A large inheritance is generally an amount that is significantly larger than your typical yearly income. It varies from person to person. Inheriting $100,000 or more is often considered sizable. This sum of money is significant, and it’s essential to manage it wisely to meet your financial goals. A wealth manager or financial advisor can help you navigate how to approach this.

Protection for You and Your Family: Discover how to combine annuities and trusts in an estate plan that works well.

Professional writers and leaders in the field, these reviewers frequently contribute to respected journals like The New York Times and The Wall Street Journal.

To make sure we are maintaining our high standards for accuracy and professionalism, our knowledgeable reviewers examine our articles and suggest revisions.

Our knowledgeable reviewers have years of experience with investments, retirement planning, and personal finances. They also possess advanced degrees and certifications. How to Cite Annuity. orgs Article.

APA Annuity. org (2023, November 10). Average Inheritance and 5 Tips for Leaving Inheritance Money. Retrieved April 14, 2024, from https://www. annuity. org/retirement/estate-planning/average-inheritance/.

MLA “Average Inheritance and 5 Tips for Leaving Inheritance Money.” Annuity.org, 10 Nov 2023, https://www.annuity.org/retirement/estate-planning/average-inheritance/.

Chicago Annuity. org. “Average Inheritance and 5 Tips for Leaving Inheritance Money. ” Last modified November 10, 2023. https://www. annuity. org/retirement/estate-planning/average-inheritance/. Why You Can Trust Annuity. org.

Leaving inheritance money for your heirs is a considerate act of generosity. However, if not handled carefully, it can be stressful and problematic. According to a study by Ameriprise Financial, only 2064% of people believe they are on track to leave an inheritance, despite the fact that 20%83 percent of people want to do so.

This is largely due to the complexity of the task and the emotion it evokes. First, there’s a lot of debate over whether it makes more sense to give the money away right away or leave it as a bequest. Then, there’s self-induced pressure to leave at least an average inheritance. For many, there’s also stress associated with deciding how to divide the money amongst multiple heirs.

Ever wonder how much the average person inherits? It’s a question that sparks curiosity and speculation, especially as we plan our own financial futures and consider what we might leave behind for our loved ones.

The answer, however isn’t as straightforward as you might think.

The “average” inheritance can vary significantly depending on several factors, including:

- Education level: Those with a college education tend to inherit more than those without.

- Race: Studies show that white households inherit more than Black and Hispanic households.

- Income: Unsurprisingly, wealthier families inherit more than those with lower incomes.

So. what is the “average” inheritance?

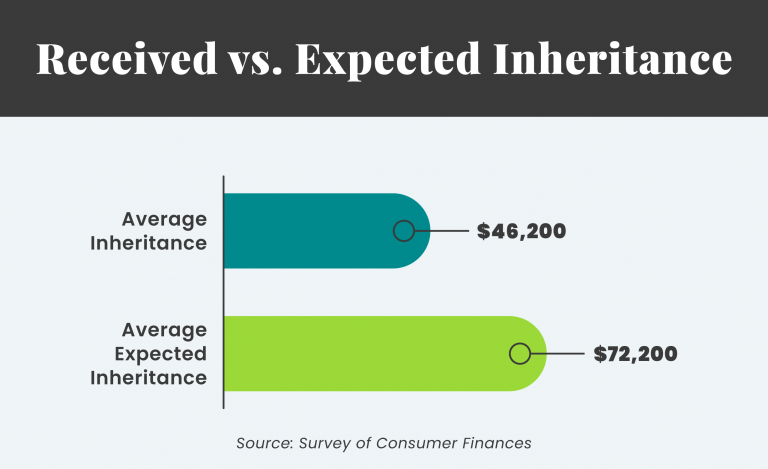

- According to the Federal Reserve, the average inheritance is around $46,200.

- However, this number can be misleading. The average is skewed by the very wealthy, who leave behind much larger inheritances.

- When you break down the numbers by economic status, the picture changes dramatically. The least wealthy families inherit an average of $6,100, while the wealthiest 1% inherit an average of $2.7 million.

