A home equity loan allows you to borrow money against the value built up in your home. While most people seek out these loans using their primary residence, it is possible to get a home equity loan on a rental property – it just tends to be harder and more expensive.

In this article, we’ll go through the information you need to make an informed decision before taking out a home equity loan on a rental property. We’ll cover the potential benefits, risks and long-term implications of such a financial move, and common questions you may have.

Owning rental property can be an excellent way to generate passive income and build long-term wealth through real estate. As you make mortgage payments and your property appreciates in value you build equity in the property – which represents potential funds you can access. One way to leverage your accumulated equity is through a rental property equity loan.

In this comprehensive guide, we’ll explore how rental property equity loans work, their benefits and drawbacks, eligibility requirements, and tips for getting the best loan terms. Whether you’re looking to finance property improvements or access cash for other investments, understanding equity loans can help you make smart financing decisions for your rental property goals.

What is a Rental Property Equity Loan?

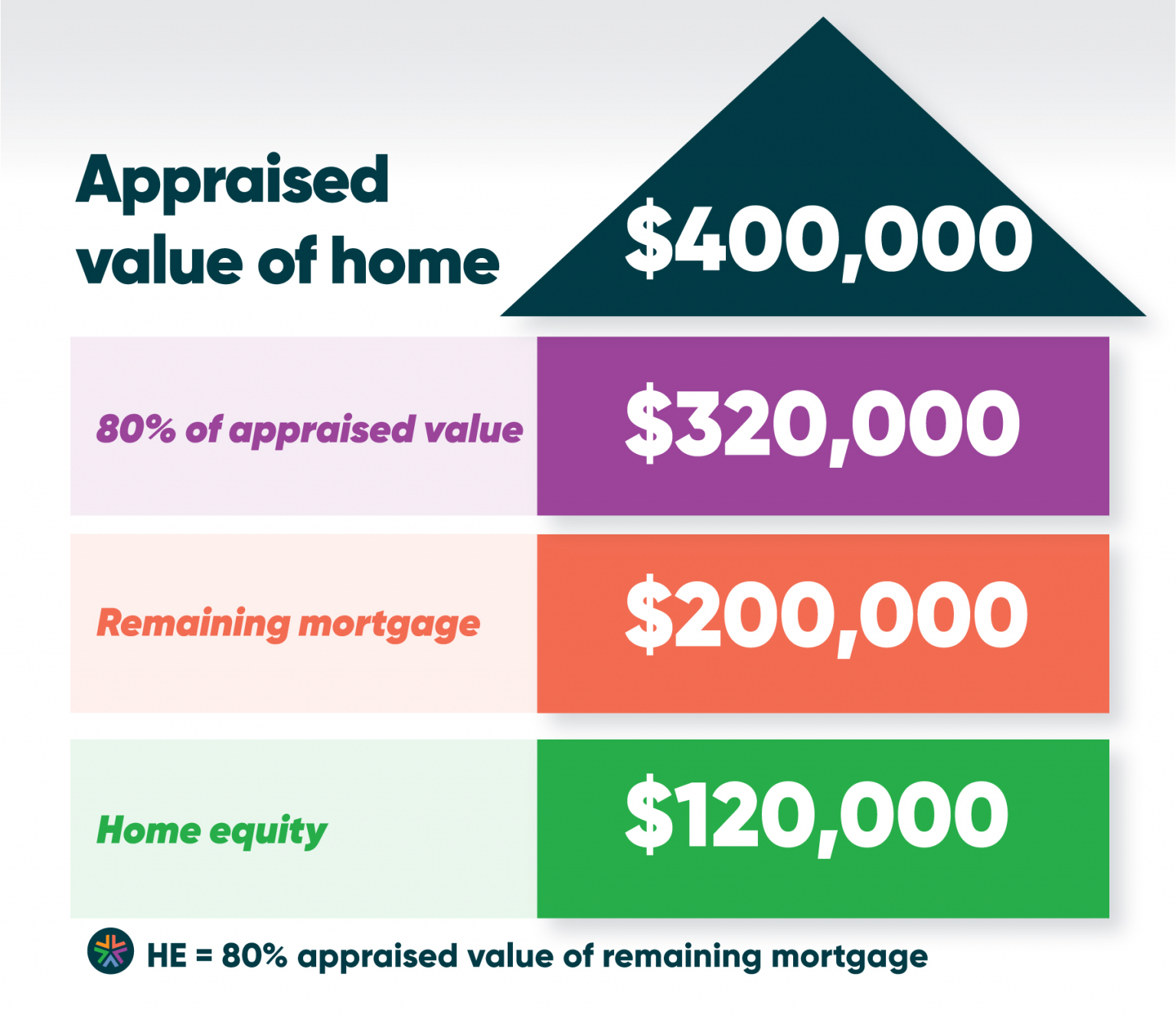

A rental property equity loan is a type of loan that allows you to borrow against the equity you have built up in your investment property. Equity represents the current market value of the rental property minus any debts like mortgages.

For example, if your rental property is worth $400,000 on the market and you owe $200,000 on your mortgage, you have $200,000 in equity. With a rental property equity loan, you can leverage this equity to receive a lump sum of cash. The loan amount is based on a percentage of your available equity, and your rental property serves as collateral for the loan.

Equity loans tend to have fixed interest rates and set repayment terms over a specific time period. You must make regular payments on the equity loan each month. Failing to repay the loan may result in the lender seizing your rental property.

How Do Rental Property Equity Loans Work?

Here’s an overview of how equity loans work for funding rental property investments

-

You apply for a loan from a lender like a bank or credit union. The lender will review factors like your credit score, debt-to-income ratio, and rental income to determine your eligibility.

-

The lender will assess the current market value of your rental property and calculate the amount of equity you have available. This equity amount represents the maximum loan amount you can qualify for.

-

