Today I’m going to demonstrate some fresh methods for borrowing money right away by simply pressing a few buttons on your mobile device (in under 5 minutes).

There are times when you need extra money to pay bills or to put money aside for something you want.

You’re wondering how to get an immediate $50 loan or what apps can pay you today because you don’t want to fall behind on your bills.

Sure, another 100 dollars paid out early wouldn’t hurt. This is a comprehensive list of things that anyone can do today to get your paycheck early so you can earn money today. We’ve all been there, but what do you usually do when that happens?

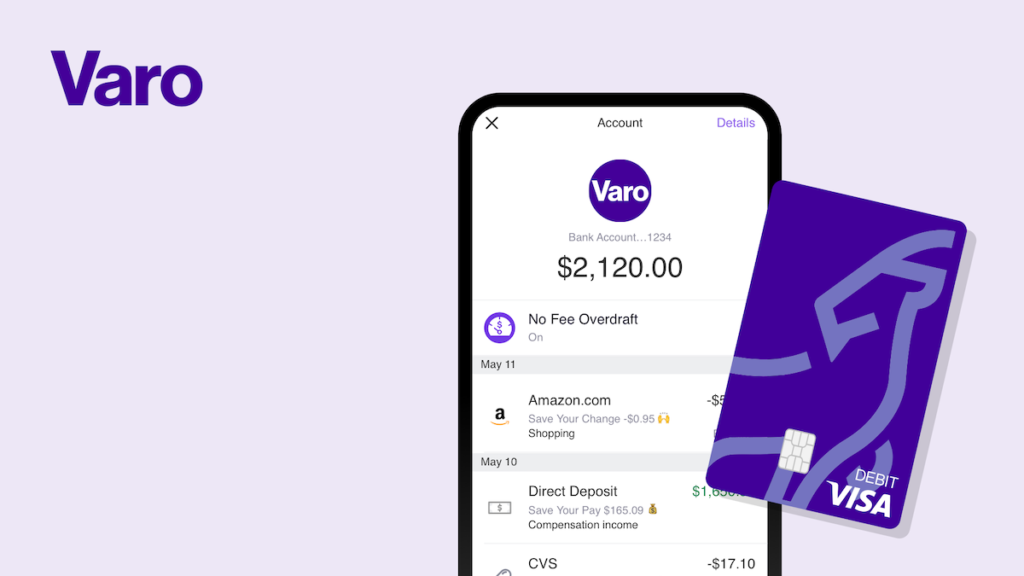

If you’re short on time, I’ll go ahead and tell Varo which payday loans are effective.

- Dave.

- Albert.

- Empower.

- MoneyLion.

- Cleo.

- Chime.

- Instacash by MoneyLion.

- Klover.

These 10 Payday Loans & Apps Work With Varo

These applications can assist you in receiving payment right away.

To easily borrow money, try these cash advance apps from the Google Play Store and the App Store:

