High demand and low supply have caused housing affordability in South Carolina to drop by 10.9%, while the average home price has increased by over 18% since 2020. These changes make it pretty hard to qualify for a first-time home in rural areas.

Luckily, there are some government-backed options for loans that can help. If you’re looking at buying a home and have a low-to-moderate income, the United States Department of Agriculture (USDA) house loans can help future home buyers in South Carolina who have income limits make homeownership more affordable and easier to reach.

This article explains what you need to ensure USDA eligibility when you are looking to get a house loan.

Owning a home is part of the American dream, but it can feel out of reach, especially in today’s competitive housing market. This is particularly true in rural areas, where access to mortgage lending is more limited. Fortunately, there is a program that can help – the USDA Home Loan Program. Offered through the U.S. Department of Agriculture (USDA), these home loans are designed specifically for low-to-moderate income buyers in rural communities.

In this article, we’ll explore how the USDA home loan program works in South Carolina and how it can help you finally achieve the dream of homeownership.

Overview of the USDA Home Loan Program

The USDA home loan program, also known as the Section 502 Direct Loan Program, helps rural residents obtain safe, decent, and sanitary housing. It offers subsidized mortgages to qualified applicants who are unable to get traditional financing.

Some key things to know about USDA home loans in South Carolina

-

Available for new purchase or repairs/renovations: You can use the loan to build, repair, renovate or relocate a home, or to purchase and prepare sites.

-

100% financing: No down payment is required.

-

Low interest rates: Current interest rates are around 4.875% for low-income borrowers. Rates can be as low as 1% with payment assistance subsidies.

-

Long repayment terms: Up to a 38 year repayment period for very low-income applicants.

-

Relaxed credit standards Credit score requirements are more flexible than conventional loans,

The program helps families in rural communities obtain home financing when they otherwise may not qualify through conventional lending sources. It promotes affordable homeownership opportunities, which supports thriving rural communities

Am I Eligible for a USDA Home Loan in South Carolina?

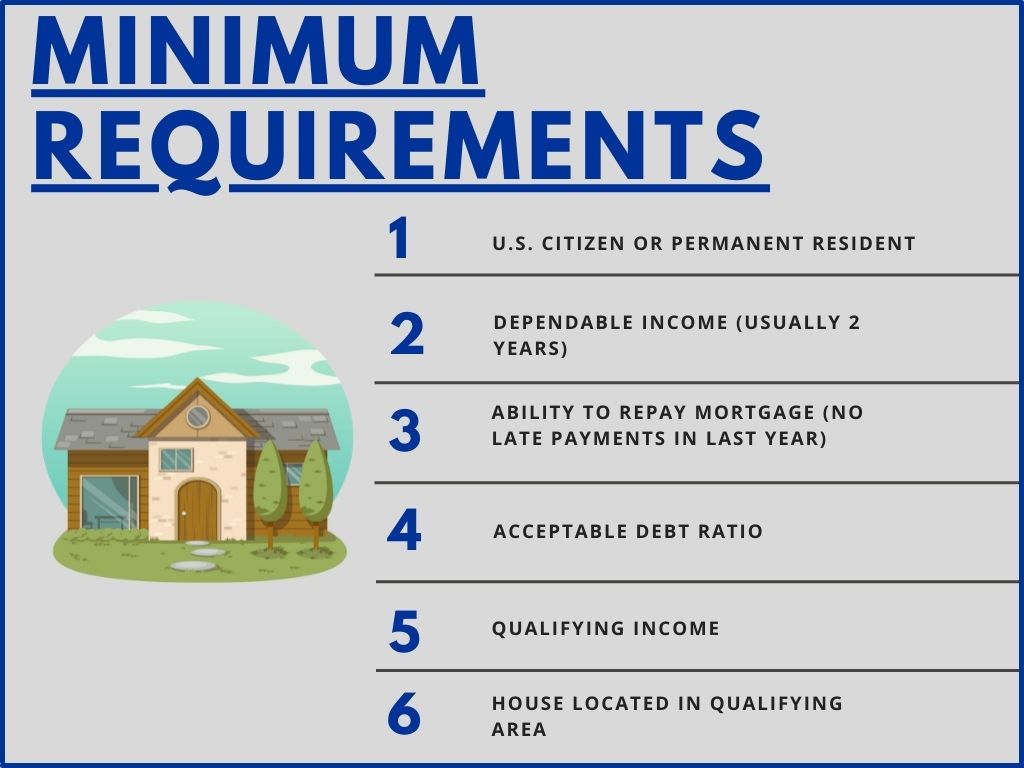

To qualify for a USDA home loan in South Carolina, there are certain eligibility requirements you must meet:

-

Location: The home must be located in an eligible rural area, as defined by the USDA. You can check your eligibility here.

