Mortgage closing costs range from 2-5% of a home’s purchase price. That can add up. But, many sellers are eager to pay your closing costs in order to sell their home faster.

There is a limit to how much a seller can pay for, though. Each loan type — conventional, FHA, VA, and USDA — sets maximums on seller-paid closing costs.

When buying a home with a conventional loan the seller can pay some of your closing costs through seller concessions. But there are limits on how much the seller can contribute based on your down payment amount. Understanding these max seller concession rules is important to make sure your loan closes smoothly.

What Are Seller Concessions?

Seller concessions, also called interested party contributions (IPCs), are when the seller pays for some of the buyer’s closing costs. Common examples include:

- Paying for the buyer’s title insurance policy

- Paying for the appraisal fee

- Paying for the buyer’s origination fee

- Paying for the buyer’s home inspection

- Paying for prepaid expenses like property taxes and homeowners insurance

Seller concessions can help make the purchase more affordable for buyers by reducing their out-of-pocket costs at closing.

Why Are There Limits on Seller Concessions?

Fannie Mae and Freddie Mac set limits on how much sellers can contribute to closing costs for conventional loans they back. These limits help prevent:

-

Inflated home prices Restrictions on seller concessions deter sellers from inflating the sale price to cover closing costs, This helps ensure appraisals accurately reflect the market value

-

Excessive risk: High seller concessions could let unqualified buyers afford houses they can’t realistically pay for long-term. Limits mitigate this risk for lenders.

-

Down payment circumvention: Seller concessions exceeding the buyer’s down payment essentially give a “free ride” by covering their funds needed to close. Limits prevent this.

Fannie Mae Conventional Loan Seller Concession Limits

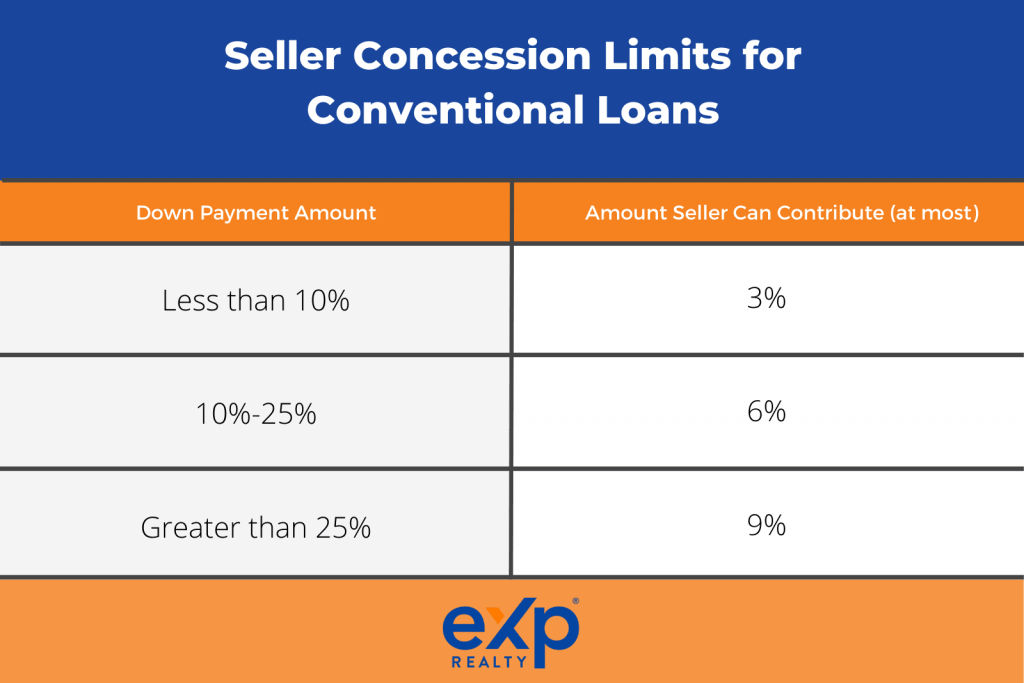

For conventional loans backed by Fannie Mae, the max seller concession depends on your down payment:

-

Less than 10% down: 3% of the home’s sale price maximum.

-

10-25% down: 6% of the sale price maximum.

-

Over 25% down: 9% of the sale price maximum.

So on a $300,000 home purchase, the max concessions would be:

- 5% down payment ($15,000): $9,000 max seller concession.

- 15% down payment ($45,000): $18,000 max.

- 30% down payment ($90,000): $27,000 max.

If the seller concessions exceed these limits, the appraised value must be reduced by the overage amount for loan approval.

Freddie Mac Conventional Loan Seller Concession Limits

The limits are slightly different for conventional loans backed by Freddie Mac:

-

Less than 10% down: 3% of the purchase price maximum

-

10-25% down: 6% of the appraised value maximum

-

Over 25% down: 9% of the appraised value maximum

The main difference is that Freddie Mac bases the limits on the appraised value rather than just the sale price. This provides more flexibility if the appraisal comes in higher than the contract price.

What Closing Costs Do Seller Concessions Cover?

Seller concessions can be used to cover virtually any closing costs the buyer is responsible for, with a few exceptions:

Cannot pay with seller concessions:

- Downpayment

- Reserves

- Discount points to buy down the rate

Can be paid with seller concessions:

- Title fees

- Transfer taxes

- Appraisal fee

- Credit report fee

- Origination charges

- Prepaids for property taxes and insurance

- Home inspection fee

- HOA capital contribution

Always verify with your lender which fees the seller can cover in your situation.

