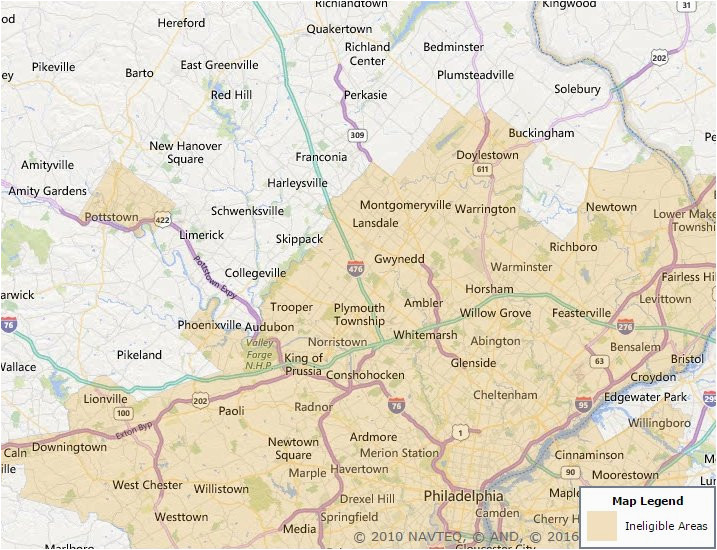

You can use this USDA eligibility map to find USDA-eligible homes in your area. Look up the address you’re interested in purchasing to verify it falls within a rural area, as determined by the U.S. Department of Agriculture.

The USDA Rural Development department offers several home loan programs to help low-to-moderate income borrowers in rural areas achieve homeownership. These loans offer benefits like low interest rates and even 100% financing However, you must meet location eligibility requirements based on where the home is situated. Certain regions of Michigan fall outside eligible rural boundaries set by the USDA Understanding which areas qualify is key to utilizing Rural Development loans.

This guide examines USDA rural housing loan eligibility in Michigan including

- Overview of key Rural Development loan options

- Eligible regions and location requirements

- Ineligible areas and boundaries in Michigan

- Steps to check a home’s eligibility status

- Alternative options if your desired property falls outside eligible zones

Armed with this knowledge, you can determine if a USDA loan is feasible for your home search area or explore other financing routes if needed

Rural Development Loan Programs in Michigan

The USDA Rural Development office in Michigan oversees several home loan programs targeted for rural residents. These loans help eligible borrowers purchase, build, repair, renovate or relocate homes in qualified rural locations.

Key loan programs available in Michigan include:

USDA Rural Housing Direct Loan

- Offered directly through USDA

- 100% financing available (no down payment required)

- Fixed interest rate below market averages

- 33 year loan term

USDA Rural Housing Guaranteed Loan

- Offered through approved lenders

- USDA guarantees the loan

- Low down payment options

- May have lower credit score requirements

Both loan types require borrowers to meet income eligibility standards and home location requirements. Income limits vary by county and household size. The property must be located in a USDA-designated rural zone.

Regions of Michigan Eligible for USDA Rural Housing Loans

USDA rural housing loans have location eligibility requirements based on population thresholds, housing density, and distance from urban areas. Regions must meet “rural” criteria.

In Michigan, eligible rural areas generally include:

- Small towns/communities with populations under 10,000

- Outlying unincorporated regions of larger towns

- Properties outside city limits situated in less densely populated locations

Some key eligible regions include:

- Upper Peninsula excluding Marquette area

- Northern Lower Peninsula such as Antrim, Otsego, and Alpena counties

- Thumb region including Huron, Sanilac, and Tuscola counties

- Southwest including Van Buren, Cass, and Berrien counties

However, not all of Michigan meets rural eligibility guidelines. Several pockets are ineligible based on proximity to urban zones.

Ineligible Regions and Boundaries in Michigan

While expansive portions of Michigan meet rural criteria, some areas are considered too urban or populated to qualify for USDA home loans.

These ineligible regions include:

- Metro Detroit area and surrounding suburbs

- Lansing, East Lansing, and nearby towns

- Ann Arbor and Ypsilanti

- Portions of Grand Rapids metro area

- Kalamazoo/Battle Creek vicinity

- Saginaw, Bay City, and Midland areas

- Flint/Burton/Davison region

- Marquette area

The USDA designates precise eligibility boundaries surrounding ineligible urban centers. Homes outside the boundaries may qualify even if near a city.

Only about 3% of Michigan falls into ineligible areas, leaving most of the state eligible. But it’s crucial to carefully check a specific property’s location.

