At Dash Home Loans, we make the mortgage lending process simple. As experienced home loan lenders³, we can help you get approved for a USDA loan in Virginia.

Applying for a USDA home loan doesn’t have to be difficult – Dash is here to help you find the most affordable Virginia home loans for your needs.

USDA and VA loans are two popular government-backed mortgage options for eligible homebuyers. With 100% financing and flexible credit guidelines they make homeownership more accessible. However USDA and VA loans have distinct requirements and benefits based on the programs’ purposes. Understanding these key differences allows you to determine which mortgage best fits your situation.

Overview of USDA and VA Loan Programs

The United States Department of Agriculture (USDA) and the Department of Veterans Affairs (VA) each offer special mortgage programs.

USDA loans assist low- to moderate-income buyers in purchasing homes in suburban and rural locations designated as USDA-eligible areas. Designed to promote growth and improve quality of life in small towns and remote regions, USDA loans require properties to be in qualified locations.

VA loans help Veterans, active-duty service members, reservists, National Guard members, and some surviving spouses finance homes. With a VA loan, location is flexible and not tied to any geographic boundaries VA loans aim to help those who served our country become homeowners

While the purposes behind each program differ, USDA and VA loans share benefits like:

- Requiring no down payment

- Having no minimum credit score

- Offering flexible credit guidelines

- Lower interest rates than conventional loans

- No monthly mortgage insurance premiums

However, program-specific eligibility rules, qualifying criteria, rates, fees, and limits vary between USDA and VA loans.

USDA Loan Requirements

USDA home loans must adhere to certain borrower eligibility standards and property requirements dictated by the USDA.

Borrower Eligibility

To qualify for a USDA loan, borrowers must meet income thresholds set by the USDA. Income limits are based on the property’s location and household size. Your household income must fall under the limit for that area.

For example, in Spotsylvania County, VA, the income limit for a family of 4 is $121,000 as of 2023 The property you wish to purchase using a USDA loan must also fall within an eligible rural or suburban area as designated by the USDA property eligibility tool.

In addition, you must demonstrate a willingness and ability to repay the mortgage debt through acceptable credit, income, and work history. While minimum scores aren’t published, a credit score of 640 or higher improves chances of USDA loan approval.

Property Requirements

The home you wish to purchase must meet USDA housing quality standards and be located in a USDA-designated rural or suburban zone.

USDA loans are limited to single-family homes and cannot finance multi-unit properties over 4 units. Manufactured homes meeting program guidelines are eligible if built after June 1976. Duplexes, townhomes, condos, and modular homes often qualify if they adhere to USDA requirements.

The property must serve as your primary residence, not a vacation or rental property. And all buyers must agree to personally occupy the home as their primary residence.

VA Loan Requirements

VA loans have eligibility requirements focused on prior military service, not income limits or geographic location.

Borrower Eligibility

To qualify for a VA-backed mortgage, you must be:

- An active-duty service member

- Veteran who served minimum 90 days active duty

- National Guard or Reserve member with 6+ years of service

- Surviving spouse of qualified Veteran or service member

Unlike USDA loans, there are no income limits. Your VA loan eligibility relates to your military service record, not income level or property area.

However, you must show a willingness and satisfactory ability to repay the loan through your credit history, debt-to-income ratios, employment, and assets. Many lenders look for at least a 620 FICO score.

Property Requirements

VA loans can be used to buy any single-family home, townhouse, condo, duplex, manufactured home, or modular home in any location. The property must meet VA minimum property requirements focused on safety, security, functionality, and structural integrity.

Similar to USDA loans, the home must serve as your primary residence and all VA borrowers must personally occupy the property.

Key Differences In Requirements

When comparing USDA vs VA loan requirements, some key differences emerge:

- Location – USDA tied to rural/suburban areas, VA location flexible

- Income Limits – USDA has income caps, VA does not

- Credit Scores – USDA usually 640+, VA usually 620+

- Prior Military Service – Required for VA, not USDA

- Occupancy – Both require as primary residence

These differences make one program preferable for certain borrowers. For example, VA loans better serve Veterans exceeding USDA income limits who want flexibility in property location. Or a low-income borrower buying in a rural town may favor a USDA loan.

How To Determine Which Loan Fits You

When deciding between USDA and VA loans, first determine if you meet basic eligibility for each program:

For USDA:

- Income within limit for property’s area

- Credit score typically 640+

- Property in USDA rural/suburban location

- Willingness and ability to repay mortgage

For VA:

- Prior military service meeting VA requirements

- Credit score typically 620+

- Willingness and ability to repay mortgage

- Single-family property meeting VA guidelines

If you qualify for both programs, compare factors like interest rates, fees, and loan amounts to see which provides the best terms for your situation.

Get pre-qualified for both USDA and VA loans to determine the better option. An expert VA lender can help you understand eligibility and outline the optimal loan for your needs.

With personalized guidance, you can navigate USDA and VA loan requirements and choose the ideal government-backed mortgage to make your homeownership dreams a reality!