You receive a lump sum of cash from the lender in exchange for putting up your equity as collateral. This money can be used for any purpose – investing in renovations, funding a down payment on another property, paying off high-interest debt, etc.

-

You pay back the loan principal plus interest in set monthly payments over a defined repayment term, usually 5-30 years. The loan has a fixed interest rate and acts as a second mortgage on the property.

-

If you default on the loan, the lender can foreclose on the property to recoup the unpaid loan balance. So it’s crucial to make on-time payments.

Benefits of a Rental Property Equity Loan

Leveraging your equity with a loan can provide useful benefits for your rental property investment strategy:

-

Access cash for renovations – Make upgrades to increase rental income and property value. New roofs, updated kitchens and bathrooms, finished basements, etc. can boost rent prices.

-

Finance another property – Use the loan as a down payment on another rental property to expand your real estate portfolio.

-

Pay off high-interest debt – Consolidate credit card balances or personal loans into the equity loan at a lower interest rate to improve cash flow.

-

Handle emergency expenses – Tap equity to cover emergency maintenance issues like roof repairs without disturbing your cash reserves.

-

Potentially tax deductible interest – You may be able to deduct interest costs on the loan as a business expense to reduce taxable rental income.

-

Build credit – Making on-time payments can help improve your credit score over time.

Risks and Drawbacks of Equity Loans

While equity loans offer useful benefits, they also carry potential downsides to consider:

-

You put your property at risk if you default on the loan and are unable to make payments. The lender can foreclose on the home.

-

Monthly payments add to your expenses, which could impact your rental cash flow if rents don’t also increase.

-

If your property declines in value, your equity can decrease – meaning you owe more than the property is worth.

-

Deducting interest costs only helps if your rental property is producing taxable net income. For tax loss properties, the deduction has no benefit currently.

-

Taking on additional debt reduces your ability to borrow more money in the future. Too much leverage increases your risk.

-

Equity loan rates may be higher than rates for primary home loans. Expect to pay a premium as an investment property owner.

What are the Eligibility Requirements?

Qualifying criteria for equity loans on rental properties are generally stricter than primary residence loans. Here are typical requirements:

-

Credit score – Most lenders require a minimum score around 660-720. The higher your credit score, the better rate you can receive.

-

Debt-to-income (DTI) ratio – Your total monthly debt payments divided by gross monthly income. Many lenders cap this at around 40-50% for rental property loans.

