What are the best allotment loans for postal workers? is the question this guide aims to address.

If you work for the postal service and require money to pay for an urgent expense, you may be eligible for an allotment loan, which allows you to borrow money using your future paychecks as collateral.

When looking for allotment loans that will meet their needs, Stately Credit is committed to giving potential borrowers information about their options.

Despite the fact that we think our allocation loans are among the best in the business, we have put together a list of the best allocation loan providers for postal workers to help you better understand the market and narrow down your search.

Please read the list below to discover more about these suppliers and what they have to offer, in no particular order.

9 Best Allotment Loans for Postal Employees

Kashable is an online lending company founded in 2013 and headquartered in New York City.

Except for West Virginia, all states provide a socially conscious wellness option for workers, including postal workers.

Kashable offers loans with amounts ranging from $250 to $20,000, rates starting at 6% APR, and terms of 6 to 24 months.

Kashable applications take a couple of minutes to complete. However, if additional information needs to be verified, there might be delays.

To determine offers and interest rates, Kashable uses information about your employment and credit, and they report payments to all three credit bureaus so that you can raise your credit score.

Monthly payments are taken directly out of your paycheck. If you leave your job or are fired early, Kashable and you will work out a different repayment plan using things like ACH payments, checks, or money orders.

Eligibility Requirements

Pros

Cons

Overview

OneBlinc is an online lending company founded in 2018 and headquartered in Miami, Florida.

They provide postal and federal employees who work in a variety of industries with allotment loans.

OneBlinc offers loans between $500 and $3,000 with interest rates between 23% and 32%. 9% APR, with payments due every two weeks at a minimum of 12 and a maximum of 84.

OneBlinc looks beyond your credit score to approve more applications. They don’t even pull your credit report.

They may add one-time fees ranging from $0 – 88. 90 may be added to your loan.

Once you apply, you may have to submit additional documents. OneBlinc will reply in 24 hours after they are uploaded and designated as “in review.” Providing incorrect information may delay your application decision.

Eligibility Requirements

Pros

Cons

Overview

BmgMoney is an online lending company founded in 2009 and headquartered in Miami, Florida.

It appears from a review of their website that they have a specific landing page for allotment loans for postal workers.

Loan amounts offered by BMG Money range from $500 to $10,000, with rates starting at 16 percent. 99% to 35. 99% APR and six- to thirty-four-month loan terms

There are no additional costs, but they might charge a one-time application fee after approval that ranges from $0 to $49.

To determine eligibility, visit this link and search for your employer. When you apply, BMG Money DOES NOT check your FICO score or credit report. They rely solely on alternative and employment data to underwrite loans.

Your funds will be deposited into your account within one to two working days of approval.

Eligibility Requirements

Pros

Cons

Overview

Lendly is an online lending company founded in 2019 and headquartered in Dayton, Ohio.

They provide those with good credit histories with access to credit at reasonable rates. They also provide solutions for postal employees.

The lendly team thinks that you are more than just your credit score and that excellent workers should have access to excellent loans.

Lendly provides loans up to $2,000 with an average APR of 175% if you choose payroll deductions as your repayment method.

Lendly doesn’t have a minimum credit score requirement. However, in order to be eligible, you must have worked there for at least 6 months.

Eligibility Requirements

Pros

Overview

USPS FCU is a federal credit union serving its members since 1934. Originally founded to help USPS employees, they now support over 24,000 members.

From loans and credit cards to checking and savings accounts, USPS provides a wide range of services. You should seriously consider joining USPS FCU if you are a postal worker employed by USPS.

One of the main advantages of joining is that you qualify for loans with lower interest rates and higher approval rates if you’re looking for an allotment loan.

To be eligible for an allotment loan, you must become a member of the credit union. They offer a fully digital application process if you’re interested.

Once your membership is approved, complete the form attached to request an allotment loan.

