A mortgage adverse action letter is a notice sent from a financial institution to a home loan applicant to inform them that their application was denied. Issuing the letter provides transparency to consumers about why their application was rejected and informs them of their right to dispute or request a copy of the report. The structure and issuance of adverse action letters fall under two (2) federal acts: the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA).

The letter is a necessity for any institution that offers mortgage lending and uses consumer reports to pre-screen applicants, which includes the following entities:

The letter must be sent whenever an entity takes adverse action on an applicant because of information in a credit report. Although businesses don’t fall under the FCRA’s requirements for reporting, they still fall under Regulation B of the ECOA. Using a general letter template that includes disclosures for both laws simplifies the process and ensures all government requirements are met.

Regulation B requires the notice to be sent within thirty (30 days) of receiving the consumer’s credit application. If the creditor makes a counteroffer to the applicant, they have ninety (90) days to inform the applicant of adverse action if the applicant does not accept the counteroffer.

Getting denied for a mortgage loan can be disappointing and confusing But the mortgage denial letter you receive can provide valuable insights into what went wrong – and how to get approved next time In this guide, we’ll walk through everything you need to know about mortgage denial letters.

What is a Mortgage Denial Letter?

A mortgage denial letter, also called an adverse action notice, is a written explanation from the lender outlining why they declined your loan application. Legally, lenders must provide this notice within 30 days of denying a completed application.

The letter details

- The specific reasons you were denied

- The factors that influenced the decision

- Instructions for obtaining free copies of your credit reports

- Information on disputing inaccurate data with credit bureaus

Reviewing this notice carefully is crucial to understanding what to fix in order to qualify in the future.

When Are Denial Letters Sent Out?

There are two main scenarios when you’ll receive a mortgage denial letter:

1. Upon initial loan denial

If your application is denied upfront, the lender must provide the adverse action letter within 30 days explaining why.

2. After loan approval but before closing

Even if you’re initially approved, lenders re-verify your financial details right before closing. If they uncover new issues like a drop in credit score or loss of income, they may deny the loan and send a denial notice.

So it’s possible to get approved first, then denied later on. Watch for denial letters even if you cleared the initial underwriting.

Mortgage Denial Letter Requirements

The Equal Credit Opportunity Act (ECOA) sets requirements for what must be included in a mortgage denial letter:

-

The specific reasons for denial – For example, debt-to-income ratio too high, credit score too low, or insufficient income.

-

Statement of rights – Language stating you have a legal right to receive the specific reasons for the denial and to dispute any inaccurate information.

-

Instructions for obtaining credit reports – Details on how to request free copies of your credit reports from Equifax, Experian and TransUnion within 60 days of receiving the letter.

-

Contact information – Name, address, and telephone number of the lender making the determination. This allows you to follow up with questions or get help filing a loan appeal.

-

Notice of right to a written statement – Notification that you have a right to request the lender send a written statement of the reasons for denial within 30 days of your written request.

Key Sections of a Mortgage Denial Letter

While formats vary, mortgage denial letters generally contain:

Header

The top displays the lender’s name, address, date, and your name/address as the applicant.

Denial Statement

A paragraph clearly stating your application was denied and the lender will not provide the mortgage loan.

Specific Reasons

A bullet list of the exact reasons for denial. Insufficient credit score, high debt-to-income ratio, and inadequate income are common.

Supporting Details

Elaboration on the denial reasons. For example, your minimum required credit score and actual score showing you fell short.

Rights Statement

Standard language on your legal right to know the specific reasons and dispute inaccurate info.

Instructions to Obtain Credit Reports

Details for ordering free credit reports and disputing errors that may have contributed to the denial.

Contact Information

Lender’s name, address, phone and website for any follow up needs.

Signature

Name and title of the lender representative who reviewed your application.

Tips for Reading Your Mortgage Denial Letter

To make the most of your denial letter, be sure to:

-

Read carefully. The specific denial reasons are key to understand. Circle or highlight them.

-

Review credit report details. Obtain your reports and check the data that triggered red flags like a low score.

