The USDA home loan program helps eligible borrowers in rural and suburban areas purchase a home with zero down payment. USDA loans offer affordable financing options for low-to-moderate income buyers

But how much will your monthly mortgage payment be with a USDA loan? This guide explains what factors impact your USDA loan payment and how to use a USDA mortgage calculator to estimate your monthly costs.

Overview of USDA Loans

First, let’s recap how USDA loans work. These mortgages are backed by the U.S. Department of Agriculture and issued by private lenders. The key features include

-

No down payment required – 100% financing means you don’t need cash for a down payment

-

Low interest rates – USDA loans often have lower rates than conventional mortgages.

-

Relaxed credit guidelines – Minimum credit scores are around 640, lower than conventional loans.

-

No mortgage insurance – No private mortgage insurance (PMI) is required.

To qualify, you must meet income and location eligibility requirements. Your home must be located in a USDA-designated rural or suburban area.

What Impacts Your USDA Loan Payment?

Several factors determine what your monthly mortgage payment will be:

Loan amount – The amount you borrow. With no down payment, this is typically the full purchase price.

Interest rate – The lower the rate, the less interest you pay each month.

Loan term – USDA loans come in 15- and 30-year terms. The longer the term, the lower the payment.

Taxes and insurance – Your monthly payment includes escrow for property taxes and homeowner’s insurance.

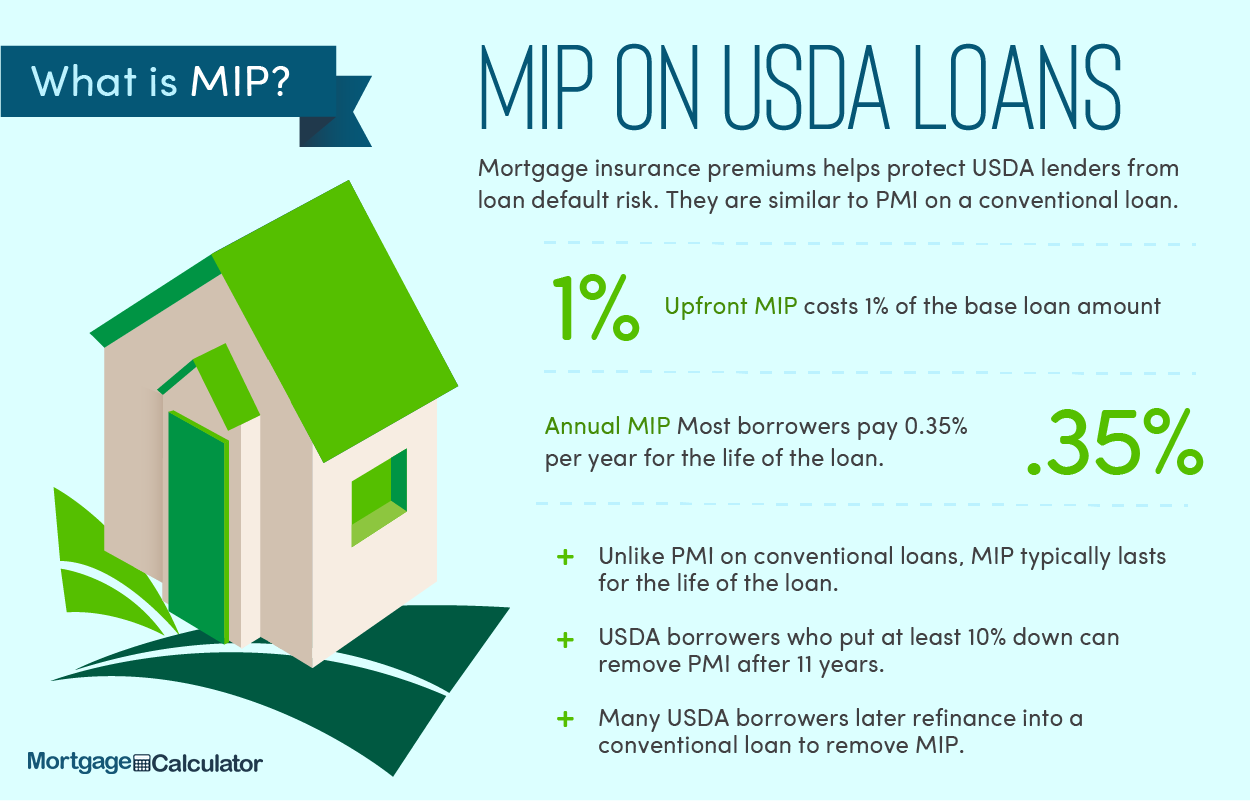

USDA fees – A 1% upfront guarantee fee and annual 0.35% premium are rolled into your loan.

