Buying a mobile home in Pennsylvania can be an affordable way to own your own home. With the right mobile home loan, you can finance the purchase of a manufactured or modular home for your family. But finding the best mobile home loans in PA does require some research.

In this article, I’ll walk you through everything you need to know about getting a mobile home loan in Pennsylvania We’ll cover

- Types of mobile homes in PA

- Costs of mobile homes in Pennsylvania

- Mobile home loans in PA

- Lenders for mobile home loans in Pennsylvania

- Tips for getting the best rate on a PA mobile home loan

Types of Mobile Homes in Pennsylvania

There are a few different types of factory-built homes you’ll find in PA

-

Manufactured homes – Also known as mobile homes. These are built entirely in a factory and then transported to your site. They meet the HUD Code standards.

-

Modular homes – Built in sections or modules in a factory, then assembled on your site. These are built to meet state or local building codes.

-

Mobile home – This term is sometimes used interchangeably with manufactured home. But it can also refer to older mobile homes built before the 1976 HUD Code went into effect.

Manufactured homes are the most common type of factory-built home in Pennsylvania today.

Costs of Mobile Homes in Pennsylvania

Mobile homes can be an affordable homeownership option because they cost less than site-built homes. Here are some average costs for mobile homes in Pennsylvania:

- A new triple-wide manufactured home: $115,000 to $150,000

- A used single-wide mobile home: $30,000 to $60,000

- Modular home: $100 to $200 per square foot

You’ll also have costs like:

- Delivery and setup fees – $5,000 to $15,000

- Land lease if in a mobile home park – $300 to $600 per month

- Skirting, decks, etc to setup the home – $5,000 to $10,000

But even with these additional costs, mobile homes are generally cheaper than site-built homes in PA.

Mobile Home Loans in Pennsylvania

There are a few different loan programs available for financing mobile homes in Pennsylvania:

-

Chattel loans – Also called home-only loans. These loans only cover the home itself, not any land.

-

Land-home loans – Finance both the home and land together.

-

FHA loans – Insured by the Federal Housing Administration. Only available for manufactured homes built after 1976 on permanent foundations.

-

VA loans – For veterans. Can be used to buy manufactured homes.

-

USDA loans – For rural areas. Can finance manufactured homes.

Many traditional lenders like banks don’t offer mobile home loans. Your best option is to go through lenders that specialize in manufactured home financing.

Lenders for Mobile Home Loans in Pennsylvania

There are a number of lenders that offer mobile home loans in PA. Here are some top options:

-

CountryPlace Mortgage – A national lender with over 25 years of experience financing manufactured homes. They offer home-only and land-home loans.

-

21st Mortgage – One of the largest manufactured home lenders in the U.S. They provide financing for new and used mobile homes.

-

Vanderbilt Mortgage – A direct lender offering manufactured housing loans. They have flexible lending programs.

-

Triad Financial – Provides mobile home loans for purchases, refinances, and construction financing.

-

Alliance Credit Union – A regional lender serving PA, OH, KY, TN and other states. They offer mobile home loans.

I recommend getting quotes from multiple lenders so you can compare interest rates and fees. Work with a lender familiar with the PA market.

Tips for Getting the Best Mobile Home Loan in PA

Here are a few tips to get the lowest rate on your Pennsylvania mobile home loan:

-

Shop around – Get quotes from at least 3 different lenders. Compare interest rates and fees.

-

Improve your credit – Aim for a credit score over 700 to qualify for the best rates. Pay down debts and resolve errors on your credit reports.

-

Offer a down payment – Putting 10-20% down can reduce your interest rate. Some lenders offer loans with just 3.5% down.

-

Pick a shorter term – Opt for a 15 or 20 year loan term instead of a 30 year to get a lower rate. Just be sure the payments fit your budget.

-

Get pre-approved – Being pre-approved can strengthen your offer when making an offer on a home.

Finding the right financing is key to buying a mobile home in Pennsylvania affordably. I recommend connecting with a few lenders to discuss your options and get personalized quotes. With today’s low interest rates, now is a great time to invest in a mobile home!

At American Mobile Home Finance… We help you obtain the American Dream!

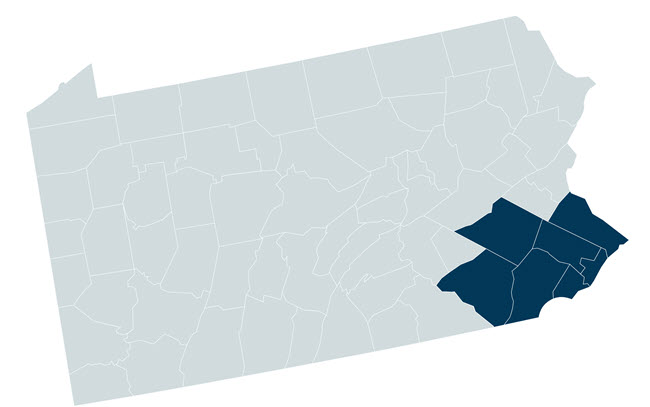

Presently, we are accepting used mobile home loan program applications in the following counties:

- Berks

- Bucks

- Chester

- Delaware

We finance new mobile homes. Contact us today! (610) 631-1600

Purchasing a Manufactured / Mobile Home is a Great Idea!

Manufactured or Mobile Homes are perfect for those who do not want a large home mortgage.

Owning your own home is still the American Dream. You could rent, but you get nothing in return. When you rent, all you are doing is paying for someone else’s investment. You don’t build up any equity. Wouldn’t you rather own your own home?

Many people are enjoying the benefits of owning a mobile home. Own your own mobile home and benefit!

Even with the recent correction in traditional home values, buying a standard home can come at a high price. Mobile and Manufacture homes are affordable, and are attracting a huge new market of smart investors. Smart home buyers are learning how far manufactured housing has come in terms of the quality of construction, available options, fixtures and amenities. It’s not just the homes that have improved. The old “trailer park” has given way to beautiful manufactured home “communities”, full of desirable amenities. Don’t you deserve to invest your money in a quality and affordable home?

American Mobile Home Finance is a premier provider of manufactured and mobile home loans. We specialize in helping the rapidly expanding number of smart investors that are choosing to purchase an affordable, quality manufactured or mobile home . Differing from traditional home mortgages, securing a mobile home loan requires expertise and experience. American Mobile Home Finance employs loan officers that specialize in finding the most competitive rates and best term programs for our clients. Each of our loans are simple interest loans with no pre-payment penalties or hidden fees.

American Mobile Home Finance offers lending programs for manufactured single-section, multi-section, modular and mobile homes. Our programs cover every aspect of lending for manufactured or mobile homes:

- New & Used Homes

- Home In-Park, Home on Rented/Leased Land

- Purchases

Mobile Home Loans and Settlement Options in Pennsylvania

FAQ

Can you get a mortgage on a mobile home in PA?

Why is it hard to get a mortgage on a mobile home?

What is the loan term for a mobile home?

Who is the best lender for manufactured homes?

|

Company

|

Starting Interest Rate

|

Loan Terms (range)

|

|

Manufactured Nationwide Best Overall

|

Varies

|

15, 20, or 30 years

|

|

ManufacturedHome.Loan Best for Good Credit

|

Varies

|

Varies

|

|

21st Mortgage Corporation Best for Bad Credit

|

Varies

|

Varies

|

|

eLend Best for Low Down Payment

|

Varies

|

Varies

|