-

Loan-to-value (LTV) ratio – The loan amount divided by the property’s value. Lenders often limit LTVs to 70-80% for investment properties to reduce risk.

-

Down payment – Typically at least 15-25% down is expected to prove you have “skin in the game”.

-

Property type – Single family homes, condos, townhouses may be acceptable. Non-traditional properties can be challenging.

-

Property condition – The home should be well-maintained and without major defects that limit marketability.

How Much Can You Borrow? What are the Loan Amount Limits?

The amount you can borrow with a rental property equity loan depends on factors like:

- How much equity you currently have available

- The lender’s minimum requirements for down payment and LTV ratios

- The value of the property according to a formal appraisal

- Your income, credit score, debt levels, and other eligibility criteria

Many lenders cap equity loans at 70-80% LTV for investment properties. So if you have $100,000 in equity, the lender may limit your loan amount to $70,000 – $80,000. They want to ensure adequate equity remains to secure the debt in case of foreclosure.

You may also face limits on the total dollar amount you can borrow – often $200,000, $500,000, or $1 million. Check with individual lenders to see their specific policies. Bringing a large down payment or using a lower LTV can help maximize your potential loan amount.

What Interest Rates and Fees Apply?

Equity loan rates on rental properties tend to be 0.5 – 1% or more higher than primary residence loans. This premium compensates the lender for the increased risk of lending against an income-producing property.

Here are some factors that influence your interest rate:

- Your credit score and history – the higher your score, the better rate you can get

- The loan-to-value (LTV) ratio – lower LTVs get better rates

- Your debt-to-income ratio – the lower the better

- Loan term – shorter terms often have lower rates

- Property type – single family homes are preferable to unconventional properties

- Market conditions – rates tend to rise in high inflation environments

In addition to interest, you’ll also owe origination fees typically ranging from 1-3% of the loan amount. Application and appraisal fees apply as well. Factor these costs in when evaluating equity loan affordability.

What Loan Terms are Available?

Equity loans feature structured repayment terms, usually lasting 10-30 years like a typical mortgage. Many lenders offer terms like:

- 10 year equity loans

- 15 year equity loans

- 20 year equity loans

- 30 year equity loans

Aim for the shortest term you can afford to pay off the debt faster and save on interest. Make extra principal payments if possible. Avoid interest-only loans that lack principal reduction.

You’ll also want to check if there are any prepayment penalties for paying off the loan early. Most lenders allow payoff without penalty but some may charge extra fees. Read the fine print.

Tips for Getting the Best Rates and Terms

Follow these tips to help secure the most favorable interest rates and loan terms when seeking a rental property equity loan:

-

Shop multiple lenders – Compare quotes from banks, credit unions, online lenders, etc. Competition can get you better offers.

-

Optimize your credit – Clean up any credit report issues and pay down balances to boost your score before applying.

-

Increase your down payment – Bringing more equity to the table results in better rates and more financing options.

-

Lower your DTI – Reduce other monthly debts as much as possible so more of your income is available to cover the new loan payment.

-

Consider shorter loan terms – Ten or fifteen year loans often have lower rates while building equity faster.

-

Improve property condition – Make any needed repairs to maximize the appraised value. Curb appeal matters

How To Get a Home Equity Loan on a Rental Property

Obtaining a home equity loan on a rental property can be a strategic financial move for investors looking to leverage their real estate assets. This section will outline the steps and considerations in securing a home equity loan on a rental property and help you navigate the process effectively.

Not all lenders offer home equity loans on rental properties, and those who do may have stricter requirements compared to loans on primary residences. Home equity loans on rental properties also often have higher interest rates than those for primary residences, reflecting the lender’s increased risk due to the property being an income-generating asset.

Qualifying for a home equity loan on a rental property typically involves meeting certain eligibility criteria set by lenders. These criteria often include a minimum credit score.

Lenders also consider the loan-to-value ratio (LTV), which is the ratio of the loan amount to the property’s appraised value. While lenders often require an LTV ratio below 80% for home equity loans on primary homes, this is often lowered to 70% for rental property home equity loans. This means you likely will need to have at least 30% equity in the property to be eligible.

