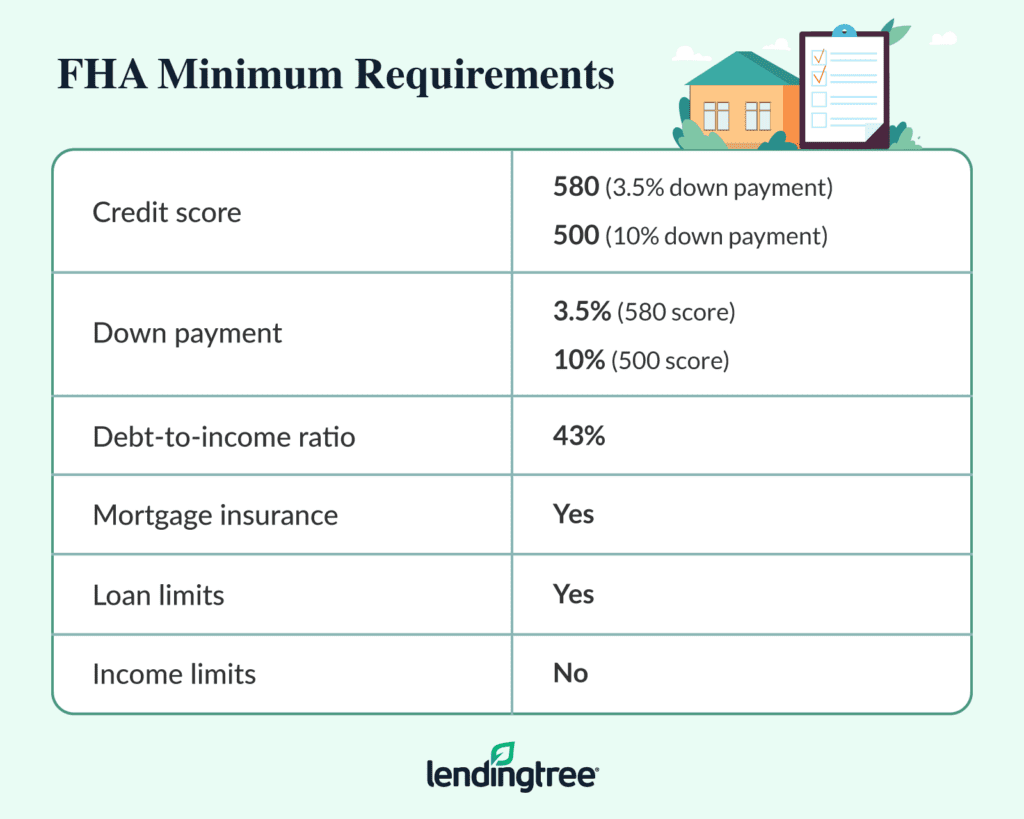

Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

The FHA has specific guidelines on whether installment loans with less than 10 payments can be excluded from debt-to-income calculations when applying for an FHA loan. This article will explain the FHA’s requirements in simple terms and provide clear details on this topic.

What is an Installment Loan?

An installment loan is a loan that is repaid through equal monthly payments over a set period of time. Common examples of installment loans are auto loans, student loans, and personal loans from a bank. The repayment structure has a fixed number of payments until the loan is fully paid off.

FHA Debt-to-Income Ratio Calculation

When applying for an FHA mortgage, the lender will calculate a debt-to-income (DTI) ratio based on your income and debts. This DTI ratio is a key factor in determining if you qualify for the loan.

The DTI ratio consists of two components:

- Housing DTI: Your proposed monthly mortgage payment divided by your gross monthly income. This includes property taxes, insurance, HOA fees, etc.

- Total DTI: Your proposed monthly mortgage payment plus all recurring debt payments divided by your gross monthly income.

To qualify for an FHA loan, your housing DTI must be less than 31% and total DTI less than 43%.

Excluding Installment Loans from DTI

The FHA does allow excluding certain installment loans from the total DTI calculation if there are less than 10 monthly payments remaining. This can help lower your DTI and improve your chances of approval.

Here are the specific FHA guidelines on excluding installment loans:

-

The loan must be an installment loan, such as a car loan, student loan, or personal loan. Revolving debts like credit cards are not eligible.