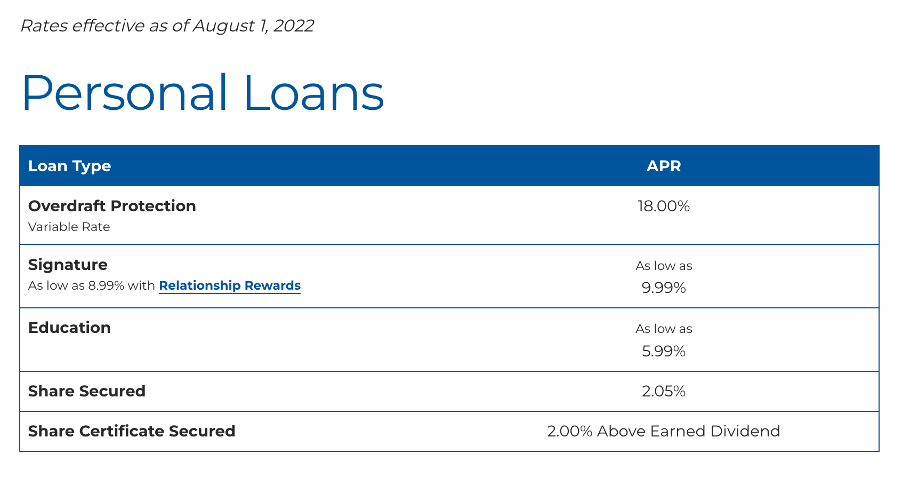

An overview of their rates is below:

Eligibility Requirements

You must satisfy the following requirements for membership in USPS FCU in order to be eligible for an allotment loan:

Pros

Cons

Overview

WorkplaceCredit is an online consumer lending company founded in 2016 and headquartered in Jacksonville, Florida.

They specialize in offering personal financial services to employees of the private sector, federal employees (including those working for the USPS), and people with stable employment histories.

WorkplaceCredit provides personal loans with flexible and affordable terms that are repaid through payroll deductions. Up to $25,000 is available for borrowing with 6 to 36 months to repay it. They also charge up to 4% in origination fees.

The fact that almost everyone qualifies for WorkplaceCredit, even those with bad credit, is a major benefit. Furthermore, after approval, you might get your money in as little as one or two days.

Eligibility Requirements

WorkplaceCredit eligibility requirements are minimal:

Pros

Cons

Overview

TPA Processing is a third-party administrator founded in 2006 and headquartered in Sand Springs, Oklahoma.

They support federal and government allotment for postal service employees as third-party administrators.

Despite the fact that you cannot apply for a loan through their website, the business is in charge of assisting other organizations in providing allotment loans to federal, governmental, and postal employees.

Overview

AccessLoans is an online lending company founded in and headquartered in Aventura, Florida.

They provide postal workers and other employees of the public and private sectors with convenient loans. They hope to encourage communities to become more financially stable while increasing lending accessibility and transparency.

Loan amounts from $850 to $6,000 are available from Access Loans, with a maximum interest rate of 35% 9% APR and terms ranging from 8 to 26 months.

During the application process, they might need your driver’s license, proof of address, pay stub, and a selfie. The approval process can take as long as two days.

Eligibility Requirements

Access loans have a few eligibility requirements you must consider:

Pros

Cons

Coast 2 Coast Lenders

Overview

Coast2CoastLenders is an online lending company headquartered in Miami, Florida.

They specialize in giving federal employees and USPS employees allotment loans.

Loan amounts from Coast2CoastLenders range from $600 to $3,000, with interest rates that vary based on where you live. Currently, they provide loans in the following states: Wisconsin, Delaware, Illinois, Mississippi, Missouri, New Mexico, South Carolina, Tennessee, Texas, and Utah.

Eligibility Requirements

Pros

Cons

If you want to apply for an allocation loan, think about one of the possibilities listed above.

Consider Stately Credit’s allotment loans if you want an allotment loan with lower interest rates, higher acceptance rates, and a fully automated application process.

FAQ

Are there special loans for federal employees?

FEEA provides qualified federal employees with private, no-interest loans to help them fill financial gaps in emergency situations. Since 1986, FEEA has provided over 13,000 no-fee, no-interest loans to assist federal employees in getting by during difficult times such as illness, the death of a loved one, or a house fire.

Can I borrow money without a credit check?

Yes, you can take a loan without a credit check. However, expect that the APR will be high. It’s still a good idea to choose a lender that performs at least a soft credit check even if you have the option to obtain a loan without a credit check. By doing so, you can obtain competitive loan offers despite having bad credit.

What is the easiest government loan to get?

Federal student loans (under the Direct Loan program) are likely your best choice if you need financial assistance for school. They offer flexibility when you’re getting on your feet (and when you face financial hardships in life), are simple to qualify for, and have competitive rates.

How do I apply for a hardship loan?

- Gather information. Make sure you have all the necessary documentation before applying for loans.

- Compare rates. Compare rates from multiple lenders. …

- Fill out your application. …

- Finalize loan documents and wait for the funds.