Buying a home is likely the biggest purchase you’ll ever make. It’s an exciting process but also a complex one with a lot of moving parts. Securing financing is a critical step to ensure you can actually afford the home you want. A mortgage loan commitment letter is a key document in this process.

In this article, I’ll explain exactly what a mortgage commitment letter is, the different types you can receive, when you’ll get one, and why it’s so important for homebuyers to have one. Whether you’re just starting to explore homeownership or are knee-deep in the mortgage process, understanding commitment letters is vital.

What is a Mortgage Commitment Letter?

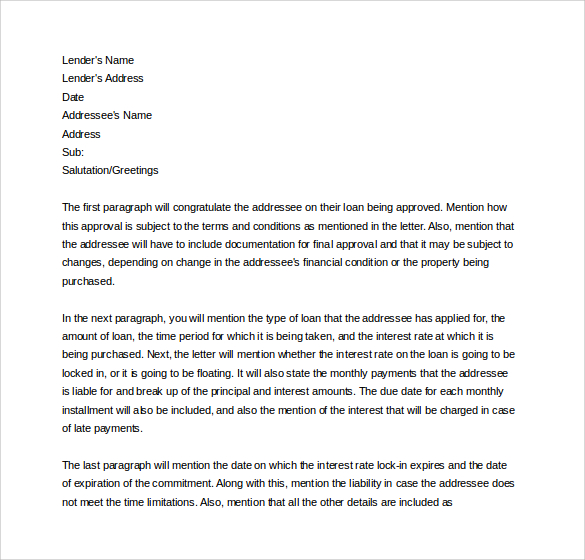

A mortgage commitment letter, also called a loan commitment letter, is a document sent to you by a lender stating you are officially approved for a home loan It specifies important details like

- The type of mortgage you are approved for (FHA, conventional, VA, etc)

- The loan amount

- The interest rate

- Length of the loan term

- Expiration date of the commitment

Lenders issue a commitment letter after you’ve completed the initial mortgage application and underwriting process. This letter confirms in writing that the lender is willing to lend you money to buy a home under the outlined terms.

Think of a mortgage commitment letter as the lender saying “Yes, we approve you for this home loan and promise to provide the financing as long as you meet any remaining requirements.”

The 2 Types of Mortgage Commitment Letters

There are two primary types of mortgage commitment letters – conditional and firm.

Conditional Commitment Letter

A conditional commitment states you are preliminarily approved but need to meet additional requirements first. These conditions may include:

- Providing additional documents

- Meeting credit score minimums

- Making a down payment of a certain amount

- Obtaining homeowner’s insurance

- Getting a clear home appraisal

Conditional commitments allow you to start making offers, but don’t guarantee the lender will provide the mortgage.

Firm Commitment Letter

Once all lender conditions are met, they will issue a firm or final mortgage commitment letter. This legally binding document states the lender must provide the mortgage as long as you close on time.

Firm commitments give certainty that financing will come through. They also allow you to lock in an interest rate for a period of time, often 60-90 days.

When Do You Get a Mortgage Commitment Letter?

The mortgage process has three main steps:

1. Prequalification – A lender makes an initial estimate of what you can afford

2. Preapproval – You fill out a mortgage application and provide financial documents for underwriting. If approved, you get a conditional commitment letter.

3. Firm Commitment – The lender verifies final details and issues a firm commitment after any underwriting conditions are met.

Here is the typical timeline for receiving commitment letters:

-

Prequalification letter – After initial discussion with a lender

-

Conditional commitment – 1 week after completing mortgage application

-

Firm commitment – 1-2 weeks before closing on the home

Having at least a conditional commitment letter before making an offer puts you ahead of most buyers. Sellers want to see a commitment letter so they know you’re a serious buyer who has a better chance of securing financing.

Does a Mortgage Commitment Letter Guarantee a Loan?

It’s important to understand a mortgage commitment letter does not 100% guarantee you’ll get the mortgage.

Conditional commitments are preliminary approvals. The lender could still deny the loan if new information surfaces or conditions are not met.

Even firm commitments come with caveats. Most are valid for 60-90 days and will expire if you don’t finalize the loan by then. The lender could also still pull the commitment if they discover fraud or your circumstances drastically change.

