Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. Follow along as we demonstrate how to use the site

Loan origination fees are commonplace when taking out a new loan. However, the accounting treatment of these fees can be confusing. This article will explain in simple terms how loan origination fees are amortized over the life of a loan.

What Are Loan Origination Fees?

When you take out a new loan, the lender often charges upfront fees. These fees have different names like origination fees, application fees, or underwriting fees. But they all serve the same purpose – to compensate the lender for the work required to set up the loan.

The lender incurs costs to originate the loan, such as evaluating the borrower’s creditworthiness, processing paperwork, and closing the deal The origination fee helps cover these expenses It is usually calculated as a percentage of the total loan amount.

For example, if you take out a $100,000 mortgage with a 2% origination fee, you would pay $2,000 upfront at closing. This fee gets deducted from the loan proceeds, so you would receive $98,000 in cash from the lender.

Why Do Lenders Amortize Fees?

Ideally, a fee should be recognized on the income statement in the same pattern as the related costs If a lender incurs all the origination costs upfront, it seems reasonable to recognize the entire fee immediately too

However, this would front-load the lender’s revenues relative to the interest income earned over the life of the loan. Generally accepted accounting principles (GAAP) avoid this mismatch by amortizing fees over the loan term.

Amortization spreads the fee evenly over the periods that the loan is outstanding. This better aligns revenues with the work involved in managing the asset over time.

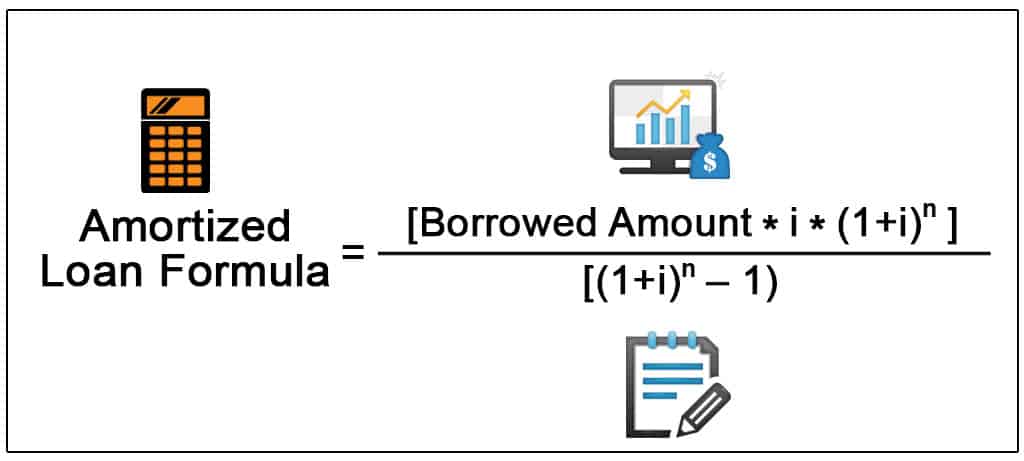

The Mechanics of Fee Amortization

Now let’s walk through the journal entries to amortize a loan origination fee.

We’ll use the same example: a $100,000 loan with a $2,000 upfront origination fee. The loan has a 5-year term and monthly payments at a 6% interest rate.

On day 1 when the loan is funded, the lender receives the $2,000 fee and makes this entry:

Dr. Cash $100,000 Dr. Fees Receivable $2,000Cr. Loan Payable $100,000Cr. Deferred Revenue $2,000The cash and loan tie out to the $100,000 in loan proceeds. The fees receivable and deferred revenue accounts track the origination fee. This fee is considered “unearned” at this point.

Each month, the lender recogizes 1/60th of the total $2,000 fee (since there are 60 monthly payments). So $33.33 moves from deferred revenue to earned fees revenue.

Dr. Deferred Revenue $33.33Cr. Fees Revenue $33.33 This monthly entry amortizes the origination fee over the five-year loan term. By the time the borrower pays off the loan, the full $2,000 fee has been recognized as revenue.

Fee Amortization in Practice

To demonstrate how this works, let’s look at the first seven months of this sample loan:

- Month 1: $2,000 fee received, deferred on balance sheet

- Month 2: $33.33 recognized into revenue, $1,966.67 remains deferred

- Month 3: $33.33 recognized into revenue, $1,933.34 remains deferred

- Month 4: $33.33 recognized into revenue, $1,900.01 remains deferred

- Month 5: $33.33 recognized into revenue, $1,866.68 remains deferred

- Month 6: $33.33 recognized into revenue, $1,833.35 remains deferred

- Month 7: $33.33 recognized into revenue, $1,800.02 remains deferred

After seven months, $233.31 of the fee has been amortized to revenue, while $1,800.02 remains deferred on the balance sheet. This pattern continues until the loan matures and the full $2,000 fee has been recognized.

