A 40-year mortgage is like a traditional 15- or 30-year mortgage, but it offers an extended repayment term. Having ten more years to pay off a loan can give you lower monthly payments, but in the long term you’ll pay far more interest.

40-year mortgages can be a more affordable way to purchase a home in today’s increasingly expensive housing market, but that’s not the most common way they’re used. More often, lenders modify an existing loan’s repayment term to 40 years in order to help struggling homeowners avoid foreclosure.

The FHA 40-year loan is an extended repayment option that allows struggling homeowners to lower their monthly mortgage payments. While 40-year mortgages can also be used by some borrowers to purchase a new home, they are more commonly used as a modification for existing FHA loans.

What Is an FHA 40-Year Loan?

An FHA 40-year loan is a mortgage insured by the Federal Housing Administration (FHA) that has a repayment term of 40 years This is 10 years longer than the traditional 30-year mortgage offered by most lenders

By extending the repayment period, monthly principal and interest payments are lowered significantly compared to a 30-year loan for the same loan amount. This can help homeowners who are facing financial hardship and struggling to make their current mortgage payments.

The FHA 40-year mortgage can be used in two main ways

-

As a loan modification – The mortgage on an existing FHA loan can be modified to a 40-year term to lower the monthly payments for a homeowner who is delinquent or at risk of default This is the most common use for FHA 40-year loans

-

As a purchase mortgage – In limited cases, borrowers may be able to qualify for a 40-year mortgage to buy a new home. However, 40-year purchase mortgages are rare.

Benefits of an FHA 40-Year Loan

The main benefits of an FHA 40-year loan are:

-

Lower monthly payments – By extending the repayment period by 10 years, the principal and interest payment is reduced significantly compared to a 30-year mortgage. This improves affordability.

-

Avoid foreclosure – Lower monthly payments may help homeowners avoid foreclosure if they have fallen behind on their current mortgage due to financial hardship.

-

Buy a more expensive home – For those able to qualify for a 40-year purchase mortgage, the lower monthly payments may allow some buyers to afford a more expensive home than they could with a 30-year loan.

Drawbacks of an FHA 40-Year Loan

While the lower monthly payments are the biggest advantage of a 40-year mortgage, there are some significant drawbacks to be aware of as well:

-

Higher interest rates – 40-year mortgages often come with an interest rate that is 0.5% to 1% higher than a 30-year loan.

-

More interest paid over time – Even if the interest rate is the same as a 30-year loan, you’ll pay substantially more interest over the life of the longer 40-year loan.

-

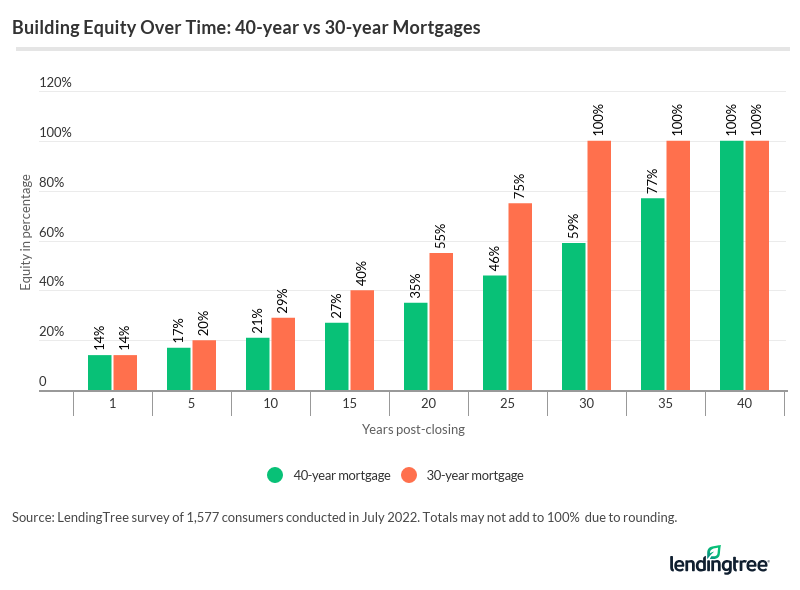

Slower equity building – With a 40-year mortgage, you’ll accumulate home equity at a much slower pace compared to a 30-year loan.

-

Difficult to qualify – 40-year mortgages have stricter eligibility requirements than standard 30-year loans. Few borrowers qualify for 40-year purchase mortgages.