What does this mean for you?

- Don’t get caught up in the average. Your own inheritance will likely be different, and that’s okay.

- Focus on what you can control. Create a solid retirement plan that ensures your own financial security.

- Consider sharing your wealth while you’re still alive. This can be a meaningful way to help your loved ones and reduce the burden of estate taxes.

Here are some additional things to keep in mind:

- Inheritance isn’t everything. While financial wealth can be helpful, it’s not the only type of inheritance you can leave behind. Share your time, knowledge, and values with your loved ones – these are priceless gifts.

- Be realistic about your own finances. Don’t overextend yourself trying to leave a large inheritance. Make sure you’re taking care of your own needs first.

- Set goals. Use a retirement planning tool like the NewRetirement Planner to see how much you can realistically expect to leave behind.

Ultimately, the “average” inheritance is just a number. What matters most is creating a financial plan that works for you and your loved ones.

Here are some resources that can help you:

- NewRetirement Planner: This free tool helps you create a personalized retirement plan and estimate your potential inheritance.

- Estate Planning 101: Learn about the essential documents you need for end-of-life planning.

- 7 Ways to Plan for an Inheritance: Explore different strategies for managing an inheritance.

Remember, the most important inheritance you can leave behind is a legacy of love and support.

Average Inheritance in the U.S.

Based on a Federal Reserve survey from 2016 to 2019, the typical inheritance received in the U.S. S. was $46,200. The average for the wealthiest one percent of those surveyed was $719,00, while the average for the lowest-income group was only $9,700.

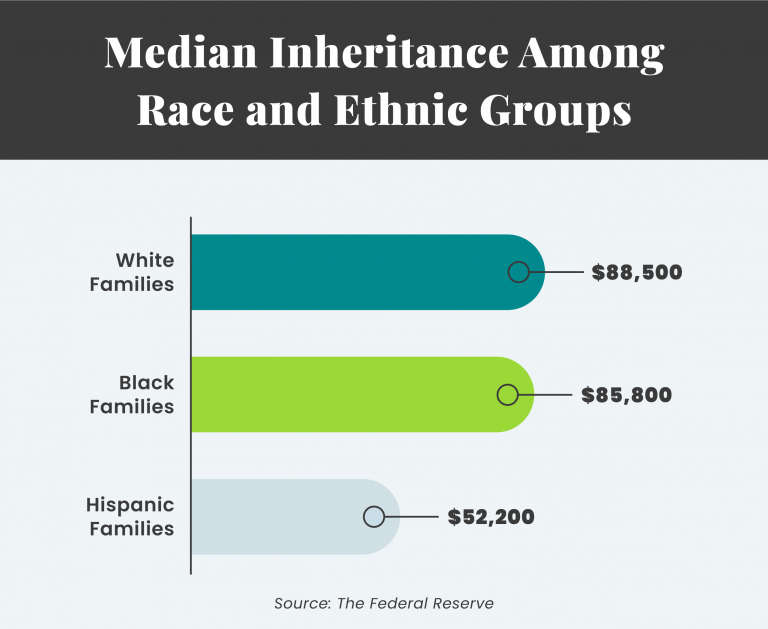

With regard to race and ethnicity, the survey produced the following data points:

- The mean inheritance among white families was $88,500, meaning that 30% of the participants got an inheritance.

- The median inheritance among Black families was $85,800, meaning that 10% of the participants got an inheritance.

- The median inheritance among Hispanic families was $52,200, or 7% of the participants’ inheritances.

- There was a median inheritance among other families of $59,400%(18% of participants received an inheritance).