| Cash Advance App | Works with Varo | Cash Advance Max |

|---|---|---|

| Empower | Yes | $250 |

| Cleo | Yes | $100 |

| MoneyLion | Yes | $250 |

| Earnin | No | $100 |

| Branch | Yes | $500 |

| Dave | Yes | $500 |

| Albert | Yes | $250 |

| Klover | Yes | $100 |

| Brigit | No | $250 |

| Chime SpotMe | Yes | $200* |

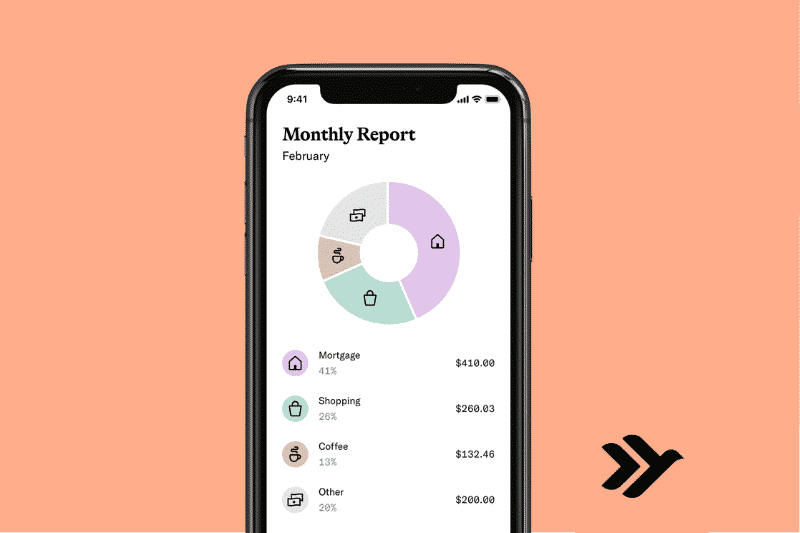

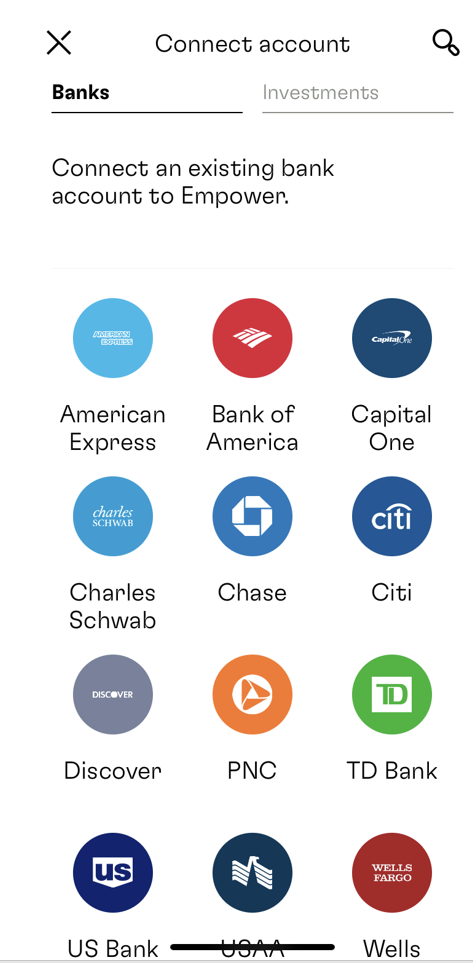

Does Empower work with Varo?

Yes. Because Varo Money and Empower are partners, you can use the app to get a cash advance of up to $250.

To link to your Varo Bank account to Empower:

If Varo Money isn’t in the list, you can search for it by tapping the magnifying glass in the upper right corner.

Empower is an app designed for today’s generation. They’ll enable you to prosper regardless of what comes next by letting you borrow money. You can save money for the future and receive a cash advance of up to $250 by downloading the app.

You can trust them to look out for you and receive a cash advance of up to $250 that is sent directly to your account. Applications, interest, late fees, credit checks, and credit risk are all absent. Simply repay them when you receive your subsequent direct deposit to avoid any further delays. Theres no catch. Its that simple. Get up to $250.

Does Cleo with work Varo?

Yes. Cleo works with Varo. When you link your Varo Account to Cleo, there are no problems. Cleo Plus subscribers ($5. 99 a month) is eligible for a $100 cash advance.

In order to add Varo to Cleo, youll have to:

Keep in mind that any account linked to your Cleo Wallet must already be linked to your Cleo account. All of your autosaves and manual transfers of funds into and out of your Cleo Wallet will now take place with this account.

A salary advance from Cleo is its response to outrageous overdraft fees and the frighteningly pricey world of payday loans; it is a feature of Cleo Plus, the apps subscription service.

To assist you in avoiding an overdraft, Cleo may be able to provide you with a no-interest advance of up to $100 if you are eligible. You choose your repayment deadline — any time between three and twenty-eight days — and pay Cleo back when it arrives. Your credit score won’t be impacted, but Cleo Plus costs $5. 99 per month. The salary advance feature is not available with the free option, but you do have access to Cleo’s digital wallet and budgeting tool, as well as a weekly quiz with the chance to win cash rewards. Get up to $100.

