If you’ve found the perfect plot of land in a rural area of Utah and are ready to build your dream home financing the construction project can be a challenge. That’s where USDA construction loans can help. These specialized home loans offered through the U.S. Department of Agriculture allow you to buy land and build a home in eligible rural locations with attractive financing options.

In this comprehensive guide, I’ll explain how USDA construction loans work in Utah, requirements to qualify, the step-by-step process, and tips for success when building with a USDA-backed loan

Overview of USDA Construction Loans in Utah

USDA offers a few different home loan programs, but the most common type used for construction is the Single Family Housing Guaranteed Loan Program. Some key facts about USDA construction loans in Utah include:

-

For rural properties – The home must be built in a USDA-designated rural area. You can check your property eligibility here.

-

Up to 100% financing – No down payment is required. Closing costs can also be financed into the loan.

-

Fixed interest rate – The interest rate is fixed for the full term, usually 30 years. Rates are very competitive.

-

No mortgage insurance – You pay an upfront guarantee fee of 1% and ongoing annual fee of 0.35% instead of mortgage insurance.

-

One-time close loan – Construction financing and permanent mortgage rolled into one loan.

-

Max loan amount – Based on your income, assets, and expenses. No set cap.

While USDA construction loans offer great perks, they do have stricter eligibility standards and a more complex process compared to conventional construction loans. Working with an experienced loan officer is key to navigating the program successfully.

Step-by-Step USDA Construction Loan Process

Building a home with a USDA-backed loan involves many steps over 6-12 months. Here is a high-level overview of the process:

-

Find land and builder – Select an eligible rural property and builder. Get pre-qualified to know your budget.

-

Submit loan application – Your lender will gather financial docs and submit your full application to USDA.

-

Design home and finalize plans – Work with builder to design home and finalize building specifications and budget.

-

Conditional commitment – USDA provides conditional approval of the loan pending appraisal.

-

Appraisal – An appraiser will evaluate the plans, land value, and issue a report.

-

Close on land – Once fully approved, close on the land purchase transaction first.

-

Begin construction – With land secured, the builder can break ground and start construction.

-

Draw loan funds – As certain stages complete, the builder will request draws from the loan to pay for materials and labor.

-

Final inspection – When home is complete, USDA will do a final inspection to ensure compliance.

-

Permanent financing – Finally, convert the construction loan into permanent financing once home is complete.

Expect this to be a lengthy process with a lot of coordination between you, lender, builder, appraiser, and USDA.

5 Tips for Success with a USDA Construction Loan

If you’re up for the challenge, building with a USDA construction loan can help you achieve your rural homeownership dreams. Follow these tips for a smooth process:

1. Find the right lender – Not all lenders offer USDA construction loans, so find one with specialized expertise to guide you. Local lenders are best.

2. Research builders thoroughly – Be very selective in choosing a qualified builder with experience building USDA homes. Get references.

3. Have home plans ready – Finalize detailed home plans and secure USDA’s Plan Approval before closing on land.

4. Budget carefully – Account for all costs in your budget, including contingency funds for changes and overruns.

5. Get everything in writing – Carefully review and understand all contracts, commitments, and agreements before signing.

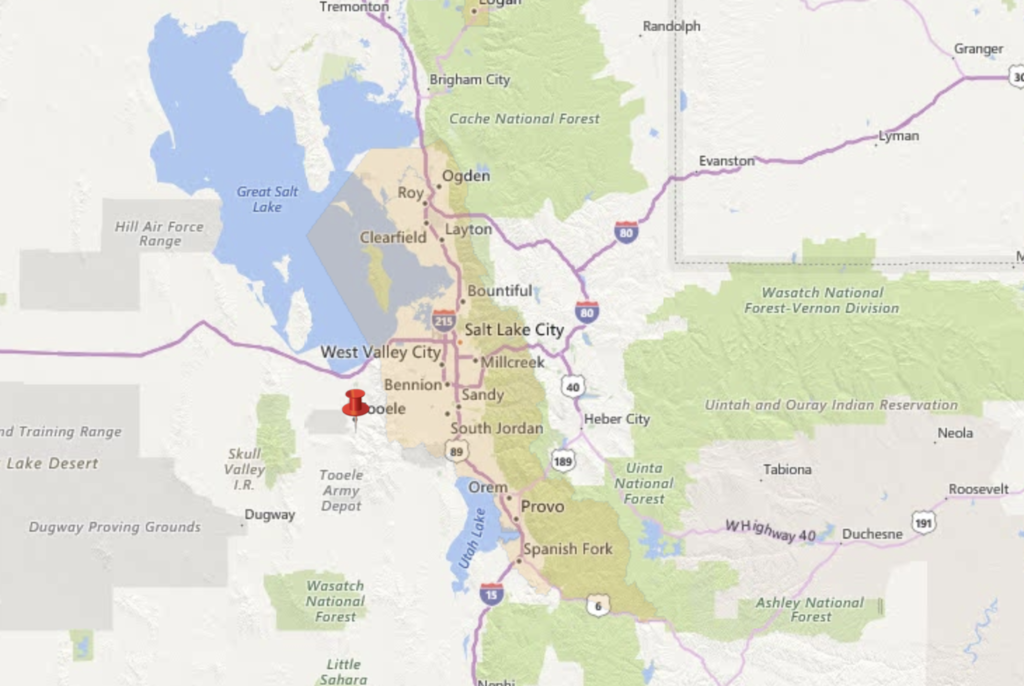

USDA Loan Property Eligibility

Finding the eligibility of a property is easy when using the official link to the USDA map. Just to give you an idea, here is how the map looks in Utah:

USDA Home Loan Limits In Utah

USDA does not have set loan limits in the same way FHA or VA loans do. The maximum loan amount is determined by the borrower’s ability to qualify when applying the income restriction, and the debt to income ratio restriction.

USDA Construction Loan Explained by a USDA underwriter

FAQ

What is the income limit for a USDA loan in Utah?

Are USDA direct loans good?

How accurate is the USDA eligibility map?