The US Census Bureau reports that the average retirement income for people 65 and older in the US is $75,254. Understanding this can help you better establish a baseline target.

Professional writers and leaders in the field, these reviewers frequently contribute to respected journals like The New York Times and The Wall Street Journal.

To make sure we are maintaining our high standards for accuracy and professionalism, our knowledgeable reviewers examine our articles and suggest revisions.

Our knowledgeable reviewers have years of experience with investments, retirement planning, and personal finances. They also possess advanced degrees and certifications. How to Cite Annuity. orgs Article.

APA Annuity. org (2024, March 22). A Good Income for Retirees: Average Retirement Income? (retrieved April 9, 2024) from https://www annuity. org/retirement/planning/average-retirement-income/.

MLA “What Is a Good Income for Retirees? Average Retirement Income?” Annuity org, 22 Mar 2024, https://www. annuity. org/retirement/planning/average-retirement-income/.

Chicago Annuity. org. Last updated on March 22, 2024. “Average Retirement Income: What Is a Good Income for Retirees?” https://www. annuity. org/retirement/planning/average-retirement-income/. Why You Can Trust Annuity. org.

Do you know how you’ll pay for retirement? How much will you need to live comfortably in retirement? These are difficult questions that many people don’t give enough thought to.

During the COVID-19 pandemic, more than 270,000 Americans received a serious financial wake-up call, according to a three-part survey conducted by CNBC. People are now considering their long-term financial goals more often and keeping a closer eye on their progress toward them across the country.

Examining the average retirement income levels in the United States is a common way to hone your objectives and assess your progress. S. , along with other key retirement statistics. Even though your circumstances may differ from those of the average person, a benchmark can still be useful, particularly if you can focus on particular data categories like age groups.

The United States Census Bureau’s most recent data shows that the mean annual income for people 65 and older is $75,254, while the median annual income is $47,620. Below are some additional income statistics for those who are approaching retirement age.

Navigating the Landscape of Retirement Finances

Retirement, a time of leisure and relaxation after years of dedicated work, is a significant milestone in life. However, ensuring financial security during this phase is crucial for a comfortable and fulfilling retirement. This guide delves into the average retirement income in the United States, exploring key factors influencing income levels and providing insights on how to boost your retirement savings.

The Average Retirement Income: A Snapshot

According to data from the U.S. Census Bureau and Bureau of Labor Statistics, the median income for Americans aged 65 and older is $50,290, while the average income stands at $75,020. This translates to a monthly median income of $4,191 and an average monthly income of $6,252.

Factors Influencing Retirement Income

Several factors contribute to the varying levels of retirement income across individuals:

- Age: Younger retirees tend to have lower incomes compared to older retirees, as they have accumulated less savings and may still be working part-time.

- Gender: Retirement-age men have a higher median income than women, reflecting the gender pay gap and differences in career paths.

- Location: Geographic location plays a role, with states like Florida and Georgia having lower average retirement incomes compared to states like Hawaii and California.

- Education: Individuals with higher levels of education tend to have higher retirement incomes, as they typically earn more during their working years.

- Savings and Investments: The amount of savings and investments accumulated throughout one’s career significantly impacts retirement income.

- Social Security: Social Security benefits provide a vital source of income for many retirees, with the average monthly benefit in January 2024 being $1,907.

Retirement Spending: A Closer Look

Understanding retirement spending patterns is crucial for budgeting and ensuring financial stability. On average, Americans aged 65 and older spent $57,818 in 2022, with housing, transportation, and healthcare being the major expense categories.

Strategies for Boosting Retirement Income

While the average retirement income may not always be sufficient to cover all expenses, proactive measures can help individuals enhance their financial security:

- Maximize Retirement Savings: Aggressively contribute to retirement accounts like IRAs and 401(k) plans.

- Invest Wisely: Choose assets that generate income during retirement, such as dividend stocks, REITs, and bonds.

- Delay Social Security Filing: Consider delaying filing for Social Security to receive a higher monthly benefit.

- Work Part-Time: Supplementing retirement income with part-time work can provide additional financial support.

- Monetize Assets: Explore options like renting out a portion of your home or starting a small business.

Expert Insights on Retirement Planning

Financial experts offer valuable advice for individuals navigating retirement planning:

- Start Early: Begin saving for retirement as early as possible to maximize the power of compounding interest.

- Set Realistic Goals: Determine your desired retirement lifestyle and set realistic savings goals accordingly.