-

Limited availability – Only a small number of lenders offer 40-year mortgage options. They aren’t widely available.

-

Can’t be sold to Fannie Mae or Freddie Mac – Longer-term mortgages cannot be purchased or securitized by the GSEs.

FHA 40-Year Loan Requirements

The eligibility criteria for FHA 40-year loans are strict compared to typical FHA requirements. Here are some of the key requirements:

Credit score – Most lenders require a minimum credit score of 580 for an FHA 40-year loan. Some may accept scores as low as 500.

Down payment – Borrowers need a down payment of at least 3.5% of the purchase price.

Debt-to-income ratio – Your front-end DTI can’t exceed 31% and total DTI can’t exceed 43%.

Mortgage history – You must have made at least six consecutive months of on-time mortgage payments prior to applying for an FHA 40-year loan.

Home value – The maximum loan limit for FHA mortgages applies. This ranges from $420,680 to over $800,000 depending on location.

Occupancy and property type – 40-year FHA loans must be used to finance single-family primary residences. Non-owner-occupied properties don’t qualify.

Building equity – You need to build a reasonable amount of equity over the loan term. Typically at least 50% by year 30.

Fixed rate – FHA 40-year mortgages must have a fixed interest rate for the entire repayment period. ARMs aren’t eligible.

How To Get an FHA 40-Year Loan

If you’re interested in an FHA 40-year mortgage, here are the steps to take:

Check your eligibility – Speak with a lender to confirm you meet all the requirements for credit score, down payment, debt ratios, payment history, etc.

Find a lender – Connect with lenders that offer FHA 40-year loan options. Ask your current servicer if they provide them. LendingTree has a database of lenders to check.

Complete the application – You’ll need to fill out an application and provide documents to verify your income, assets, employment, credit history and more.

Get preapproved – Most lenders require preapproval before they will make a 40-year loan. This shows you meet the eligibility criteria.

Shop for homes – Work within your preapproval amount as you search for homes to purchase.

Make an offer – Once you find the right home, make an offer and negotiate the purchase price.

Final underwriting – The lender will do a final review of your finances before final approval.

Close on the mortgage – Once approved, you’ll sign all the closing documents to secure the 40-year mortgage.

How FHA 40-Year Loan Modifications Work

Homeowners who have an existing FHA mortgage can apply to modify their loan terms to lower their monthly payment. Here is how FHA 40-year modifications work:

-

Eligibility – To qualify for an FHA modification, your loan must be at least 12 months old and you need to be 2+ months delinquent on payments.

-

Application – You apply through your mortgage servicer. Documentation of hardship is required.

-

Trial period – You make three modified trial payments before the modification becomes permanent.

-

Modification terms – The mortgage is modified by extending the term to 40 years and recalculating the payment.

-

Closing documents – After successfully completing the trial period, you sign final modification paperwork.

-

Modified rate and term – The interest rate remains the same, but the monthly payment is lowered based on the now 40-year repayment term.

-

Credit impact – Your credit report will show the loan modification, which can negatively impact your credit score.

Alternatives to an FHA 40-Year Loan

If you don’t qualify for an FHA 40-year mortgage or want to consider other options, here are a few alternatives:

-

Conventional 30-year loan – You may be able to afford the monthly payments on a standard 30-year mortgage.

-

FHA streamline refinance – Refinancing your current FHA loan to lower the interest rate could reduce your payment.

-

Forbearance – Your lender may grant a forbearance period where you can temporarily reduce or suspend payments.

-

Repayment plan – Setting up an affordable repayment plan with your servicer may help you get caught up if you’ve fallen behind.

-

Loan modification – Your lender may be able to modify your loan in other ways, such as extending the term to 35 years only.

-

FHA-HAMP – This FHA mortgage modification program can help those facing long-term financial hardships.

The Bottom Line

An FHA 40-year loan can be a double-edged sword. On one hand, it may enable struggling borrowers to avoid foreclosure by reducing their monthly payments. On the other hand, the longer loan term results in substantially higher interest costs over the full repayment period.

Carefully weigh the pros and cons of an FHA 40-year mortgage to decide if it’s the right option for your situation. Be sure to consider alternative programs as well.

How does a 40-year mortgage compare to a 30-year mortgage?

A 40-year mortgage can lower your monthly payments, but it’ll also greatly increase how much you’ll pay in interest. To see what this could look like in the real world, choose the example below that applies to your situation. If you’re only interested in how a longer loan term can affect your ability to build home equity, head to the final example.

