Buying your first home is one of the most exciting and rewarding experiences in life. However, it can also be daunting, especially when it comes to securing financing. This is where a USDA housing loan can help make homeownership more accessible and affordable.

USDA stands for the United States Department of Agriculture. They offer special mortgage loans to eligible borrowers in rural areas. These loans require no down payment and have very low interest rates.

To estimate your monthly payments, you can use the USDA housing loan calculator. This simple tool allows you to plug in a few key details and estimate your mortgage costs.

In this comprehensive guide, we’ll explain everything you need to know about USDA loans, from eligibility requirements to how to use the USDA mortgage calculator.

What is a USDA Loan?

USDA loans help low-to-moderate income borrowers achieve homeownership in rural communities. They offer 100% financing, meaning no down payment is required.

The USDA guarantees these affordable mortgages, ensuring qualified lenders offer better rates and terms Borrowers work directly with USDA-approved lenders to get a USDA home loan.

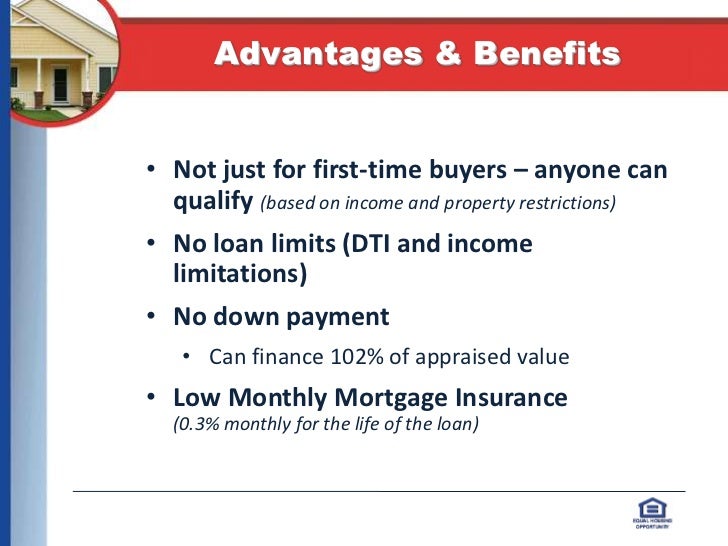

Some key benefits of USDA loans include:

-

No Down Payment: 100% financing means you can buy a home without any down payment.

-

Low Interest Rates: USDA loans offer below-market interest rates, making monthly payments more affordable.

-

Low Fees: No private mortgage insurance (PMI) required, saving you money each month.

-

Flexible Credit Guidelines: Credit score requirements are more flexible than conventional loans.

-

No Prepayment Penalties: You can pay off your USDA loan early with no extra fees or charges.

USDA Loan Eligibility Requirements

To qualify for a USDA home loan, you must meet certain eligibility criteria:

-

Location: The home you wish to buy must be in an eligible rural area. The USDA has an eligibility map you can check.

-

Income Limits: Your income must be below the limit for your county and family size. These vary based on location.

-

Credit History: You’ll need a credit score of at least 640. Requirements vary by lender.

-

Debt-to-Income Ratio: Your total debt payments should equal less than 41% of your gross monthly income.

-

Home Size: Existing homes must be under 2,000 square feet. New construction has no size limits.

Meeting these requirements is key to securing USDA financing. Connect with a participating lender to confirm you qualify before house hunting.

How To Use the USDA Mortgage Calculator

The USDA provides an online mortgage calculator to estimate your monthly loan payments. Here are the steps to use it:

-

Visit the USDA Mortgage Calculator page.

-

Enter the home’s purchase price.

-

Input your down payment amount. For USDA loans this is $0.

-

Select your expected interest rate. Rates for USDA loans range from 1% to 6%.

-

Choose your desired loan term in years. Common terms are 15 or 30 years.

-

Click “Calculate”.

-

View your estimated principal and interest payment, along with total monthly costs including taxes and insurance.

The calculator simplifies the process of estimating your mortgage costs. Plugging in different home prices or down payments shows how those factors impact affordability.

What Other Costs Are Involved?

When budgeting for a USDA home loan, expect to pay costs beyond just principal and interest:

-

Upfront Guarantee Fee: 1% of the loan amount, can be financed.

-

Annual Fee: 0.35% of the loan balance each year.

-

Closing Costs: Appraisal, credit check, title search and insurance fees. Estimate 2-5%.

-

Prepaid Costs: Homeowner’s insurance premiums, property taxes, and interest.

-

Mortgage Insurance: Not required on USDA loans, saving you money.

Work with your lender to estimate total costs. Closing costs may be able to be financed into your mortgage loan.

Sample USDA Mortgage Calculator Results

Let’s look at some examples to see the USDA mortgage calculator in action:

-

For a $200,000 home with a 30-year USDA loan at 4% interest, the payment would be $899/month.