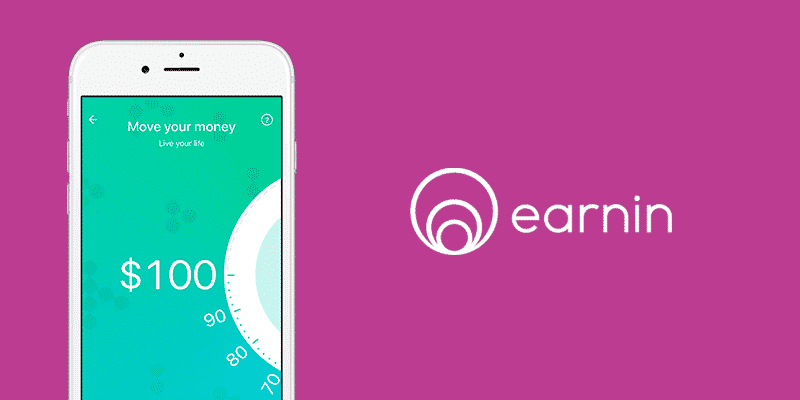

Does Earnin work with Varo?

No. Because Varo gives users access to their paychecks up to two days early, making it challenging to define a fixed payday, Earnin has been unable to support Varo users.

With Earnin, you receive payment today and have access to up to $100 per day from your pre-earned salary, free of any additional costs or interest. You decide how much you want to contribute to the service’s support (it can be $0), and you can get immediate access to your hard-earned money when you need it. This represents a significant departure from the typical operation of other instant loan apps. There are a few apps like Earnin, but the majority of them require a monthly fee, so Earnin stands out because it is totally free. Get up to $500.

Does MoneyLion work with Varo?

Yes, MoneyLion does work with Varo. When linking your Varo account to MoneyLion, there are no issues. Members of MoneyLion are eligible for 0% APR cash advances up to $250.

On the Transfers screen of the MoneyLion app, click “Add account” to link an outside bank account, such as Varo, for use with transfers.

With MoneyLion banking, you get much more so that you can get paid right away. With Instacash, you can receive $250 at any time without paying interest. Apply here and link your checking account for 0% APR cash advances up to $250 to help you pay for unexpected expenses and necessities. There is no monthly fee. RoarMoney also offers simple ways to borrow, save, invest, and earn money, as well as the ability to receive your paycheck up to two days early. All in one app. Get up to $250.

