“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors opinions or evaluations. Please view our full advertiser disclosure policy.

Mortgages backed by the Department of Veterans Affairs (VA) can be easier to qualify for compared to conventional loans. They also tend to come with lower interest rates, and they don’t require a down payment.

Here’s what you need to know about VA loans to see if they’re the right fit for you.

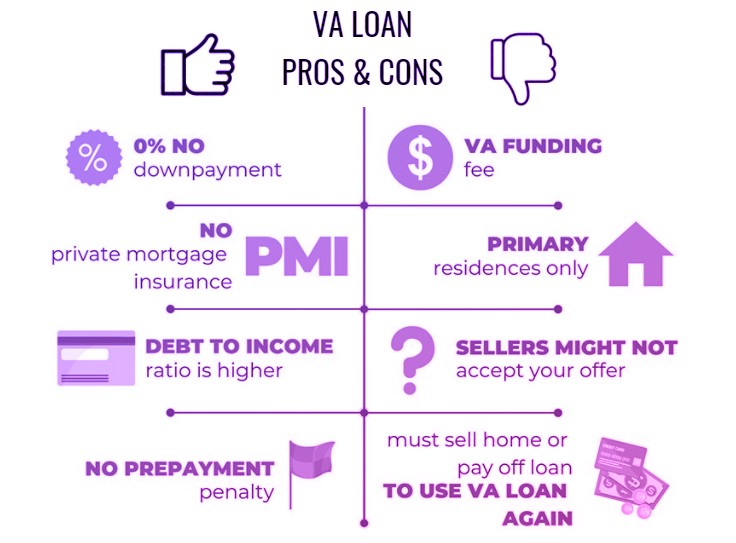

VA loans are government-backed mortgages designed to help veterans, active-duty military members, and eligible surviving spouses purchase homes. These loans offer unique benefits like no down payment and no private mortgage insurance. However, VA loans also come with some drawbacks to consider. This comprehensive guide examines the key pros and cons of VA loans to help you determine if this program is the right choice for your home financing needs.

An Overview of VA Loans

The VA home loan program was established in 1944 as part of the GI Bill to help WWII veterans purchase homes after returning from the war. It is run by the US Department of Veterans Affairs and has helped over 22 million servicemembers buy homes.

To qualify for a VA loan, you must have served at least 90 days of active duty during wartime or 181 days during peacetime. Reservists and National Guard members are also eligible after serving 6 years. Surviving spouses of veterans who died in the line of duty or from service-related disabilities can receive VA home loan benefits as well.

VA loans are provided by private lenders but insured by the VA This removes some of the risk from lenders and allows them to offer more flexible terms

Now let’s dive into the main pros and cons of VA loans.

The Pros of VA Loans

1. No Down Payment Required

The biggest benefit of VA loans is that they require no down payment. This makes it easier for eligible borrowers to purchase a home, especially first-time buyers who haven’t had time to accumulate savings.

With a conventional loan, you typically need a 20% down payment to avoid private mortgage insurance (PMI). With a VA loan, no down payment is required regardless of the loan amount.

2. No Private Mortgage Insurance

Speaking of PMI, VA loans do not require this expensive insurance like most conventional loans with less than 20% down.

PMI protects the lender in case you default, but costs 0.5% – 1% of the total loan amount annually. With a $250,000 mortgage, that could mean $1,250 – $2,500 extra per year.

VA loans skip PMI thanks to the VA guarantee, saving borrowers a lot over the life of the loan.

3. Relaxed Credit Requirements

The VA has more relaxed credit standards than conventional loans. Minimum credit scores are generally around 620 compared to 700+ for conventional mortgages.

The VA also allows higher debt-to-income ratios, meaning your total monthly debt can be up to 41% of your gross income. Conventional loans usually limit this ratio to the mid 30% range.

Additionally, borrowers can qualify sooner after bankruptcy, foreclosure, or late payments compared to other loans. VA guidelines require just a 2 year wait after bankruptcy or foreclosure.

4. Lower Interest Rates

Interest rates on VA loans are consistently lower than rates for conventional or FHA mortgages. VA’s average 30-year fixed rate is 0.25% – 0.5% less than other common loans.

Over a 30 year term, that small difference can save tens of thousands in interest charges. Lower rates lead to lower monthly payments too.

5. No Prepayment Penalties

VA loans do not charge any prepayment penalties for paying off your loan early. This provides flexibility if you later want to refinance or sell your home.