-

There must be less than 10 monthly payments remaining on the loan until it is fully paid off

-

You cannot pay down the loan balance to reach the 10 payment mark. The loan must already be structured with less than 10 payments left based on the original repayment terms

-

The monthly payment amount must be 5% or less of your gross monthly income that is used to qualify for the FHA loan.

-

You can only exclude one installment loan using this guideline. If you have multiple installment loans only the one with the lowest payment balance can be excluded.

Let’s look at a couple examples to illustrate how this works:

Example 1:

- Gross Monthly Income: $4,000

- Car Loan Balance: $2,400

- Car Loan Monthly Payment: $400

- Car Loan Remaining Payments: 6

In this case, the $400 monthly car payment is 10% of the gross monthly income ($400 / $4,000). Since it exceeds 5%, it cannot be excluded even though there are less than 10 payments left.

Example 2:

- Gross Monthly Income: $6,000

- Student Loan Balance: $1,500

- Student Loan Monthly Payment: $250

- Student Loan Remaining Payments: 5

Here the $250 monthly student loan payment is 4% of the gross monthly income ($250 / $6,000). Because it is less than 5% and there are less than 10 payments left, this installment loan can be excluded from the DTI calculation.

Other Important Points

Here are some other key things to keep in mind about excluding installment loans on an FHA loan:

-

You cannot pay down the loan balance just to reduce the remaining payments below 10. The loan terms must already be structured that way.

-

The FHA does not place limits on the total dollar amount that can be excluded. As long as the payment is less than 5% of income and there are less than 10 payments left, any loan balance can be excluded.

-

The exclusion only applies to the monthly payment amount. The overall loan balance still must be included in your debt liabilities.

-

An installment loan with more than 10 payments left cannot be partially excluded. Either the full monthly payment is included in DTI or the full payment is excluded.

-

Other types of recurring debts like revolving credit cards, alimony payments, and child support cannot be excluded. The exemption is only for installment loan debts.

-

You must provide documentation verifying the balance, monthly payment, and number of payments remaining on any installment loan to be excluded.

-

The exclusion only applies to monthly DTI calculations. Excluding an installment loan payment does not impact your required cash down payment.

Carefully reviewing the FHA guidelines on installment loan exclusions can help you strategically structure your debts to lower your DTI and improve your chances of approval for an FHA mortgage. Just remember loans must have less than 10 payments remaining and relatively small monthly payments to qualify for this exemption.

Learn About FHA Loans

Find out why FHA mortgages with low down payments are so popular with homebuyers.

FHA Loan Programs for 2024

The most recognized 3.5% down payment mortgage in the country. Affordable payments w/good credit.

Can Installment debt with fewer than 10 payments remaining be excluded…..

FAQ

Can installment debt with less than 10 months remaining be excluded?

What is the FHA 12 month rule?

What is the new FHA rule for student loans?

Can you exclude installment debt in FHA?

What are HUD Guidelines & requirements for FHA loans?

The HUD guidelines and requirements for FHA (Federal Housing Administration) loans are outlined in HUD Handbook 4000.1. This handbook covers various aspects of FHA loans, including borrower eligibility, property requirements, loan limits, credit and income criteria, and more.

What is the minimum down payment for an FHA loan?

FHA loans require a minimum down payment of 3.5% of the purchase price. Down payment funds can come from personal savings, gifts, grants, or approved down payment assistance programs. Borrowers should generally have debt-to-income (DTI) ratios within acceptable limits, typically at most 43% of gross income.

Do installment loans count in DTI?

Formerly : Payments for installment loans with ten or fewer months to go did not count in the applicant’s DTI. Now : For installment loans with 10 or fewer payments, underwriters include any portion of the payment exceeding five percent of a borrower’s monthly income in the DTI calculation.

What if the monthly payment is not available for installment debt?

If the actual monthly payment is not available for installment debt, the Mortgagee must utilize the terms of the debt or 5 percent of the outstanding balance to establish the monthly payment. (G)Student Loans (Manual) (1) Definition Student Loan refers to liabilities incurred for educational purposes. (2) Standard