The Home Loan Guarantee for Rural Kansas (HLG) helps financial institutions guarantee the gap under a loan used for land and building purchases, renovation, and new construction costs that may be capitalized or financed within rural Kansas counties. HLG will guarantee the amount of the loan that exceeds 80% of the appraised value of the home, up to 125% of the appraised value of the home subject to the loan. Each amount of guarantee shall not exceed $100,000.

The Home Loan Guarantee for Rural Kansas serves financial institutions that serve existing and prospective homeowners in rural Kansas counties. Eligible financial institutions include banks, trust companies, savings banks, credit unions, savings and loan associations, or any other lending institution.

$2 Million in Non-Recourse Guaranty through the Kansas Rural Home Loan Guarantee Act. The amount of each guarantee shall not exceed $100,000.

Buying your first home can be an exciting yet daunting experience Determining what loan is best for you in terms of interest rates, repayment terms, and eligibility can feel overwhelming, especially when you don’t know where to start. That’s why Rural Development loans administered by the USDA are an excellent option for first-time homebuyers in Kansas looking for an affordable path to homeownership

What is Rural Development?

Rural Development is an agency within the United States Department of Agriculture (USDA) that provides loans, grants and loan guarantees to support essential services for rural communities This includes housing, economic development, health care, first responder services and equipment, and water, electric and communications infrastructure

The Rural Development mission area has a $220+ billion portfolio of loans and will administer $30 billion in loans, loan guarantees and grants through its programs in the current fiscal year alone. Their programs operate in every state and territory, including tribal lands and colonias.

Rural Development Single Family Housing Direct Loan Program

One of Rural Development’s most popular offerings is the Section 502 Direct Home Loan program, also known as the Single Family Housing Direct loan program This program assists low- and very low-income applicants obtain safe and decent housing in eligible rural areas by providing subsidized repayment terms to increase an applicant’s repayment ability

According to the Rural Development Kansas website, here are some key details on eligibility and use of funds for the Single Family Housing Direct loan program:

Eligibility

To qualify for a direct loan, applicants must:

- Have an income below the applicable low-income limit set for their area

- Lack decent, safe, and sanitary housing

- Be unable to obtain a traditional loan

- Agree to personally occupy the home as their primary residence

- Have the legal capacity to take on a loan obligation

- Meet citizenship and eligible noncitizen requirements

- Not be suspended or debarred from federal program participation

In addition to applicant eligibility, the home itself must:

- Be located in an eligible rural area

- Not have a market value higher than the area loan limit

- Not be designed for any income-producing activities

Use of Funds

Direct loan funds can be used to:

- Purchase homes

- Build, repair, renovate, or relocate homes

- Purchase and prepare home sites, including providing or improving water and sewage facilities

Loan Terms

- Up to 100% financing, no down payment required in most cases

- Current interest rate of 4.75% for low-income applicants

- 1% interest rate possible when subsidized via payment assistance

- 33 year repayment term, up to 38 years for very low-income applicants

- Fixed interest rate based on market rates at time of approval or closing

What Qualifies as a Rural Area in Kansas?

To qualify for Rural Development loans in Kansas, the home you purchase must be located in an eligible rural area. But what exactly constitutes a rural area?

According to the Rural Development eligibility site, rural areas are open country and towns with population sizes less than 35,000 that are not part of an urban area.

More specifically, here are the criteria used to determine if a location is considered rural per Rural Development guidelines:

- Population under 20,000 if located outside an urbanized area

- Population between 20,000 and 35,000 if not located within an urbanized area that serves as a suburb or bedroom community to a larger populated area

- Not within a Metropolitan Statistical Area (MSA) as defined by the Office of Management and Budget

- Has a serious lack of mortgage credit available for low- and moderate-income borrowers

You can easily verify if a specific address is in an eligible rural area using the Rural Development eligibility site. This will ensure any home you’re interested in will qualify for Rural Development loans prior to applying.

