USDA loans include occupancy requirements that specify how USDA-financed homes can be used and by whom.

The most important USDA occupancy requirement is the primary residency requirement, which says the home must be used as your primary place of living — not a second home, vacation house, or income-earning property.

Individual scenarios can make determining eligibility a bit murky, so let’s break these rules down a bit.

As a real estate investor, you’re always looking for creative ways to finance properties with favorable loan terms and low down payments. This allows you to free up more capital for additional investments.

You may have heard about USDA home loans, which offer 100% financing and competitive interest rates. At first glance, these loans seem perfect for purchasing investment properties.

However there is one major catch – USDA loans can only be used for primary residences. You cannot directly utilize USDA financing to purchase a rental property vacation home, or other investment asset.

Does this completely rule out using USDA loans in your real estate investing strategy? Not necessarily. With the right approach, you may still be able to capitalize on USDA financing and its benefits.

In this comprehensive guide, we’ll explore innovative strategies investors can employ to work within the guidelines of the USDA loan program. While the loans are intended for owner-occupants, savvy investors can still leverage them to their advantage.

Here’s what we’ll cover:

- Overview of USDA loan basics

- Analysis of USDA eligibility and restrictions

- Strategies to use USDA financing for investments

- House hacking

- Live-in flips

- The Nomad real estate investing method

- Tips for navigating USDA loans as an investor

- Alternatives if you don’t qualify for USDA financing

Let’s dive in and uncover how you may be able to capitalize on USDA loans to grow your rental property portfolio!

USDA Loan Program Basics

Before we explore workarounds let’s quickly recap what USDA home loans are and how they work.

USDA loans are mortgages backed by the U.S. Department of Agriculture, intended to help low-to-moderate income buyers purchase homes in rural and some suburban locations.

Some of the key features include:

- 100% financing – No down payment required

- Competitive rates – Typically lower than conventional loans

- Lenient credit requirements – Minimum scores around 640

- Low mortgage insurance – 1% upfront and 0.35-1.0% annually

Clearly, USDA loans offer financial perks that any real estate investor would love to tap into. But there are strict borrower eligibility criteria you must meet:

USDA Loan Borrower Eligibility and Restrictions

As an investor interested in utilizing USDA financing creatively, you need to understand the program guidelines and limitations in detail:

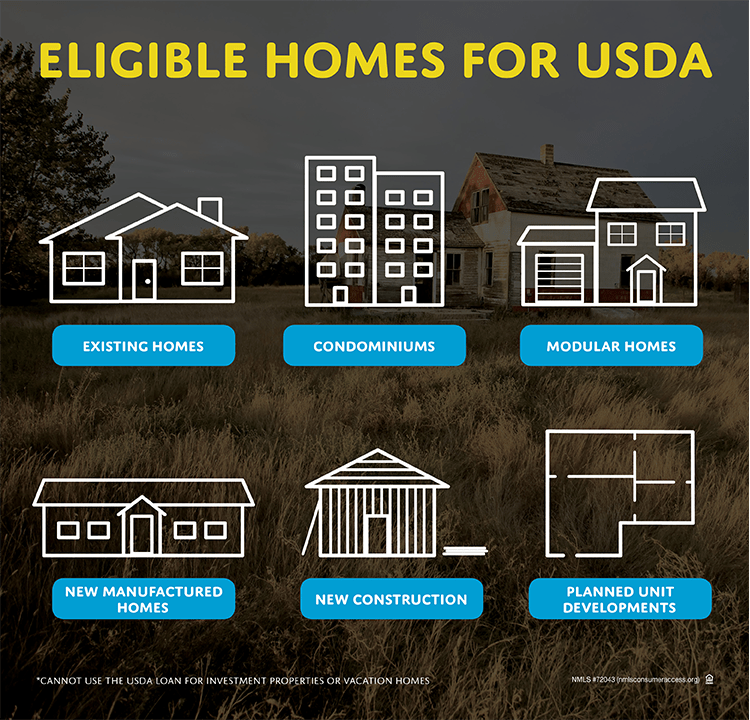

Property location – Must be in an eligible rural or suburban area, verified via USDA property eligibility tool

Income limits – Vary by region and household size. Check your county limits to confirm.

Primary residence requirement – Borrower must live in the home as their primary residence.

Credit score – Each lender sets a minimum, typically around 640.

Debt-to-income ratio – Must be under 41% in most cases.

First-time homebuyer status – Not an explicit requirement, but priority is given to first-time buyers.

Citizenship – U.S. citizens, permanent residents, and qualifying non-permanent residents may be eligible.

Loan purpose – Can only be used to purchase (not refinance) a primary residence.

As you can see, the primary residence stipulation is the biggest barrier to directly utilizing USDA financing for a rental property or vacation home.

But with the right strategy, you may still be able to reap the benefits of USDA loans for your real estate investments. Let’s look at some creative approaches.

