Giving a family member a loan can be helpful, but it’s important to be aware of any potential tax repercussions. Learn about family loan taxes inside.

EarlyBird enables friends, family, and caregivers to contribute to a child’s financial future. Learn more. What Youll Learn.

When we think of loans, we frequently consider mortgages and auto loans, which frequently involve mountains of paperwork and stringent criteria. But what about more informal loans from family or friends?.

There are some crucial tax considerations to keep in mind if you’re considering borrowing money from family members or giving a loved one a loan.

This article will concentrate on the tax consequences of lending to family members. Everything you need to know about providing financial assistance to close family members will be covered, including how to structure the loan to reduce your tax liability and how to make these unofficial loans IRS compliant.

Get Started!Enter your phone number below, and we’ll text you the link to download the EarlyBird app to start investing in the kids you love.

Giving a family member a loan can be helpful, but it’s important to be aware of any potential tax repercussions. Learn about family loan taxes inside.

Last updated:

EarlyBird enables friends, family, and caregivers to contribute to a child’s financial future. Learn more. What Youll Learn.

When we think of loans, we frequently consider mortgages and auto loans, which frequently involve mountains of paperwork and stringent criteria. But what about more informal loans from family or friends?.

There are some crucial tax considerations to keep in mind if you’re considering borrowing money from family members or giving a loved one a loan.

This article will concentrate on the tax consequences of lending to family members. Everything you need to know about providing financial assistance to close family members will be covered, including how to structure the loan to reduce your tax liability and how to make these unofficial loans IRS compliant.

Basics of Family Loans

Family loans are direct loans made to members of the same family or close friends.

They are typically informal, so there isn’t a credit reporting system or loan application process.

Although it’s strongly advised to put the loan details in writing — more on this below — the loan may simply be a “handshake deal,” or there may be a basic contract or written agreement.

Family loans can be used for a variety of purposes and come in all sizes. For instance, a mother might loan her son $3,000 to help with general expenses after a job loss, or an uncle might loan his niece $50,000 to help with a down payment on her first house.

There are significant benefits to family loans, such as:

Family loans may, however, also have some drawbacks, including:

It’s crucial to take into account the drawbacks of family loans, especially the possibility of awkwardness or family drama if something goes wrong.

Be sure to talk to a family member about your concerns before you sign a loan agreement with them.

The potential tax obligations are a further consideration and depend on the loan’s size.

Family loans under $10,000 are typically handled on an informal basis and are not governed by the same complicated interest rate regulations as larger loans (more on this below).

Over $10,000 large family loans can be more complicated and are subject to IRS tax regulations.

Do Family Loans Get Taxed?

Family loans could result in tax liabilities for the lender, the borrower, or both. Everything depends on the size and structure of the loan.

First of all, a basic contract that both parties sign should always be used to formalize family loans. This is a requirement of the IRS because, in the absence of a contract, the IRS might classify the transaction as a gift rather than a loan and subject it to gift tax laws.

Additionally, the IRS prefers that interest be added to loans made to family members. Loans with no interest are possible, but the tax reporting regulations are much more complicated.

Not the loan itself, but the interest payments may be tax deductible. Therefore, if you lend $50,000 to someone, neither of you will have to pay taxes on the amount of the loan; however, you will probably have to pay income taxes on the interest payments you receive from the borrower.

Additionally, if you don’t charge interest, you might have to pay tax on the interest that you could have charged, which complicates matters. Typically, charging the borrower a small amount of interest is much simpler.

Fortunately, the minimum interest rules generally do not apply to smaller loans under $10,000. Thus, a smaller loan can be made interest-free without causing the borrower too much tax trouble.

Tax implications for the borrower

On the borrower’s side, there are typically no tax implications. Usually, the borrower won’t have to disclose the loan and won’t have to pay income tax on it.

In some circumstances, borrowing money from family may provide a tax benefit for the borrower. This only applies if the borrowed funds were used to buy a house.

The loan agreement might be structured to look like a second mortgage if the funds are used to buy a home. For the purpose of creating an appropriate loan agreement, a CPA may be needed.

