Non recourse loans are an uncommon but potentially useful financing option for certain borrowers. As their name suggests, these loans offer additional protections compared to standard recourse loans by limiting the lender’s abilities to go after a borrower’s assets in case of default.

In this comprehensive guide, we’ll explain what non recourse loans are, their key features and limitations, and provide tips on finding non recourse loan lenders that may be able to help you.

What is a Non Recourse Loan?

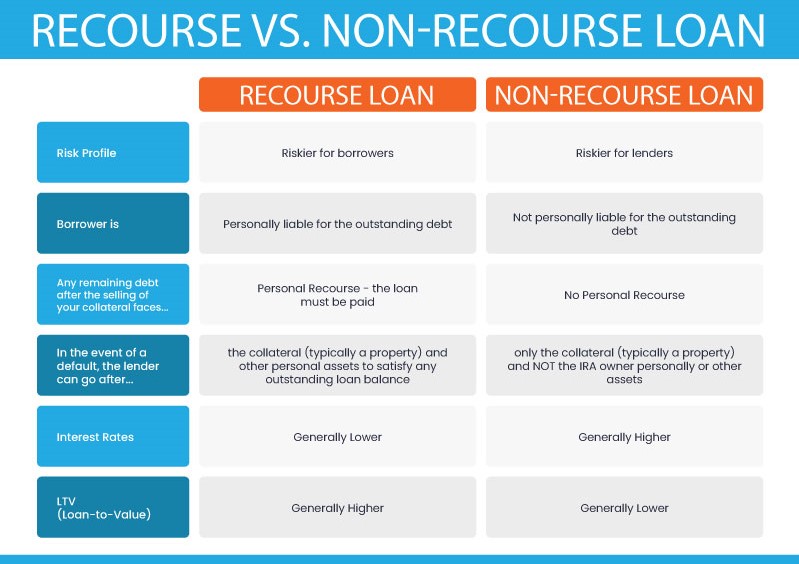

A non recourse loan is a type of financing where the lender cannot pursue the borrower’s other assets if the loan goes into default With a standard recourse loan like a mortgage, credit card, or auto loan, the lender can seize collateral as well as pursue wage garnishment or liens on other assets if the collateral does not fully cover the remaining loan balance.

Non recourse loans provide more protections for the borrower by limiting the lender’s remedies only to the original collateral securing the loan. If the collateral is insufficient to repay the debt after default and foreclosure the lender has no further recourse against the borrower. Their remaining assets and wages stay protected.

This arrangement shifts more risk onto the lender, which is why non recourse loans are less common and frequently have stricter eligibility requirements. But for borrowers who qualify, they can provide welcome peace of mind in case of future difficulties repaying the debt.

Non Recourse Loan Features

Non recourse loans have the following key features:

-

Limited recourse against the borrower – Lender can seize collateral but cannot pursue other assets or garnish wages to recover a deficiency balance Their recourse stops at taking the collateral

-

Higher interest rates – To compensate for the extra risk, lenders charge higher interest on non recourse loans.

-

Lower loan amounts – Lenders offer smaller non recourse loans because of the limited payback options.

-

Stricter eligibility requirements – Since lenders take on more risk, they have more rigid standards for credit scores, income, and loan-to-value ratios.

-

Fewer lenders offering them – Only some lenders are willing to provide non recourse loans given their uniqueness.

While non recourse loans do not make sense for every borrower, the extra protections can be attractive if you’re concerned about worst-case scenarios when taking on debt. Just be aware you’ll pay for them with higher rates and a more selective application process.

Non Recourse Loan Examples

The most common examples of non recourse loans include:

-

Non recourse mortgages – In a dozen states, mortgages are treated as non recourse loans where lenders cannot pursue deficiency judgments against borrowers after foreclosure.

-

Commercial real estate loans – Some commercial property loans are structured as non recourse. This shifts risk away from the borrowing entity onto the lender.