Strategies to Use USDA Financing as an Investor

While USDA loans are intended for owner-occupied primary residences, savvy real estate investors employ strategies to work within these guidelines and still capitalize on the program’s advantages.

Here are three examples of innovative approaches to using USDA financing for investment purposes:

House Hacking

The house hacking real estate method involves purchasing a 2-4 unit residential property, living in one unit as your primary residence, and renting out the other units.

This approach allows investors to meet USDA’s owner-occupancy requirement, while generating rental income from the tenant units.

For example, you might buy a duplex with a USDA loan, live in one half, and rent out the other half. The rental income can help cover your mortgage payment and expenses.

After fulfilling the primary residence period stipulated in your USDA loan documents, you may then be able to move out and rent both units – converting the property to a fully investment asset.

Live-In Flip

With a live-in flip, you purchase a property using USDA financing, move in as your primary residence, and renovate the home during your occupancy period.

Once you fulfill the loan’s minimum occupancy requirements, you can sell the improved property for a higher value and pocket the profit.

This approach enables you to capitalize on the USDA loan’s benefits like no down payment and low rates, while ultimately netting investment returns from the property sale.

The Nomad Real Estate Strategy

This creative strategy involves using USDA financing to purchase a primary residence property. You live there for the minimum occupancy period, then purchase a new primary residence (also using USDA financing if eligible).

You then rent out the previous property and repeat the process, slowly amassing a portfolio of USDA-financed investment assets.

The key is adhering to each USDA loan’s primary occupancy rules. But over time, this approach allows you to build up rental properties with little to no down payment requirement.

Tips for Navigating USDA Loans as an Investor

If you plan to utilize USDA financing with any investment strategy, here are some tips to streamline the process:

- Verify property and borrower eligibility upfront using USDA’s online tools

- Find a lender experienced with USDA loans for a smooth approval process

- Consult a knowledgeable real estate attorney to understand all guidelines

- Be upfront with the lender on how you plan to use the property

- Have a plan to meet minimum occupancy requirements before renting

The extra planning and preparation will pay dividends and prevent headaches down the road. With the right approach, you can benefit from USDA loans’ advantages.

Alternatives If You Don’t Qualify for USDA Financing

For investors who don’t meet eligibility criteria or want more flexibility, here are two alternatives worth considering:

Rent-to-own – Find a seller willing to structure the purchase as a long-term lease agreement with an option to buy.

Transactional funding – Utilize a specialized lender providing short-term financing for property acquisitions.

While they come with their own caveats, these options open additional avenues to capitalize on investment opportunities without rigid occupancy rules.

Wrap Up

At first glance, USDA loans appear off-limits to real estate investors because they mandate owner-occupancy of the property. However, as we’ve explored, strategic investors can employ clever approaches to enjoy the benefits of USDA financing.

By house hacking, executing live-in flips, or using the Nomad real estate strategy, you may be able to leverage USDA loans’ advantages like no down payment and low rates to build your rental portfolio over time.

Understanding the eligibility criteria and being upfront about your plans are key to successfully navigating USDA financing as an investor. With the right game plan, these loans can become a valuable tool for your real estate business.

What creative strategies have you considered to capitalize on mortgage and lending programs not overtly meant for investors?

Who is allowed to live in the home?

The USDA doesnt have any specific requirements regarding who can live in the home. However, USDA loans are intended to help homebuyers finance their primary residence and not an income-producing property.

FAQs About USDA Loan Occupancy Requirements

If you intend to rent out your home from the start, you won’t be eligible for a USDA loan. Instead, you’ll need to use a conventional mortgage to finance your home purchase.

USDA Loan vs. DSCR Loan: Best Investment Property Financing Options in 2023

FAQ

Can an investor assume a USDA loan?

Is FHA better than USDA?

What are the requirements for a USDA loan in Ohio?

Can USDA loan be used on Fixer Upper?

What is a USDA loan?

USDA loans are designed to assist low- and moderate-income Americans in becoming homeowners with incredibly affordable financing options for eligible buyers. They help individuals transition from renting to owning, even when they thought homeownership was out of reach. Verify your USDA loan eligibility.

Should you consider a USDA Rural Development Loan?

Consider getting a USDA rural development loan if you’re interested in buying, refinancing, or renovating a home in a rural community that will be your primary residence. The first step is talking to a USDA-approved lender, who can help you explore all the loan options available to find the right mortgage for you.

What are the requirements for a USDA home loan?

To get a USDA home loan, the property must be in an eligible rural area as defined by the USDA, and borrowers must meet the household income requirements that vary depending on location and household size. The USDA also offers the Single Family Housing Direct loan through the Section 502 Direct Loan Program.

Where can I find a lender for a USDA loan?

To find a lender for a USDA loan, visit the U.S. Department of Agriculture’s website. They maintain a list of approved lenders for the Rural Housing Program. The USDA Rural Housing loan offers a 30-year fixed-rate mortgage only.