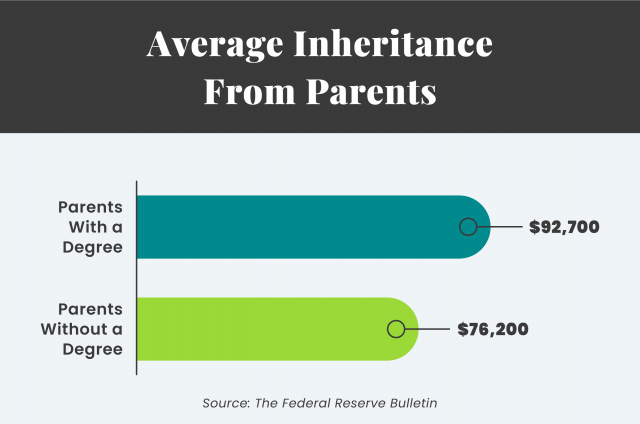

According to the most recent data available from the Federal Reserve, for individuals who received an inheritance, the median value received from families with a parent with a college degree was $92,700. This is $16,500 higher than the median value received from families that did not have a parent with a degree. Fast Fact

Information from the Organization for Economic Cooperation and Development (OECD) indicates that inherited wealth has contributed approximately 2050 percent to 2060 percent of the total amount of U.S. S. private wealth since the early 1900s.

Similarly, children of parents with a degree are more likely to expect an inheritance. Only 9. 5% of individuals with parents without a college degree expect an inheritance, while 23. 6% of individuals who have parents with a degree expect to receive bequeathed assets.

Depending on the type of inheritance, taxes vary. Most of the time, inheritances are not subject to taxation. This is because the Internal Revenue Service permits a lifetime gift and estate tax exemption of $12. 92 million as of 2023.

In addition to the lifetime exemption, there is an annual gift tax exclusion. For 2023, this provision permits a gift exclusion of $17,000 per person per year. The person receiving the gift does not pay taxes on it. Any amount over $17,000 is deducted from the donor’s lifetime gift tax cap, and they must file a gift tax return.

See a financial advisor or a tax expert if you’re having trouble deciding whether to give or leave assets to your loved ones. He or she can run some scenarios and help you decide on the best option.

Improve Your Estate Planning with Annuities Learn how annuities can provide unmatched tax efficiency, seamless asset transfers, and seamless integration with trusts. It’s time to redefine your estate’s future.

Manage Your Expectations

The first step in planning an inheritance is to determine how much money to give to your heirs. This entails segregating your retirement savings from the assets you can afford to bequeath.

In doing so, be conservative. Keep enough cash on hand to reduce the possibility of outliving your savings, also referred to as the “longevity risk.” This very real threat for retirees has been amplified by rising health care costs and other inflationary pressures.

Don’t overextend yourself because of a desire to be generous. Your loved ones should understand how challenging it can be to manage money, especially in retirement. If they don’t, talk to them about it. By doing this, you can reduce any worry you may have about setting aside a sufficient sum of money for yourself.

Mapping Out Your Retirement: Are You on Track? Effective retirement planning is a click away. Learn about annuities that can bolster your retirement strategy.

Inherited $400,000, What Should I Do With It?

FAQ

How much inheritance does the average person get?

What’s considered a large inheritance?

Is $500,000 a big inheritance?

Is 100000 a big inheritance?

How much inheritance does a family get a year?

When you break down average inheritance by the economic status of the household, the numbers look very different. According to analysis by Demos: The least wealthy group of families have received, on average, $6,100 in inheritance. The wealthiest 1 percent of families have received, on average, $2.7 million in inheritance.

How much money do heirs get if they inherit?

Those receiving any inheritances under age 26 inherit about $79,000, less than half of the $190,000 average inheritance for heirs aged 56-75. Past age 75 however, inheritances drop significantly. Those between 76-85 who received any inheritance received about $96,000, and the median across surveys for those older than 86 falls to about $32,000.

What percentage of households inherit money?

While less than a third of all households inherit any money, between 70% and 80% of households receive no inheritance at all. Average Inheritance By Wealth Level What Is the Average Inheritance? A consistent reality with inheritance is that almost all households who receive an inheritance expect more than they get.

What is the average inheritance?

The Federal Reserve reports data on average inheritance based on whether or not the household has a college degree. Those with a college education leave behind more than those without. The Survey of Consumer Finances (SCF), reports that the median inheritance was $69,000 (the average was $707,291).