Steps to Check a Home’s USDA Rural Loan Eligibility

With defined eligible and ineligible regions, how can you check if a home fits location requirements?

The USDA provides an online map-based tool to enter any address and instantly see if it falls within an eligible rural zone for their home loan programs.

To check eligibility:

-

Go to https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do

-

Enter the home’s full street address, city, state, and zip code

-

Click “Find Property”

-

View the results – it will specify if USDA home loans are available for that location

You can also work with USDA-approved lenders who can guide you and determine eligibility as you search.

Alternatives if Your Michigan Home is Ineligible

If your ideal home falls into an ineligible area, don’t lose hope! You still have options:

-

Check boundaries carefully – Even if near a city, locations just outside the USDA-defined boundaries may still qualify. Carefully review the eligibility maps.

-

Consider adjacent towns/counties – Expand your search radius to adjacent rural towns or counties that are eligible. You may find the perfect home a short drive away.

-

Pursue alternative financing – Conventional mortgages, FHA loans, VA loans, and more are still feasible. Shop multiple lenders to find the best rate/terms.

-

Investigate state/local programs – Michigan offers down payment assistance and homebuyer programs that may aid you even if USDA loans aren’t an option.

With proper research into eligible areas and smart financing alternatives, you can make your Michigan homeownership dreams happen even if USDA loans aren’t viable. The ideal home may be within closer reach than you think!

Key Takeaways on USDA Rural Housing Loan Eligibility in Michigan

-

USDA home loans offer benefits like low rates/fees and 100% financing but have location eligibility requirements.

-

Around 97% of Michigan meets rural eligibility criteria. Ineligible areas include metro Detroit, Lansing, Grand Rapids, Ann Arbor, and Marquette.

-

Precisely check a property’s eligibility using the USDA’s online map tool before applying.

-

Consider adjacent eligible towns or alternative financing if your preferred home is ineligible. With flexibility, you can find a path to purchase.

While buying a home is complicated, understanding where USDA rural loans apply in Michigan simplifies one piece of the puzzle. Empower yourself with information to navigate the mortgage process. There are many options to finance a home even if USDA loans don’t fit your situation. Stay persistent to achieve your dreams in the right place for you and your family.

USDA Loan Property Eligibility Requirements

Though USDA loans are often referred to as rural housing loans, you don’t have to live in the country or purchase farmland to use them. In fact, you might be surprised at just how much of the country is actually eligible for these loans.

According to the Housing Assistance Council, a whopping 97% of U.S. land is located within USDA-eligible boundaries. Those areas claim about 109 million Americans — or around a third of the country’s entire population.*

Buyers in large cities and more densely populated suburbs aren’t eligible for these loans, but many living in surrounding towns and cities may be. An area with a population of 35,000 or less can be considered “rural” in the USDA’s eyes.

The easiest way to determine USDA property eligibility is to look up the address in the map above. Simply type the property address into the tool, press enter, and you’ll see if the home is eligible for USDA financing. If the property shows up in a shaded area of the USDA eligibility map, it is not currently eligible.

USDA Eligibility Map: Verify an Address

Areas in red are not currently eligible for a USDA-backed loan.

Buying a House Using USDA Rural Development Loan ($1,000 DOWN)

FAQ

How do you qualify for a rural development loan in Michigan?

What is the MI coverage requirement for a USDA rural development loan?

What does USDA consider a rural area?

How accurate is the USDA eligibility map?

What is a USDA Rural Development Loan?

The USDA loan program is also known as the USDA Rural Development Guaranteed Housing Loan Program by the United States Department of Agriculture. The USDA helps over 100,000 people a year buy homes using their cost-effective program. It’s important to know when asking what is a USDA Rural Development Loan, to understand how they work.

Who is eligible for a rural development loan?

They are for homebuyers who don’t mind living in suburban or rural areas. Over 97% of the United States is eligible for a Rural Development Loan. Any place with a population of 35,000 or less can qualify for a USDA Loan. If you are ok with purchasing a home outside of the city limits, the Rural Development Loan is a great program.

Where can I get a home loan with rural development?

The CSC services mortgage loans and grants to individuals in rural areas throughout the United States, Puerto Rico, American Samoa, Virgin Islands and the Pacific Trust Territories. If you would like information about obtaining a home loan with Rural Development, contact your local service center.

Does rural development provide accurate information regarding eligible and ineligible areas?

Every effort is made to provide accurate and complete information regarding eligible and ineligible areas on this website, based on Rural Development rural area requirements. Rural Development, however, does not guarantee the accuracy, or completeness of any information, product, process, or determination provided by this system.