This credit card debt statistics page tracks Americans’ credit card use each month. This page is updated frequently, and we look at things like how much debt people have, how frequently they carry a balance from month to month, how frequently they make late credit card payments, and more.

People, hold onto your hats—the numbers are in, and they’re not very pretty. A staggering 249 percent of credit card holders are currently carrying a balance from month to month. That represents a 2010 percentage jump from just two years ago, and it’s the highest percentage we’ve seen in more than a decade.

The rise in credit card debt can be attributed to a confluence of factors, such as:

- Inflation: The cost of everything from groceries to gas has skyrocketed, forcing many people to rely on credit cards to make ends meet.

- Rising interest rates: The Federal Reserve has been hiking interest rates in an effort to combat inflation, which means that carrying a balance is now even more expensive.

- Emergency expenses: Unexpected medical bills, car repairs, and other emergencies can quickly lead to credit card debt.

But wait, there’s more! Not only are more people carrying balances, but they’re also carrying bigger balances The average credit card balance is now over $5,500, and that number is only going up

So, what does this mean for you? If you’re carrying a credit card balance, it’s important to take action now. Here are a few tips:

- Create a budget and stick to it. This will help you track your spending and make sure you’re not overspending.

- Pay more than the minimum payment. This will help you pay off your debt faster and save on interest.

- Consider a balance transfer card. This can help you save money on interest if you can qualify for a lower rate.

- Seek professional help. If you’re struggling to manage your debt, a credit counselor can help you develop a plan to get back on track.

The bottom line is this: credit card debt is a serious problem, and it’s only getting worse. If you’re not careful, it can quickly spiral out of control and ruin your credit score. So, take action now to get your finances under control and avoid becoming another statistic.

Who’s Most Likely to Carry a Credit Card Balance?

It turns out that not all credit card holders are created equal. Some groups are more likely to carry a balance than others. Here’s a breakdown:

- Generation X: Gen Xers are the most likely generation to carry a balance, with 55% saying they do so. This could be due to the fact that they’re in the “sandwich generation,” caring for both their children and their aging parents.

- Millennials: Millennials are close behind, with 51% carrying a balance. This is likely due to the fact that they’re just starting out in their careers and may not have as much financial stability as older generations.

- Gen Z: Gen Zers are the least likely generation to carry a balance, with 48% doing so. This could be because they’re more tech-savvy and are more likely to use budgeting apps and other tools to manage their finances.

- Women: Women are more likely to carry a balance than men, with 52% of women carrying a balance compared to 45% of men. This could be due to the fact that women are more likely to work in lower-paying jobs and are more likely to be single parents.

Why Are People Carrying Credit Card Balances?

There are a few main reasons why people carry credit card balances. The most common reason is emergency expenses Unexpected medical bills, car repairs, and home repairs can all lead to credit card debt

Another common reason is day-to-day expenses. A lot of people pay for their daily expenses, such as groceries and gas, with credit cards. When you’re not using cash, it’s simple to overspend, so this could be a slippery slope.

How Long Do People Carry Credit Card Balances?

The answer to this question varies depending on the person Some people are able to pay off their balances quickly, while others struggle for years

The average person with credit card debt carries a balance for about 2 years. However, 10% of people say they’ve been carrying a balance for 5 years or more.

What Can You Do About Credit Card Debt?

If you’re carrying a credit card balance, don’t despair. There are a few things you can do to get out of debt:

- Create a budget and stick to it. This will help you track your spending and make sure you’re not overspending.

- Pay more than the minimum payment. This will help you pay off your debt faster and save on interest.

- Consider a balance transfer card. This can help you save money on interest if you can qualify for a lower rate.

- Seek professional help. If you’re struggling to manage your debt, a credit counselor can help you develop a plan to get back on track.

The Bottom Line

Credit card debt is a serious problem, but it’s not insurmountable. You can take control of your finances and prevent yourself from becoming another statistic if you act now.

Additional Resources

- Bankrate Credit Card Debt Survey

- LendingTree Credit Card Debt Statistics

- Consumer Financial Protection Bureau

Frequently Asked Questions

Q: What is the average credit card balance?

A: The average credit card balance is over $5,500.

Q: Who is most likely to carry a credit card balance?

A: Generation X, millennials, and women are most likely to carry a credit card balance.

Q: Why do people carry credit card balances?

A: The most common reasons are emergency expenses and day-to-day expenses.

Q: How long do people carry credit card balances?

A: The average person carries a balance for about 2 years, but some people carry balances for much longer.

Q: What can I do about credit card debt?

A: Create a budget, pay more than the minimum payment, consider a balance transfer card, and seek professional help if needed.

What percentage of credit card accounts carry a balance?