-

Business/startup loans – Occasionally lenders will extend non recourse loans to new businesses so that the business owner’s personal assets stay protected.

-

Private party loans – You may be able to find a private lender willing to provide personal non recourse loans based on factors besides your credit score.

While less common among mainstream lenders, situations like these demonstrate that non recourse loans are still an option for those who need their benefits.

Tips for Finding Non Recourse Loan Lenders

If you’re interested in non recourse lending, here are some tips to improve your chances:

-

Check if your state allows non recourse mortgages – This can be the easiest source of non recourse loans for homeowners in those states.

-

Look for private lenders willing to structure custom loan terms – Less conventional sources like private lenders or peer-to-peer platforms may offer more flexibility.

-

Improve your credit score and financial profile – A stronger application helps justify the extra risk to a non recourse lender.

-

Use business assets or collateral as security – Helps reduce the need for personal liability and wage garnishment threats.

-

Comparison shop multiple lenders – Cast a wide net to find those open to non recourse loans for your situation.

-

Highlight stable income and assets – Good income sources and financial resources help offset the limited payback options.

While it takes effort to find them, non recourse loan lenders are out there for borrowers who value the extra liability protections. Do your homework and present your best case for approval.

Weighing the Pros and Cons of Non Recourse Loans

Before pursuing a non recourse loan, consider some key pros and cons:

Pros

- Protection from wage garnishment and liens on other assets

- Peace of mind in case of inability to repay

- Allows focus of financial issues solely on collateralized asset

Cons

- Higher interest rates than comparable recourse loans

- More stringent lender approval requirements

- Lower maximum loan amounts approved

- Requires research to find willing lenders

- Riskier for any co-signers on loan

For many borrowers, the protections are well worth the tradeoffs. But be sure you understand and are comfortable with the limitations.

While non recourse lending is still relatively rare compared to standard recourse loans, this unique type of financing offers distinct benefits for certain borrowers who qualify. By limiting personal liability and putting more focus on the collateralized asset itself, non recourse loans provide additional peace of mind in case of default. For real estate investors, business owners, and anyone concerned about worst-case scenarios when taking on debt, exploring this option may pay dividends if you can find lenders willing to work with you.

Frequency of Entities:

non recourse loans: 22

lender: 16

borrower: 10

collateral: 9

loan: 35

IRA Non-Recourse Loan FAQs

North American Savings Bank, F.S.B. has been providing loans to individuals since 1927. As a leader in the mortgage industry, NASB offers a variety of mortgage loans and is the only nationwide nonrecourse lender for IRA real estate investments. We have retail lending branches in Missouri and offer nationwide lending via the internet.

A non-recourse loan is one in which the IRA account holder is not personally liable for repayment of the loan. The security instruments allow no recourse against the individual account holders or the balances of your IRA funds. In the event of default/foreclosure the lender can only look to the property as the sole source of repayment. The non-recourse lender cannot pursue other assets owned by the account holder or the IRA.

Anyone who has at least 30-40% of the purchase price vested in a self-directed IRA has the opportunity to buy rental properties using a non-recourse loan. This is subject to loan approval, including an acceptable real estate appraisal, as determined by NASB.

Our website offers a list of Self-Directed IRA Administrators who allow non-recourse loans. Please contact one of the administrators for more details. NASB does not represent or endorse any of these companies nor do they represent NASB. Please perform all prudent due diligence before setting up an account.

The minimum required for a single family home is 30%-40% of the purchase price and 40% of the purchase price for condos or 2-4 units. Insufficient cash flow or the condition of the property may require a larger down payment.

NASB can finance eligible property with non-recourse loans in all 50 states.

Allow 30-45 days from the date we receive your loan application and your purchase contract.

NASB offers a 7/1 and 10-year ARM, and 10, 15, 20 or 25-year fixed. All loan programs are principal and interest payments.