If the loan is structured as a second mortgage, the borrower may be able to deduct the interest portion of payments under the Home Mortgage Interest Deduction rules.

However, because of how difficult this can be, it’s best to seek advice from a tax advisor.

Also, the mortgage interest deduction is only relevant if the borrower itemizes deductions. Only around 13.7% of American taxpayers itemize their deductions, so the home mortgage interest deduction won’t be relevant for most borrowers.

Tax implications for the lender

The primary tax repercussion of lending money to a relative is that the lender will have to pay taxes on the interest they receive.

For instance, if you lend $100,000 at 4% interest, you would receive interest income of about $4,000 per year. This $4,000 will be considered taxable income, so you must include it in your tax return.

And here’s where it gets weird: If you charge no interest or an interest rate below the applicable federal rates (AFR), you may owe tax on the interest you should have earned.

If you are unprepared, these alleged “imaginary interest payments” may cause you some tax headaches.

The difference between the interest rate charged and the applicable federal rate is known as the imputed interest. And it’s this figure that you’ll use to calculate what you may owe in taxes.

Unfortunately, there’s a double tax hit with imputed interest. The interest you should have earned will be subject to income tax, and you may be required to declare the interest the borrower should have paid as a “gift” to the borrower.

This all gets a bit complicated. It’s best to keep the loan under $10,000 if you don’t want to charge interest in order to avoid complicated regulations.

It’s best to seek advice from a tax expert for interest-free (or extremely low interest) loans over $10,000.

Ultimately, the simplest way to loan money is to charge at least the minimum interest rate, which is published each month by the IRS.