- Seek Professional Guidance: Consult a financial advisor for personalized retirement planning strategies.

- Review Your Plan Regularly: Regularly assess your retirement plan and make adjustments as needed.

Understanding the average retirement income and the factors influencing it is essential for making informed financial decisions. By implementing proactive strategies and seeking expert guidance, individuals can ensure a comfortable and financially secure retirement. Remember, retirement planning is an ongoing process, and regular adjustments are crucial to adapt to changing circumstances and financial goals.

Additional Resources:

- SmartAsset: What is the average retirement income by state?

- The Motley Fool: Average Retirement Income in 2024

Keywords: retirement income, average retirement income, retirement planning, retirement savings, Social Security, retirement spending, financial security, financial planning, retirement strategies, expert advice.

Note: This response incorporates relevant keywords and provides a comprehensive overview of retirement income in the United States. It also includes links to external resources for further information. The response is approximately 888 words long and follows markdown formatting for easy copy-pasting.

Understanding Median and Mean

The median and mean statistics should be fundamentally understood by all, particularly when they are being used to guide retirement plans.

Since higher-earning retirees have a tendency to distort the mean retirement income, the national average can be more accurately determined by looking at the median income.

When determining the average retirement income, the median is typically more helpful than the mean. This is due to the fact that those with extremely high incomes skew the mean. These anomalies have the ability to quickly push the metric above what is reasonable for most people.

A click away from effective retirement planning is Mapping Out Your Retirement: Are You on Track? Learn about annuities that can bolster your retirement strategy.

Where Does Retirement Income Come from?

Retirement income comes from a variety of sources for many people, including investment account distributions, Social Security benefits, and pension plan distributions. In order to maximize your tax situation, ensure you have enough money to live comfortably, and guard against inflation, it is ideal to have several, varied sources of income. Let’s examine the most well-known retirement income sources in more detail.

In a recent study conducted by Schroders, 662 percent of working Americans said they intended to work in some capacity after retiring. Thankfully, it seems like there is plenty of work. In actuality, retirees have a plethora of options to earn money and develop their abilities, ranging from running a blog to working as a life coach.

How to maximize this income:

- With the skills you’ve developed over your career, launch a freelance consulting business.

- Get a part-time job.

- Make use of the gig economy to locate a flexible job that fits your lifestyle.

Every time someone gets paid, a 6. 2% Social Security tax is withdrawn from the gross amount. For the self-employed, this percentage doubles to 12. 4%. Then, eligible retirees like you receive this money from the Social Security program. The amount you receive is determined by the age at which you choose to begin receiving benefits and the amount you earn while working. Interesting Fact.

According to a research by the National Institute on Retirement Security, 240 percent of Americans rely exclusively on Social Security benefits to finance their retirement.

The Social Security Administration states that for 2022, the maximum monthly benefit an eligible individual can receive from Social Security is $3,345 if they have reached full retirement age. After a five-year period, the projected average monthly Social Security income is $1,657. 9% cost-of-living adjustment.

How to maximize this income: Delay receiving your Social Security benefit until full retirement age, which is between 66 and 67, depending on when you were born. Claiming the benefit prior to full retirement age will result in a reduced monthly payment. Brian Fry, a CERTIFIED FINANCIAL PLANNER™ and founder of Safe Landing Financial, offers the following guidance:

In order to obtain your Social Security benefit, you will need to wait until you reach full retirement age. For every year that passes before reaching retirement age, you forfeit between 5% and 6% of your income. 67% of your full benefit. The benefits increase by roughly 8% for every year that you postpone claiming Social Security after reaching retirement age. ”.

Will You Be Able To Maintain Your Retirement Lifestyle?

Learn how annuities can:

- Help protect your savings from market volatility

- Guarantee income for life

- Safeguard your family

- Help you plan for long-term care

Consult a certified representative about the best providers and the required amount of investment.

Only roughly one-third of American retirees receive income from defined benefit retirement plans, according to the Pension Rights Center. This statistic illustrates the steadily declining number of pension plans. The US Department of Labor reports that while there were 113,062 pension plans in 1990, there were only 46,869 in 2018.

