Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

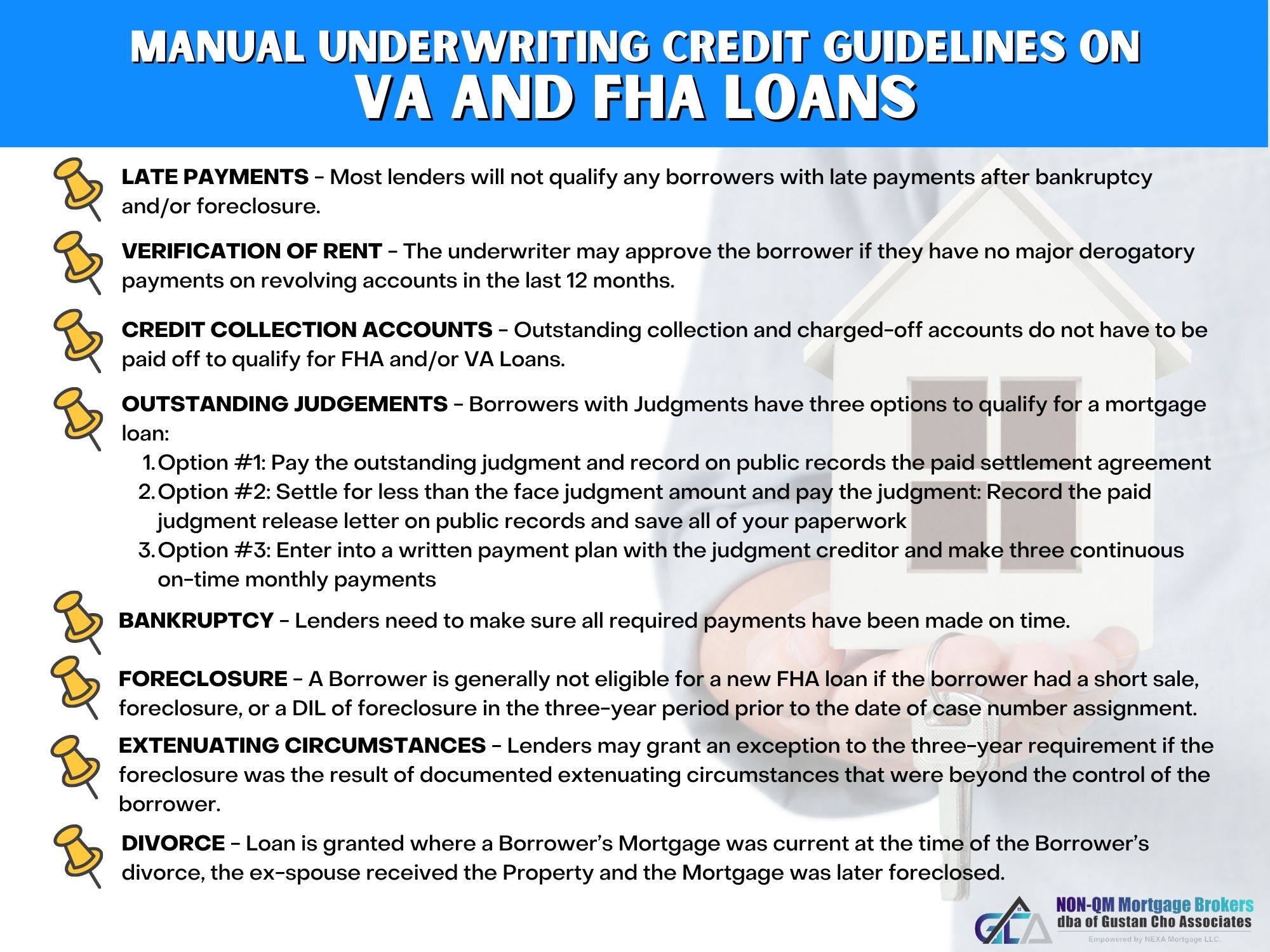

When you have an FHA or VA mortgage, making your monthly payments on time is essential. Late payments can result in late fees being charged by the lender. These late charges are capped at a maximum amount set by FHA and VA guidelines.

Understanding the rules around late fees for government-backed loans can help you avoid unnecessary penalties. Let’s take a look at the maximum late charges allowed on FHA and VA loans.

FHA Loan Late Fees

For FHA-insured mortgages lenders are permitted to charge a late fee if the monthly mortgage payment is not received by the due date. Here are the key facts on late charges for FHA loans

-

Maximum late fee – 4% of the overdue monthly mortgage payment

-

When charged – If payment is not received by the due date in the mortgage documents typically the 1st of the month

-

Additional lateness – An additional late fee can be charged for each subsequent month the payment is not received on time

-

Partial payments – The late fee percentage is based on the full monthly payment, even if a partial payment was made

So if your monthly mortgage payment is $1500 and you pay on the 5th instead of the 1st, the lender can charge a late fee of up to $60 (4% of $1500). This helps compensate the lender for the added costs and risks of late payments.

The Department of Housing and Urban Development (HUD) sets and oversees guidelines for FHA-approved lenders. By adhering to these uniform rules, late fees on FHA loans have some regulation.

VA Loan Late Fees

The Department of Veterans Affairs has different rules regarding late charges on VA loans:

-

No specific maximum – VA does not dictate a maximum late fee percentage

-

Set by lender – The mortgage servicer establishes its own late fee policy

-

Typically 5% – Many VA lenders set late fees around 5% of the monthly payment

-

No limit on successive fees – Additional fees can be charged each month payment is late

Since the VA does not impose a maximum allowable late charge percentage, these fees can vary more than on FHA loans. VA lenders have more flexibility and discretion.