Prepayment penalties with some non-VA loans can total 3-6 months of interest if you pay off the loan within the first few years. VA loans give borrowers penalty-free prepayment.

6. Funding Fee Can Be Financed

The VA funding fee ranges from 1.4% – 3.6% of the loan amount. While not ideal, the fee can be financed into the mortgage instead of paid upfront.

For a $300,000 loan amount, the funding fee is $4,500 – $10,800. Rolling this into the loan prevents this from being a huge cash expense at closing.

7. Streamlined Refinancing Available

The VA streamline refinance lets existing VA borrowers refinance easily into a lower rate or shorter term mortgage. Limited documents and appraisals are required, making this one of the simplest refinances.

As long as your home value has remained fairly steady, you can likely refinance your existing VA loan into another with lower payments. This “VA to VA” refinance is a huge perk for eligible homeowners.

8. Portable Benefit

VA borrowers can reuse their loan benefit to purchase another home in the future. Your VA entitlement gets restored once your current VA loan is paid off.

This gives veterans and military members home financing flexibility throughout their lifetime. It also gives homeowners the option to rent out their current home and use their VA loan for a new primary residence.

9. Options for Renovation Financing

The VA Renovation loan combines a mortgage and rehab costs into a single loan. Borrowers can purchase a fixer-upper home and finance up to $35,000 in immediate repairs through this program.

Construction and energy efficient improvements are also eligible. This makes it easier for buyers to take on needed upgrades to older homes.

10. No Restrictions on Home Resale

Unlike some loan programs, VA loans do not impose any restrictions or recapture penalties when selling your home. You can sell whenever you want without worrying about paying back the VA.

This gives VA borrowers flexibility if they need to move for a job relocation, change in family size, or other major life event. There are no home resale rules to complicate matters.

The Cons of VA Loans

While very beneficial, VA loans do come with a few potential drawbacks.

1. Strict Loan Limits

There are limits on how much you can borrow with a VA home loan. The baseline limit is $453,100 but can go higher in certain counties. In expensive areas, VA’s cap may make it hard to buy larger homes.

VA also limits subsequent use loans to only 90% of the home’s value. So repeat buyers will need a down payment on their next VA purchase.

2. Required VA Funding Fee

As mentioned earlier, VA loans require a funding fee of 1.4% – 3.6% of the mortgage amount. This fee helps the VA cover losses from borrower defaults.

While the fee can be financed, it still results in higher closing costs. First-time VA borrowers pay a lower fee of 1.4% – 1.65%, while repeat users pay the higher rates.

3. Slower Closing Times

VA appraisals and paperwork can slow down the closing process compared to conventional mortgages. Sellers may be wary of longer VA timelines if they need to close quickly.

Closing in under 45 days may be tough with a VA loan. Build in extra time for processing and underwriting when making offers.

4. Limited Home Selection

The VA has strict appraisal and home eligibility guidelines. Homes must be move-in ready with proper utilities, no peeling paint, and working appliances. The home must also be intended as your full-time residence.

These rules can make it harder to purchase very old homes, manufactured housing, co-ops, or multi-unit properties with VA financing. Home selection is more narrow than other loans.

5. Lower Appraisal Value Possible

VA appraisers tend to be more conservative when assessing home values. It’s possible for the VA’s appraised value to come in below both the sale price and appraisals from other lenders.

If the VA value is lower, the buyer has to make up the difference in cash or negotiate a lower price with the seller. Otherwise, the deal could fall through.

6. Refinancing Restarts Entitlement

When VA borrowers refinance, their available entitlement gets used up again by the new loan. This prevents being able to purchase a second home with VA financing right away.

You either have to wait until refinancing your current home, or until you’ve paid down the balance by at least 25% of the original amount.

Is a VA Loan Right for You?

VA loans offer excellent benefits but aren’t right for every borrower. Here are a few things to consider when deciding if this program fits your situation:

-

Are you an eligible veteran, servicemember, or surviving spouse? Only qualifying applicants can use VA home loans.

-

Will you stay in the home long-term? Frequent moves may be difficult due to VA’s slower closing timelines.

-

Does the property meet VA guidelines? Not all homes or condos qualify for VA financing.

-

Can you afford the VA funding fee? While financeable, the fee increases costs.

-

Do you need to buy sooner than later? VA loans can take 45+ days to close.

-

Is your credit score over 620? If not, the VA likely won’t approve your application.

