An amortized loan is a type of loan where the loan amount is paid off over the term of the loan in equal installments. Each installment payment consists of both principal (the original loan amount) and interest. In an amortized loan, the amount of principal and interest in each installment changes over time, but the total payment amount stays the same.

Amortized loans are very common – examples include mortgages auto loans, and student loans. By the end of the loan term the entire loan amount including all interest is paid off if payments are made on time.

Let’s break down the key aspects of what an amortized loan means

Amortized Loan Basics

-

An amortized loan has a set term or length, such as 5 years, 15 years, 30 years, etc. This is the total time period you have to pay off the loan.

-

There is a fixed interest rate that does not change over the term of the loan Common rates are 3-6% for mortgages, 4-10% for auto loans, and 5-12% for student loans.

-

There is a fixed monthly payment amount that does not change. This is based on the original loan amount, interest rate, and length of the loan term.

-

Each monthly payment consists of both principal (original loan amount) and interest.

-

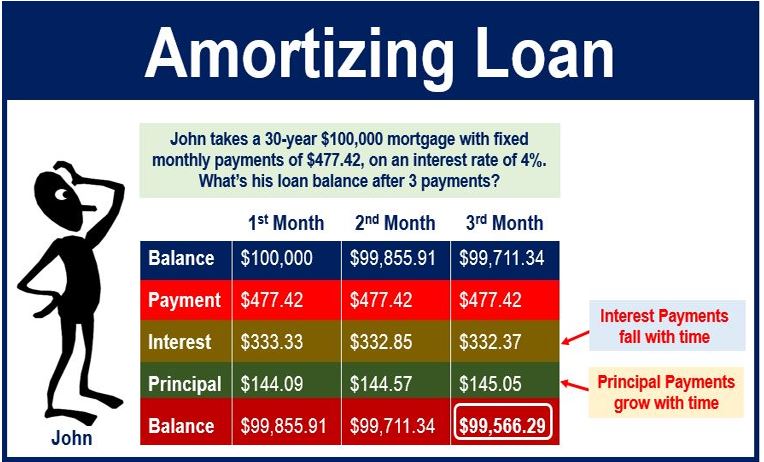

In the beginning repayment period, most of the monthly payment goes towards interest charges. As the loan progresses, more of the payment goes towards paying down the principal.

-

By the end of the loan, the entire original principal and all interest is paid off through the fixed monthly installments.

How Monthly Payments Work

Let’s look at a simple example of a $10,000 amortized loan with a 5 year term and 5% interest rate:

-

The fixed monthly payment amount is calculated to be $193 based on the loan details.

-

In the first month’s payment, about $83 goes to interest and $110 goes to the principal.

-

In the final payment, only about $8 goes to interest and $185 goes to principal.

-

Over the 60 payments, the borrower pays a total of $11,580, consisting of the original $10,000 principal plus $1,580 of interest charges.

-

Each payment is the same amount, but the breakdown between principal and interest changes. In the beginning, most of the payment is interest, and by the end, most is principal.

The key takeaway is that with an amortized loan, the payment stays constant over the loan term, even though the principal vs interest breakdown changes month to month.

Why Amortize a Loan?

There are a few key benefits to amortizing a loan rather than having interest-only payments:

-

Amortized loans have predictable, fixed monthly payments that fit better into a borrower’s budget.

-

By slowly paying down the principal with each payment, the loan is guaranteed to be paid off at the end of the term.

-

Paying principal over time means interest charges decrease with each installment, saving money overall.

-

Borrowers build equity as the principal balances owed decreases each month.

For these reasons, amortization allows borrowers to take on loans with predictable payments they can afford to pay off over time.

Examples of Amortized Loans

Some of the most common types of amortized loans include:

-

Mortgages – Almost all mortgages for home purchases are amortized loans with a 15 or 30 year term. Each installment makes progress towards paying off the home.

-

Auto Loans – Car loans are amortized so buyers can budget for a fixed monthly payment over 3-5 years until the vehicle is paid off.

-

Student Loans – Federal and private student loans for college are amortized over 10-25 years so graduates have affordable payments.

-

Personal Loans – Unsecured personal loans from banks or online lenders come with amortization terms from 1-7 years typically.

-

Business Loans – Loans for small businesses like lines of credit and SBA loans often have amortized structures.

Any large loan that cannot reasonably be paid back in a lump sum can benefit from amortization.

How Loan Amortization Works

When a lender sets up an amortized loan, they use an amortization schedule and formula to determine the fixed monthly payment amount and breakdown of how much goes to principal vs interest each month.

