Investing in real estate can be an excellent way to build long-term wealth. However, coming up with the down payment for a property can be a major obstacle for many investors. Non recourse loans allow real estate investors to leverage property without putting their personal assets at risk. If the investment fails to generate enough income to repay the loan, the lender can only repossess the property – they cannot go after the borrower’s other assets or income sources.

In this article we will explore the top 10 non recourse loan providers that real estate investors should consider when financing investment properties.

What is a Non Recourse Loan?

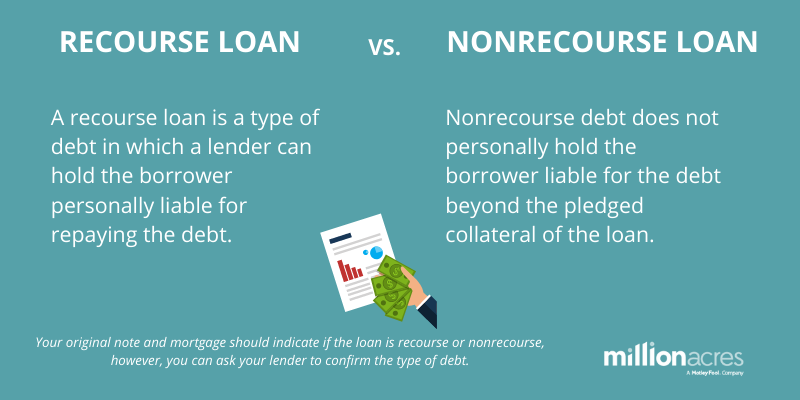

A non recourse loan, also called a nonrecourse loan, is a loan that is secured only by the collateral pledged against the loan itself. The borrower is not personally liable if they default on the loan payments. The lender can only seize the collateral – they have no recourse to pursue other assets owned by the borrower.

This is in contrast to a recourse loan, where the borrower remains personally liable for repaying the debt even if the underlying asset loses value or is lost. With a recourse loan, the lender can go after the borrower’s bank accounts, investment accounts, future wages, and other assets if they default

Non recourse loans shift the risk from the borrower to the lender. The lender must do thorough due diligence on the valuation and profit potential of the asset being used as collateral. For real estate investments, factors like location, appreciation potential, and cash flow projections come into play when lenders decide on loan terms.

Benefits of Using Non Recourse Loans

-

Leverage: Non recourse loans allow investors to leverage their capital and purchase more expensive properties than they could with an all-cash purchase. This increases upside potential.

-

Liability Protection: The borrower’s personal assets are not at risk if the investment underperforms. This reduces personal financial exposure.

-

Tax Benefits: Interest payments on investment property loans are generally tax deductible expenses. This reduces taxable rental income.

-

Flexible Terms: Non recourse loans often have more flexible qualification requirements and longer repayment terms than recourse loans.

-

High Loan-to-Value (LTV) ratios: Non recourse loans commonly have LTVs up to 80-90%, allowing the purchase of property with a much smaller down payment.

Top 10 Non Recourse Loan Providers

1. First National Bank of America

First National Bank of America offers non recourse loans for residential rental properties across all 50 states. They lend on properties with 1-4 units and have flexible lending terms:

-

Loan amounts from $50,000 to over $1 million

-

Up to 80% LTV for SFH, 75% for 2-4 units

-

Loan terms up to 10 years

-

Amortization up to 20 years

-

Rates starting around 5%

-

Can lend on unimproved land

-

Fund in 30-45 days

2. Pacific Crest Savings Bank

Pacific Crest Savings Bank offers non recourse loans for investment property purchases in Washington State. They have some of the most flexible requirements I have seen:

-

Lending in all counties statewide

-

1-4 unit residential properties

-

80% LTV for SFH, 75% for 2-4 units

-

5/1 ARM loans with 30 year amortization

-

No limit on number of financing requests

-

Will lend down to $50,000

3. First Western Federal Savings Bank

First Western Federal Savings Bank offers fixed rate non recourse loans nationwide for residential investment property. I like them because they fully amortize with no balloons.

-

Lending in all 50 states

-

Lends for 1-4 unit and small multifamily properties

-

Up to 60% LTV for 1-4 units, 50% for multifamily

-

Fully amortizing 25 year fixed rate loans

-

Loans from $40,000 to $800,000

-

Funds in 30-35 days on average

4. American IRA

American IRA is a non recourse lender that caters specifically to real estate investors using self-directed IRAs. They stand out for offering zero origination fees.

-

Zero lender & broker fees

-

Lends in 48 states

-

Residential properties and commercial up to $5M

-

Up to 60% LTV

-

5 & 10 year loan term options

-

Will lend for construction/rehab projects

5. Equity Trust Company

Equity Trust Company provides non recourse loans nationwide for those investing in real estate using IRAs and solo 401(k)s.

-

Lends in all 50 states

-

Residential and commercial properties

-

Up to 60% LTV

-

Interest rates starting at 5%

-

Loan amounts from $50k to $500k

6. IRA Innovations

IRA Innovations offers competitive non recourse loans for real estate investors using retirement funds like IRAs and solo 401(k)s.