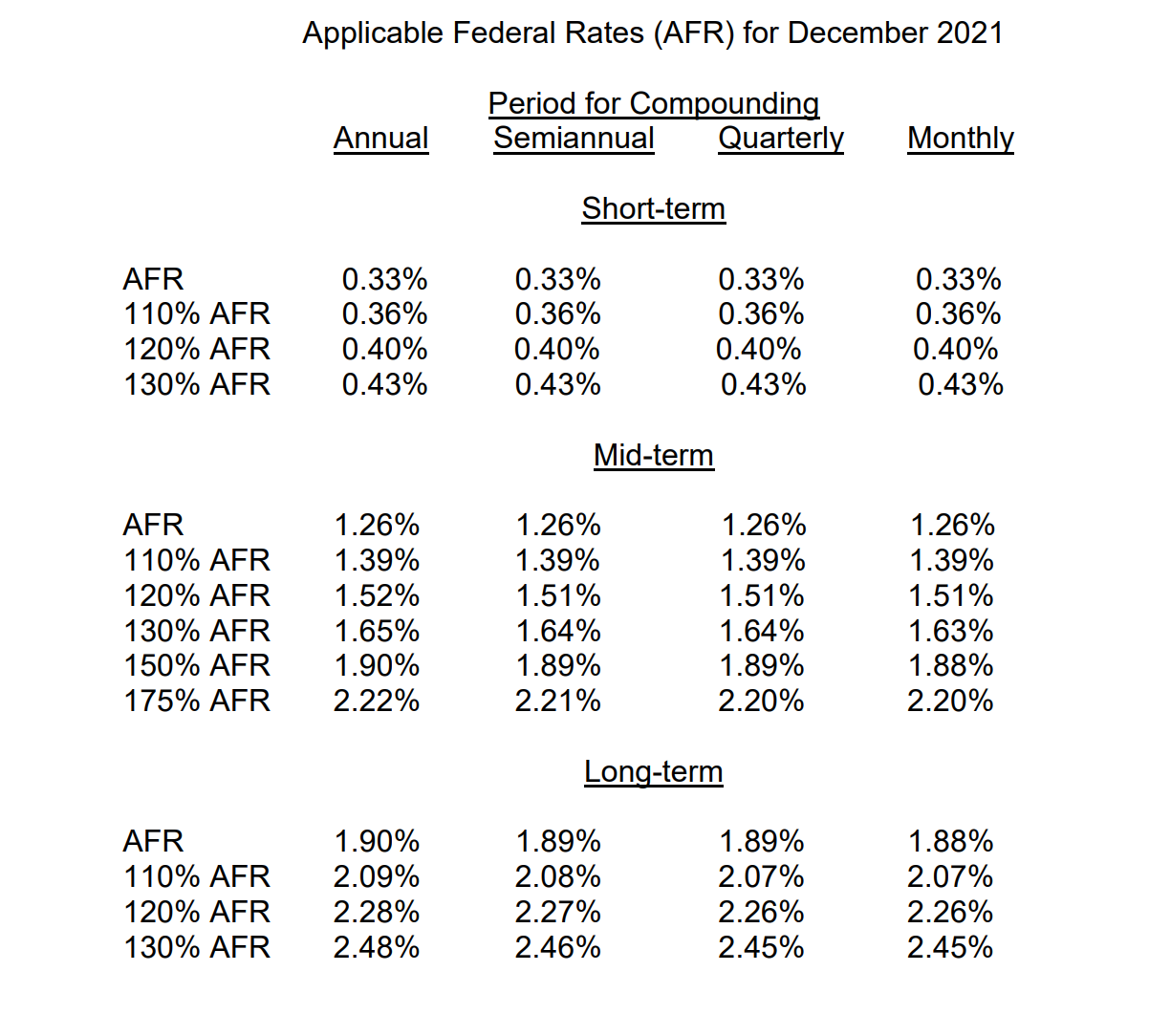

These rates are quite low, ranging from 0. 33%–1. 89% as of December 2021 (depending on the loan length).

It is much simpler to report the interest you actually earned as taxable income than imputed interest income as long as your interest rate matches or exceeds the AFR.

How to Make an IRS-Compliant Loan to a Family Member

Here are some general guidelines to adhere to if you decide to lend money to family in order to comply with IRS regulations.

1. Make a written loan agreement. If there’s no written agreement, the IRS may consider any money transferred between family members to be a gift — potentially making the transaction subject to gift tax. Use a loan agreement template to make things easy.

2. Agree to a repayment schedule. Create a clear repayment schedule in your loan agreement to prevent issues.

The rules discussed in this article are primarily for term loans — for instance, a five-year loan with monthly payments or a six-month loan with biweekly payments. The rules for demand loans (which have no formal repayment schedule) are different and can be more complex.

3. Charge interest based on the applicable federal rates. If you structure the loan to charge a small amount of interest based on the applicable federal rates, you’ll avoid most of the complexities of the tax code. And the borrower will still enjoy a much lower interest rate than would be available from a traditional lender.

The interest rate is set for the life of the loan, as long as there’s a clearly defined loan term. Here are the rates as of December 2021 (these change every month — check here for the latest rates).

4. Report income earnings as taxable income. When you file your taxes, any interest the borrower pays you needs to be listed as taxable income. The borrower doesn’t need to report anything.

5. If you want to make a zero-interest loan, speak with a tax advisor. The rules are more complicated if you don’t charge the applicable AFR or higher or if you make a loan with no interest. It’s best to consult a tax advisor in this case.

Alternatives to Loaning Money to Family

In some circumstances, it may be more prudent to forego lending money to a relative. This could be for tax purposes or for private reasons, such as not wanting to make your family dynamic awkward.

Giving money as a gift rather than lending it and offering to cosign on a traditional loan are two of the best substitutes.

It can be awkward around the holiday table if you have family members who you owe money to. Additionally, as previously mentioned, loans to family members may have some tax implications.

If you are willing, giving the relative the money as a gift would be a more ethical option.

For instance, you could give your granddaughter $40,000 to help out if she wants to buy a house but doesn’t have much saved up for a down payment. By doing this, the tax repercussions of a loan and any potential awkwardness would be avoided.

Additionally, a loan could hinder her chances of getting a mortgage because the lender would factor in your debt payments to you when determining her debt-to-income ratio.

The eligibility for a mortgage would not be impacted by a gift, however.

Remember that gifts might still need to be reported to the IRS. However, because of the generous exemptions, most gifts won’t actually result in a tax bill.