-

Income limits: Your adjusted household income must be below the applicable low-income limit set by the USDA. View income limits for South Carolina here.

-

Credit history: You must have an acceptable credit history demonstrated by timely payments of debts. Minimum score requirements are more flexible than conventional loans.

-

Repayment ability: You must demonstrate adequate and dependable income to repay the loan.

-

Citizenship: You must be a U.S. citizen, U.S. non-citizen national, or qualified alien.

-

Homeownership need: You must be unable to obtain traditional credit and need assistance to buy or renovate a home.

As long as you meet these criteria, you can apply for a USDA home loan even if you’ve been turned down for conventional financing. The program is designed specifically to help lower-income borrowers in rural communities achieve homeownership.

How Do I Apply for a USDA Home Loan in South Carolina?

If you think you may qualify, follow these steps to apply for a USDA home loan in South Carolina:

-

Contact a local USDA Rural Development office. There are several regional offices throughout the state where you can get information and start the application process. Locate your closest USDA office here.

-

Check your preliminary eligibility. Use the USDA’s online self-assessment tool to get an initial read on whether you may qualify based on location, income, and credit history.

-

Compile required documents. You’ll need to submit various personal and financial documents as part of your application, including tax returns, pay stubs, bank statements, and more.

-

Complete and submit the application. Work with a USDA representative to fill out the required forms. Applications can be submitted online or through a certified loan application packager.

-

Get pre-approved. The USDA will review your application and verify your eligibility. If approved, you’ll get a pre-approval letter stating the loan amount you qualify for.

-

Find a home and make an offer. Your pre-approval letter allows you to make offers on USDA-eligible homes within your qualified loan amount.

-

Close on the home. Once your offer is accepted, work with the USDA to finalize loan documents and close on the property.

While the process takes time, the USDA will guide you through every step – from determining your eligibility all the way to closing. Their staff is available to help make your dream of homeownership a reality.

What Are the Benefits of a USDA Home Loan?

USDA home loans offer many advantages that can help you achieve affordable homeownership, including:

-

No down payment required. You can buy a home with 100% financing.

-

Below market interest rates. Current interest rates start around 4.875% and can be subsidized down to 1% based on need.

-

Lower monthly payments. Interest credits and payment subsidies make monthly payments more affordable.

-

Flexible credit requirements. Minimum credit scores are more lenient than conventional mortgages.

-

No maximum income limits. Only the floor income limits apply, not ceilings. High earners can qualify.

-

No first-time homebuyer requirement. The program helps new and existing homeowners.

-

No prepayment penalties. You can pay off your loan early with no extra fees.

For many borrowers, these advantages make USDA home loans the most accessible path to affordable homeownership. The program provides a lifeline to purchasing a home when other options may be out of reach.

What Are the Loan Limits for USDA Home Loans in South Carolina?

The maximum loan amount you can borrow under the USDA home loan program depends on two main factors:

-

The appraised value of the property

-

The area loan limit for the county where the home is located

Your loan cannot exceed 100% of the appraised value of the home. Additionally, it cannot be higher than the maximum loan limit for that county as determined annually by the USDA.

As an example, here are the 2023 South Carolina USDA loan limits for a few counties:

- Richland County: $386,600

- Greenville County: $349,150

- Charleston County: $439,150

- York County: $314,850

You can look up loan limits for all South Carolina counties using this lookup tool. The highest loan amount is reserved for more populous and higher cost areas.

In determining your personal maximum loan amount, the USDA will consider your repayment ability along with the county loan limits. This ensures you receive adequate financing without being overburdened.

What Are the Repayment Options on USDA Loans in South Carolina?

USDA home loans offer flexible repayment terms tailored to each borrower’s financial situation:

-

Repayment period: Up to a 38 year repayment term, ensuring affordable monthly payments.

-

Payment subsidies: Subsidies or interest credits can lower monthly payments to as low as 1% of income initially.

-

Graduated payment plans: Payments start lower and gradually increase over 5-7 years as income grows.

-

Income-Based repayment: Payment is based on 22% of adjusted monthly income.

-

Assumption: Loans can potentially be assumed by eligible new buyers when you sell.

Because the goal is affordable homeownership, the USDA works with each borrower to ensure a reasonable payment plan that fits their budget. You have multiple options to make repayment manageable.

Are There Closing Costs or Down Payments With USDA Loans?

A major benefit of the USDA home loan program is that no down payment is required in most cases. You may also be eligible for assistance with closing costs through a USDA Rural Development grant.

