Since the national housing crisis of 2007, which resulted from relaxed mortgage lending standards, mortgage lenders have been raising their lending standards and making it difficult for investors to obtain a mortgage.

Nowadays, potential investors looking to receive funding for their next investment should be prepared to dive deeply into their savings, earnings, and debt-to-income (DTI) ratio, which is a metric used to compare how much you owe to how much you earn every month.

Speaking of income, many types of income can help you access a mortgage. Many mortgage lenders also don’t impose a minimum income requirement to access a mortgage.

In today’s post, we’re going to look at how to use rental income to qualify for mortgage for rental property.

Using rental income to qualify for a mortgage or refinance can help you secure financing and buy additional investment properties. But you’ll need to properly document your rental income to have it counted by lenders. Follow these steps to prove your rental income and leverage it to purchase real estate.

Why Use Rental Income to Qualify?

Counting rental income allows real estate investors to qualify for larger loans and lower their debt-to-income (DTI) ratio This gives you greater purchasing power You can buy more expensive properties with larger mortgages while keeping your DTI in check,

Rental income also shows stable consistent cash flow. This appeals to lenders and helps you qualify if you are self-employed or have variable income streams.

Overall, leveraging documented rental income gives investors an advantage in securing financing.

What Rental Income Counts Toward Qualifying?

When applying for a mortgage, you can use up to 75% of rental income from current properties to qualify. You may also use projected future income if renting out part of a primary residence or investment property purchased with the new loan.

There are two main types of rental income:

- Actual income – Proven rental income from tax returns and documentation.

- Subject income – Projected rental income estimated by the lender at 75% of market rates.

Actual documented income carries more weight, but subject income can still be used in many cases.

How to Document Actual Rental Income

To prove actual rental income already being generated, provide the following documentation:

- Federal tax returns – Highlight Schedule E showing rental income and expenses.

- Leases – Provide current lease agreements showing rental rates.

- Bank statements – Show regular rent deposits.

- Profit and loss statement – Summarize income and operating expenses from rentals.

This concrete paperwork proves a stable track record of rental income over time.

How to Calculate Potential Rental Income

If you don’t have a history of rental income yet, you can provide an estimate or projection. The lender will scrutinize this closely to ensure accuracy.

Follow these steps to estimate rental income potential:

- Research market rates for comparable rentals in the area. Look at size, age, amenities, and location.

- Draft a sample lease agreement for your property with fair market rents.

- Calculate expected operating expenses like taxes, insurance, maintenance, etc.

- Subtract expenses from projected income to find your net rental income.

- Apply the 75% rule by multiplying net income by 0.75. This is the amount you can use.

Supporting documents like market comps, your lease, and expense estimates back up these income projections.

Tips for Documenting Rental Income

Here are some tips for proving rental income during the mortgage process:

- Current leases – Have tenants sign new leasesLocked in rental rates documented on current leases.

- Security deposits – Show deposits help validate rental amounts.

- Property management agreements – Having a third-party manage your rentals adds legitimacy.

- Past tax returns – Returns from the last 2 years help prove consistent income.

- Repair invoices – Documenting expense helps confirm it’s an investment property.

- Property photos – Photos depicting tenants and furnishings prove occupancy.

- Purchase contracts – If buying a rental, provide the purchase agreement and lease.

- Fair market rents – Use localized data to justify projections.

Dos and Don’ts of Documenting Rental Income

Follow these dos and don’ts when proving rental income:

DO:

- Stick to market rental rates

- Be conservative with income projections

- Document both income and expenses

- Explain periods of vacancy

DON’T:

- Inflate rental rates unrealistically

- Leave out operating expenses

- Claim rental income without documentation

- Provide fraudulent leases or financial statements

Documenting rental income takes work, but pays off in qualifying for better mortgage terms.

How Lenders Evaluate and Verify Rental Income

Lenders investigate rental income carefully when approving loans. Here’s how they evaluate it:

-

Reasonableness – Do rents align with market rates for the area and property type? Rents exceeding market norms raise flags.

-

Stability – Is income consistent month to month? Large fluctuations are concerning.

-

Continuity – Has the income level persisted over multiple years? Consistent income reduces risk.

-

Expenses – Are operating expenses realistic? Understating expenses inflates income numbers.

-

Leases – Do lease terms match documentation? Rent differing from leases draws scrutiny.

-

Occupancy – Is there documentation showing tenants occupying the property? Fake leases get detected.

Scrutinizing these factors helps lenders mitigate risk when using rental income to qualify borrowers.

How Much Rental Income Do You Need?

As a guideline, plan on generating at least 75% of your intended mortgage payment amount in rental income for a property.

So if your projected mortgage payment is $2,000 per month, aim for $1,500 in net rental income. This provides a buffer so the property pays for itself.

The more rental income you can document, the higher mortgage amount you can qualify for. Just remember lenders cap it at 75% of proven rents.

Alternatives If You Can’t Document Rental Income

If you lack tax returns or leases to document rents, alternatives include:

-

Using a lower DTI – Reduce your DTI below 43% without rental income.

-

Paying a higher down payment – Put down 25-30% to offset missing rental income.

-

Finding a portfolio lender – Some lenders use experiential rental income without documentation.

-

Using non-rental income – Income from W2s, 1099s, assets can also help qualify.

While documenting rents is ideal, other options exist if you have limited documentation. An experienced mortgage broker can advise you on the best approach.

Steps for Refinancing Using Rental Income

You can also tap into your rental income when refinancing. Follow similar steps to document income:

- Gather current leases to prove occupancy and rents

- Obtain recent bank statements showing rent deposits

- Have profit and loss statements prepared summarizing income and expenses

- Request an appraisal to establish market rental rates

- Pull last year’s tax returns highlighting Schedule E

This rental income documentation lets you maximize your cash-out refinance amount or debt consolidation loan size. Actively leveraging your rental income opens up more financing options.