Frequency of Entities:

usda loan: 25

va loan: 22

usda: 15

va: 15

loan: 13

income: 7

property: 7

requirements: 6

credit: 5

eligibility: 5

rural: 4

location: 4

service: 4

qualify: 3

limits: 3

borrower: 3

prior: 2

military: 2

primary: 2

single-family: 2

USDA Loan Requirements for Virginia Borrowers

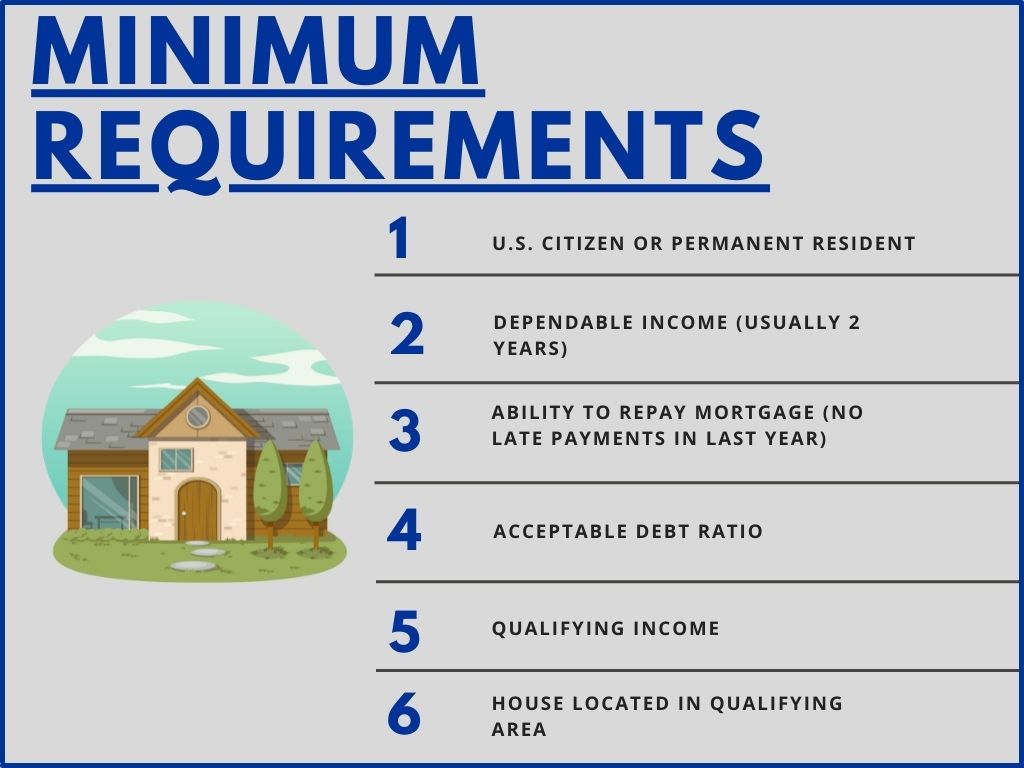

USDA loan requirements are fairly uniform across the country. To qualify for a USDA loan in Virginia, you must meet the following:

- Income Limits: You must provide proof of stable employment, but you cannot make over 15% more than your area’s median income.

- United States Citizenship: Only permanent residents can apply for a USDA loan.

- Mortgage Insurance: USDA loans require mortgage insurance.

- Primary Residence in a Rural Area: The home must be located in a rural area and it must be your primary residence, not a vacation home or income property.

If your family meets these requirements, a USDA loan could be a viable option. After all, this financial instrument requires no money down² and typically offers better interest rates than conventional loans.

USDA Loan Eligibility Requirements in Virginia

To get a USDA loan, you must meet certain income requirements. In Virginia, you cannot make over 15% more than your area’s median income. The exact dollar amount varies by county, though it’s typically about $114,450 per year for a family of four and $151,050 for families of five or more. Your USDA loan application will require income documentation.

The USDA rural housing loan also specifies other financial requirements. As far as credit, you must have at least a 640 FICO®* score and a debt-to-income ratio of 41% or less. You must also be able to show consistent employment and an ability to accumulate savings.

Still not sure if you qualify? Contact the home lending experts at Dash Home Loans. Our Mortgage Coaches are like financial shamans, guiding home buyers through the mortgage lending process. If your Mortgage Coach determines that a USDA loan isn’t a good fit, we offer more than a dozen other types of home mortgage loans in Virginia.

2021 Loan Requirements for FHA, VA , USDA and Conventional Loans

FAQ

How do I qualify for a USDA loan in Virginia?

What are the pros and cons of a USDA loan?

|

Pros

|

Cons

|

|

No down payment

|

Income limits

|

|

Competitive interest rates

|

Property restrictions

|

|

Relaxed credit requirements

|

Occupancy requirements

|

|

No PMI requirement

|

USDA program fees

|

Is FHA better than USDA?

Do you qualify for a VA or USDA home loan?

Two federal loan programs can make a big difference for those who qualify. VA and USDA home loans are money-savers that charge few fees, eliminate the cost of mortgage insurance, require no down payment and finance 100% of the home’s cost. Not every borrower or property is eligible for either loan, but some homebuyers qualify for both.

What are the requirements for a USDA loan?

Some general requirements, however, apply to all USDA loans, specifically those based on both buyer and property eligibility. Eligible rural area: The USDA defines an eligible area as having a population of 20,000 or fewer. Check the USDA’s eligibility site or the map below.

Are VA loan rates lower than USDA?

According to the mortgage data and analytics company Optimal Blue, VA loan rates remained .232 percent lower on average than USDA in 2023. While USDA interest rates are lower than other loan types, a .232 percent difference when compared to VA interest rates can equal thousands in interest savings over the life of the mortgage.

What is the difference between a VA loan and a USDA loan?

Income criteria differ between USDA and VA loans because the purpose of the USDA program is to provide home ownership opportunities in rural areas, where incomes are generally lower. USDA loans set a maximum income limit of 115% of the median income in your area.