-

On a $150,000 house with a 15-year USDA loan at 3% interest, the monthly mortgage payment would equal $1,006.

-

If you could qualify for a 1% interest USDA loan on a $100,000 property, the monthly payment would be just $422.

As you can see, the calculator provides an easy way to estimate payments and see how different factors like home price, rates, and term length impact affordability.

Should You Consider a USDA Mortgage?

A USDA home loan can be a great option for eligible borrowers, especially first-time homebuyers. Key advantages include:

- No down payment required, making it more accessible

- Below market interest rates keep monthly payments low

- Relaxed credit guidelines compared to conventional mortgages

- No mortgage insurance saves you money each month

The big caveat is that you must buy a home in an eligible rural area. Use the USDA Property Eligibility tool to check if neighborhoods you’re considering qualify.

Also, understand that no down payment means you may end up underwater if home values decline. And, low rates also mean a slower path to building equity.

Carefully weigh the pros and cons. For the right homebuyer, a USDA mortgage can be an affordable path to homeownership.

Next Steps After Using the USDA Calculator

Once you have an estimate from the USDA mortgage calculator, here are some next steps:

-

Get pre-qualified by a lender to confirm you meet eligibility requirements.

-

Check your credit and take steps to improve your score if needed to qualify.

-

Determine your budget including total monthly housing costs beyond just your mortgage payment.

-

Start your home search in USDA-eligible areas. Follow property size and age limits.

-

Make an offer when you find the right home for your budget and lifestyle.

With pre-approval from a lender, you’ll be in a strong position to make a competitive bid on a USDA-eligible property.

Homeownership Made Easier with USDA Loans

The USDA housing loan calculator provides a simple starting point for estimating your mortgage costs. USDA loans open up home buying possibilities for rural residents by offering no down payment and low rates.

First weigh whether you meet location, income, and credit requirements. Then use the mortgage calculator to get an idea of potential monthly payments. With a USDA loan, you may be able to achieve your homeownership dreams sooner than you thought possible.

USDA Loan Calculator Definitions

| Input | Explanation |

|---|---|

| Home Value | Home value is the total estimated purchase price of the home. |

| Down Payment | Down payment is the amount of money you intend to pay upfront for the home at closing. USDA loans dont require a down payment, but putting money down can reduce your starting loan amount. |

| Interest Rate | Interest rate is the cost of borrowing money to purchase your home with a USDA loan. APR stands for “Annual percentage rate” and is used to help estimate your interest rate, including origination fees. |

| Loan Term | Loan term is the length of time you want to repay the loan. Typically, USDA loan terms are set for a period of 15 or 30 years. |

| Property Tax | Property taxes are generally estimated to be 1.2% of the homes value but will vary depending on your location. |

| Home Insurance | Annual homeowners insurance is typically 0.35% of the homes value. Homeowners insurance is usually included in your monthly mortgage payment for USDA loans. Still, you pick your insurance provider and can change insurers at any point in the future. |

USDA Loan Payment Breakdown

Our USDA loan calculator gives you the total estimated monthly payment and a monthly breakdown showing how your payment is calculated. You will see the following:

- Principal & Interest

- Taxes

- Insurance

- USDA Annual Fee

These calculations are based on your specific inputs, as described above. Principal & Interest accounts for most of your monthly USDA loan payment. Principal represents the money youve borrowed to purchase your home and builds up in the form of equity as each monthly payment is made.

USDA Mortgage Calculator: Here’s how to CORRECTLY calculate a USDA monthly payment

FAQ

Are USDA loan payments cheaper?

How is the maximum loan amount calculated in USDA?

What is the debt to income ratio for a USDA home loan?

How is USDA mortgage insurance calculated?

How do I use a USDA loan calculator?

To use this calculator, you’ll need to input values for some basic information including your estimated home price, down payment, loan term (in years) and interest rate. USDA loans typically don’t require a down payment, but you can enter an amount to see how much less your monthly payments might be if you chose to put money down.

What is a USDA payment calculator?

A **USDA payment calculator** is a tool that helps you estimate your monthly payments for a USDA mortgage.It takes into account factors such as your estimated home price, down payment, loan term, and interest

What is a USDA mortgage amount?

USDA Mortgage Amount. This is amount of the USDA loan you are seeking. The larger your mortgage, the greater your monthly payment and other costs such as USDA mortgage insurance. Interest Rate. This is the mortgage rate you pay on your loan.

How does the USDA mortgage calculator work?

The USDA mortgage calculator is easy to use with breakdowns of every payment shown in the mortgage amortization schedule with monthly and biweekly payment options. The USDA PMI calculator also offers extra payment options that show you how much faster you can pay off the mortgage if you are making regular extra payments.