-

Look for errors. If your reports contain mistakes like wrong balances or closed accounts listed open, start disputes.

-

Ask questions. If any denial reasons seem unclear or inaccurate, contact the lender for clarification.

-

Consider an appeal. Find out if you can provide documents to appeal the decision and get re-evaluated.

-

Address the issues. Make a plan to resolve the problems highlighted before reapplying.

How to Write a Mortgage Denial Letter (Lender’s Perspective)

As a lender, you must provide denial letters that comply with ECOA requirements. Follow these steps:

1. Include applicant info – Name, mailing address, loan type and purpose at the top.

2. Note the denial – Open with a paragraph stating the applicant is denied and will not receive the mortgage loan.

3. List specific reasons – Provide the main reasons for denial in order of importance – credit score too low, debt-to-income ratio too high, etc.

4. Give details – For each reason, elaborate with supporting data like minimum score required vs. actual score.

5. Insert consumer rights – Include standard language on right to receive reasons and dispute inaccurate info.

6. Explain obtaining credit reports – Provide instructions and links for ordering applicant’s free credit reports.

7. Add contact information – Name, address, phone, email and website of lender making the determination.

8. Note the written statement right – Applicant can request a written statement of reasons within 30 days.

9. Sign the notice – Finished letter should have representative name, title and signature.

10. Send within 30 days – Mail the adverse action notice within 30 days of the completed application denial.

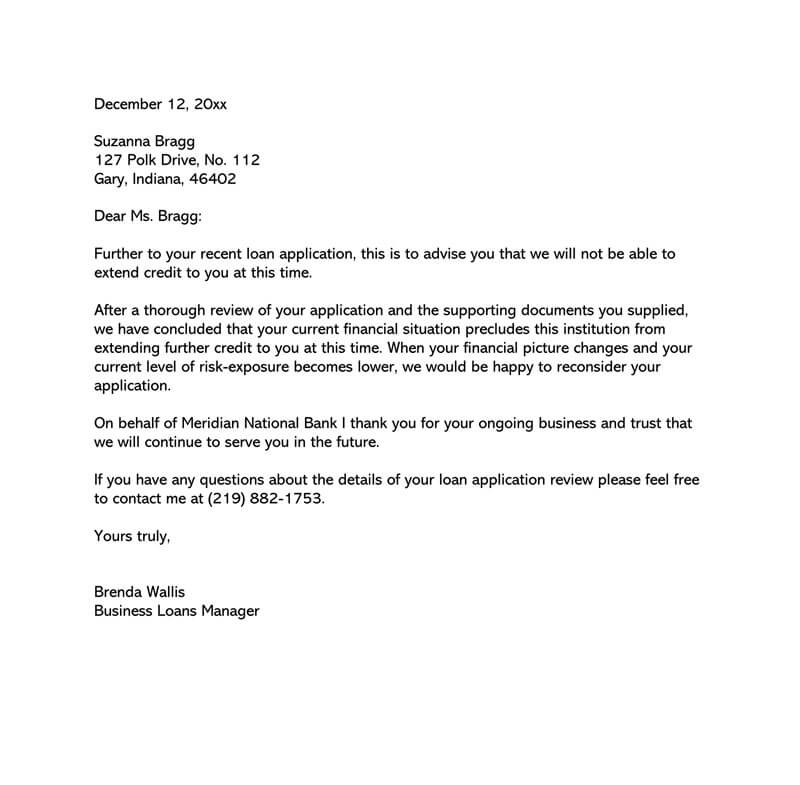

Sample Mortgage Denial Letter Template

Refer to this template when drafting mortgage denial letters:

[Lender Name and Address]

[Date]

[Applicant Name and Address]

Dear [Applicant’s Name],

We regret to inform you that your application for a mortgage loan has been denied. [Lender Name] will not provide the requested mortgage loan for the purchase of your home located at [property address].

The specific reasons for the denial are:

-

Your credit score of [XXX] is below the minimum required score of [XXX] for this loan program.

-

Your total debt-to-income ratio of [XX%] exceeds the maximum of [XX%] for your type of loan.