Common Roadblocks When Using Rental Income

Some common obstacles that can derail using rental income include:

- Leases showing rents exceeding market rates

- Attempting to claim capital expenses as operating expenses

- Providing fraudulent or exaggerated documentation

- Having large, unexplained gaps between tenants

- Poorly documented income and expenses

Proper planning and accurate documentation helps avoid issues when validating rental income.

Key Takeaways

- Documenting rental income allows real estate investors to qualify for larger mortgages and lower DTIs.

- Provide current leases, tax returns, bank statements, and profit and loss statements to prove income.

- For new rentals, carefully estimate projected income with market data.

- Follow proper documentation protocol to show stable, realistic income.

- Lenders verify rental income closely to mitigate risk when underwriting loans.

Properly leveraging your rental income can expand your real estate investing capabilities. Just document completely and accurately to benefit.

What Kind of Documents Do You Need?

The process of applying for a mortgage using rental income is more or less the same as applying for one without rental income. The difference is that you might need to go through a thorough screening process. Besides, be prepared to show proof of your actual or anticipated rental income.

When providing other necessary financial details of your application to your lender, also be prepared to include your rental income.

Generally, prepare copies of the following documents:

- Two years of tax returns

- Two years of W-2s or 1099s

- Pay stubs for the past 30 days

- Monthly or quarterly bank statements for all your financial accounts, including investments

- A profit and loss statement for self-employed applicants

- A signed copy of the real estate purchase agreement

If you currently don’t have a tenant but can provide proof of tax returns, your application should be fine. Otherwise, you’re probably going to need to calculate how much rental income you expect from your property.

However, note that a rough estimate won’t be sufficient for the lender. The lender will carefully examine your income and may order an appraisal. To estimate the rental income, the appraisal also considers other real estate comps in your neighborhood and their rental rates.

In addition, the lender might require a copy of the lease and copies of the most recent checks to determine whether the rent will be paid on time and consistently.

That said, know that your rental property’s income might be eligible to be reported as income. Before starting the mortgage application process, talk to the lender. Make sure to confirm which documents you’ll need to provide to support your application. This way, you’ll have everything ready and avoid wasting time looking for additional documents.

How to Calculate Your Rental Income to Qualify for a Mortgage

As you can see, estimating your monthly rental income is essential when using rental income to qualify for a mortgage. You need to carry out due diligence even when applying for a loan for property owned by LLC.

As you can already tell, manually conducting the calculations would be a time-consuming affair. You need to gather, organize, and analyze a lot of data. A simple error can make your entire analysis inaccurate. That’s why you need to use modern real estate tools.

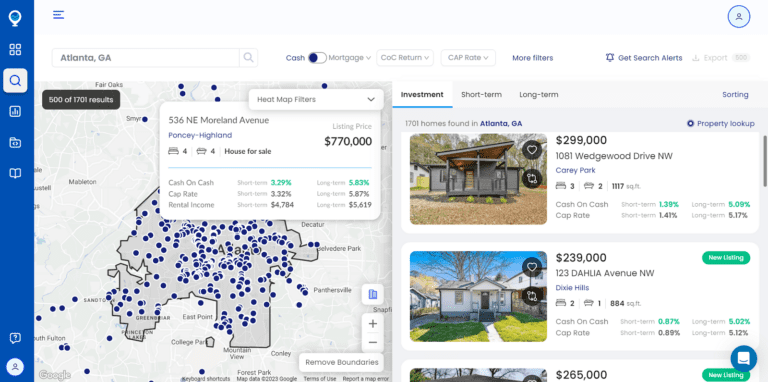

Your best bet when it comes to estimating your rental income is Mashvisor. It is an online real estate platform that helps investors make smart business decisions by providing them with reliable and accurate data and analytics.

Mashvisor is a massive database with huge amounts of data that are regularly updated. It helps investors carry out analysis easily by making everything available with just the click of a button.

The platform offers a wide variety of tools to help you with your investment property analysis. For example, the investment property calculator will allow you to come up with accurate monthly rental income estimates. The numbers generated are accurate and realistic.

Our tools are interactive. If your research or experience on the ground shows that some numbers might be different, you can adjust them and see how the ROI will change.

If you want to get started with real estate investing and using rental income to qualify for a mortgage this year, we recommend using Mashvisor to ensure you get started on the right note. On top of the functions mentioned above, Mashvisor will also help you invest in the best market and rental property.

Sign up with Mashvisor today and start your 7-day free trial.

Many landlords who own and operate rental properties will be glad to know that using rental income to qualify for a mortgage is possible. Lenders will typically look at your debt-to-income ratio and income streams.

The process becomes way easier if you documented your rental income, and it’s verifiable. Using the estimated rental income you expect to receive from the investment property is a bit complicated. The lender will ask for an independent appraisal of the property to evaluate the market rental rate.

The lender may also use a signed lease agreement for occupied rental properties to determine the percentage of rent that will be used to qualify you for a mortgage.

Keep in mind that you will need to provide your lender with important supporting documents, such as bank statements, tax returns, profit and loss statements, and many more. The lender will also take into account the property’s expenses and cash flow when considering your application.

If you find it hard to calculate how much rental income you can expect from your property, use a reliable real estate tool such as Mashvisor. The real estate platform will help you calculate a property’s rental income and ROI. It will also assist you in choosing a profitable real estate market to invest in.

Schedule your demo today and see how Mashvisor’s tools can help you.

Find out more using rental income when applying for a mortgage below: