This credit card debt statistics page tracks Americans’ credit card use each month. This page is updated frequently, and we look at things like how much debt people have, how frequently they carry a balance from month to month, how frequently they make late credit card payments, and more.

Yo, credit card warriors! Buckle up, because we’re diving deep into the murky waters of credit card debt and its alarming rise in 2022.

Hold tight as we’ll be dissecting the latest stats, uncovering the reasons behind this surge and dropping some knowledge bombs on how to navigate this financial landscape.

So, what’s the deal with average credit card debt in 2022? Brace yourself, because it ain’t pretty. According to Experian, the average American household was drowning in $5910 of credit card debt by the end of 2022. That’s a whopping 13.2% increase from the previous year folks.

Ouch! That’s a hefty chunk of change to be carrying around. But before you start panicking, let’s break down the reasons behind this surge and see what we can do about it.

Why the sudden spike in credit card debt? Well, several factors are at play here:

- Inflation: The rising cost of living has forced many folks to rely on credit cards to make ends meet. Groceries, gas, rent – everything’s getting more expensive, and it’s putting a strain on household budgets.

- Interest rate hikes: The Federal Reserve has been raising interest rates to combat inflation, which means that carrying a balance on your credit card is becoming even more expensive.

- Supply chain disruptions: The ongoing supply chain issues have led to shortages of goods and services, which has driven up prices and made it harder for people to pay off their debts.

So, what can we do about this growing mountain of credit card debt? Don’t despair, my friends! Here are a few tips to help you get back on track:

- Create a budget and stick to it: This is the foundation of any successful debt repayment plan. Track your income and expenses, and make sure you’re not spending more than you earn.

- Prioritize high-interest debt: Focus on paying off the cards with the highest interest rates first. This will save you money in the long run.

- Consider a balance transfer: If you have good credit, you may be able to transfer your balance to a card with a lower interest rate. This can save you a significant amount of money on interest charges.

- Seek professional help: If you’re struggling to manage your debt on your own, don’t hesitate to seek help from a financial advisor or credit counselor. They can help you develop a plan to get out of debt and stay on track.

Remember, folks, credit card debt doesn’t have to control your life. By taking action and implementing these strategies, you can break free from the shackles of debt and achieve financial freedom.

Now, let’s dive into some additional resources that can help you on your debt-busting journey:

- Experian: Experian offers a wealth of information on credit cards, credit scores, and debt management. Check out their website for articles, tips, and tools to help you manage your credit card debt.

- Federal Reserve: The Federal Reserve provides valuable insights into the state of the economy and consumer credit. Their website offers reports, data, and analysis that can help you understand the factors driving credit card debt.

- LendingTree: LendingTree is a marketplace for loans and credit cards. They offer a variety of resources, including articles, calculators, and comparison tools to help you find the best deals on credit cards and debt consolidation loans.

Stay strong, credit card warriors! You’ve got this!

Which states’ residents have the most credit card debt?

Based on data from LendingTree, credit cardholders in New Jersey have the highest average credit card debt of any state, while those in Mississippi have the lowest.

LendingTree analysts computed these averages and produced a list of the states with the highest levels of debt by looking over anonymized credit report data from the fourth quarter of 2023 for over 350,000 LendingTree users. Additionally, we contrasted that data with the findings from our analysis of over 310,000 reports conducted in the third quarter. In the fourth quarter of 2023, the average national card debt among cardholders with outstanding balances decreased to $6,864 from $6,993 in the third quarter. That includes debt from bank cards and retail credit cards.

The five states with the highest debt are all in the eastern U. S. , with all but Maryland in the Northeast. The four with the lowest are in the South. At the top and bottom of our rankings, there are significant disparities in the balances owed: cardholders in New Jersey owe $8,909, while those in Mississippi owe $4,956. (It’s the only state with an average balance of less than $5,000. ) That means the average New Jersey balance is 80% higher than the average balance in Mississippi.

Oregon has the fastest-growing card debt between the periods analyzed. That state’s average card balance grew 7. 8% from the third quarter of 2023 to the fourth, rising from $6,485 to $6,988. California (5. 4%) and Massachusetts (5. 2%) were the only other states with increases of 5. 0% or more.

Meanwhile, two states saw double-digit decreases: Kentucky (14. 0%) and Mississippi (12. 4%). Arkansas (9. 5%) and West Virginia (9. 3%) weren’t far behind.

How much credit card debt do Americans have?Americans’ total credit card balance is $129 trillion in the fourth quarter of 2023, according to the latest

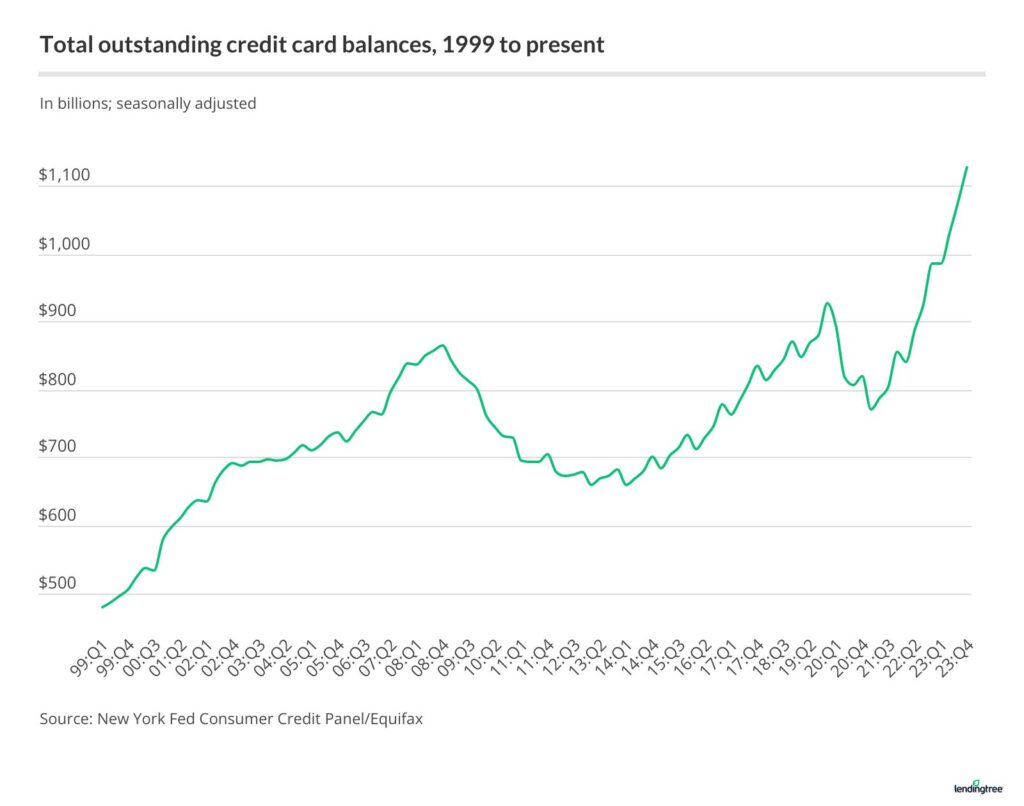

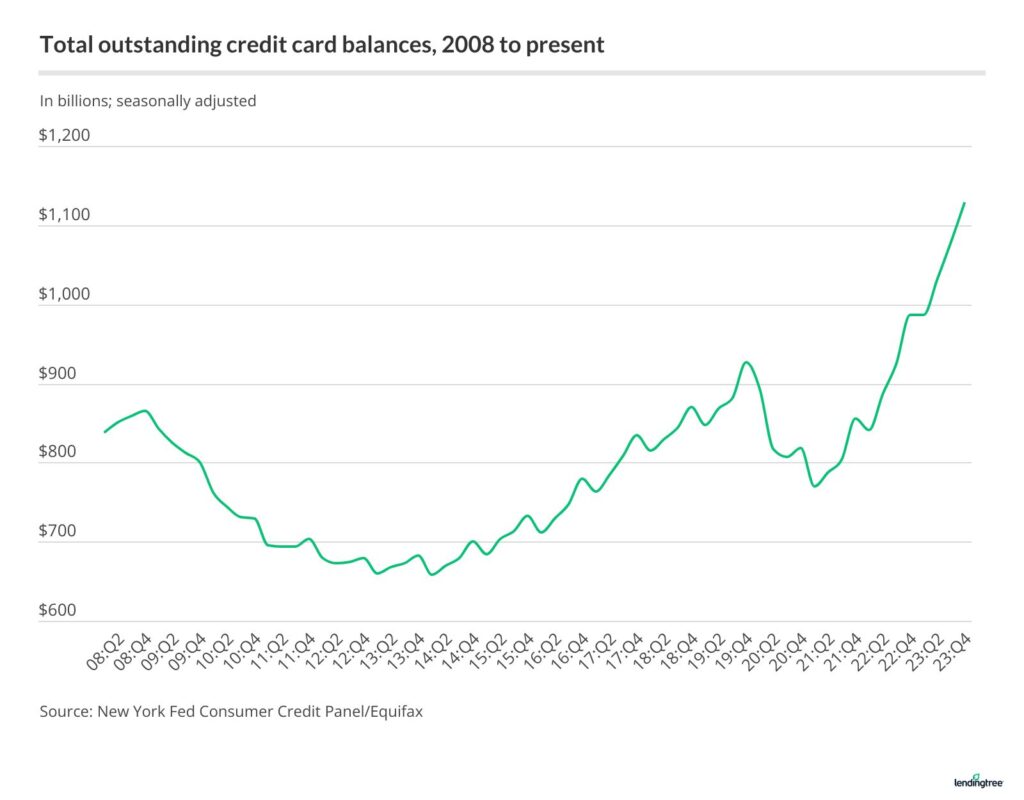

Prior to the second quarter of 2023, Americans’ credit card balances had never surpassed $1 trillion. This is the third consecutive quarter that this has happened. It also continues a trend of fourth-quarter credit card debt increases. Just twice, in 2009 and 2010, as the country struggled with the effects of the Great Recession, has credit card debt decreased during the fourth quarter of a year since the start of this quarterly report in 1999.

With this latest increase, credit card balances have risen by $273 billion since the fourth quarter of 2021. The record amount of credit card debt held by Americans, which was $927 billion at the end of 2019, has been surpassed by $202 billion. However, credit card balances are probably only going to rise in the near future due to record interest rates, persistent inflation, and a host of other economic factors.

These record balances are light years above the $478 billion recorded in the first quarter of 1999, more than 20 years ago.

Prior to the 2008 financial crisis, card debt grew at a hockey stick rate; balances decreased from $866 billion in the fourth quarter of 2008 to $660 billion in the first quarter of 2013. But, as you can see in the chart below, the hockey stick returned.

Credit card balances then fell once more when the pandemic struck in 2020, falling from $927 billion in the fourth quarter of 2019 to $770 billion in the first quarter of 2021. However, the hockey stick reappeared once more as a result of a significant spike in the fourth quarter of 2021.

Americans Tell Us How Much Credit Card Debt They Have

FAQ

How much is the average person in credit card debt?

|

Generation

|

Average Credit Card Debt

|

|

Generation Z

|

$3,262

|

|

Millennials

|

$6,521

|

|

Generation X

|

$9,123

|

|

Baby boomers

|

$6,642

|

What is the average credit card debt in america in 2022?

Is $2,000 a lot of credit card debt?

Is $5000 in credit card debt a lot?

What is the average credit card debt in 2022?

Average credit card debt by member was $6,469 — a 4.4% increase from May 2022. Gen Z and members with credit scores of 660 and lower saw the highest growth in average debt from May 2022 to February 2023. Read on for more findings, including a breakdown of credit card debt by generation, state and more. Learn more about our methodology.

What is the average credit card debt in 2023?

The average balance is $6,501 as of the third quarter of 2023, according to Experian. That’s a 10% increase from 2022 and the first time average credit card debt has exceeded $6,000 since 2019. Data source: Experian (2023). Total U.S. credit card debt reached an all-time high in the fourth quarter of 2023, reaching $1.129 trillion.

How much credit card debt do Americans owe?

Average household debt: The average American household owes $10,848 in credit card debt. Average debt over time: The average American household’s credit card balance has increased by more than 78% since 1990, after adjusting for inflation.

How much did credit card balances rise in 2022?

All states saw a rise in average credit card balances in 2022, and almost all of them saw double-digit percentage jumps. In California, the average balance rose by 17 percent to $6,030, and in New York it rose by 14.5 percent to $6,269.