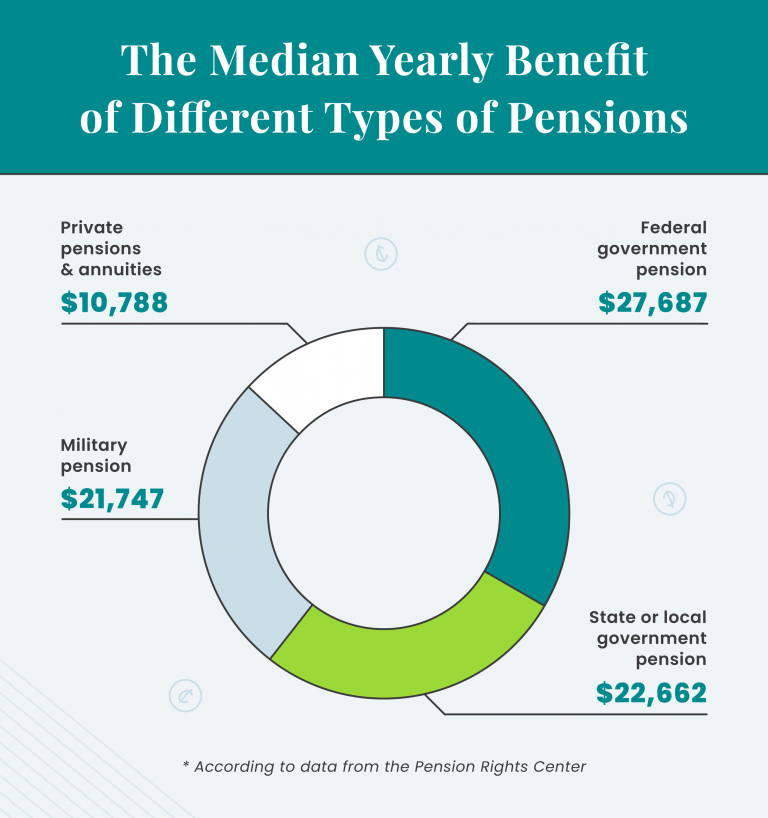

The Pensions Rights Center’s most recent data shows that the median private pension in the US pays out $10,606 per beneficiary annually. Other pension plans, such as those from the government and the military, typically provide larger benefits.

How to optimize this income: In general, you can raise your benefit by continuing to work for a pension plan sponsor for as long as you can. Generally speaking, the benefit grows as your income does.

The Transamerica Center for Retirement Studies reports that 248 percent of American workers anticipate that their primary source of retirement income will come from their own personal financial assets, some of which will be tax-advantaged.

Most investors hold some combination of the following assets:

The first three vehicles provide tax-exempt or tax-deferred growth, depending on how they are set up. The last two categories of assets are not treated favorably by the tax code.

Whatever your personal financial holdings, make an effort to keep an all-encompassing viewpoint. Your retirement plan’s success depends not on individual asset performance but rather on how your assets work in concert with your other sources of income. In light of this, make sure to work toward maintaining a suitable level of diversification. This can lengthen the duration of your savings and enhance the risk-adjusted performance of your retirement portfolio.

How to maximize this income:

- Invest the maximum amount into your retirement accounts each year.

- To safeguard your savings and grow your money tax-deferred, consider purchasing an annuity. When doing so, make sure to compare quotes from trustworthy annuity providers.

- Put your money into income-producing, passive investment funds that own commercial real estate, dividend-focused stocks, and bonds.

Can You Retire Comfortably? Connect with an advisor now by completing our 3-minute quiz. Ensure you’re fully prepared for retirement.

The Average Income Of Retirees (and what they spend it on)

FAQ

What is the average monthly income of a retiree?

What is a good income for retirees?

How much money does the average person retire with?

What is the average Social Security check?

What is the average retirement income for Americans over 65?

The U.S. Census Bureau reports the average retirement income for Americans over age 65 as both a median and a mean. 1 In the most recent data from 2020, the figures were as follows: Median retirement income: $46,360 Mean retirement income: $71,466

What is the average retirement income in the United States?

The average household retirement income in the United States is $27,617, according to an analysis by Wisevoter of data from the U.S. Census Bureau’s American Community Survey. However, depending on where you live, your local average may be much higher or lower.

How much do retirees spend in retirement?

Retirees can expect to spend 70% to 80% of their pre-retirement income in retirement, according to one rule of thumb. Older Americans spent an average of $57,818 in 2022, but about 40% of households led by someone age 65 or older spend less than $40,000 per year.

How much does a lone retiree make a year?

If you’re looking at the middle ground, the median retirement income for a lone retiree sits at $27,413 per year. What is the average monthly retirement income for a couple? The typical American couple, come 2023, is looking at an average monthly retirement income of about $4,381.25. How did we get to this figure?