Below, we compare two hypothetical loan options for a $430,000 home with a 13% down payment. As a best-case scenario, we’ll give both loans the same interest rate.

| Loan amount | Interest rate | Monthly payment | Total cost | |

|---|---|---|---|---|

| 30-year mortgage | $374,100.00 | 7.79% | $2,690.45 | $968,560.64 |

| 40-year mortgage | 374,100.00 | 7.79% | $2,542.39 | $1,220,346.21 |

Takeaways: While you’d save $148.06 per month on your mortgage payments by going with a 40-year loan, you would end up spending about $251,800 more for the privilege.

Here we look at both 30- and 40-year loan options for a home with $300,000 still owed to the lender. In our example, there is no difference in the interest rate because a loan modification doesn’t alter the interest rate of the existing loan. The monthly payment amounts reflect principal and interest only.

| Loan amount | Interest rate | Monthly payment | Total cost | |

|---|---|---|---|---|

| 30-year mortgage | $300,000.00 | 6.27% | $1,851.06 | $666,380.04 |

| 40-year mortgage | $300,000.00 | 6.27% | $1,707.45 | $819,576.04 |

Takeaways: In this example, you would have paid $153,196 more in interest by choosing to modify your loan. But, on the other hand, if this was the only way to prevent foreclosure, it may very well have been worth it.

It’s worth taking a look at how much more slowly you’ll build equity with a 40-year loan, because it can affect your ability to get other loans or sell your home in the future. The chart below compares the equity-building timelines for 30- and 40-year mortgages.

As you can see, with a 30-year loan, you would build 20% equity in just five years — but with a 40-year loan, you’d have to wait nearly nine years to build that much equity. And depending on other terms of the loan (e.g., an interest-only period), it could take even longer to build equity.

Where can I get a 40-year mortgage?

Most of the big, “household name” lenders don’t offer 40-year loans. But here are some lenders who do offer a 40-year option:

It’s also worth a shot to ask a bank or lender you already have a relationship with if they’ll offer a 40-year loan. If they don’t, there are multiple places you can look:

- Mortgage brokers. Some mortgage brokers work with lenders that specialize in 40-year loans and other nonqualifying mortgages.

- Online and local lenders. You may have success finding an online lender — or a small local or regional bank — that offers 40-year mortgages.

- Credit unions. Some credit unions have more flexible lending terms and may offer 40-year mortgages.

- Housing counselors. Your state or local HUD office can point you to a housing counselor and other resources. Additionally, the CFPB has a database of housing counselors.

![]()

FHA approved 40-year mortgage for homebuyers in May

FAQ

Does FHA offer a 40 year mortgage?

Is there such a thing as a 40 year mortgage?

What is the longest term FHA loan?

How many years is a FHA loan for?

|

FHA Loans vs. Conventional Loans

|

|

|

|

FHA LOAN

|

|

Minimum Down Payment

|

3.5% with a credit score of 580+ and 10% for a credit score of 500 to 579

|

|

Loan Terms

|

15 to 30 years

|

|

Mortgage Insurance Requirements

|

Upfront MIP + annual MIP for either 11 years or the life of the loan, depending on LTV and length of the loan

|

Do FHA loan borrowers have a 40-year option?

FHA loan borrowers have access to a similar 40-year option, as do VA loan borrowers, thanks to the VA’s recent update to its loan modification options. Some mortgage lenders offer a 40-year mortgage outside of modification situations. ( Carrington Mortgage, for instance, offers a 40-year loan.)

Does FHA have a 40-year loan modification?

The provisions of the final rule will expand FHA’s loss mitigation options to include a standalone 40-year loan modification. The 40-year loan modification can assist borrowers in avoiding foreclosure by spreading the outstanding mortgage balance over a longer period, thereby making their monthly payments more affordable.

What is a 40 year mortgage?

A 40-year mortgage allows you to repay your loan over 40 years instead of the more common 30 or 15 years. This extended term comes with a lower monthly payment, but at the cost of a higher interest rate and more paid toward interest over the life of the loan. Forty-year mortgages are a type of non-qualified mortgage (non-QM loan), however.

Can you get a 40-year mortgage?

Yes, it’s possible to get a 40-year mortgage — but it’s not as simple as getting a more traditional 15- or 30-year loan. 40-year mortgages aren’t a common option for borrowers in good financial standing who are simply looking for a longer loan term on a new purchase. Instead, lenders typically use 40-year loans as a loan modification option.