Buying a home is a multi-step process, and everyones homebuying journey may vary. It’s an extremely common question for many first-time homebuyers: “How long will it take to buy a home with a VA loan?” Theres a lingering myth that VA loans take forever to close, but thats simply not the case.

Getting approved for a VA loan can be an exciting yet stressful process, especially if you’re a first-time homebuyer. Having an understanding of the typical VA loan approval timeline can help you set proper expectations and plan accordingly. In this comprehensive guide, we’ll walk through the entire VA loan process from start to finish so you know what to expect.

Overview of the VA Loan Approval Process

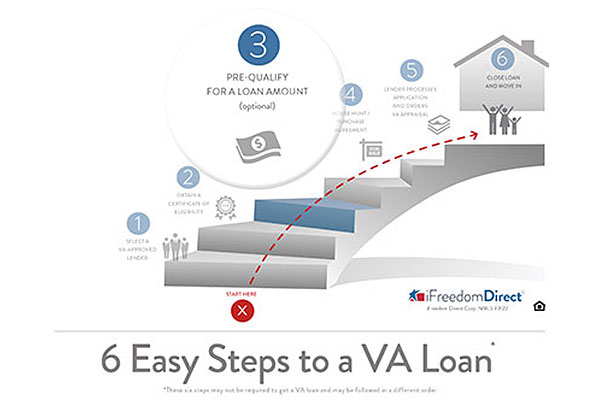

The VA home loan process can generally be broken down into 5 main steps:

- Getting pre-qualified

- House hunting

- Making an offer and going under contract

- Loan underwriting and appraisal

- Closing on your new home

While individual timelines may vary, the typical VA loan approval process takes between 30-50 days from the time your purchase contract is accepted to closing day. However, this does not include the preliminary steps required before making an offer, which can add several more weeks to your timeline.

Below we’ll explore each phase of the process in detail, along with tips for keeping your VA loan on track.

Step 1: Getting Pre-Qualified (1-2 Weeks)

Pre-qualification is one of the most important first steps for VA loan approval, and often takes 1-2 weeks to complete. Here’s an overview of what’s involved:

-

Apply for a Certificate of Eligibility (COE). This document from the VA confirms you meet the minimum service requirements to be eligible for a VA-backed loan.

-

Choose a lender Shop around and compare multiple lenders to find the best VA loan terms and rates

-

Gather documentation. Your lender will need documents like tax returns, pay stubs, and bank statements to verify your finances.

-

Complete your application Provide all required documents and fill out your loan application fully

-

Get pre-qualified. The lender will assess your credit, income, debts, and assets to determine the maximum mortgage amount you can afford.

Getting pre-qualified early shows sellers you are a serious buyer and gives you a budget for your home search. Don’t spend time looking at homes above what you can afford.

Step 2: House Hunting (2-4 Weeks)

With pre-qualification letter in hand, you can confidently start searching for your dream home within your approved price range. Here are some tips for an efficient house hunting process:

-

Research neighborhoods. Consider commute times, school ratings, amenities, and more to find areas that fit your lifestyle.

-

Find a real estate agent. An experienced agent will help you identify homes meeting your needs and submit strong offers.

-

See lots of options. Be open-minded and expect to view several homes that don’t feel right before finding “the one”.

-

Act fast on homes you love. In competitive markets, desirable homes go fast. Be ready to submit an offer on your top choices right away.

While frustrating at times, try to enjoy exploring different homes and neighborhoods. With persistence, you’ll eventually find the perfect fit.

Step 3: Making an Offer and Going Under Contract (2-3 Weeks)

Once you’ve found the right home, the fun part begins! Here’s what to expect after your offer is accepted:

-

Earnest money deposit. You’ll need to provide an earnest money deposit, typically 1-2% of the purchase price. This reserves the home and shows you’re serious.

-

Review disclosures. Pay close attention to the seller’s property disclosures about defects, renovations, or other material facts.

-

Negotiate repairs or credits. Request repairs for any problems found during inspections or appraisal. If seller won’t fix issues, ask for a credit.

-

Get homeowners insurance. Your lender will require you have an insurance policy ready to go into effect at closing. Shop rates!

-

Finalize your loan application. Provide any additional documents your lender needs to proceed with underwriting.

