Nearly every commercial real estate transaction involves a loan, and commercial real estate mortgages can be far more complicated than their residential counterparts. In many cases, CRE mortgages offer additional options and nuances that are needed to meet the unique needs of a commercial real estate borrower.

Several of these unique options have to do with the loan’s term and amortization period. These features are often confused for each other, so it is the intent of this article to clear up the differences between a loan term vs. amortization, since they are important inputs into the loan payment calculation.

When taking out a real estate loan, two key factors determine how you pay it back – the loan term and amortization period Both affect your repayment schedule, interest costs, cash flow flexibility, and more.

Understanding the difference between a loan’s term versus its amortization allows you to optimize financing for your investment property goals.

This guide will compare term loans and amortized loans, discuss their pros and cons, provide examples, and offer tips on choosing the right loan structure.

Overview of Loan Term and Amortization

First, let’s define these two central loan concepts:

Loan Term – The loan term is the overall length of time you have to repay the loan until maturity Common real estate loan terms are 5, 10, 15, 20, and 30 years.

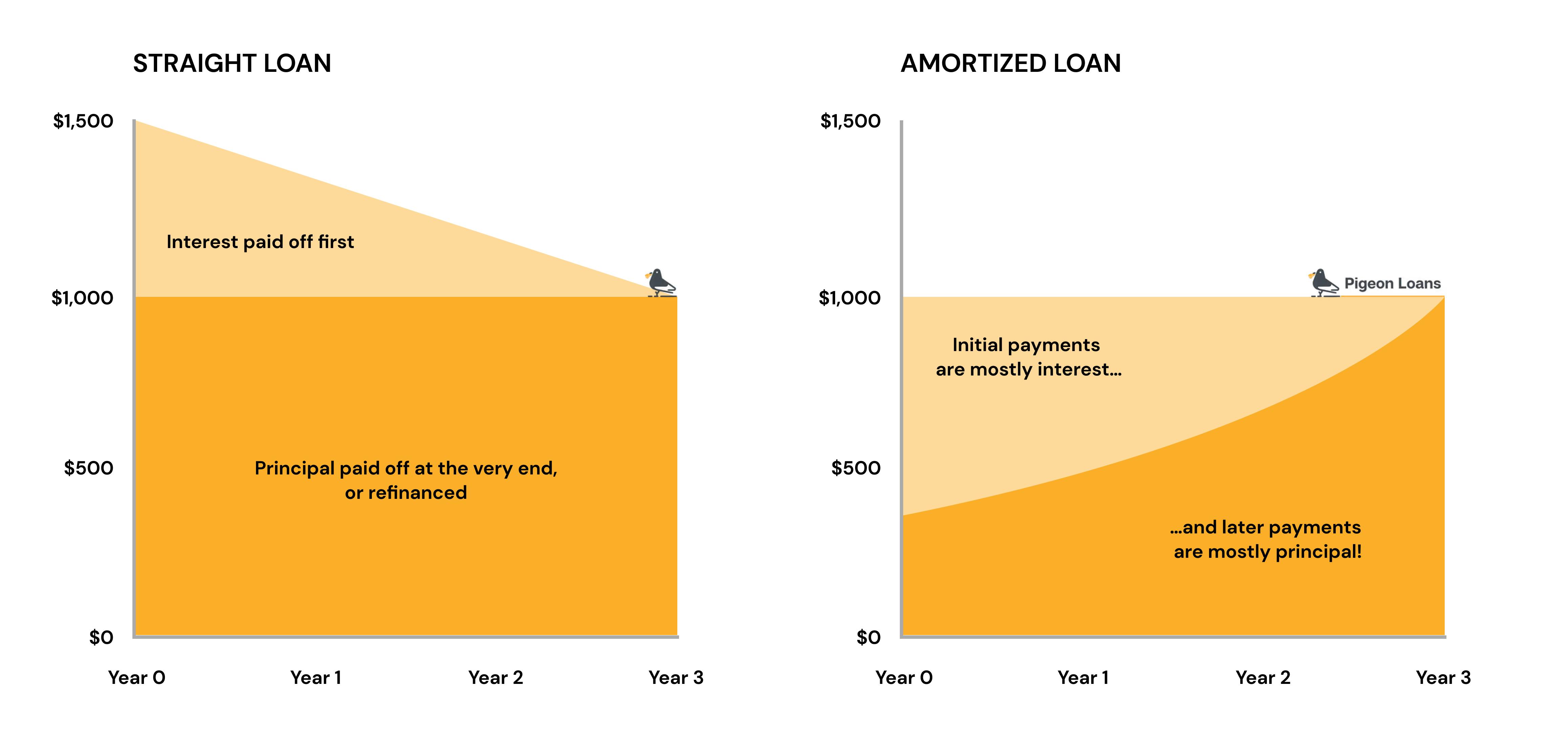

Amortization – The amortization period determines how the principal loan balance gets paid off over time. With amortized loans, your payments apply more to interest upfront and more to principal later.

For some loans the term and amortization schedule align. For others, they differ. This leads to the categorization of term loans and amortized loans.

Term Loans

A term loan has loan payments spread evenly over the term, with a large balloon payment of the remaining principal due at maturity.

Characteristics:

-

Term and amortization period are different

-

Payments based on interest-only or moderate principal

-

Large balloon payment required at the end

Pros

-

Smaller periodic payments free up cash flow

-

Interest-only options further reduce payments

-

Works well for shorter-term projects

Cons

-

Risk of needing to refinance the balloon payment

-

Potentially higher payments later if rates rise

Term loans give flexibility today through lower payments, but less predictability long-term. The risk comes due when the balloon payment is owed.

Amortized Loans

With an amortized loan, the term and amortization align so that you fully pay off the principal over the term through your regular repayments.

Characteristics:

-

Term length = amortization schedule

-

Payments blend principal and interest

-

The balance declines to zero by maturity

Pros

-

No balloon payment due at the end

-