If you value perks like no PMI, relaxed credit requirements, or easy streamline refinancing, a VA loan may be a great fit. But also consider downsides like stricter home standards and potentially lower appraisals. Analyze both pros an

VA loan eligibility requirements

While VA loans are designed for those who serve in the military and their families, not everyone will qualify. Here’s a look at some of the main requirements:

For current or previous members of the military, service-related requirements work as follows:

- Active-duty service members: You must serve at least 90 continuous days to qualify for a Certificate of Eligibility (COE). This is a document that tells lenders you’re eligible for a VA loan.

- Veterans: If you’re a veteran, you’ll have different requirements based on when you served. For instance, if you served anytime between Aug. 2, 1990, and the present, you must have served for either 24 continuous months or 90 continuous days in active duty. You can also qualify if you were discharged for a hardship or a reduction in force and you also served at least 90 days. If you were discharged for a service-connected disability, you’re eligible if you served fewer than 90 days.

- Discharged service members: To qualify for a VA loan, you must have received a discharge under conditions outside of dishonorable, such as general, honorable or under honorable conditions. If you received a dishonorable discharge, you won’t be eligible for a VA loan.

- Surviving spouses: While spouses are eligible for a VA loan, they also need to meet certain requirements. For instance, you’re eligible if you’re the spouse of a veteran who’s a prisoner of war (POW) or missing in action. You’re also eligible if you’re the surviving spouse of a veteran and you haven’t remarried.

- Previous borrowers: If you’ve taken out a VA loan before, you might be eligible for another one if you meet certain conditions. For example, you could qualify if you’ve sold the home you bought with the prior loan or if you’ve repaid the loan in full and haven’t sold that home yet.

While you aren’t required to have a minimum down payment with a VA loan, your lender might have specific financial requirements you’ll need to meet. For example, the VA doesn’t specify a minimum credit score, but lenders often require a score of at least 620 — similar to conventional loan criteria.

Your home’s location can also factor into qualification requirements. This is because the lender might compare your income to the area median, according to Rebecca Richardson, the founder of The Mortgage Mentor.

“For the majority of people, there’s a calculation based [on] a minimum that must be met based [on] where you live in the country (as well as family size),” Richardson says. “That amount is calculated based [on] your gross income minus the mortgage payment minus any other debts.”

What is a VA loan?

A VA loan is a mortgage backed by the U.S. Department of Veterans Affairs. This type of home loan is available to eligible military service members, veterans and surviving spouses. Standard VA loans are offered by private VA lenders. However, the loans are regulated and insured by the VA. There are also VA direct loans where the VA serves as your mortgage lender.

Note that while VA loans don’t require a down payment or mortgage insurance, they do come with a funding fee that you’ll pay at closing. This ranges from 1.25% to 3.3% of your loan amount, depending on if you’ve previously taken out a VA loan and your down payment (if you opt to make one). USA TODAY Blueprint may earn a commission from this advertiser.

PROS and CONS of a VA Loan

FAQ

What is a drawback of a VA loan?

What are the pros and cons of a VA loan for a seller?

|

Pros for Seller

|

Cons for Seller

|

|

Higher closing rate

|

VA appraisals

|

|

Quick turnaround

|

VA minimum property requirements

|

|

Less stringent underwriting

|

May not get to meet the buyer (if that’s important to you)

|

What are the pros and cons of a VA home loan?

Assumptions have traditionally been a lesser-known and lesser-used pro of the VA home loan. The biggest benefit of assumptions is that borrowers can take over a Veteran’s loan and lock into interest rates lower than what is currently available.

What are the drawbacks of a VA loan?

Here’s a look at the main drawbacks of a VA loan. Those who take advantage of the VA loan must pay the VA funding fee — a mandatory fee charged by the VA to help keep the program running for future generations. The good news is that this fee can be rolled into the mortgage, which reduces the out-of-pocket expense when buying a home.

What are the benefits of a VA home loan?

There are benefits of a VA home loan, as well as drawbacks to consider. While conventional mortgages require a down payment of at least 3 percent of the purchase price, VA loans allow eligible borrowers to become homeowners without putting a penny down upfront.

Is a VA loan better than a conventional mortgage?

Lenders who offer VA loans typically do so at lower interest rates than conventional mortgages. Typically, the rate is about one-half of a percentage point lower than conventional loans. This provides the benefit of a lower monthly payment, which keeps more money in the servicemember’s pocket.