Consumers who need to lease a car or rent an apartment need to prove the income that they earn. The party leasing the car or renting the apartment needs evidence that you can afford to make the payments. If you’re applying for a mortgage loan, or refinancing a loan, you’ll also need to prove your income.

When applying for a personal loan, mortgage, or other type of credit, lenders will almost always require proof of your income. They want to verify your ability to repay the debt before approving you. Having the right documents on hand can make the application process faster and easier. This comprehensive guide covers everything you need to know about providing proof of income for a loan.

Why Lenders Require Income Verification

Lenders need to confirm your income for a few key reasons:

-

To assess your ability to repay By reviewing your income, lenders can calculate your debt-to-income ratio and determine if you can manage the new monthly payment.

-

To comply with regulations: For mortgages, lenders must follow the Ability-to-Repay rule and verify income. For other loans, it’s standard practice.

-

To prevent fraud Income verification helps minimize the risk of applicants falsifying their earnings

-

To set loan terms: Your income can impact loan eligibility, amount, rate, and other terms.

While it may feel intrusive, income verification protects you, the lender, and the larger lending system. Approvals based on unverified income are riskier for all involved.

Documents to Provide as Proof of Income

Lenders today have many options for verifying applicants’ incomes digitally. However, you may still need to supply documents, especially if you have non-traditional income sources. Here are some common options:

-

Pay stubs: Provide your most recent pay stubs, covering about one month. This shows year-to-date earnings.

-

W-2 forms: Have your W-2s from the past two years handy. This establishes a history.

-

Tax returns: For the self-employed or those with other incomes, tax returns may be needed.

-

Bank statements: Statements can help prove regular deposits of non-employment income.

-

Written verification: Your employer can verify your income directly on a form.

-

Profit and loss statement: For self-employed applicants, a P&L statement summarizes income and expenses.

-

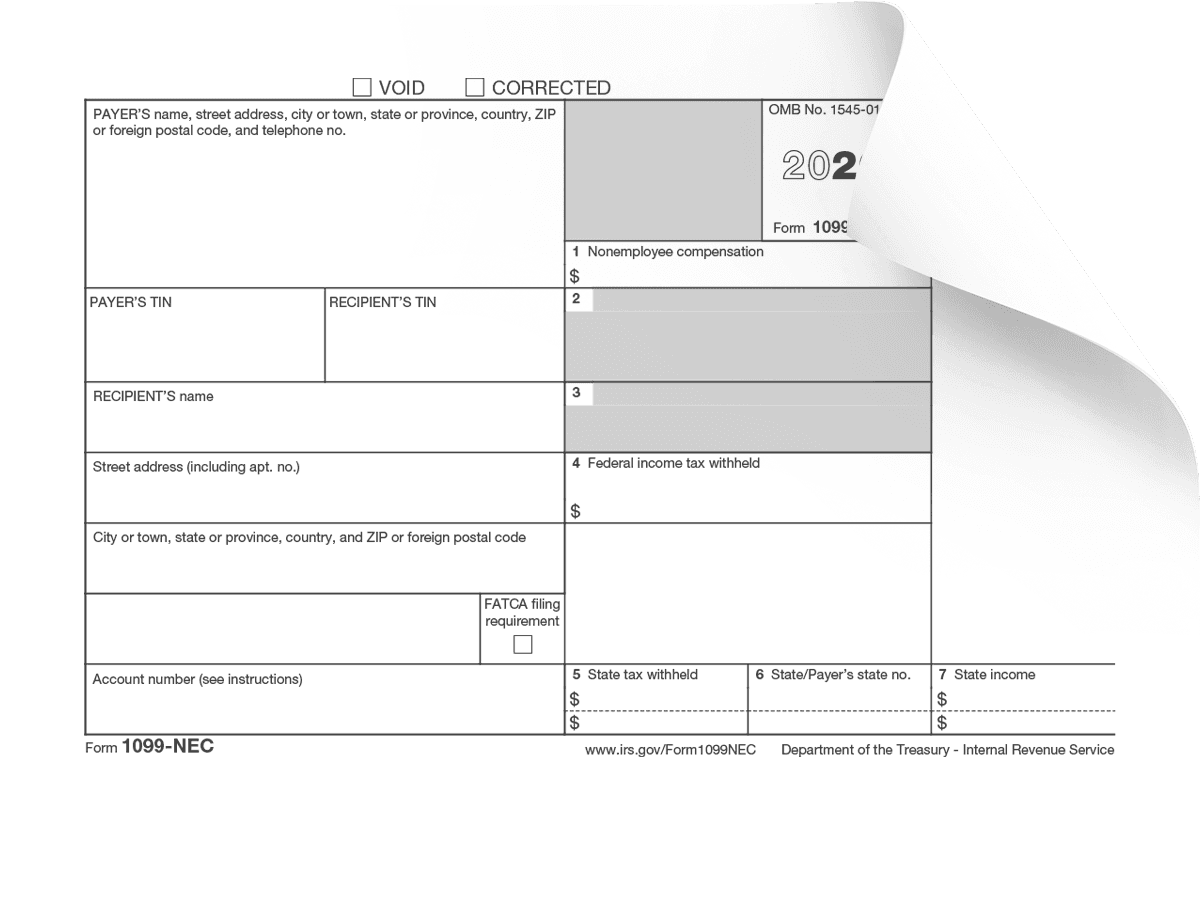

1099 forms: If you work as an independent contractor, 1099s can help document your earnings.

