Buying a home is an exciting time, but it can also be filled with a lot of paperwork. One important document you’ll receive during the mortgage process is a mortgage loan commitment letter. This letter outlines the terms of the mortgage loan you have been approved for by the lender.

A mortgage commitment letter is a crucial part of the home buying process, so it’s important to understand what it is, when you’ll receive it, and what information it contains Keep reading for a comprehensive guide to mortgage loan commitment letters

What is a Mortgage Loan Commitment Letter?

A mortgage loan commitment letter, also known as a mortgage commitment letter, is a document issued by a lender that formally commits to lending you a specific amount of money to purchase a home, under agreed upon terms.

There are two main types of mortgage commitment letters

-

Conditional Commitment: This letter indicates you have been pre-approved for a mortgage after an initial review of your finances. However, you still need to meet certain requirements for final approval.

-

Firm Commitment: A firm commitment letter means you have completed the full mortgage application and underwriting process. The lender agrees to provide you the mortgage as outlined, as long as you meet any remaining requirements.

The mortgage commitment letter acts as proof to sellers that you are a qualified, serious buyer who has been validated by the lender. This gives you an edge in competitive housing markets.

When Will I Receive the Mortgage Commitment Letter?

You will receive mortgage commitment letters at two different points during the home buying process:

Pre-Approval – After applying for pre-approval and submitting financial documents, the lender will review your information and issue a conditional commitment letter if you meet their initial requirements.

After Applying – Once you have an accepted offer on a home, you’ll complete the full mortgage application and underwriting process. At the end, the lender will issue a firm commitment letter with your finalized loan details.

What Information is Included?

Mortgage commitment letters will contain important details about the loan the lender is willing to offer you. Here are some key items to look for:

-

Loan amount: The maximum loan amount the lender has approved you for.

-

Interest rate: The rate that will apply if approved. Rates are subject to change until locked in.

-

Loan type: Such as fixed-rate or adjustable-rate mortgage.

-

Loan term: Such as 15 or 30 years.

-

Expiration date: The date the commitment letter details expire if loan is not finalized.

-

Conditions: Remaining requirements that you must meet for final approval.

Review the letter carefully and make sure you understand all the details. Ask your loan officer if you have any questions.

Why is the Mortgage Commitment Letter Important?

There are a few key reasons why the mortgage commitment letter is a valuable part of the home buying process:

-

Proves you are a serious buyer: With a letter in hand, sellers can verify you are qualified and have the backing to purchase their home. This gives you an advantage over buyers without financing in place.

-

Locks in key terms: The letter secures important loan details like interest rate and loan amount, protecting you if rates rise.

-

Outlines final steps: Knowing the remaining requirements helps you finalize approval smoothly.

-

Commits the lender: While not a guarantee, the letter shows the lender intends to finance the purchase if you meet the conditions.

Having a commitment letter in today’s competitive market can make your offer stand out from the rest.

What to Do After Receiving the Letter

Once you receive a mortgage commitment letter, either for pre-approval or final approval, there are a few important next steps:

-

Review carefully: Understand all terms and conditions thoroughly. Ask your lender to clarify anything that is unclear.

-

Meet all requirements: For a conditional approval, be sure to satisfy any remaining conditions stated in the letter by the deadline.

-

Shop with confidence: The pre-approval letter allows you to make offers, knowing you are qualified for a mortgage of a certain amount.

-

Lock your rate: Work with your lender to lock in your interest rate, so it doesn’t rise before closing. Rates fluctuate often.

-

Act before expiration: Finalize the mortgage application before the commitment letter expires to avoid having to restart the process.

-

Maintain your finances: Avoid making major financial moves, like buying a car, until after closing. Any changes could jeopardize your approval.

Can a Mortgage Commitment Letter be Revoked?

In some cases, yes – a lender can revoke a mortgage commitment letter under certain circumstances:

-

You no longer meet the loan or income requirements outlined in the letter.

-

Your credit score decreases significantly.

-

Your debt-to-income ratio changes so you no longer qualify.

-

You provided inaccurate or false information on your application.

-

The value of the home comes in much lower than expected.

-

Any other significant change in your financial standing.

To avoid this, be sure to maintain your financial profile and keep your lender updated on any changes before closing.