Benefits of Rural Development Loans in Kansas

Rural Development loans offer homebuyers in Kansas several advantages compared to traditional mortgage loans, especially when it comes to affordability.

Low Interest Rates

As mentioned above, current interest rates for Rural Development direct loans is 4.75%. With subsidized payment assistance, rates can be as low as just 1% – considerably lower than current market rates. This makes monthly payments more affordable.

No Down Payment Required

Most Rural Development loans do not require any down payment. This removes the largest obstacle many first-time buyers face in saving up enough cash to qualify for a mortgage. Applicants with assets above eligibility limits may be required to use a portion of those assets as a down payment.

Longer Repayment Terms

First-time buyers often benefit from longer repayment terms that keep monthly payments lower. Rural Development loans allow up to 38 years for very low-income borrowers – 5 years longer than most conventional mortgages.

Easier Credit Requirements

Rural Development direct loans are available to applicants with limited or poor credit history that may not qualify for traditional loans. Having less stringent credit standards helps more Kansans become homeowners.

Lower Income Limit Requirements

Since Rural Development loans are intended to assist low-income rural residents, income thresholds are lower compared to conventional mortgages. Household income can be up to 30% below an area’s median income.

No Private Mortgage Insurance (PMI) Required

Private mortgage insurance is usually required on conventional loans when a down payment of less than 20% is made. Because Rural Development loans do not have a down payment requirement, PMI is not needed. This saves borrowers substantial amounts over the life of the loan.

How to Apply for a Rural Development Loan in Kansas

If a Rural Development direct home loan sounds right for you, follow these steps to submit an application:

1. Check income limit eligibility

Use the Income and Property Eligibility site to see if your income falls below the threshold for your county’s median household income.

2. Verify property eligibility

Ensure the property you want to buy is in an eligible rural area as defined above using the eligibility tool.

3. Find your local office

Applications are accepted through your local Rural Development office. Locate your local office to submit your application or ask any questions.

4. Gather required documentation

You will need to submit various financial documents like pay stubs, bank statements, tax returns, and a copy of your credit report. Having these ready will make the application process faster.

5. Complete and submit application

The Rural Development direct loan application includes sections for household, income, military service, assets, property, and signatures. Work with your local office to complete.

Getting Started on the Path to Homeownership

Buying a home doesn’t have to be an impossible dream. Rural Development loans help eligible Kansans in rural communities realize the dream of homeownership. With low interest rates, no down payment requirement, and expanded eligibility, Rural Development loans increase access for those who may not qualify through traditional lenders.

If you feel overwhelmed by the mortgage process, don’t go it alone. Reach out to the knowledgeable staff at your local Rural Development office for guidance. Their job is to help customers like you navigate the loan application and make achieving the goal of homeownership a reality.

Yes! You can own a home!

The Home Loan Guarantee for Rural Kansas (HLG) helps financial institutions guarantee the gap under a loan used for land and building purchases, renovation, and new construction costs that may be capitalized or financed within rural Kansas counties. HLG will guarantee the amount of the loan that exceeds 80% of the appraised value of the home, up to 125% of the appraised value of the home subject to the loan. Each amount of guarantee shall not exceed $100,000.

The Home Loan Guarantee for Rural Kansas serves financial institutions that serve existing and prospective homeowners in rural Kansas counties. Eligible financial institutions include banks, trust companies, savings banks, credit unions, savings and loan associations, or any other lending institution.

$2 Million in Non-Recourse Guaranty through the Kansas Rural Home Loan Guarantee Act. The amount of each guarantee shall not exceed $100,000.