Credit – Better credit means better rates and lower payments.

How to Use a USDA Mortgage Calculator

A USDA loan payment calculator allows you to estimate your monthly costs based on your specific loan details and financial profile.

Follow these steps:

-

Enter the purchase price of the home you want to buy.

-

Input your expected interest rate – check online mortgage rate tools.

-

Select your preferred loan term – 15 or 30 years.

-

Enter your credit score range to estimate rates.

-

Review the estimated payment including principal, interest, taxes, insurance, and USDA fees.

-

Adjust numbers to see the payment impact of different loan amounts, rates, terms.

A USDA mortgage calculator provides an approximation of your costs. Get pre-approved for more accurate estimates.

Breaking Down the USDA Monthly Payment

A USDA loan payment consists of:

-

Principal – The amount borrowed to purchase the home.

-

Interest – The cost of borrowing money, stated as a percentage rate.

-

Taxes – Property taxes paid to local government, often escrowed.

-

Insurance – Premiums for homeowner’s insurance, also escrowed.

-

USDA fees – 1% upfront guarantee fee + annual 0.35% mortgage insurance premium.

-

HOA fees – If required, homeowner’s association dues.

A detailed USDA mortgage calculator will estimate taxes, insurance, and fees so you understand the complete payment.

USDA Loan Payment Calculator Tips

Follow these tips when using a USDA mortgage calculator:

-

Input conservative estimates for interest rate, home price, taxes, and insurance.

-

Consider both 15- and 30-year terms to compare payments.

-

Use your middle credit score range for rate estimates.

-

Factor in HOA fees if applicable.

-

Adjust numbers to see how changes impact payment.

-

Use calculators for estimates only – get pre-approved for more accurate payment quotes.

Can I Lower My USDA Monthly Payments?

If the USDA mortgage calculator shows a payment that is too high for your budget, you have a few options to reduce it:

-

Buy a lower-priced home to decrease the loan amount.

-

Improve your credit score to qualify for a lower interest rate.

-

Make a small down payment to reduce the principal.

-

Choose a 30-year term instead of a 15-year loan.

-

Shop lenders thoroughly for the best rate deal.

Even modest improvements can make your payment more affordable.

Next Steps After Using USDA Payment Calculator

Once you have a rough estimate of potential USDA loan payments, take these next steps:

-

Get pre-approved to confirm precise monthly payments.

-

Evaluate your budget to ensure the payment works for you.

-

Make sure you meet all USDA eligibility requirements.

-

Research lenders and shop around for the best rates and fees.

-

Find a USDA-approved property in your target location and price range.

The USDA loan payment calculator provides a starting point to determine if this affordable financing option makes sense for your home buying goals.

USDA Mortgage Calculator FAQs

What credit score is needed for a USDA loan?

The minimum credit score is around 640 for USDA financing, but many lenders prefer 660 or higher. The better your credit, the lower your interest rate.

Do USDA loans require a down payment?

No, zero down payment is a key benefit of the USDA loan program. However, you can make a down payment to lower your monthly costs if desired.

What are the USDA mortgage insurance premiums?

You’ll pay a 1% upfront guarantee fee and an annual mortgage insurance premium of 0.35% of the loan amount. These fees are rolled into your loan.

Can I get a USDA loan for a manufactured home?

Yes, USDA loans can be used to purchase a manufactured or modular home, as long as it meets program requirements.

What are current USDA loan rates?

USDA loan rates fluctuate daily but tend to be lower than conventional mortgage rates. Check current rate trends to estimate your potential rate.

The Bottom Line

The USDA home loan payment calculator provides a preliminary snapshot of how affordable this mortgage option may be for your situation. Make sure to get pre-approved and budget thoroughly before committing to a home purchase. USDA financing can be an excellent choice for eligible borrowers ready to buy in rural locations across America.