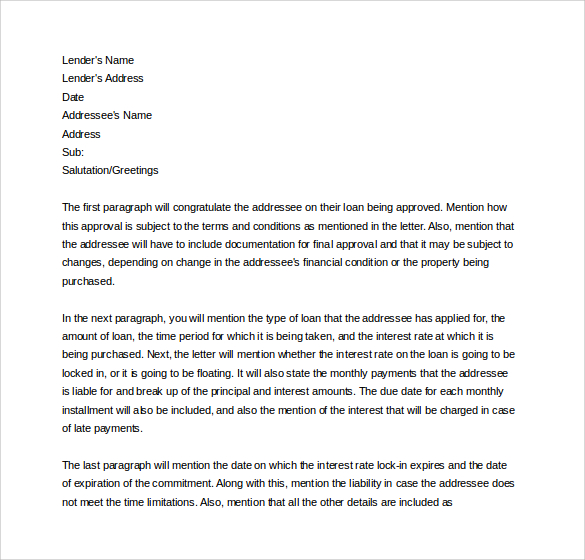

Mortgage Commitment Letter Template

While commitment letters vary by lender, they follow a standard format and contain key details about your loan.

Here is an example mortgage commitment letter template:

[Date][Your Name][Your Address]Re: COMMITMENT FOR MORTGAGE LOANDear [Your Name]: [Lender Name] is pleased to inform you that you have been approved for a mortgage loan up to $[approved loan amount], for the purchase of the property located at [property address].Loan Details:- Loan Type: [fixed-rate/adjustable-rate] - Interest Rate: [current rate]%- Term: [15/30 years]- Expiration Date: [date commitment expires]This commitment is subject to the following conditions:- Property appraises for at least the purchase price of $[purchase price].- Clean title search free of encumbrances.- Final verification of employment and income.- Clear termite inspection report.Provided the conditions outlined above are met on or before [expiration date], we are committed to providing you the mortgage financing under the terms described in this letter. Please contact us if you have any questions or need clarification.Congratulations on finding a new home, and we look forward to helping finance this exciting purchase!Sincerely,[Loan Officer Name][Lender Name]Always review your personalized commitment letter carefully and seek clarification from your lender on any unclear or questionable items. This ensures you thoroughly understand the terms of the loan.

The Bottom Line

The mortgage loan commitment letter is a key milestone in the home buying journey. This important document formally states the lender’s commitment to providing financing, proving to sellers you are a qualified buyer.

Knowing what to look for in the letter, when you’ll receive it, and what to do after acceptance empowers you to navigate the closing process smoothly. With a commitment letter in hand, you can move forward confidently towards your dream of homeownership.

Our process puts you in control.

Convenient online access makes it easy to achieve your financial and homeownership goals.

Estimate your monthly payment

See how much home you can afford

Estimate your amortization schedule

Start your home loan journey today.

There are a lot of great mortgage options out there, but you might not see them if you work with a big bank. As Canada’s premier mortgage broker, we help you find the best mortgage option for you.

Finance: What is a Commitment Letter?

FAQ

What is a mortgage loan commitment letter?

Is a commitment letter legally binding?

What is a mortgage commitment letter?

Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process. The letter tells the applicant how large of a mortgage the lender will likely approve, and the applicant can use the letter to show real estate agents and home sellers that they’re creditworthy and a serious home buyer.

Do I have to sign a mortgage commitment letter?

Yes. You are not committed to borrowing from a specific lender until you sign closing documents and receive the funds. A mortgage commitment letter is a document from a lender, verifying it’ll approve your home loan. But not all letters are created equal.

What are the different types of mortgage commitment letters?

There are two types of commitment letters that you can secure as a prospective home buyer: conditional and final. Here’s a breakdown of the two: Conditional mortgage commitment letter: This document specifies that you’re approved to borrow a specific amount of funds given that certain predetermined conditions are met.

What is a conditional mortgage commitment letter?

A conditional mortgage commitment letter is the more common type, the one that indicates you’ve been preapproved for a loan. This type of letter generally includes the following information: Obtaining a conditional mortgage commitment letter doesn’t mean you’re sure to get the loan or even the specific sum the lender mentions.