-

Your monthly income of [$X,XXX] falls short of the required minimum income of [$X,XXX].

You have a right under the Equal Credit Opportunity Act to know the specific reasons your application was denied. You also have the right to dispute and correct any inaccurate information submitted to the credit bureaus by writing to:

Equifax Credit Bureau

PO Box 740241

Atlanta, GA 30374

(800) 685-1111

www.equifax.com

Experian Credit Bureau

PO Box 2002

Allen, TX 75013

(888) 397-3742

www.experian.com

TransUnion Credit Bureau

PO Box 2000

Chester, PA 19016

(800) 888-4213

www.transunion.com

Within 60 days of receiving this notice, you may request a free copy of your credit report from each of the nationwide consumer reporting agencies listed above.

For more information regarding this notice, please contact [Name and Title] at [Lender Name] by phone at [phone number] or email at [email address]. Our office is located at [address].

Sincerely,

[Lender Representative Name]

[Title]

[Lender Name]

What to Do After a Mortgage Denial

Don’t get discouraged if your mortgage application gets denied – focus on resolving the issues for future approval. Here are constructive next steps:

Review and Dispute Credit Report Errors

Check all three of your credit reports closely. If you find mistakes like wrong account statuses or information belonging to someone else, start disputes immediately. Also look for credit building opportunities.

Ask About Reconsideration or Appeals

Some lenders may re-evaluate with additional verification of income, assets or credit. Or they may suggest alternate loan programs. Ask about options.

Improve Your Financial Profile

Pay down debts, increase your down payment amount, or take other steps to better your credit score and debt-to-income ratio.

Apply Elsewhere

Your profile might be approved at other banks or lenders. Shop around and compare mortgage offers.

Get Professional Advice

Housing counselors and mortgage brokers can review your situation and recommend solutions.

Prepare to Reapply

Correct any credit or income issues and apply again in 6 months or longer. The problems causing the initial denial should be resolved.

Common Reasons for Mortgage Denial

Lenders review many aspects of your financial situation when deciding on loan approval. Here are some of the most common reasons they might deny your mortgage application:

-

Credit score too low – Most conventional loans require minimum scores in the 620-660 range. Federal and state loans have lower thresholds.

-

High debt-to-income (DTI) ratio – Your total monthly debt divided by gross monthly income is too high for lenders’ limits, typically around 43-50%.

-

Insufficient income – Lenders want stable income adequate to cover the new mortgage payment and existing obligations. Varied or seasonal income poses challenges.

-

Work history gaps – Employment gaps make it hard to document consistent income for repaying the mortgage.

-

Credit history length – Too few years of established credit history can negatively impact your credit scores.

-

Missed payments – Recent late payments on credit accounts or previous mortgages may make lenders see high risk.

-

Collections – Outstanding debts sent to collections raise questions about your repayment habits, even in the past.

-

Judgments or liens – Any legal judgments against you or tax liens filed on your property make for a weaker application.

-

High utilization – Maxing out cards or having too many accounts near their limits can result in denial.

-

New credit inquiries – A high number of new credit accounts or hard inquiries dampen your scores.

-

Inaccurate personal details – Inconsistent application info with gaps, errors or multiple names/addresses hurts applications.

-

Lack of homeowner’s insurance – Being denied homeowner’s insurance can in turn preclude mortgage approval.

Can I Appeal a Mortgage Denial?

In some cases, yes. Many lenders have an appeals process or loan review program where they’ll re-evaluate a denied application. Your chances may improve by:

-

Providing updated income or employment verification

-

Documenting additional down payment funds

-

Adding a co-signer with stronger credit

-

Supplying evidence of resolved credit issues

-

Explaining special circumstances like medical bills harming your credit

If the lender agrees to reconsider, they will re-review your application and issue a new decision. However, approval is not guaranteed.

When Will Mortgage Denials Impact Future Applications?

A single recent denial likely won’t hurt your chances too badly with other lenders. However, multiple denied mortgage applications over a short timeframe can have a negative effect.

