Homeownership can be expensive, but with the right mortgage, you can save thousands of dollars over the life of your loan.

With so many options available for borrowers, home buyers may forget about government-backed programs like the USDA loan. USDA loans are guaranteed by the Rural Development Guaranteed Housing Loan program from the US Department of Agriculture (USDA) and can provide mortgage assistance to help you become a homeowner while spending less.

With a USDA loan, you can expect a zero percent down payment in eligible rural towns. But is this loan right for you? Let’s discuss USDA loans, including their pros and cons, to help you make the right decision for you and your family.

USDA loans offer many benefits for eligible borrowers, including no down payment and flexible credit requirements But these government-backed mortgages also come with some potential drawbacks that borrowers should understand before applying In this comprehensive guide, we’ll explore the key cons of USDA loans that you need to be aware of.

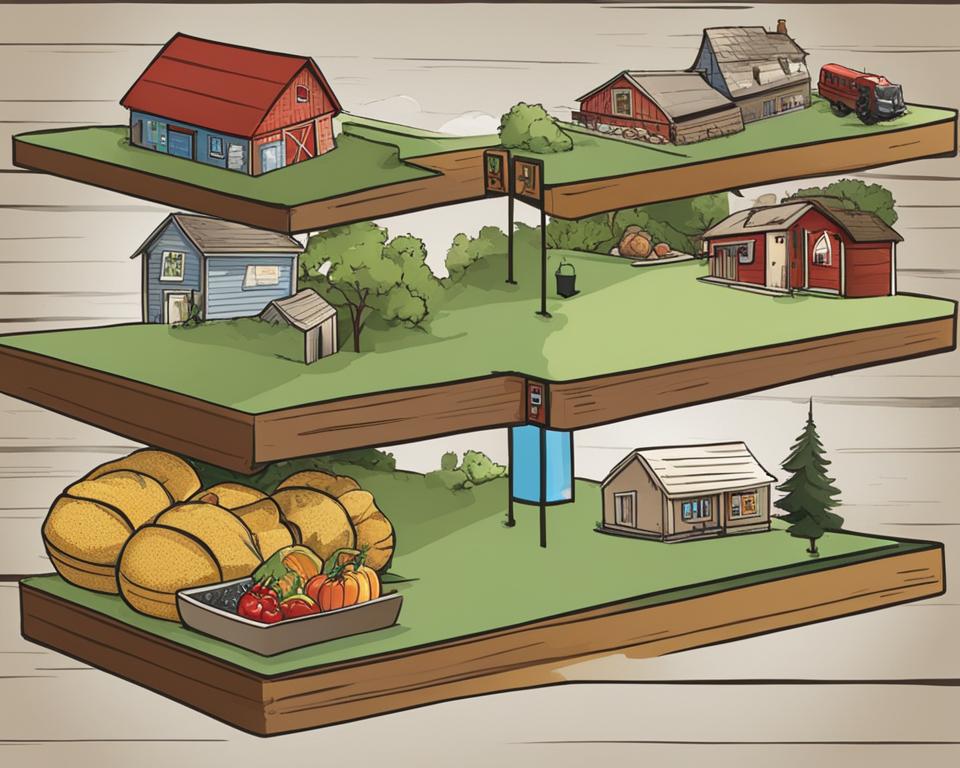

Geographic Restrictions Limit Where You Can Use a USDA Loan

One of the biggest limitations of USDA loans is that they can only be used for properties in certain eligible rural and suburban areas. The USDA has a property eligibility map you can check to see if a particular home or neighborhood qualifies.

In general, USDA loans can be used in rural towns with populations under 35,000. They may also be allowed in some suburban neighborhoods on the outskirts of larger cities, but not within the main urban city limits. So if you’re hoping to use a USDA loan to buy a condo in downtown Manhattan or a row house in the heart of San Francisco, you’ll be out of luck.

This geographic restriction is the #1 factor that disqualifies many borrowers from using a USDA loan. If the home you want doesn’t fall within an eligible area you’ll have to consider other mortgage options like FHA VA, or conventional loans.

Borrowers Face Strict Income Limits

USDA loans are intended to help low-to-moderate income borrowers, so there are firm income limits in place:

- For a 1-4 person household, your income must be $110,650 or less

- For a 5-8 person household, your income must be $146,050 or less

These thresholds are non-negotiable requirements. If your income exceeds the limit based on your household size, you won’t qualify for a USDA mortgage regardless of your credit score or assets.

The income caps are definitely one of the biggest drawbacks for higher-earning borrowers who might otherwise benefit from a USDA loan. Make sure you check the current income limits in your county to see if you fall below the thresholds.

Adjustable Rate Mortgages Aren’t Allowed

USDA loans only permit traditional fixed-rate mortgages. Adjustable rate mortgages, or ARMs, which start with a low introductory rate that later adjusts to market rates, are not allowed.

This restricts borrowers who might prefer the lower initial payments of an ARM. Just be aware that if you qualify for a USDA loan, you’ll be required to get a fixed-rate mortgage which could mean higher rates and payments than an ARM, especially during the intro period.

Only Single-Family Homes are Eligible

USDA loans can only be used to finance single-family housing units. That includes detached homes, townhouses, and condos.