Single family detached residential, warrantable condos, PUDs, duplexes, 4-plexes, and multi-family (5 or more units). Ineligible properties include: Residential with large acreage, raw land, farms, manufactured or log homes, *non-warrantable condos, condo-hotels, co-ops, time shares, hotels, senior or assisted living facilities, non-franchise restaurants, entertainment properties, mini-storage. Square footage must be 750+ (per unit) for condos and 900+ (per unit) for all other properties.

*Condominiums: Condos must meet the following minimum criteria to be considered warrantable. The project building must be 100% complete, including common areas. The units within the building must be 60% sold and 33% of all building units must be owner occupied or second homes (versus tenant occupied). Condos not meeting these criteria are not eligible under our non-recourse program.

Yes. Discuss the LLC structure with your legal/tax advisor or an IRA administrator.

Yes, the funds would be distributed back into the IRA. This allows you the option of purchasing more assets within your IRA.

- Purchase transactions for investment property only.*

- IRA assets to be managed by a custodian in a self-directed IRA.

- IRA assets must be verified for purchase and reserves. IRA reserve requirement may be up to 20% of the loan amount, to be available in the event of insufficient cash flow to pay operating expenses and mortgage payments.

- No employment or income verification required.

- Properties must meet the debt service coverage ratio** guidelines.

*Must be income producing investment property (rental)

**DSCR: Debt service coverage ratio = net operating income/annual debt service

Typically, the financed property must generate sufficient net operating Income (rents minus operating expenses) to exceed the debt payments by 20%-25%.

Just email us here or contact an IRA representative at 866-735-6272.

NASB offers an unique financing program designed for the non-recourse financing requirements for IRA investments, and the application process is easy. Loan approval is generally within 48 hours of receipt of a complete application, and is subject to appraisal and verification of IRA funds for closing. NASB will quote interest rates on a case by case basis of the collateral type and down payment. The following fees (subject to change without notice) and costs apply:

- 1% origination fee to NASB

- $485 underwriting fee to NASB

- $410 processing fee to NASB

- $16 Flood Certification fee

- $500-$600 appraisal fee (including rent comps), due at time of application

- $_____Settlement/escrow fee

- $_____Title Insurance

- $_____Recording fees

- $_____Mortgage registration or other state fees (if applicable)

- $_____Prepaid Interest and taxes*

- $_____Initial Hazard Insurance Premium*

- $200 Attorney Review Fee

*Escrows for taxes and hazard insurance are required. Additional costs may be incurred for commercial and multi-family properties.

- Completed Property Eligibility Quote Form

- Current detailed Rent Roll or copies of signed leases (leases or rent roll for currently unoccupied properties are not required)

- Most recent asset statement verifying IRA assets for purchase and reserves

- Purchase/Sales contract, signed by the IRA account holder and the administrator. The contract must show the buyer to be in the name of the IRA or LLC

- Acceptable real estate appraisal for the property to be financed. Appraisal fee required at the time of loan application before NASB will order the real estate appraisal

A minimum loan amount of $175,000 is required to apply. Exceptions include mortgage products for properties located within the Greater Kansas City metro and surrounding areas. Contact a NASB Loan Officer for details on the excluded areas and/or zip codes.

Reach out to us.

By clicking the Submit button you agree that you are providing an electronic signature expressly authorizing NASB to contact you by telephone at any of the telephone number(s) provided above using an automatic telephone dialing system or an artificial or prerecorded voice or via text/SMS message, even if the telephone number is assigned to a cellular telephone service or other service for which the called party is charged. NASB may also contact you via email using any email address you provided. This authorization overrides any previous registration on a federal, state or corporate Do Not Call Registry or any internal NASB privacy or solicitation preference you have previously expressed. You are not required to provide this authorization as a condition of purchasing any property, goods or services from NASB. As an alternative, you may call us directly at (866) 753-6272 and we will process your request over the phone.