Too many denials can signal increased lending risk tied to your profile. Instead, take time to improve your financial standing before applying again. Avoid repeated denials by ensuring previously cited issues are corrected first.

Key Takeaways About Mortgage Denial Letters

While discouraging, a mortgage denial notice provides an opportunity to understand and remedy issues blocking your home loan approval. Critical takeaways include:

- The letter outlines the exact reasons for denial and rights to credit reports.

MORTGAGE ADVERSE ACTION LETTER

As required by the Fair Credit Reporting Act (FCRA)

Date: [MM/DD/YYYY]

Dear [APPLICANT NAME], thank you for your recent application. Your request for a mortgage was carefully considered, and we regret that we are unable to approve your application at this time for the following reason(s):

Your Income: ☐ Is below our minimum requirement. ☐ Is insufficient to sustain payments on the amount of credit requested. ☐ Could not be verified.

Your Employment: ☐ Is not of sufficient length to qualify. ☐ Could not be verified.

Your Credit History: ☐ Of making payments on time was not satisfactory. ☐ Could not be verified.

Your Application: ☐ Lacks a sufficient number of credit references. ☐ Lacks acceptable types of credit references. ☐ Reveals that current obligations are excessive in relation to income. Other: [OTHER REASON]

The consumer reporting agency we contacted to provide the information that influenced our decision in whole (or in part) was:

Agency name: [AGENCY NAME] Agency address: [AGENCY ADDRESS] Agency phone number: [AGENCY PHONE]

It’s important to know that the reporting agency played no part in our decision and is unable to supply specific reasons why we have denied credit to you. You have a right under the Fair Credit Reporting Act to know the information contained in your credit file at the consumer reporting agency. You also have a right to a free copy of your report from the reporting agency if you request it no later than 60 days after you receive this notice. In addition, if you find that any information contained in the report you receive is inaccurate or incomplete, you have the right to dispute the matter with the reporting agency. Any questions regarding such information should be directed to [REPORTING AGENCY NAME] (consumer reporting agency). If you have any questions regarding this letter, you should contact us at:

Creditor name: [CREDITOR NAME] Creditor address: [CREDITOR ADDRESS] Creditor phone number: [CREDITOR PHONE]

☐ (Check if applicable) We also obtained your credit score from the consumer reporting agency and used it in making our credit decision. Your credit score is a number that reflects the information in your consumer report. Your credit score can change depending on how the information in your consumer report changes.

Your credit score: [SCORE] Date: [MM/DD/YYYY]

Scores range from a low of [#] to a high of [#].

Key factors that adversely affected your credit score:

- [FACTOR 1]

- [FACTOR 2]

- [FACTOR 3]

- [FACTOR 4]

- ☐ Number of recent inquiries on consumer report, as a key factor (check if applicable).

If you have any questions regarding your credit score, you should contact the entity that provided the credit score at:

Address: [CONTACT ADDRESS] Phone number (toll-free): [CONTACT PHONE]

ECRA Notice: The Federal Equal Credit Opportunity Act prohibits creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status, age (provided the applicant has the capacity to enter into a binding contract); because all or part of the applicant’s income derives from any public assistance program; or because the applicant has in good faith exercised any right under the Consumer Credit Protection Act. The Federal agency that administers compliance with this law concerning this creditor is (name and address as specified by the appropriate agency listed in appendix A).

The letter is a necessity for any institution that offers mortgage lending and uses consumer reports to pre-screen applicants, which includes the following entities:

- Banks

- Credit Unions

- Mortgage Lenders

The letter must be sent whenever an entity takes adverse action on an applicant because of information in a credit report. Although businesses don’t fall under the FCRA’s requirements for reporting, they still fall under Regulation B of the ECOA. Using a general letter template that includes disclosures for both laws simplifies the process and ensures all government requirements are met.

Regulation B requires the notice to be sent within thirty (30 days) of receiving the consumer’s credit application. If the creditor makes a counteroffer to the applicant, they have ninety (90) days to inform the applicant of adverse action if the applicant does not accept the counteroffer.