Up to $16,000 can be given tax-free in 2022 without having to file a gift tax return. Each person is entitled to this annual exemption, so married couples can give up to $32,000 tax-free.

You and your spouse could give each of your three children up to $32,000 per year without having to file any kind of gift tax return because it is per recipient.

You must submit a gift tax return if you give more than the allowed amount. However, because of the substantial lifetime gift tax exemption, you probably won’t actually owe any taxes.

Basically, each person is allowed to gift up to $12. 06 million over the course of their lives without having to pay any gift taxes This is in addition to the annual exemptions.

For instance, if a single father gave his daughter $100,000, he would use the entire $16,000 annual exemption and subtract $84,000 from his lifetime exemption. No gift tax would be due.

Full gift tax details can be found on the IRS’ instructions for form 709 – Gift Tax Return.

Cosigning for a standard loan with the borrower is an additional choice.

For instance, you could offer to cosign on a standard bank loan if your nephew wants to get a $50,000 personal loan but doesn’t have the best credit.

This might help him get the loan and most likely pay a lower interest rate than he otherwise would have, presuming you have better credit.

This means that you will be jointly responsible for repaying the loan. You’ll be responsible for the debt if your nephew doesn’t pay it back.

The advantage of this strategy is that you avoid any tax complexities, but there are still clear drawbacks. Additionally, the borrower gains the advantage of establishing a good credit history by making timely payments on a formal loan.

There are no tax repercussions for you or the borrower if you cosign a loan, and the borrower can simply shop around for the best rate from conventional lenders.

It’s crucial to comprehend the IRS’s detailed guidelines for intra-family loans.

The simplest approach is to charge a small amount of interest in accordance with the relevant federal rates, with clear terms set forth in writing.

As a result, the lender will not be subject to any of the more complicated tax situations that are associated with interest-free loans, but will still be required to report and pay income tax on the interest.

Visit the EarlyBird blog for a variety of useful resources and insights if you want to learn more about personal finance and gifting money to loved ones.

There is no financial advice on this page, only general information. All investments involve risk. Any hypothetical performance shown is for illustrative purposes only. For a variety of factors, including but not limited to market fluctuations, time horizon, taxes, and fees, actual investment performance may differ. For advice on making investments, please speak with a licensed financial advisor and/or tax specialist.

Download EarlyBird now to start investing in your child’s future. INVEST EARLY, GROW TOGETHER

Download EarlyBird now to start investing in your child’s future. INVEST EARLY, GROW TOGETHER

Download EarlyBird now to start investing in your child’s future. INVEST EARLY, GROW TOGETHER

Download EarlyBird now to start investing in your child’s future. INVEST EARLY, GROW TOGETHER

Download EarlyBird now to start investing in your child’s future. INVEST EARLY, GROW TOGETHER

You might also enjoy

Start your child’s nest egg with $15 on us, or send a gift to any child in your life.

Download the app to redeem your gift!

New customers only. Terms apply.

FAQ

How much money can you loan to a family member without paying taxes?

Most of the time, you won’t be required to pay taxes for “loans” that the IRS considered gifts. Only when your lifetime gifts to all recipients exceed the Lifetime Gift Tax Exclusion do you owe gift tax. For tax year 2021, that limit is $11. 7 million (increasing to $12. 06 million in 2022). For most people, that means they’re safe.

Do I have to report a family loan to the IRS?

Tax repercussions for the borrower Typically, the borrower won’t be required to report the loan and won’t be required to pay income tax on it. In some circumstances, borrowing money from family may provide a tax benefit for the borrower. This only applies if the borrowed funds were used to buy a house.

How much money can be legally given to a family member as a loan?

Theoretically, you can lend or borrow as much money as you feel comfortable exchanging with a family member. On loans exceeding $10,000, the lender might have to pay taxes on the interest earned.

Can I make a personal loan to a family member?

Making loans to family members (or people not related to you, for that matter) is not prohibited by the tax code. However, the so-called below-market loan rules apply unless you charge what the IRS deems an “adequate” interest rate.