This does not mean VA lenders can charge excessive fees. Late charges still must be “reasonable and customary” as with other loan closing fees. But without a VA cap on late fee percentages, borrowers should verify their lender’s policy.

What Happens If You Don’t Pay the Late Fee?

On both FHA and VA loans, any assessed late charges that are not paid will accrue and be owed. The lender will expect these late fees to be paid eventually.

If you simply pay your next month’s regular payment without the past due late fee, here is what happens:

- The current monthly payment gets applied first to the late fee

- Any remainder goes toward the regular principal/interest

- But this may result in the full payment not being made, triggering another late fee

To avoid escalating late charges, you must pay the full regular monthly payment plus any outstanding late fees. Communicate with your lender if you are struggling to catch up.

How to Avoid Late Fees on FHA and VA Loans

The best way to steer clear of late fees is ensuring your full monthly mortgage payment arrives by the due date every month. Try these tips:

-

Set payment reminders and keep a cushion in your bank account

-

Enroll in auto-pay through your lender to schedule automatic payments

-

Speak with the lender immediately if you anticipate any difficulty making on-time payments

-

Pay online or via phone payment options for faster processing

-

If late, add the late fee amount to your next payment to get caught up

-

Request a one-time waiver of the late fee if you have a good history of on-time payments

While FHA and VA rules regarding late charges may differ, the bottom line is avoiding fees by paying on time. If your loan becomes delinquent, know your rights but also take responsibility by communicating with the lender. They can often work with borrowers to get payments back on track without excessive late penalties.

Alternatives to Paying Late Fees

Before paying FHA or VA late fees, be sure to exhaust any options to remove or reduce the charges, such as:

-

Good payment history – Ask for a one-time courtesy removal of the fee if you rarely pay late.

-

Extenuating circumstances – See if the lender will waive the fee if you have proof of hardship, like job loss or medical issues.

-

Late fee caps – Ask if the lender will lower the fee to be more in line with industry standards, like 5% maximums.

-

Payment arrangements – The lender may waive late fees if you enter into a repayment plan to catch up.

-

Mortgage assistance – Federal, state, and lender mortgage relief programs may entitled you to reduced or waived late fees along with other help.

If you’ve been a responsible borrower and the lateness was an anomaly, don’t just pay exorbitant late penalties without exploring fee removal options first.

Key Takeaways on FHA and VA Late Fees

While both FHA and VA loans permit lenders to charge late fees, the rules vary:

- FHA late charges cannot exceed 4% of the monthly mortgage payment

- VA has no maximum limit on late fee percentages

- Unpaid fees get tacked on to the overall balance owed

- Avoid fees by paying on time or asking for removal if possible

Knowledge of the policies, your rights as a borrower, and available alternatives gives you power to dispute unreasonable fees. Don’t resign yourself to expensive late penalties without first trying to get them lowered or waived.

Choose Your Loan TypeFHA.com is a privately owned website, is not a government agency, and does not make loans.

Do you know whats on your credit report?

Learn what your score means.

Whether youre a first-time homebuyer, moving to a new home, or want to refinance your existing conventional or FHA mortgage, the FHA loan program will let you purchase a home with a low down payment and flexible guidelines.580 Credit Score- and only -3.5% Down RELATED ARTICLES

FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Each state has different limits, so be sure to look up your state to understand what is available for your FHA home loan.

For , the FHA floor was set at $498,257 for single-family home loans. This minimum lending amount covers most U.S. counties. The FHA ceiling represents the maximum loan amount and is illustrated in the table below.

| FHA Limits (low cost areas) | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $498,257 | $637,950 | $771,125 | $958,350 |

Also for 2024, the FHA ceiling was set at $1,149,825 for single-family home loans. This represents the highest amount that a borrower can get through the FHA loan program. It applies to high cost areas in the United States and is illustrated in the table below.

| FHA Limits (high cost areas) | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $1,149,825 | $1,472,250 | $1,779,525 | $2,211,600 |

Paying the upfront costs of buying a new home can be challenging. To help overcome this hurdle, many local and state agencies offer down payment assistance in the form of grants or second mortgages.

Learn About FHA Loans

Find out why FHA mortgages with low down payments are so popular with homebuyers.

Why are Sellers Are Rejecting FHA & VA Loans – First Time Home Buyer

What is a late payment on an FHA loan?

These FHA loan rules for late payments are found in HUD 4000.1 A section in that volume titled “Late Charges” explains what the FHA views as a late payment on the FHA loan. According to HUD 4000.1: “Late Charges are charges assessed if a Mortgage Payment is received more than 15 days after the due date.”

Do FHA & VA notes have a late fee?

Unless state laws have a lower percentage, four percent will print on all FHA and VA notes. The language on the notes, however, may come in conflict with state laws which restrict late fees to percentages which are higher than FHA’s and VA’s limitations, but which are applied to a smaller amount than the full monthly payment.

What if I have a late fee on my FHA loan?

Before collecting a late, fee the lender is obliged by FHA loan rules to notify the borrower with “advance written notice” of the late fee to meet the following requirements. “The Mortgagee must include in the advance notice the following information:

What is a mortgage late charge?

According to HUD 4000.1: “Late Charges are charges assessed if a Mortgage Payment is received more than 15 days after the due date.” And the lender is allowed to start issuing mortgage loan late charges on the 17th day of the month of the late payment.