-

Other documentation: Awards letters, contracts, leases, divorce decrees, etc. that show income sources.

The more types of income you have, the more documents you should prepare. Organize them logically and be ready to explain any fluctuations or discrepancies.

How Mortgage Lenders Verify Income

Mortgage lenders typically require the most extensive income documentation. Under the Ability-to-Repay rule, they must assess if you can afford the monthly payments:

- You’ll need to provide pay stubs covering 30 days, W-2s, and often tax

Understanding documents that report income

A lease, rental agreement, or loan may require you to provide these documents:

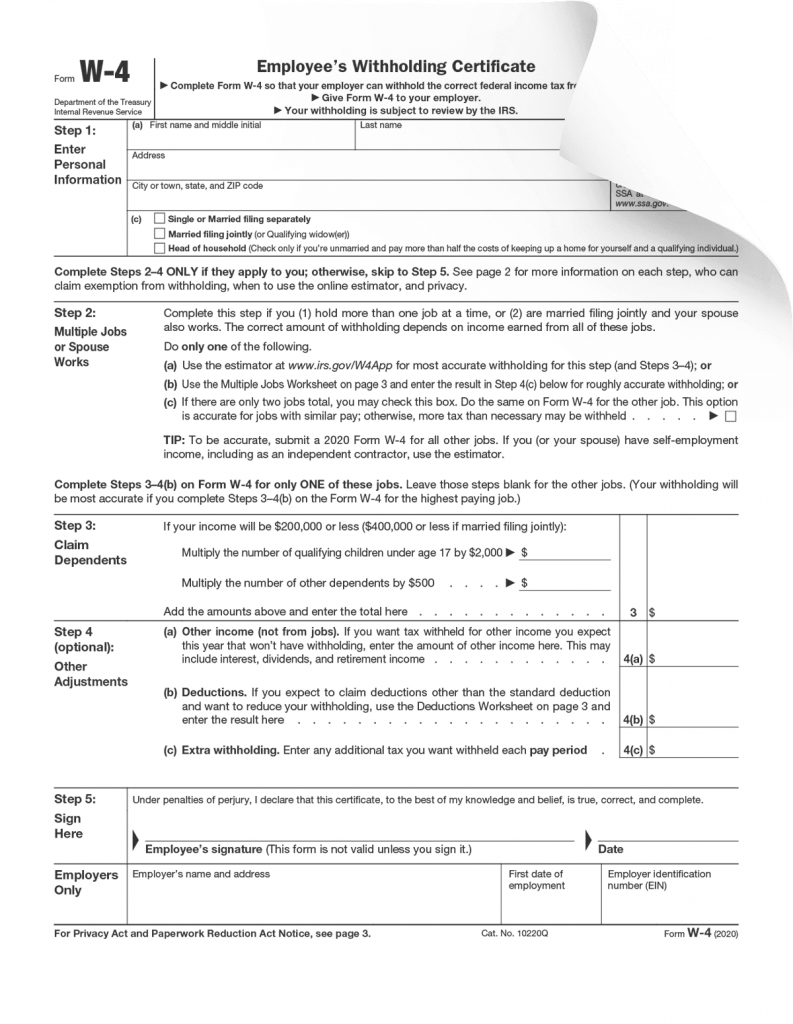

Filling out Form W-4

Employees complete a W-4 when they are hired, or when they have a pay increase or a change in family status (child). The W-4 is used to calculate allowances, which help to determine the dollar amount of taxes withheld from pay.

An employee with five children, for example, has more exemptions on the personal tax return than a single taxpayer. Adding more W-4 allowances for children means that more taxes are withheld from pay.

Form 1099-NEC reports taxable income paid to independent contractors (freelancers). Keep in mind that income taxes and FICA taxes are not withheld from payments to independent contractors. The contractor is responsible for tracking his or her income, and determining the tax liability on earnings.

Businesses who pay contractors must send all 1099s to the IRS each year, so that the IRS can verify that the contractor reported the payments as income. If a contractor is paid less than $600 during a particular year, a 1099 does not have to be issued. However, the income is still taxable to the contractor.

How To Create Your Own Proof Of Income Legally For Guaranteed Approvals

FAQ

What is a legit proof of income?