factors.

-

No strict debt-to-income (DTI) limits – DTI caps are higher for VA loans than conventional mortgages. Your entire financial picture is reviewed.

-

No prepayment penalties – The flexibility to pay off a VA loan early or refinance saves money long-term.

-

Ability to reuse benefit – You can qualify again for a future VA loan after paying off your current one.

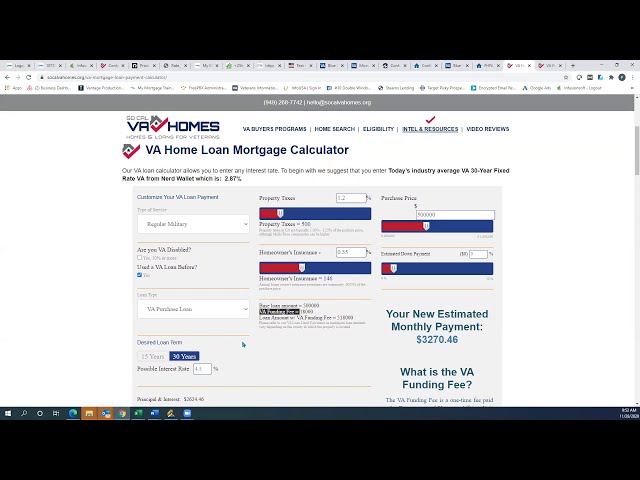

How VA Loan Calculators Work

Online VA loan calculators allow you to estimate your potential mortgage amount based on financial factors like income, debts, interest rate, taxes, insurance, and loan term. Calculators can’t guarantee an exact approval amount since full underwriting is needed, but they provide ballpark figures to guide your home search.

VA lenders analyze your debt-to-income ratio as part of determining affordability. DTI looks at your monthly housing payment plus other recurring debts compared to gross monthly income. VA guidelines don’t impose a strict DTI limit, but most lenders cap it around 41%. Lower DTI ratios increase your purchasing power.

Here are key inputs VA loan calculators use to estimate affordability:

-

Gross annual income

-

Monthly housing budget target

-

Monthly debt payments

-

Estimated property taxes

-

Estimated homeowners insurance

-

Mortgage term (often 30 years)

-

Interest rate

-

Loan type (fixed or adjustable rate)

VA lenders can also account for factors like tax deductions, maintenance, investments and other costs to fine-tune your borrowing estimate.

Tips to Improve Affordability

Small tweaks to your finances can significantly impact what you can afford. Here are tips to stretch your homebuying budget with a VA loan:

-

Boost your credit – Just a few months focused on improving your credit can lower your mortgage rate and monthly payment.

-

Pay down debts – Reducing recurring monthly debts like credit cards and auto loans will lower your DTI and increase approval odds.

-

Save for a larger down payment – Even a 5-10% down payment on a VA loan can drop the interest rate and needed financing amount.

-

Lower your DTI – Keep housing costs below 30% of gross income and total debts under 41% to meet general VA DTI guidance.

-

Pick a shorter loan term – Opting for a 15-year mortgage will increase your payment but significantly reduce interest costs over the loan term.

-

Buy below your limit – Being approved for the max won’t leave room for unexpected costs. Build in a buffer between approval amount and purchase price.

-

Shop multiple lenders – Compare rates and fees to maximize your buying power. Ask about closing cost assistance programs.

Other Mortgage Calculators

In addition to a VA loan calculator, other specialized tools can provide more insight into home affordability:

-

Mortgage payment calculator – Estimates principal, interest, taxes and insurance.

-

Refinancing calculator – Helps determine if refinancing will save money.

-

Mortgage insurance calculator – Shows the monthly cost of private mortgage insurance on conventional loans.

-

Property tax calculator – Calculates taxes based on local rates, assessment value and exemptions.

-

Rent vs. buy calculator – Compares costs of renting vs. buying to determine the better financial move.

Using multiple calculators provides a more complete picture of homeownership costs to make an informed buying decision.

Get Preapproved for a VA Loan

The most accurate way to determine your maximum VA loan amount is to go through the preapproval process. Preapproval involves fully documenting and verifying your income, assets, debts and credit profile. This allows your lender to give a solid estimate of pricing and loan amount options.

Going through preapproval before house hunting also makes for a smoother purchase process. Sellers know you are qualified when making an offer. And your lender can lock in an interest rate while you search for the right home. This protects you from potential rate hikes.

Explore your VA loan benefits and get prequalified to turn affordability estimates into mortgage reality. VA loans allow military families to achieve the dream of homeownership sooner with innovative financing.

How to use Credit Karma’s mortgage calculator for a VA loan

If you’re in the market for a new home, Credit Karma’s VA mortgage calculator can help you estimate your monthly mortgage payments. Below is a list of the information you must provide to get an estimate.

Keep in mind these may not be all the costs you have to pay when buying a home. You may be responsible for additional expenses, including discount points, origination and lender fees, and closing costs for things like appraisals and title insurance.

What is your VA eligibility type?

If you buy a home using a VA loan, you may be required to pay a VA loan funding fee. If you receive, or are eligible to receive VA compensation for a service-related disability, you’re exempt from paying this funding fee, which could save you thousands of dollars. For example, some individuals receiving VA disability income for a service-related disability are exempt from paying the VA funding fee. See this page on the VA website for details.

How Much House Can I Afford with VA Loan?

FAQ

How much VA loan will I get approved for?

|

State:

|

Loan Limits Starting At:

|

Link:

|

|

California

|

$510,400

|

See all California loan limits >>

|

|

Colorado

|

$510,400

|

See all Colorado loan limits >>

|

|

Connecticut

|

$510,400

|

See all Connecticut loan limits >>

|

|

Delaware

|

$510,400

|

See all Delaware loan limits >>

|

How much do I need to make to buy a $400k house with VA loan?

Can I get a VA loan for $800000?

Can I afford more on a house with a VA loan?

How does the VA loan affordability calculator work?

Simply input your values into the corresponding areas and it will automatically calculate a home price budget for you. The VA loan affordability calculator is set to the top end of the VA’s recommended DTI ratio of 41 percent. Learn more about how we calculate affordability below. Effective income on a VA loan must be stable and reliable.

How do I use the VA mortgage calculator?

To use this VA mortgage calculator, enter your loan amount, term, interest rate and start date below to find out what your monthly payments would be. For VA loans, no down payment is required from qualified borrowers buying primary residences. Use Bankrate’s VA loan calculator to find out what your monthly loan payments would be.

How do I calculate my VA home loan payment?

Use our VA home loan calculator to estimate your monthly mortgage payment with taxes and insurance. Simply enter the purchase price of the home, your down payment and details about the loan to calculate your VA loan payment breakdown, schedule and more.

How much home can I afford with a VA loan?

To calculate how much home you can afford with a VA loan, VA lenders will assess your debt-to-income ratio (DTI). DTI ratio reflects the relationship between your gross monthly income and major monthly debts. Our calculator uses the information you provide about your income and expenses to assess your DTI ratio.