However, USDA loans cannot be used for:

- Multi-unit properties like duplexes or triplexes

- Manufactured or mobile homes

- Houseboats or other non-traditional housing

- Investment properties

- Second homes or vacation properties

So if you’re looking to purchase anything other than a single-family primary residence, the USDA program won’t be able to help you. This restriction on property types is another factor that eliminates many borrowers from qualifying.

Cash-Out Refinancing Isn’t Allowed

While borrowers can refinance an existing USDA loan into a new USDA loan, cash-out refinancing is prohibited.

With a cash-out refi, the borrower takes equity out of the home in cash at closing. This option isn’t available with USDA mortgages. You can only refinance into a new USDA loan for a better rate/term – you cannot tap home equity for cash.

For borrowers hoping to use their home’s equity for renovations, debt consolidation, or other expenses, the lack of a cash-out refi option is a major disadvantage.

Upfront Guarantee and Annual Fees Apply

All USDA loans require borrowers to pay two types of fees:

-

Upfront guarantee fee – This is a 1% fee charged at closing based on the loan amount. On a $200,000 loan, this fee would be $2,000.

-

Annual fee – An ongoing annual fee of 0.35% of the loan amount is charged each year. On a $200,000 loan, this yearly fee would be $700.

These fees are used to help fund the USDA mortgage program. But they still represent extra costs that don’t apply with conventional loans. Borrowers can finance these fees into the loan amount rather than paying upfront. But either way, it’s an added expense to factor in.

Underwriting and Processing Takes Longer

Due to the extra documentation and approval requirements involved with these government-backed loans, USDA loans typically take longer to underwrite and process than conventional mortgages.

In some cases, USDA loans can take several weeks longer than other home loans to close. This can be an issue for borrowers up against tight deadlines or in a hurry to move. You’ll need to account for the slower processing times when applying for a USDA mortgage.

Final Thoughts on USDA Loan Cons

While USDA loans provide wonderful benefits like no down payment and flexible credit requirements, they aren’t the right fit for every borrower. Make sure you fully understand and can live with the potential drawbacks and restrictions before pursuing a USDA mortgage.

In particular, carefully consider if you meet the income limits as well as if your desired property is in an eligible location. If not, you may need to look at an FHA, VA, or conventional loan for your situation. But for qualifying borrowers buying homes in suburban or rural areas, USDA loans can be a great financing option despite their disadvantages.

How Does a USDA Loan Work?

There are two types of USDA loans. Guaranteed loans are issued through a private lender like Griffin Funding, while USDA direct loans are issued directly through the USDA. However, USDA direct loans typically come with more stringent requirements, and borrowers must be considered low-income and unable to obtain any other type of financial assistance.

USDA loans make getting approved for a loan easier because they have more flexible lending criteria when you get them from a private lender. With these loans, you can get 100% financing and avoid needing a down payment while taking advantage of incredibly low interest rates.

The USDA loan is only available for properties in rural areas, which are defined as places not part of an urban area with small populations. You can use the USDA map to find eligible areas that match these guidelines.

When applying for a loan, USDA loans work similarly to other mortgage programs when you work with a private lender. However, unlike other loan options, USDA loans don’t have prepayment penalties.

Like some other government-backed loans, you can’t use USDA loans for vacation investment properties; they can only be used for primary residences. However, you can use these loans to purchase any type of primary residence, ranging from newly built homes and foreclosures to condos and manufactured homes, as long as they’re located in a rural area.

What Is a USDA Loan?

USDA loans are a type of mortgage assistance program that can reduce the costs of buying a home. These loans are designed for low- to moderate-income families who wish to purchase properties in rural areas and can be used to purchase or refinance an existing property.

These loans are designed to help individuals who may not qualify for other types of home loans achieve their dreams of homeownership because they don’t require a down payment and have low interest rates and more favorable terms.

See if you qualify for one of our non-traditional mortgages.

Contact Us Today

Pros and Cons of a USDA Loan | All You Need to Know About USDA Home Loans EXPLAINED

FAQ

What is the downside of a USDA loan?

Are USDA loans worth it?

Which is better FHA or USDA?

Do USDA loans have higher interest rates?

What are the pros and cons of a USDA home loan?

The major benefit of a USDA home loan is that there’s no down payment requirement. This can be a great program for homebuyers on a budget who are flexible about where they live. The cons mostly have to do with the restrictions on where you can buy or how much income your family can make.

What are some problems with USDA loans?

USDA loans have some limitations. If you want to buy a home in the heart of a major city, USDA loans aren’t for you as urban properties fall outside of the qualifying geographic areas.

Can you make too much money to qualify for a USDA loan?

For homes with 1-4 members, the income limit for USDA loans is $110,650. For homes with 5-8 members, the income limit is $146,050. USDA loans require an upfront guarantee fee for processing the loan, which equals 1% of the loan amount. The income limit, also known as an income cap, means that you can indeed make too much money to qualify for a USDA loan.

What are the restrictions on a USDA loan?

These restrictions help direct the program’s benefits to those seeking homes in less densely populated areas, but they can limit options for borrowers looking in more urban environments. USDA loans come with specific occupancy requirements. For example, a home financed by a USDA loan must serve as the borrower’s primary residence.