Additionally, lenders may assess the condition and marketability of the rental property, as they want to ensure that the property is in good shape and has the potential to generate rental income.

>> Related: Learn more about home equity loan requirements

Applying for a home equity loan on a rental property involves several steps. Below is a general step-by-step guide to help you through the application process:

- Research lenders: Start by researching and comparing lenders that offer home equity loans on rental properties. Look for favorable terms and requirements that align with your financial situation.

- Get pre-qualified: Contact your chosen lender for pre-qualification. During this stage, the lender will assess your eligibility based on factors like credit score, income and the property’s value. This pre-qualification step gives you an idea of how much you may be able to borrow.

- Gather documentation: Prepare the necessary documentation, which typically includes:

- Proof of identity, such as a driver’s license or passport.

- Proof of income, such as tax returns, W-2 forms or rental income statements.

- Property-related documents, such as the deed and recent appraisal.

- Information about your existing mortgage, if applicable.

- Submit application: Complete the lender’s application form, providing accurate and detailed information about yourself and the rental property. Be prepared to disclose your financial history, including debts and assets.

- Complete property appraisal: The lender will usually order an appraisal of the rental property to determine its current market value. This step helps establish the property’s equity and the maximum loan amount you can qualify for.

- Go through underwriting and approval: Once your application is submitted and all required documentation is provided, the lender’s underwriting team will review your application, assess your creditworthiness and verify the property’s value. If everything meets their criteria, they’ll likely approve your loan.

Understanding Home Equity Loans on Rental Property

A home equity loan is a financial tool that permits owners to borrow money against the equity they’ve built up in their property. Equity is the difference between the property’s current market value and the outstanding mortgage balance.

When you take out a home equity loan, you receive a lump sum of cash that can be used for various purposes, such as home renovations, debt consolidation or purchasing additional properties. A home equity loan is an additional loan on top of the current mortgage, commonly referred to as a second mortgage.

Home equity loans typically have fixed interest rates and set repayment terms, making them a predictable and stable financing option. The borrower must make regular monthly payments, including principal and interest, until the loan is repaid. One key feature of home equity loans is that the borrower’s home serves as collateral, which means the lender can seize the property if the borrower fails to make the required payments.

>> Related: Learn more about the best home equity loan rates

HELOCs for Rental Property Are BACK (Use Your Equity!)

FAQ

What is the best way to take equity out of a rental property?

How much of a HELOC can you get on a rental property?

|

|

Investment properties

|

Primary residences

|

|

Credit score minimum

|

Generally 700

|

650-680

|

|

Debt-to-income (DTI) maximum

|

43% (can depend on anticipated rental income)

|

43% to 50%

|

|

Loan-to-value (LTV) maximum

|

80%

|

85%

|

Is a home equity loan on a rental property tax deductible?

How much equity do you need to refinance a rental property?

Can I get a rental property home equity loan?

Your financial situation will dictate whether or not you can get approved and whether or not you can afford to repay your rental property home equity loan. Lenders will check your income and credit report. Most lenders require a score of at least 700. Your debt-to-income (DTI) ratio may also affect your ability to borrow.

Can you borrow against equity in a rental property?

For a home equity loan, an investment property and rental property are treated the same; you can borrow against the equity in either. Here’s what you should know about borrowing against your equity in a rental property (or other non-primary residence) and why other types of financing may be a safer bet. What is home equity?

Can you get a home equity loan on an investment property?

A home equity loan allows you to tap the equity in a property to obtain a one-time lump sum you can use for any purpose. Most homeowners take out these loans on their primary residences. But can you get a home equity loan on an investment or rental property? If you have sufficient equity in it — potentially, yes.

Which banks offer home equity loans on rental property?

If you’re shopping around for a home equity loan, consider some of the following banks that offer home equity loans on rental property. Multinational TD Bank offers a fixed rate on home equity loans and one lump sum upfront. Terms are available from 5 to 30 years. Borrowers must take out a minimum of $10,000.