While rare, lenders can withdraw mortgage commitments in certain scenarios. This underscores the importance of honesty throughout the application process.

Why is a Mortgage Commitment Letter So Important?

There are two big reasons buyers need a mortgage commitment letter before house hunting:

Strengthen Your Offer – Sellers are more likely to accept an offer from a buyer who has been preapproved by a lender. The letter shows you’re a serious buyer who has started the mortgage process. This gives sellers confidence you can secure financing to purchase their home.

Lock in Your Rate – Mortgage rates fluctuate frequently. But a firm commitment allows you to lock in a rate for 60-90 days typically. This protects you from hikes if rates rise while you search for a home.

How Much Can You Rely on a Mortgage Commitment?

For the most part, a lender will stand by the terms of their mortgage commitment letter. But there are cases when they may need to modify details:

- If your financial situation changes significantly

- If the appraisal comes back lower than expected

- If your credit score drops before closing

- If the initial commitment period expires

Lenders reserve the right to alter the loan amount or terms if new information comes to light. Be prepared for the possibility, while knowing major changes are uncommon once you have a firm commitment.

Can I Back Out After Receiving a Commitment?

Yes, you can withdraw your mortgage application even after being approved. Legally nothing is final until you sign the closing documents.

But backing out after starting the mortgage process can negatively impact your credit score. Try to avoid applying unless you’re serious about purchasing a home within a few months.

Common Mortgage Commitment Letter Questions

Here are answers to some other frequently asked questions about mortgage commitment letters:

What if my income decreases or debts increase?

Inform your lender immediately if your financial situation changes. They may need to modify the loan amount or terms, or in severe cases withdraw the commitment.

What if interest rates drop after I get a commitment?

You can request your lender re-issue the commitment letter with the lower rate. This avoids having to pay a higher rate than necessary.

How long is a mortgage commitment valid?

Most commitments expire in 60-90 days. The letter should indicate the exact expiration date. You must close on the home before that date.

Can I get a commitment letter without a property?

Yes, you can get a preapproval letter without identifying a specific home. But you’ll need the property address before the lender issues a firm commitment.

What should I do if my credit score drops before closing?

A slight drop of a few points is unlikely to impact your approval. But a significant decrease could lead to a higher interest rate or change in loan amount. Keep your lender updated on any credit changes.

How to Get a Mortgage Commitment Letter

If you’re ready to move forward, follow these steps:

1. Prequalify – Get estimates from multiple lenders on what you can afford. This initial step is fast, easy, and doesn’t affect your credit.

2. Pick a lender – Choose the lender that offers the loan types, rates, and fees that align with your needs.

3. Apply for preapproval – You’ll provide financial documents so the lender can underwrite your application. This results in a conditional commitment letter.

4. Shop and make an offer – Make offers armed with your preapproval letter. Submit the final contract to your lender.

5. Get firm commitment – The lender will verify final details and issue a firm commitment letter within weeks of closing.

6. Close on time – Finalize all paperwork and funding to purchase the home before your rate lock expires.

Following these steps helps ensure you receive a mortgage commitment in time to give your offer an advantage.

Wrapping Up on Mortgage Commitment Letters

-

A mortgage commitment letter is issued by a lender confirming you’re approved for a home loan after underwriting.

-

Conditional and firm commitments state the mortgage amount, terms, and requirements.

-

Having a letter shows sellers you’re creditworthy so they take your offer seriously.

-

Commitments allow you to lock in an interest rate for 60-90 days typically.

-

Lenders can withdraw commitments if your finances drastically change or conditions aren’t met.

-

You should start the mortgage process and get preapproved before making offers on homes. This puts you steps ahead.

A mortgage commitment letter is a crucial milestone when buying a home. It provides reassurance you can obtain financing, while enabling you to make competitive offers backed with proof of your financial readiness. Understand the ins and outs of mortgage commitments to smoothly navigate your path to homeownership.

Why is a mortgage commitment letter important?

A mortgage commitment letter is important because it confirms loan approval, increases buyer confidence, outlines loan terms, expedites the closing process, and provides protection against financing contingencies. Moreover, it means that the loan has gone through approval by the underwriting team.

See how much you can afford.

Your approval amount will give you an estimate on how much house you can afford.