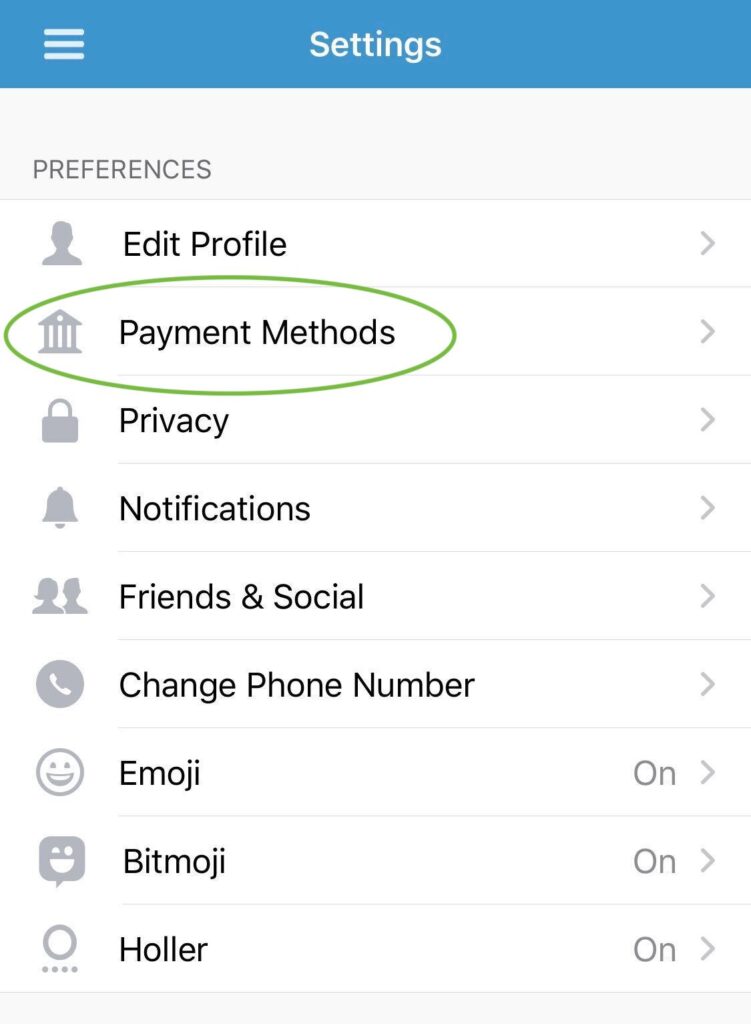

Does Branch work with Varo?

Does Branch work with Varo? There is a catch, though Branch can function for Varo users. According to the Branch Support Page, in order to be eligible for an advance if you bank with Varo, you must place your direct deposit in your Branch Wallet.

Select Settings, then Payment Methods to add Varo to Branch. You have the option to add a new bank or card at the bottom of Payment Methods. Click on the “Add Bank or Card” and select “Bank. ” and choose Varo.

For working Americans, apps like Branch provide a mobile digital wallet. This get paid today app enables any employee to receive a payroll advance (up to $500 in earned wages per paycheck), manage their cash flow, and spend anywhere—all from their smartphone—helping them meet their daily financial needs.

Does Dave work with Varo?

Yes, Dave does work Varo. There are no issues when logging into Dave with your Varo Account. Members of Dave can receive free advances of up to $500.

Apps like Dave pride themselves on being banking for humans. Discover the banking app that eases your financial worries. Build your credit history, get paid up to two days early, and receive fee-free advances of up to $500. Dave is regarded as one of the best reputable cash advance apps by its 7 million members and growing. Get up to $500.

Does Albert work with Varo?

Yes, Albert does work Varo. Your Varo Account can be connected to Albert without any problems. You may be eligible for up to $250 in advances with Albert Instant.

To add Varo to Albert:

Albert will lend you up to $250 so you can survive. There are no hidden charges, interest rates, credit checks, or late fees. You may apply for up to three cash advances each pay period as long as you have a paycheck and have paid back any prior advances. Get up to $250.

Does Klover work with Varo?

Does Klover work with Varo? Yes, Klover does work Varo. Your Varo Account can be connected to Klover without any problems. Members of Klover can receive advances of up to $100 without paying any fees.

In order to add Varo to Klover:

You can get some extra cash before payday with apps like Klover. If you meet the requirements—having received at least three regular direct deposits from the same employer over the previous two months without any pay gaps—you can apply and ask for a boost of a $100 cash advance.

Does Brigit work with Varo?

No, due to connectivity issues, Brigit does not work with Varo, Capital One, Net Spend, or Chime.

Another instant loan app that can assist anyone in getting paid today is Brigit. You can join the 1 million members who get paid up to $250 and budget and save more wisely with Brigit by downloading the free app on iOS or Android. Only takes 2-minutes. No credit check. No interest. Get up to $250.

There are a lot more cash advance apps that work with Chime than Varo, and both digital banking apps have comparable features, so do you want more options?

Don’t forget that you can use the Chimes SpotMe feature to receive up to $200* on cash withdrawals and debit card purchases without being charged an overdraft fee.

Traditional banks took $11 Billion in overdraft fees in 2019. At Chime, they do things differently. They don’t charge you an overdraft fee and let you overdraw up to $200* without any fees. Therefore, even if you are in need of a purchase but lack the necessary funds, you can still do so thanks to Chime SpotMe. Since so many apps are compatible with Chime, it is a flexible choice for any consumer. Get up to $200*.

More Financial Assistance During Pandemic

You can get your paycheck early with the help of payday apps like Empower so that you get paid today. These apps can be of great assistance when you need money to survive until payday. All these payday apps are listed in this article.

There are websites where you can complete online tasks to instantly receive payment. On websites like Swagbucks and InboxDollars, you essentially receive payment for performing tasks.