Considerations for Amortizing Fees

Here are some other important points on amortizing loan origination fees:

-

Fees are deferred as an offset to the loan balance, not as a separate asset. Under GAAP, deferred fees that provide no future value cannot be classified as assets.

-

The interest method is used to determine the monthly amortization amount. This method ensures the fee is recognized evenly based on the outstanding loan balance each month.

-

Any costs the lender incurs to originate the loan are netted against the fees and amortized together. For example, if origination costs were $500, the net $1,500 fee would be amortized.

-

Fees are not amortized when a loan is placed on non-accrual status. Amortization resumes only when interest income recognition resumes.

-

Prepayment of the loan accelerates the remaining fee recognition. The outstanding deferred amount is recognized as revenue when the loan is paid off.

Benefits of Amortizing Fees

While amortization is an accounting burden, it provides useful information to financial statement users. The key benefit is matching revenues to the periods when loan management occurs. This gives a more accurate picture of profitability over time.

If large lump-sum fees were recognized upfront, revenues would spike early in a loan’s life. Amortization smooths out this distortion, better reflecting the lender’s business model. For management and investors, amortized fees are preferable to front-loaded revenue recognition.

So while the mechanics of amortization entries are tedious, the rationale behind deferring and spreading out fees makes sense. The process produces financial reporting aligned with economic reality.

Loan origination fees serve an important purpose for lenders, helping cover the costs of setting up new loans. But recognizing these fees upfront would mismatch revenues with the underlying loan activity.

Amortization provides a more accurate accounting method by linking fee recognition to the periods the loan is outstanding. Following the interest method and netting related costs ensures fees are recorded consistently based on the loan balance over time.

While amortizing fees adds complexity, it results in financial statements that better reflect a lender’s business. Both management and investors can gain useful insights from this revenue recognition approach aligned with the lending relationship.

So rather than a meaningless accounting exercise, amortizing fees helps reinforce the economic substance of a lender’s operations. Understanding the rationale behind deferring and spreading out fees can help demystify this intricate, but important, accounting process.

Search within this section

Select a section below and enter your search term, or to search all click Loans and investments

{{isCompleteProfile ? “Setup your profile before Sign In” : “Profile”}}

You can set the default content filter to expand search across territories.

Welcome to Viewpoint, the new platform that replaces Inform. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

Loan amortization schedule in MS Excel | Effective Interest rate | Transaction cost | IFRS | PMT

FAQ

Are loan origination fees capitalized or expensed?

What is the amortization period for loan costs?

Are loan closing costs amortized or depreciated?

What is the amortization code for loan fees?

|

IRC Section

|

Property or Expense

|

|

Sec. 197

|

Amortization of goodwill/other intangibles

|

|

Sec. 178

|

Acquiring a lease

|

|

Sec. 171

|

Bond premiums

|

|

Sec. 461

|

Loan fees

|

Are loan origination fees amortized?

However, this practice is not in accordance with Generally Accepted Accounting Principles (GAAP). According to Accounting Standards Codification (ASC) 310-20-25-2, loan origination fees and direct costs are to be deferred and amortized over the life of the loan to which they relate. What constitutes loan origination fees and costs?

What are loan origination fees and costs?

According to Accounting Standards Codification (ASC) 310-20-25-2, loan origination fees and direct costs are to be deferred and amortized over the life of the loan to which they relate. What constitutes loan origination fees and costs? The fees and costs include but are not limited to: Recent Read: A Look at the Modern Audit: Are You Missing Out?

What are origination fees?

Origination fees are upfront charges imposed by lenders when obtaining a loan, such as a mortgage. They cover the cost of processing the loan application, underwriting, and preparing necessary documents for closing. Origination fees can be expressed as a percentage of the loan amount or a flat fee, impacting the borrower’s upfront costs.

Are loan origination fees capitalized?

Beyond origination fees, loan origination involves direct costs incurred by financial institutions. Navigating the cost landscape requires careful accounting to reflect the economic impact accurately: Direct costs directly attributable to the acquisition of a mortgage loan are capitalized.