Keep your lender updated on any contract changes and be responsive to their requests to avoid delays.

Step 4: Loan Underwriting and Appraisal (2-3 Weeks)

While you’re wrapping up contract details, your lender will be busy underwriting your loan to assess credit risk and confirm you can afford the home. Here’s what happens during underwriting:

-

Verify all documentation. Lenders double check pay stubs, bank statements, and other files to confirm your initial info still holds true.

-

Order an appraisal. An appraiser will ensure the home meets VA minimum property standards and establish fair market value.

-

Assess property eligibility. The lender confirms the home meets all VA requirements regarding type of property, condition, etc.

-

Review automated underwriting findings. Software will analyze your financial profile and determine overall loan eligibility and risk.

-

Use manual underwriting if needed. If the automated review denies your loan, a manual underwriting review may have more favorable results.

This stage is largely handled behind the scenes by your lender, but be ready to quickly provide any additional requested documents.

Step 5: Closing on Your New Home (1-2 Weeks)

Congratulations, the finish line is in sight! During the last 1-2 weeks you’ll finalize all legal and financial details needed to close on your new property.

-

Get closing disclosure. At least 3 days before closing, you’ll get final details on all costs and loan terms you’re agreeing to.

-

Read documents thoroughly. Don’t rush through your closing documents! Make sure you fully understand everything before signing.

-

Final walkthrough. Do one last tour of the property shortly before closing to ensure no major changes.

-

Sign closing docs. Bring valid ID and funds for any remaining down payment and closing costs to your closing appointment.

-

Get your keys! The home is officially yours after closing!

Schedule movers and get ready to celebrate – you did it! Enjoy your new home.

Tips for Keeping Your VA Loan on Track

While every home purchase involves some unpredictable moments, you can prevent unnecessary delays by staying organized and on top of the process:

-

Provide all required documents as quickly as possible. Lenders can’t proceed until they have everything they need.

-

Stay in frequent communication with your loan officer on any changes or issues that come up. Surprises slow things down.

-

Be responsive to all phone calls and emails from lenders, agents, title companies, etc. Dragging your feet bogs down the process.

-

Don’t make any major purchases or change jobs before closing. This may require re-verification of your finances and delay approval.

-

Read everything sent to you thoroughly and ask questions right away if you’re unsure. Confusion leads to hold ups.

-

Shop for homeowners insurance early. Having a policy ready to bind at closing is required.

Following the tips above will help ensure your VA loan timeline stays on track. But also remember perfection is impossible – an unexpected delay or two is normal. With flexibility and patience, your keys will be in hand before you know it!

VA Loan Closing Timeline Summary

Here is a quick summary of the typical timeline for VA loan approval from start to finish:

- Pre-Qualification: 1-2 weeks

- House Hunting: 2-4 weeks

- Under Contract: 2-3 weeks

- Underwriting: 2-3 weeks

- Closing: 1-2 weeks

Total VA loan timeline: Approximately 30-50 days from accepted offer to closing, plus a few additional weeks to get pre-qualified and find a home.

The key is working with trusted professionals like loan officers and real estate agents who will help you successfully navigate the process. If you ever have any questions or concerns along the way, don’t hesitate to ask! Your team wants to see you become a proud homeowner.

VA Loan Preapproval

Getting preapproved for a VA loan is one of the best ways to shorten the homebuying waiting game. A “preapproved buyer” has met a lender’s basic requirements and is likely to obtain a loan, provided that certain conditions are met. VA loan preapproval shows that a buyer will likely obtain financing, eliminating potential uncertainty and delays.

It’s best to get preapproved for a loan as soon as you consider buying a home. Most lenders recommend getting preapproved months before starting the actual house hunt. This provides plenty of time to clear up any eligibility or income issues before falling in love with a home.

How long does it take to get a VA loan?

You can expect your VA loan to close within 40 to 50 days. This is a pretty standard timeline for the mortgage industry regardless of the type of financing.

In fact, dig into the numbers a bit, and you dont find much difference between VA and conventional loans.

This guide will review five key factors affecting the VA loan process timeline.

Beginners Guide to VA Home Loans in 2023

FAQ

How long does a VA loan take to approve?

Can a VA loan close in 30 days?

How fast can you get a VA loan?

Why does a VA loan take so long?