Here is a simplified example of how the amortization schedule works:

-

Loan amount: $200,000

-

Interest rate: 4%

-

Loan term: 30 years (360 monthly payments)

-

Monthly payment (calculated): $955

-

Total interest over 30 years: $215,267

-

Total amount paid: $415,267

| Payment Number | Beginning Balance | Interest | Principal | Payment | Ending Balance |

|---|---|---|---|---|---|

| 1 | $200,000 | $667 | $288 | $955 | $199,712 |

| 12 | $199,034 | $663 | $292 | $955 | $198,742 |

| 120 | $179,288 | $597 | $358 | $955 | $178,930 |

| 360 | $0 | $0 | $955 | $955 | $0 |

You can see how in the beginning, most of the $955 monthly payment goes to interest, but by payment 360 the entire $955 goes towards the remaining principal. This table demonstrates how an amortized loan works to pay off interest and principal through fixed installments.

How to Calculate Amortized Loan Payments

While lenders use specialized software to calculate amortized loan payments, you can also calculate them manually using some basic loan amortization formulas.

The core formula to determine the fixed monthly payment (PMT) is:

PMT = [Loan Amount x Monthly Interest Rate] / [1 – (1 + Monthly Interest Rate)^-Total Months]

Let’s break this down in an example:

- Loan amount: $100,000

- Interest rate: 5% annually (0.42% monthly)

- Loan term: 20 years (240 months)

Monthly interest rate = 0.42%

Total months = 240

PMT = [$100,000 x 0.0042] / [1 – (1 + 0.0042)^-240]

PMT = $537.15

This loan would have a fixed monthly payment amount of $537.15 over the 20 year term, consisting of some interest and some principal each month.

You can calculate the amortization schedule manually or use an online calculator to see the breakdown per month over the life of the loan.

Pros and Cons of Amortized Loans

Here are some key pros and cons of taking out an amortized loan:

Pros:

- Predictable fixed monthly payments

- Interest costs decrease over time

- Guaranteed payoff by end of term

- Can fit repayment into monthly budget

- Build equity as principal is paid down

Cons:

- Monthly payments are higher than interest-only loans

- Loan takes longer term to pay off

- Miss payments and interest charges accumulate

- Prepayment penalties may apply if paid off early

- Total interest paid is higher than lump sum repayment

Overall, amortized loans allow for accessible loan repayment, but borrowers take on more total interest. Evaluate both pros and cons before committing to an amortized loan.

The Takeaway

An amortized loan means repayment occurs through fixed monthly installments over a set term where each payment is partially interest and partially principal. This structure allows large loans to be budgeted and paid off over time rather than as a lump sum.

Common amortized loans include mortgages, auto loans, student loans, and personal loans. Lenders calculate an amortization schedule so payments properly pay off interest and principal over the term.

Amortization gives borrowers predictability and guarantees eventual payoff. However, total interest paid is higher compared to a shorter term loan. Overall, amortizing a loan can make repayment affordable by spreading payments over time.

How Do Fully Amortizing Loans Work?

Apply online for expert recommendations with real interest rates and payments.

What Is A Fully Amortized Loan?

Your Credit Profile Excellent 720+ Good 660-719 Avg. 620-659 Below Avg. 580-619 Poor ≤ 579

When do you plan to purchase your home? Signed a Purchase Agreement Offer Pending / Found a House Buying in 30 Days Buying in 2 to 3 Months Buying in 4 to 5 Months Buying in 6+ Months Researching Options

Do you have a second mortgage?

Are you a first time homebuyer?

Consent:

By submitting your contact information you agree to our Terms of Use and our Privacy Policy, which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! NMLS #3030

Congratulations! Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage.

If a sign-in page does not automatically pop up in a new tab, click here

What is a fully amortized loan?

What is an Amortized mortgage?

With an amortized loan, your mortgage is guaranteed to be paid off by the end of the term as long as you make all your payments over the life of the loan. Here’s an example of how an amortization schedule would look for the following loan:

What is amortization of a loan?

Amortization is the process of spreading out a loan into a series of fixed payments. The loan is paid off at the end of the payment schedule. Amortization is the way loan payments are applied to certain types of loans.

How does an amortized loan payment work?

An amortized loan payment first pays off the interest expense for the period; any remaining amount is put towards reducing the principal amount. As the interest portion of the payments for an amortization loan decreases, the principal portion increases.

What is a fully amortized loan?

Fully amortized loans are usually home loans, auto loans or personal loans. They can be secured (backed by the borrower’s assets) or unsecured. Fully amortized loans have schedules such that the amount of your payment that goes toward principal and interest changes over time so that your balance is fully paid off by the end of the loan term.