We’ve listed a few apps in this article that will give you free money.

Yes, you may use one of these cash advance applications to borrow money for a brief period of time. They are available for download and use on smartphones, allowing for quick and convenient cash distribution.

Use the selected app to submit your application for a cash advance. Give your personal and banking information so that you can get the money you want.

For each borrower, a checking account must be connected to the app of your choice. If not, the borrow money application won’t be able to deposit money on your behalf to satisfy your needs.

You can choose the programs that let you borrow money against your future earnings. By doing this, you will receive the money you have already earned before the next payday and automatically return it once your wages are deposited into your account.

External resources, so you don’t have to do the research:

1) You can apply for unemployment benefits if you’ve lost your job. Additionally, users of apps like Brigit who have applied for unemployment benefits receive automatic advance extensions. No questions asked.

2) Need some government help? Smarts is tracking everything to do with the governments two trillion dollar stimulus package. Are you eligible? How much will you get and do you need to file? It’s all here.

We have two articles on this topic—one for those looking for full-time online employment and another for those looking for part-time employment (the gig economy)—so check them out.

4) If you’re worried about your bills, check out this article from our team on grocery budgeting. Additionally, some banks and credit card companies are delaying payments, waiving fees, and eliminating interest charges. Read about it here. You can get out ahead of these problems.

5) If you’re trying to stretch your budget, read our article on how to live cheaply. Maybe you already know everything, but perhaps there are some helpful tidbits in there.

If you’re like the majority of people, any new financial demand or need irritates and tenses you up. The best app for borrowing money can assist you in immediately meeting your needs. Because you’re probably unprepared for financial emergencies, each additional one can make you anxious

Instead of going to a local bank or pawnshop to try and get quick cash, there are several benefits to borrowing money through an app. Today, each city has a number of lending institutions, but you might not be familiar with all the differences, interest rates, and fees between them.

Everyone who is considering borrowing should be aware that they are entirely responsible for any loans or cash advances they obtain. Since this money will only be used temporarily, it should not be taken for granted.

Finally, such small loan amounts are insufficient to support long-term financial goals. Think about other options for financing your long-term objectives and requirements, or try to increase your income potential with side jobs.

Having said that, good luck using these apps to borrow money!

*Chime SpotMe requires a single deposit of $200 or more in eligible direct deposits to the Chime Checking Account each month as a condition for use. All eligible members will initially be permitted to overdraw their accounts by a maximum of $20 on debit card purchases and cash withdrawals, but they may later be qualified for a higher limit of up to $200 or more depending on their Chime Account history, the frequency and size of their direct deposits, their spending habits, and other risk-based variables. Within the Chime mobile app, your limit will be shown to you. You will receive notice of any changes to your limit. Your limit may change at any time, at Chimes discretion. Although there are no overdraft fees, ATM transactions may still incur out-of-network or third-party fees. Non-debit card transactions, such as ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions, are not covered by SpotMe. See Terms and Conditions. Early access to direct deposit funds is dependent on when the payer submits the payment file. The day the payment file is received, which could be up to two days earlier than the scheduled payment date, is typically the day we make these funds available.

FAQ

Can I get a loan with my Varo account?

A loan that is deposited into your Varo Bank Account and called an “advance” must be repaid. Qualifications apply. You must have received direct deposits totaling $1,000 or more into either your Varo Bank Account or Varo Savings Account over the previous 31 days in order to continue receiving advances; neither account may be overdrawn, suspended, or closed.

Can you get cash advance with Varo?

Even though it’s a short-term loan from your bank, Varo Advance may be a better choice if you require additional funds. Once you are eligible, Varo Advance allows you to get a cash advance of up to $100 right from the Varo Bank app.

Does Bridget work with Varo?

Bank with Chime®, Net Spend or Varo. Brigit does not currently connect with accounts at these banks.

Where can I get Varo cash advance?

Start using Varo Advance in the Varo Bank app right away. For more details, check out the Varo Advance webpage. Varo will evaluate your creditworthiness and payment history on a monthly basis for advances over $20, and it may raise your credit limit.