Closing costs you may incur include:

- Origination fee: 1% of the loan amount

- Appraisal fee

- Credit report fee

- Title search and insurance

- Legal fees

- Recording fees

But any fees paid upfront can usually be financed as part of your total loan amount

How Do USDA House Loans in South Carolina Work?

USDA home loans aim to help families with low- to moderate-income and an income limit buy a home in eligible rural areas by applying lower interest rates. Without the program, these families may find securing a mortgage nearly impossible.

Backing from the USDA lets lenders offer low, 30-year fixed rates with no down payment. This makes it more affordable and easier to get into a home — even with income limits.

There are two specific loan options through the USDA mortgage loans plan. With a Single-Family Housing Direct Home Loan, loans are offered by the USDA itself. You can apply directly to your local USDA mortgage state office.

The Single Family Housing Guaranteed Loan Program, which is more common, is offered by private creditors, while the USDA insures the loans against loss. Although it has a few additional requirements, the process is very similar to a traditional home-buying program.

To get a future home buyer a residence loan eligibility, they’ll need to meet some general rules. These serve to prove that you can both afford the loan amount of mortgage payments and mortgage insurance and that you are in the target demographic of buyers who may not be able to secure a traditional mortgage.

One of the key property eligibility requirements is that your household income can’t exceed 115% of the area’s median income. Because these numbers vary drastically based on location and family size, you should check with your mortgage creditor to see if you meet this requirement for the purchase price.

In addition, you must have decent credit, though there is no minimum credit score required. Some creditors like to see a 620 credit score, but this is not required across the board.

Your creditor will also check your debt ratios comparing your debts to income. In general, creditors look for ratios no higher than 29% for housing costs and 41% for total debt.

The credit score and debt ratios of the program are more guidelines than requirements, meaning there is some wiggle room in meeting the house purchase qualifications. You will be evaluated on the overall strength after you apply, not just whether you check all of the boxes. For instance, if you have a strong credit score or a lot of savings, your creditor may be willing to compromise on the debt ratio program.

Home Requirements for North Carolina USDA Loan

The home you plan to purchase will also need to meet certain program prerequisites in order to be approved for a house loan in South Carolina. A key requirement is that the home is located in a rural area, which is usually determined by census tract density.

Since the definition of rural is vague and open for interpretation, rural housing in many areas you may not consider is actually legitimate. Start by looking outside of cities and metropolitan areas. Sometimes suburbs may be eligible too.

As towns grow and population density changes, eligible USDA rural areas can change too. Check an updated USDA home loan map in South Carolina to ensure the area you are considering will be acceptable for a house loan.

The home you plan on purchasing must be a primary residence. It can’t be an investment property, farm, vacation home, second home, or rental property. You can even use your residence loan to build a home.

The home can be any type of home. This includes preexisting or new construction, manufactured, townhouse, condo, foreclosure, or short-sale properties.

There can’t be any “income-producing” type buildings on the property, such as silos or barns used for commercial use.

You will need to have an appraisal to ensure certain other general prerequisites are met. The appraiser will look for a structurally sound foundation, stable roof, and easy access from the road. They will also check for functional heating and cooling, electrical, and plumbing systems, and well and septic systems, if present.

How to Buy a House with Zero Down Payment | USDA Home Loans 2023

FAQ

What is the income limit for a USDA loan in South Carolina?

What credit score do you need for a USDA loan in SC?

Is it easier to get FHA or USDA?

What are the pros and cons of a USDA loan?

|

Pros

|

Cons

|

|

No down payment

|

Income limits

|

|

Competitive interest rates

|

Property restrictions

|

|

Relaxed credit requirements

|

Occupancy requirements

|

|

No PMI requirement

|

USDA program fees

|

How many USDA backed home loans are there in South Carolina?

There are 24,419 USDA backed residential loans in South Carolina with an average loan balance of $117,236. Over 82% of the loans went to help first time home buyers. Borrowers were an average age of 39 years old. The typical appraised home value was around $121,399.

What is the USDA home loan program?

The USDA Home Loan Program is a zero down payment required home loan program for those looking for a home in a small town or rural setting. This is the “go to” mortgage program for folks who want to live outside Raleigh in Clayton or Holly Springs Neighborhoods .

How do I get a USDA home loan in NC?

There are three basic USDA Home Loan requirements for getting a Home Loan in NC. The home must be located within the USDA Home Loan footprint (obviously, these boundaries could be changing in NC based on a new definition of “rural” mandated by Congress). Each borrower needs at least 2 credit scores of at least 600.

How does Rd determine eligibility for a home loan?

Upon receipt of a complete application, RD will determine the applicant’s eligibility using verified information and the applicant’s maximum loan amount based on their repayment ability and the area loan limit for the county in which the property is located. What is the interest rate and payback period?