-

Lends in 47 states

-

Residential 1-4 units and commercial properties

-

Up to 75% LTV

-

Loans from $50k to $5M

-

Rates starting at 4.5%

-

10 to 20 year fixed rate terms

7. Guidant Financial

Guidant Financial offers non recourse loans nationwide for investors using self-directed IRA and solo 401(k) funds.

-

Lends in all states except NY

-

Residential 1-4 units

-

Up to 80% LTV

-

Loans from $25k to $500k

-

Rates starting at 5%

8. IRA Services Trust Company

IRA Services Trust Company provides non recourse loans to real estate investors using IRAs and other self-directed retirement plans.

-

Lends in 48 states

-

Residential 1-4 units and small commercial

-

Up to 75% LTV

-

Loans from $50k to $5M

9. CamaPlan

CamaPlan offers non recourse loans nationwide for investors using IRAs and 401(k)s to invest in real estate.

-

Lends in 47 states

-

Residential 1-4 units and small commercial

-

Up to 60% LTV

-

Loans from $45k to $500k

-

Rates starting at 4.5%

10. Directed IRA

Directed IRA offers competitive non recourse real estate loans for retirement account investors.

-

Lends in all 50 states

-

Residential 1-4 units and small commercial

-

Up to 75% LTV

-

Loans from $30k to $500k

-

Rates starting at 4.5%

Non Recourse Loans Allow Real Estate Investment With Limited Risk

As you can see, there are numerous lenders ready to offer non recourse loan options to real estate investors. This allows you to leverage your capital in larger property purchases without additional personal liability. Just be sure to run the numbers conservatively and do sufficient due diligence on any property. With non recourse loans reducing your personal financial risk, you can confidently expand your real estate portfolio.

Contact InfoPatrick Prunty | NMLS 12057334299 MacArthur Blvd., Ste. 105, Newport Beach, CA 92660 949-885-8173 |

Pacific Crest Savings Bank was established in 1984 as Phoenix Mortgage and converted to a Washington State chartered, federally insured savings bank in 1998. PCSB combines the advantages of independent ownership with three decades of experience to offer the highest level of customer service.

They offer non-recourse loans to investment properties in Western Washington State that are held in a self-directed retirement plan such as a Solo 401(k), IRA and more. Pacific Crest offers loans for purchase, rate and term refinance, and cash out refinance.

- The maximum loan-to-value is 50%

- Positive cash flow is required.

General Terms & Conditions

- Loan Amounts: from $50,000 to $500,000

- Maximum Loan To Value: 65%; this may be reduced subject to specifics of a particular transaction

- Interest Rates: Approx. 5.25% – 6.5% (based on underwriting)

- Origination Fee: 1.5%

- Terms: Terms: 7/1 Adjustable Commercial Real Estate loan amortized over 25 years with all interest, principal, taxes and insurance due monthly

- Maturity: Up to 25 years

- Other Requirements: The property must generate sufficient net operating income (rents minus operating expense) to exceed loan payment by at least 25%. Minimum cash reserves must be maintained in your retirement account held at Solera National Bank.

What is a Non-Recourse Loan and How to Use it | Mark J Kohler | Tax & Legal Tip

FAQ

How hard is it to get a non-recourse loan?

What is an example of a non-recourse loan?

Is North Carolina a non-recourse state?

Is an FHA loan a non-recourse loan?

Can a non-recourse loan be used for real estate?

Some states predominantly offer non-recourse loan real estate options, while others might have more restrictions or not permit them. Additionally, non-recourse loan rates might fluctuate based on state regulations and the overall risk associated with these loans.

What are the benefits of a non-recourse loan?

A non-recourse loan can provide the additional funds you need without putting additional collateral at risk. Asset protection is the most significant benefit of a non-recourse loan, as the loan shields unrelated assets if you default. This is especially important for investors who use non-recourse loans to purchase real estate.

Does NASB offer a non-recourse loan?

NASB is proud to be America’s IRA Non-Recourse Lender™, helping you use your self-directed IRA to purchase real estate as a tax-sheltered retirement investment. Use your self-directed IRA to purchase real estate with a non-recourse loan. We offer a unique financing program for the purchase of property with a real estate IRA.

How are non-recourse loans treated differently in different states?

Here are some examples of how non-recourse loans are treated differently in various states: In California, non-recourse loans are the norm for purchase-money mortgages used to buy a home. However, refinanced loans, home equity lines of credit, and home equity loans are generally recourse loans.

Do all states allow non-recourse loans?

Not all states allow non-recourse loans. The permissibility and conditions of these loans vary depending on state laws. Some states predominantly offer non-recourse loan real estate options, while others might have more restrictions or not permit them.

Is a non-recourse loan a refinanced loan?

In California, non-recourse loans are the norm for purchase-money mortgages used to buy a home. However, refinanced loans, home equity lines of credit, and home equity loans are generally recourse loans. In Florida, non-recourse loan mortgages are rare; most mortgages are recourse loans.