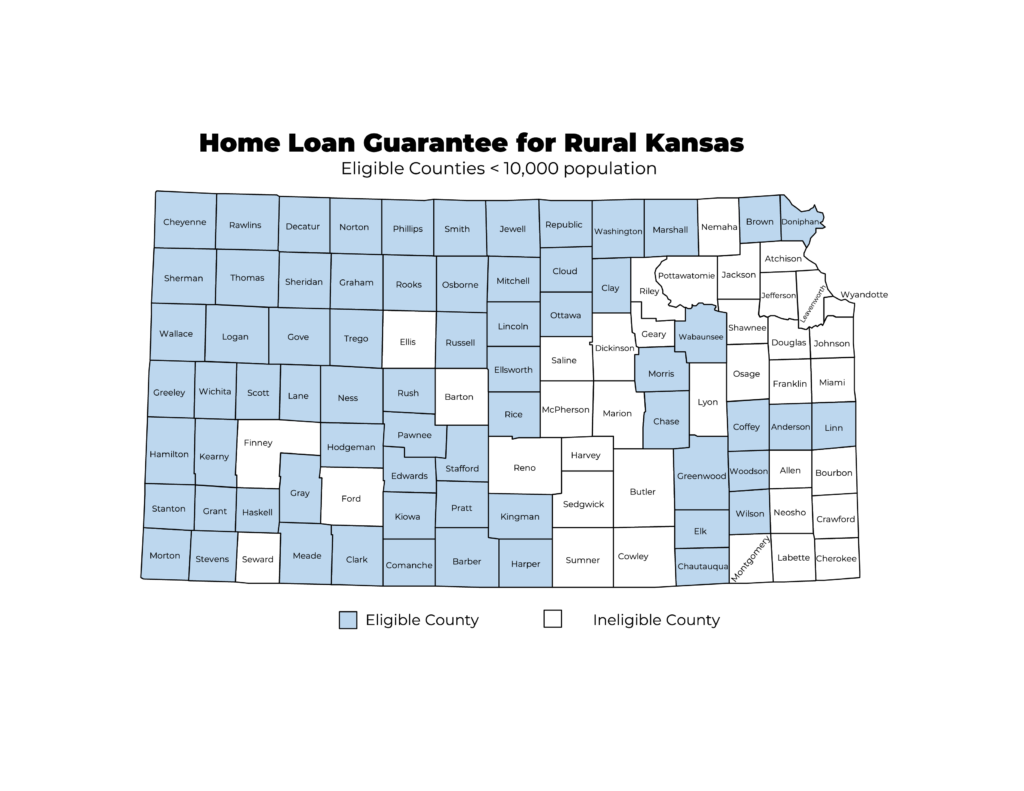

Rural counties are defined as those with populations under 10,000, as certified by the Secretary of State on July 1 of the preceding year.

HLG provides from 80% of the appraised value up to the loan amount or 125% of the appraised value, whichever is less, subject to an overall limit of $100,000.

- If the loan amount is $225,000, the guaranty is $65,000 (80% of the appraisal up to the loan amount because the loan amount is less than 125% of the appraisal)

- If the loan amount is $250,000, the guaranty is $90,000 (80% of the appraised value up to the loan amount because the loan amount is equal to 125% of the appraisal)

Seeking assistance covering your home’s appraisal gap? Find a lender serving your area here.

Want to partner with us as a participating lender?

Prospective lenders must first complete the lender enrollment form. Once approved, KHRC and the lender will jointly complete an MOU. The lender may then submit each new loan to KHRC along with a completed loan enrollment application.

The following entities are eligible to participate as lenders: banks, trust companies, savings banks, credit unions, savings and loan associations, or any other lending institution located in Kansas. All must have an active NMLS and provide mortgage loans.

The HLG program opened January 3, 2023. View the HLG Fact Sheet here.

Questions? Email our Home Loan Guarantee team at [email protected]

Buying a House Using USDA Rural Development Loan ($1,000 DOWN)

FAQ

What is the income limit for a USDA loan in Kansas?

Is a rural development loan the same as a FHA loan?

Is a USDA loan the same as rural development?

Are hud and USDA the same thing?