Seller Concession Rules: 3 Key Tips

When getting a conventional loan, keep these key tips in mind about seller concessions:

-

Check your limits. Confirm with your lender the max concessions for your down payment amount and loan program.

-

Watch for red flags. Very high seller concessions could signal potential appraisal inflation concerns.

-

Include concessions on contract. Clearly specify any seller-paid closing costs in the purchase agreement.

Following these tips will help ensure you abide by program guidelines and get to the closing table without issues.

Alternatives to High Seller Concessions

If your closing costs exceed what the seller can pay, look at these options instead of high concessions:

-

Negotiate credits into deal. Ask for closing credits upfront rather than big seller concessions.

-

Exchange higher rate. Pay a slightly higher rate in return for lender credits to cover costs.

-

Pay out of pocket. If affordable, cover excess fees yourself rather than pushing limits.

-

Remove contingencies. Waiving contingencies like financing and appraisal may give more negotiation leverage.

-

Split extra costs. If overage is small, consider splitting excess fees with seller.

-

Lower offer. Reduce purchase price to align with appraisal and stay within guidelines.

How Are Seller Concessions Paid?

Seller concessions will appear as a credit to the buyer on the Closing Disclosure form. For example:

Seller Credit to Buyer: - Title insurance premium $500 - Transfer taxes $1,500 - Origination charges $750Total Seller Concession: $2,750They are essentially a reduction in the buyer’s closing costs. The lender will reduce the seller’s proceeds at closing by the concession amount.

Unlike downpayment assistance programs, the seller concessions are not paid directly to the buyer. The credits go toward closing costs only.

Can Seller Concessions Be Used for Downpayment?

No, seller concessions cannot be used to cover any part of the buyer’s down payment, closing costs that are considered prepaid items (such as reserves, interest, property taxes, or homeowners insurance), or to meet minimum borrower contribution requirements.

If a seller concession is being used to cover the down payment, the loan would be rejected unless the contract is re-negotiated to align with program guidelines.

Seller Concession Rules on Non-Conventional Loans

If you are getting an FHA, VA, or USDA loan, there are no set limits on how much sellers can pay in closing costs.

However, the lender must still ensure:

- Appraisal is not inflated to cover concessions

- Concessions do not cover any portion of downpayment

- Buyer is still making a minimum required investment

So while government loans offer more flexibility, large seller credits will still face increased scrutiny.

Next Steps for Seller Concessions

The best way to handle seller concessions is to discuss them up front with your real estate agent and lender. Confirm the max amounts you can receive based on your specific down payment, loan program, and property appraisal. Then formalize those concessions in the purchase contract before applying for your mortgage.

Following program guidelines on seller concessions will help ensure your conventional loan closes on time. With a clear understanding of these rules, you can better negotiate your home purchase with confidence.

Maximum seller-paid costs for conventional loans

Fannie Mae and Freddie Mac are the two rule makers for conventional loans. They set maximum seller-paid closing costs that are different from other loan types such as FHA and VA. While seller-paid cost amounts are capped, the limits are very generous.

A homebuyer purchasing a $250,000 house with 10% down could receive up to $15,000 in closing cost assistance (6% of the sales price). This dollar figure is a lot more than the typical seller is willing to contribute, so the limits won’t even be a factor in most cases.

| Property Type | Down Payment | Maximum Seller-Paid Costs |

| Primary residence or second home | less than 10% | 3% |

| Primary residence or second home | 10%-25% | 6% |

| Primary residence or second home | 25% or more | 9% |

| Investment Property | Any amount | 2% |

FHA seller concessions have similar rules to conventional loans. For all FHA loans, the seller and other interested parties can contribute up to 6% of the sales price or toward closing costs, prepaid expenses, discount points, and other financing concessions.

If the appraised home value is less than the purchase price, the seller may still contribute 6% of the value. FHA indictors that the lessor of the two (purchase versus appraised) values may be used.

Can the seller contribute more than actual closing costs?

No. The seller’s maximum contribution is the lesser of the sales price percentage determined by the loan type or the actual closing costs.

For instance, a homebuyer has $5,000 in closing costs and the maximum seller contribution amount is $10,000. The maximum the seller can contribute is $5,000 even though the limits are higher.

Seller contributions may not be used to help the buyer with the down payment, to reduce the borrower’s loan principal, or otherwise be kicked back to the buyer above the actual closing cost amount.

What are Seller Concessions, What are the Max Concessions on Conventional loan, FHA, VA, USDA

FAQ

What are the most seller concessions for a conventional loan?

What is the most seller can pay in closing costs?

What is the maximum seller contribution Fannie Mae?

What is the maximum contribution to a conventional loan?

What is a seller concession on a conventional loan?

A ‘seller concession’ refers to any arrangement where closing costs on a home purchase are paid by the seller rather than the buyer. What is the maximum seller concession on a conventional loan? If your down payment is less than 10%, the maximum seller contribution is 3%.

What is the maximum seller concession on a FHA loan?

The maximum amount of **seller concessions** allowed on an **FHA loan** is **6% of the sale price**.This means that the seller can contribute up to 6% of the home’s purchase price towards **closing costs**,

What are the concession limits for conventional loans?

Concession limits for conventional loans depend on the buyer’s down payment: For down payments of less than 10%, concessions are capped at 3% of the purchase price. For down payments between 10% and 25%, concessions are capped at 6% of the purchase price. For down payments of more than 25%, concessions are capped at 9% of the purchase price.

What are FHA seller concessions?

FHA seller concessions have similar rules to conventional loans. For all FHA loans, the seller and other interested parties can contribute up to 6% of the sales price or toward closing costs, prepaid expenses, discount points, and other financing concessions.