Forced equity build-up through principal paydown

-

Lower interest costs overall

Cons

-

Higher periodic payments

-

Less flexibility if you want to exit early

Amortized loans create payment predictability and avoid a big lump sum, but reduce cash flow flexibility during the loan.

Comparing a 5-Year Term Loan vs a 5-Year Amortized Loan

Let’s look at a hypothetical example to highlight the differences:

You take out a $500,000 commercial real estate loan.

5-Year Term Loan

-

5-year term

-

30-year amortization

-

6% interest

-

Payments based on a 30-year schedule

-

$477,415 balloon payment due at the end

5-Year Amortized Loan

-

5-year term

-

5-year amortization

-

6% interest

-

Payments based on 5-year amortization

-

Loan fully paid off by maturity

The term loan has lower periodic payments but requires you refinance or pay the large balloon. The amortized loan builds equity through principal paydown but squeezes cash flow with higher periodic payments.

Which Is Better – Term or Amortized Loan?

So which loan structure wins out? The right choice depends on factors like:

Investment Strategy – Amortized loans create forced equity for buy-and-hold investors. Term loans provide flexibility for fix-and-flip investors.

Cash Flow – If you need to minimize payments, interest-only term loans help. Amortized loans drain more cash flow.

Risk Tolerance – Are you comfortable with refinancing uncertainty down the road? Or do you prefer predictability?

Asset Type – Properties with stable cash flow suit amortized loans. Riskier or transitional assets pair better with term loan flexibility.

Market Conditions – In high interest rate environments, shorter term loans minimize risk. Stable rates favor long-term amortized loans.

Exit Strategy – Will you sell soon, or hold long-term? Amortized loans build equity for selling. Term loans allow quicker exits.

Analyze these factors in your situation to decide if a term, amortized, or blended loan structure fits best.

Tips for Choosing the Right Loan Amortization and Term

When reviewing loan options, keep these tips in mind:

-

Compare scenarios of how term loans vs amortized loans affect cash flow, equity build-up, and sales proceeds

-

Crunch the numbers at different terms – how does a 10-year amortized loan compare to a 20-year?

-

Look at “partially amortized” loans blending features of term and amortized loans

-

Consider using separate construction and permanent loans with tailored terms

-

Weigh if lower payments today are worth higher costs long-term

-

Research potentialballoon loan refinancing options in case you need to go that route

-

Ensure you can cover the balloon payment through refinancing, sales proceeds, or cash reserves

Modeling different combinations gives you the flexibility to structure real estate loans optimally for your investment horizons and risk preferences.

