Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

Opening, or simply applying for, a new credit card can temporarily ding your credit score. However, obtaining a new card can also have some positive effects on your credit, like increasing your credit limit. Here’s what to know.

In the realm of personal finance, credit cards play a pivotal role in shaping our financial health While they offer convenience and rewards, the impact of opening a new credit card on your credit score is a topic that often sparks debate. This comprehensive guide delves into the intricacies of how new credit card accounts affect your credit score, exploring both the potential drawbacks and benefits We’ll analyze the insights from two reputable sources – LendingTree and NerdWallet – to provide you with a balanced and informative perspective.

The Short-Term Impact: A Slight Dip in Your Score

Opening a new credit card can initially lead to a slight decrease in your credit score. This temporary dip primarily stems from two factors:

-

Hard Inquiry: When you apply for a new credit card, the lender typically pulls your credit report from one or more of the three major credit bureaus (Equifax, Experian, and TransUnion). This inquiry, known as a hard inquiry, can shave off a few points from your score. The impact is usually around 5 to 10 points and remains on your credit report for two years, although the negative effect fades after one year.

-

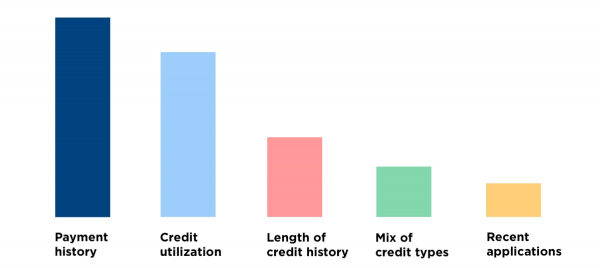

Reduced Average Age of Accounts: Your credit history comprises various factors, one of which is the average age of your accounts. Opening a new card lowers the average age, as it’s a relatively new addition to your credit portfolio. This factor contributes to 15% of your FICO Score, so maintaining older accounts generally reflects positively on your creditworthiness.

The Long-Term Advantage: Boosting Your Credit Score

Although getting a new credit card might have a negative immediate impact, the long-term advantages can greatly exceed the drawback. Here’s how opening a new card can potentially boost your credit score:

-

Better Utilization Ratio: Your credit score is heavily influenced by your credit utilization ratio, which is the proportion of your available credit that you are currently using. If you don’t increase your spending, opening a new card can lower your utilization ratio by increasing your total available credit. A good rule of thumb is to keep utilization below 30%. You can raise your credit score overall by using multiple cards strategically to maintain a healthy credit utilization ratio.

-

Extended Credit Mix: The various credit accounts that you own, comprising your credit mix, account for 2010 percent of your FICO score. Having a mix of credit cards and loans demonstrates responsible credit management. Opening a new card, especially if it differs from your existing accounts (e. g. , a travel or rewards card), can help you improve your credit score by varying the types of credit you have available.

Finding the Optimal Balance: How Many Credit Cards Are Too Many?

While having at least one credit card is beneficial for building credit, the optimal number varies depending on individual circumstances. Some individuals might find one card sufficient, while others might utilize multiple cards to maximize rewards in different spending categories. The key is to manage your cards responsibly, keeping track of due dates and ensuring timely payments. Consider setting up payment reminders or utilizing autopay features to maintain good credit standing.

Building and Maintaining a Stellar Credit Score: Essential Tips

Building and maintaining a good credit score is crucial for various financial aspects, from securing loans to obtaining favorable interest rates. Here are some key tips to keep in mind:

-

Prioritize On-Time Payments: Making timely payments is the most critical factor influencing your credit score. Aim to pay your credit card balances in full whenever possible. If full payment isn’t feasible, prioritize at least the minimum due to avoid late fees and negative marks on your credit report. Remember, payments are typically reported as late after 30 days, so act swiftly if you miss a due date.

-

Keep Balances Low: Avoid maxing out your credit cards. Maintaining low balances helps keep your credit utilization ratio in check, demonstrating responsible credit management to lenders.

-

Apply for New Credit Sparingly: Limit the frequency of new credit applications. Each inquiry can impact your score, and excessive applications might raise concerns about your creditworthiness.

-

Maintain a Healthy Credit Mix: As mentioned earlier, diversifying your credit mix with different types of accounts can enhance your score. Consider responsible use of credit cards and loans to build a well-rounded credit profile.

Opening a new credit card can have both short-term and long-term implications for your credit score. While the initial impact might involve a slight decrease, responsible management and utilization can lead to significant score improvements over time. By prioritizing timely payments, maintaining low balances, and diversifying your credit mix, you can leverage new credit cards as valuable tools for building and maintaining excellent creditworthiness. Remember, responsible credit management is key to unlocking the numerous financial benefits associated with a good credit score.

It may lower the average age of your accounts

How long you’ve had credit also affects your score. Your new card can reduce the average age of your credit. If you have few credit cards, it will have a bigger impact than if you have many.

Length of credit history, however, is a relatively minor factor in credit scores. It counts as 15% of your FICO score. As %20making%2021%%20of%20your%20VantageScore%203,%20VantageScore%20lists%20%E2%80%9Cdepth%20of%20credit,%E2%80%9D%20the%20age%20of%20your%20credit%20accounts 0 score.

How opening a new card can help your credit

A new line of credit can also help your credit profile.

Does Opening a New Credit Card Hurt Your Credit Score?

Will a new credit card boost my credit score?

A new credit card might boost your credit score if it is your first one or if you had little credit history before opening the account. You might not have had a credit score at all before getting your first credit card. Within six months of opening the account, however, there should be enough information to generate a credit score for you.

Does opening a new credit card hurt your credit score?

Opening a new credit card can also hurt your credit score by reducing your average age of accounts. Length of credit history makes up 15% of your FICO Score, the scoring model typically used by lenders when deciding whether to extend you credit, and the average age of accounts is part of that factor.

How much does a new credit score affect your credit score?

New credit (10%): New inquiries on your credit report account for 10% of your score. Related: How credit scores work How can applying for a credit card hurt your credit score? Your credit will likely be checked dozens of times throughout your life, whether you’re applying for a credit card or starting a new job.

What happens if you open a new credit card?

Opening new credit lowers the average age of your total accounts. This, in effect, lowers your length of credit history and subsequently, your credit score. New credit, once used, will increase the “amounts owed” factor of your credit score. Amounts owed is composed of credit utilization — the ratio of your credit balances to your credit limits.