If you are an active duty servicemember looking to buy a home using a VA loan, one of the key documents you’ll need is a statement of service. This detailed letter provides crucial information that proves your military employment history and eligibility for VA home financing

I know firsthand how confusing VA loans can be, especially gathering all the right documentation In this article, I’ll walk you through what a statement of service is, why you need it, what should be included, and how to request it from your commanding officer My goal is to provide a thorough, easy-to-understand guide so you can check this requirement off your list and move forward with confidence in the homebuying process.

What is a VA Loan Statement of Service?

A statement of service is an official letter from your commanding officer verifying details of your military service record. It acts as concrete proof of your employment and income history in the armed forces.

VA lenders require this documentation because it provides key details they need to evaluate your eligibility for a VA-backed loan.

While the exact format may vary, a statement of service typically includes:

- Full legal name and Social Security number

- Date of birth

- Branch of service

- Rank and date entered active duty

- Current pay grade and monthly income

- Unit assigned to and duty station

- Duration of any time lost

- Discharge history

- Eligibility for reenlistment

- And more

This comprehensive overview from your commanding officer gives VA lenders critical insight into your military status and career progression.

Key Differences from a Leave and Earnings Statement

It’s important not to confuse your statement of service with a Leave and Earnings Statement (LES). While both are required for VA loans, they serve different purposes:

- Statement of Service – Provides overall military employment details to establish your eligibility and history.

- LES – Focuses specifically on income and finances to confirm your ability to repay the loan.

So in short, the statement of service looks at your broader military profile, while the LES zooms in on your current earnings and deductions. Together, they give lenders a full picture of your service record and finances.

Why You Need a Statement of Service for a VA Home Loan

Providing a statement of service is mandatory when applying for a VA mortgage as an active duty servicemember. But why is this document so crucial?

There are a few key reasons lenders require a statement of service:

-

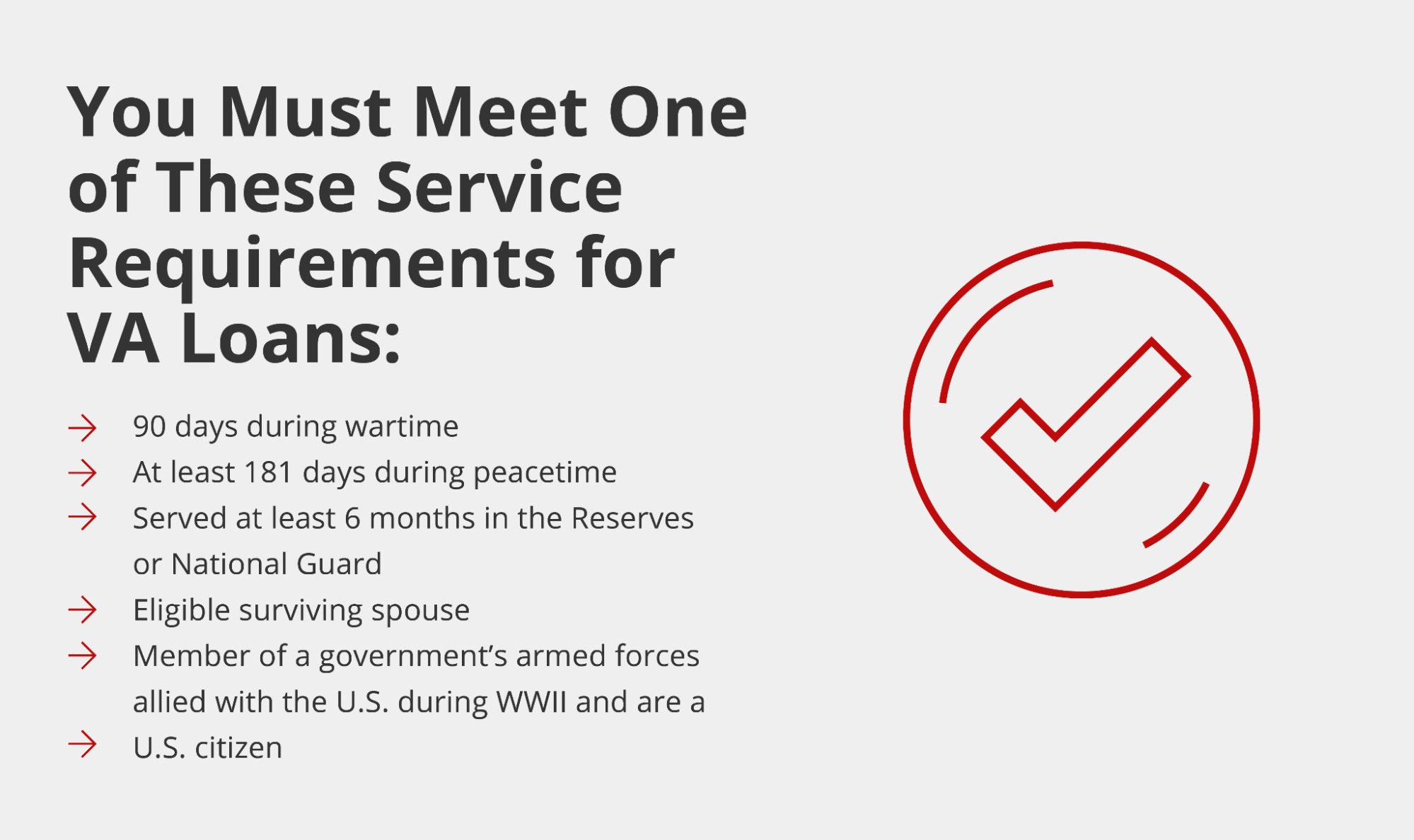

Verifies your military status – It proves you have qualifying active or reserve service to meet basic VA loan requirements.

-

Confirms income – Your statement of service helps lenders determine your long-term income stability from military pay. This ensures you have the financial means to repay the mortgage.

-

Checks service history – Lenders analyze your career progression, promotions, and time lost to evaluate your reliability.

-

Proves employment – For active duty members, it shows continuous employment. This helps satisfy underwriting requirements for income documentation.

Bottom line, the statement of service checks all the boxes related to your military profile. It gives lenders confidence in your eligibility, income, employment, and service history when underwriting your VA loan.

What Should be Included in a VA Statement of Service

While formats can vary, most statements of service include the following details:

Header

- Date issued

- Military branch letterhead

Personal Information

- Full name and SSN

- Date and place of birth

Military Profile

- Branch of service

- Date entered active duty

- Periods of prior service (if any)

- Current pay grade and date of rank

- Monthly income from military pay

- Unit assigned to and current duty station

- Projected separation or retirement date

- Amount of time lost during service (if applicable)

Service History

- Previous discharges or separations

- Type of discharge for previous service (honorable, general, etc.)

- Eligibility for reenlistment

- Veteran status for prior service

- Flagged or barred from reenlistment

Certification

- Statement verifying that information is current

- Name, title, signature, and contact of commanding officer

Ensuring all these details are included will avoid delays in getting approved for your VA loan.

How to Get a Statement of Service from Your Commanding Officer

Give yourself plenty of time! Getting your statement of service can take weeks or sometimes over a month. Since it comes directly from your commanding officer, the process is outside your control.

To start, notify your C.O. that you need a statement of service letter for a VA mortgage application. Provide them with key personal details to include. Request the letter at least 6-8 weeks in advance before you need to submit loan documentation.

If possible, follow up periodically on the status. Military leaders often have a heavy workload, so a friendly nudge may be needed to get it completed on time. Don’t wait until the last minute!

What if You’re Not Eligible for a VA Loan? Alternative Options

Unfortunately, some servicemembers find out they don’t qualify for a VA loan after requesting their statement of service. If you end up in this situation, don’t panic! You still have options:

-

Conventional mortgages – These standard home loans don’t require military service. If you have good credit and income, this route may work.

-

FHA loans – Government-backed mortgages insured by the FHA are an accessible option for most borrowers.

-

USDA loans – For properties in rural/suburban areas, USDA loans offer affordable financing.

-

Down payment assistance programs – State and local groups provide grants for down payments if you struggle to save.

As you can see, just because a VA loan falls through doesn’t mean homeownership is out of reach. There are many alternatives if you’re determined and patient. With persistence, you can still make owning a home a reality!

Let’s Recap – Statement of Service Key Takeaways

If you’re an active duty servicemember applying for a VA mortgage, here are the main things to remember about obtaining your statement of service:

-

It’s an official letter from your C.O. verifying your military record.

-

VA lenders require it to confirm your eligibility, income, employment, and service history.

-

Provide your C.O. with all details to include – name, income, rank, duty station, etc.

-

Request the letter from your commanding officer with plenty of lead time (6-8 weeks minimum).

-

Be persistent following up if you don’t receive it when expected.

-

If you end up not qualifying for a VA loan, don’t panic! Conventional, FHA, or USDA loans are options.

Why Applicants Need A VA Statement Of Service

Rocket Mortgage® uses information about your income, assets and credit to show you which mortgage options make sense for you.

What Is A Statement Of Service For VA Loans?

Your Credit Profile Excellent 720+ Good 660-719 Avg. 620-659 Below Avg. 580-619 Poor ≤ 579

When do you plan to purchase your home? Signed a Purchase Agreement Offer Pending / Found a House Buying in 30 Days Buying in 2 to 3 Months Buying in 4 to 5 Months Buying in 6+ Months Researching Options

Do you have a second mortgage?

Are you a first time homebuyer?

Consent:

By submitting your contact information you agree to our Terms of Use and our Privacy Policy, which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! NMLS #3030

Congratulations! Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage.

If a sign-in page does not automatically pop up in a new tab, click here

The Statement Of Service & Why You MIGHT Need One If You’re Trying To Use The VA Mortgage

FAQ

How do I get a statement of service from the VA?

Is a statement of service required on a VA loan?

How do I obtain a statement of service?

Is a statement of service the same as a DD214?