Recap & Next Steps

Term and amortization define distinct loan payback schedules. Term loans offer predictable payments but large balloon dues. Amortized loans build equity through gradual principal reduction without any balloon.

Blending features provides further flexibility to match financing to your property goals. Look at both in isolation and together when assessing loan programs.

Now it’s time to put this knowledge into action! Reach out to lenders to start exploring loan term and amortization scenarios for your next real estate project.

The right loan configuration saves money and optimizes your equity. By proactively comparing term loan vs amortized loan options, you can make a well-informed, strategic financing decision.

Calculating a Loan’s Payment and Amortization Schedule

Loan term and amortization are two of the four inputs that are needed to calculate a loan’s payment and create an amortization schedule. The other two inputs are the loan amount and the interest rate.

To illustrate how the loan term, amortization, amount, and interest rate work together, suppose an investor is seeking a loan for $1,000,000. It has a 5 year term, an amortization period of 20 years, and an interest rate of 6%.

Rather than calculate the payment manually, these variables can be plugged into a financial calculator or spreadsheet program to calculate a payment amount of $7,164 per month. Translating this payment into an amortization schedule is a little bit more difficult.

In the first month, the interest portion of the payment is calculated by multiplying the starting loan amount of $1,000,000 by the interest rate of 6%. The result of $60,000 indicates the amount of annual interest so it must be divided by 12 to get a monthly interest payment of $5,000. This means that in the first payment, $5,000 goes towards interest and the remaining $2,164 goes towards principal. After the first payment, the remaining loan principal is $997,836. This amortizing calculation continues for the entirety of the loan term, at which point the remaining balance is due as a balloon payment. The first 5 and last 5 payments are shown in the amortization table below.

From the table it can be seen that the amount of interest paid goes down a little bit each month and the amount of principal goes up. But, at the end of the loan term, month 60, the outstanding balance of $848,996 becomes due. This is the balloon payment and highlights the risk of a loan with a split amortization (versus a fully amortized loan). There are very few borrowers with this amount of cash to pay off the loan balance in full. As such, the best option is to refinance into a new loan, but there is no guarantee that this loan request will be approved.

What is Loan Amortization?

A loan’s amortization period is the amount of time over which a loan’s payments are calculated. In a commercial real estate transaction, it is common for a loan to have a “split amortization,” meaning that the loan’s term and amortization periods are different.

For example, a loan could have a term of five years, but the payments could be based on a 25-year amortization schedule. For the borrower, this has the benefit of a lower monthly payment to minimize cash outlay, but it also means that there is a “balloon payment” at the end of the term. A balloon payment is one that is much larger than the standard monthly payment and it typically consists of the remaining loan balance at the end of the loan term.

A loan’s amortization period can also vary from one transaction to the next, and it is chosen to accommodate the specific needs of the transaction. However, commercial real estate loan amortization periods typically fall within the range of 20-30 years. Once it is determined, an “amortization schedule” can be created that details exactly how much of each loan payment goes towards retiring the loan’s principal balance versus how much goes towards interest.

Term vs Amortization

What is the difference between amortization period vs loan term?

The amortization period vs loan term is both terms that relate to the total length of a loan. However, they are not the same thing. Understanding the difference between the two can help you keep your mortgage payments under control and ensure you repay your loan on time. Find out about Loan Term vs Amortization Period.

What is an amortized mortgage?

An amortized mortgage is a type of loan where your mortgage is guaranteed to be paid off by the end of the term as long as you make all your payments over the life of the loan. Here’s how an amortization schedule would look for such a loan: Each payment is the same total amount of $1,123.

How is a loan amortized?

A loan is amortized by determining the monthly payment due over the term of the loan and then preparing an amortization schedule that clearly identifies what portion of each month’s payment is attributable towards interest and what portion towards principal.

What is the difference between an amortized and unamortized loan?

This means that each monthly payment the borrower makes is split between interest and the loan principal. Because the borrower is paying interest and principal during the loan term, monthly payments on an amortized loan are higher than for an unamortized loan of the same amount and interest rate.