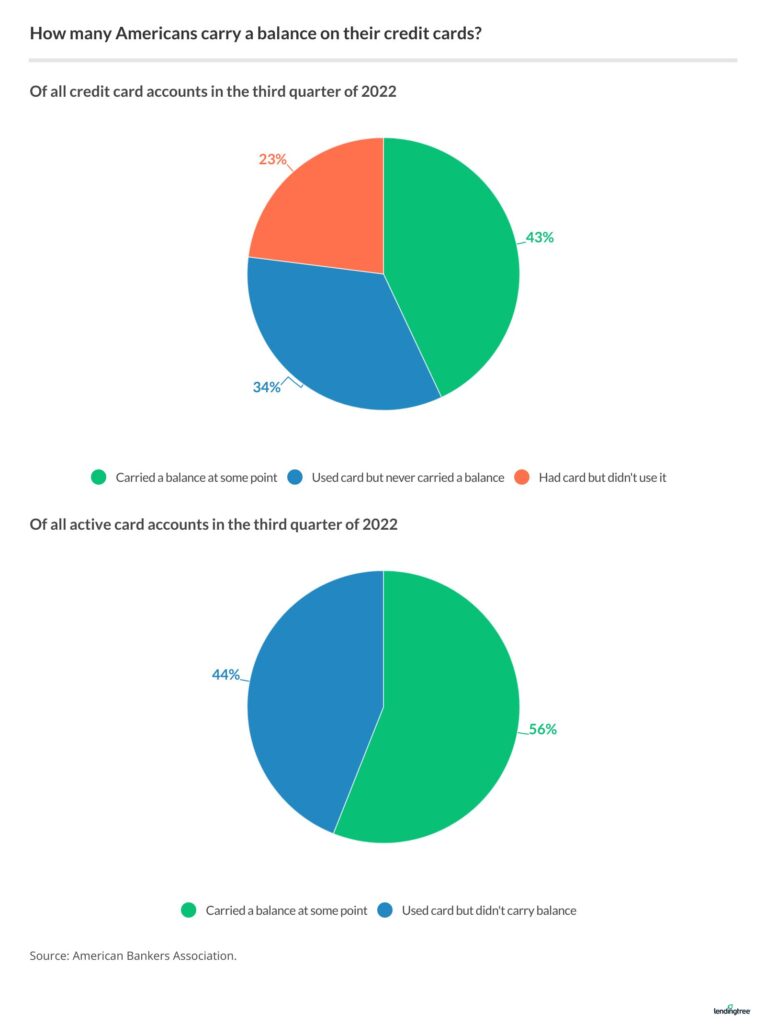

Americans carried a balance on 56% of all active credit card accounts in the third quarter of 2022, according to the most recent available data from the American Bankers Association.

Job No. The first thing to do for anyone who has a credit card is to pay the entire amount off at the end of each month. However, as life happens and we all know, it’s not always possible to pay off your credit cards on time every month. Unfortunately, most people with an active credit card account don’t always pay their bills in full. A survey conducted by LendingTree in November 2020 revealed that a mere 335 percent of cardholders stated they always pay their credit card balance in full each month, whereas 65 percent stated they carry a balance at least occasionally. It would take them at least a year to pay it off, according to nearly half (46%) of cardholders with outstanding debt.

According to data from the American Bankers Association, more than half (56%) of all active accounts carried a balance in the third quarter of 2020–2022, the most recent quarter for which we have data. That’s up 3 percentage points from the second quarter of 2022. Even with the recent increases, however, that percentage is still below pre-pandemic levels. For instance, in the first quarter of 2019%20, 2060% of active accounts carried a balance, but this fell throughout 2020%20, reaching as low as %2051% in the second quarter of 202021.

Looking at all credit card accounts, according to data from the American Bankers Association, in the third quarter of 202022, 2043 percent of accounts were active and carried a balance at some point, while 2034 percent of accounts were active but did not carry a balance and 2023 percent of accounts were dormant for the quarter.

Which states’ residents have the most credit card debt?

Based on data from LendingTree, credit cardholders in New Jersey have the highest average credit card debt of any state, while those in Mississippi have the lowest.

LendingTree analysts computed these averages and produced a list of the states with the highest levels of debt by looking over anonymized credit report data from the fourth quarter of 2023 for over 350,000 LendingTree users. Additionally, we contrasted that data with the findings from our analysis of over 310,000 reports conducted in the third quarter. In the fourth quarter of 2023, the average national card debt among cardholders with outstanding balances decreased to $6,864 from $6,993 in the third quarter. That includes debt from bank cards and retail credit cards.

The five states with the highest debt are all in the eastern U. S. , with all but Maryland in the Northeast. The four with the lowest are in the South. At the top and bottom of our rankings, there are significant disparities in the balances owed: cardholders in New Jersey owe $8,909, while those in Mississippi owe $4,956. (It’s the only state with an average balance of less than $5,000. ) That means the average New Jersey balance is 80% higher than the average balance in Mississippi.

Oregon has the fastest-growing card debt between the periods analyzed. That state’s average card balance grew 7. 8% from the third quarter of 2023 to the fourth, rising from $6,485 to $6,988. California (5. 4%) and Massachusetts (5. 2%) were the only other states with increases of 5. 0% or more.

Meanwhile, two states saw double-digit decreases: Kentucky (14. 0%) and Mississippi (12. 4%). Arkansas (9. 5%) and West Virginia (9. 3%) weren’t far behind.