Closing costs can be a huge, unexpected expense when purchasing a home. Think $8,000 to $10,000 or more on a typical purchase.

But current mortgage rules allow sellers and other parties to pay all or part of your closing costs.

Purchasing a home is likely the biggest financial decision you’ll ever make. And in today’s competitive housing market buyers need every advantage they can get to have their offer accepted. One strategy that is becoming more common is asking the seller for a seller concession to help cover closing costs. But how much can a seller pay toward closing costs on a conventional loan? Let’s take a deep dive into seller concessions and how they work with conventional financing.

What Is a Seller Concession?

A seller concession is when the home seller agrees to contribute a certain dollar amount towards the buyer’s closing costs This concession lowers the amount of cash the buyer needs to bring to closing,

Seller concessions are typically used to entice buyers by making the home more affordable. In a competitive housing market, a seller concession can set a buyer’s offer apart from others.

The seller concession comes directly from the seller’s proceeds at closing. So they don’t actually reduce the total closing costs – they just shift who pays them. The seller gets less money while the buyer brings less to closing.

How Do Seller Concessions Work With Conventional Loans?

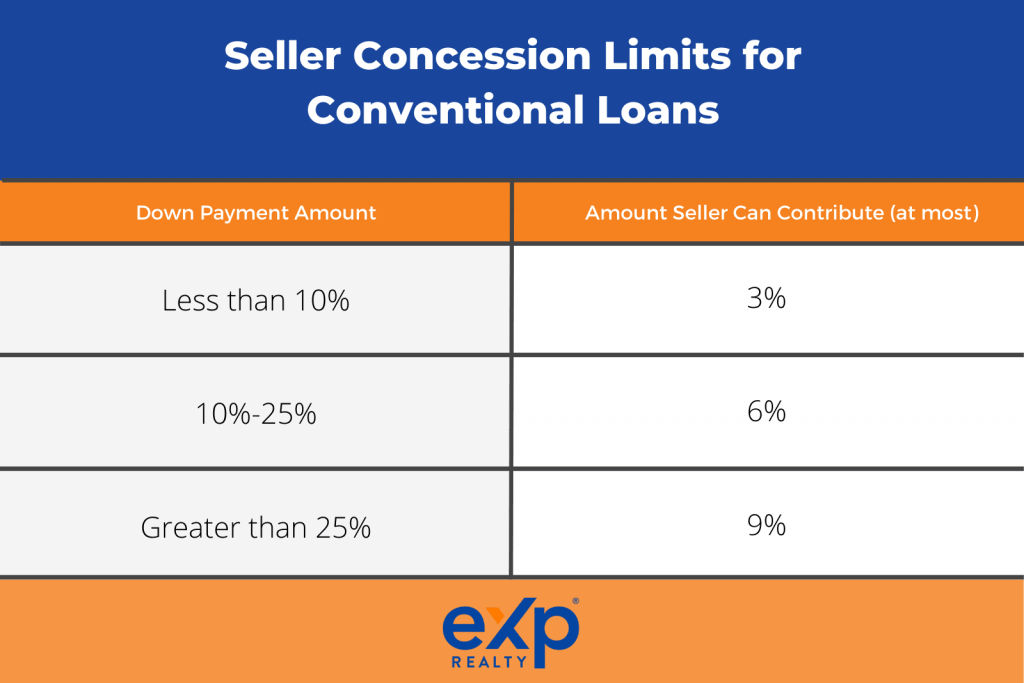

Fannie Mae and Freddie Mac place limits on how much a seller can pay in concessions when the buyer is getting a conventional loan. These limits depend on the down payment amount:

- Less than 10% down: The maximum seller concession is 3% of the purchase price.

- 10-20% down: The maximum seller concession is 6% of the purchase price.

- More than 20% down: The maximum seller concession is 9% of the purchase price.

For example, if you’re putting 5% down on a $300,000 home, the max concession you could get from the seller is $9,000 (3% of $300,000).

Any amount over the limit is considered a sales concession. The appraised value of the home must be reduced by the excess amount when calculating the loan-to-value ratio.

Why Do Conventional Loans Limit Seller Concessions?

Conventional loans put limits on seller concessions to reduce risky lending practices. High seller concessions could allow buyers to acquire homes they otherwise wouldn’t qualify for.

Without limits, a buyer could use a large seller concession to cover their down payment and closing costs. This means they’d get 100% financing without having any actual equity in the home.

The limits force buyers to have more skin in the game. This results in less risk for lenders.

What Closes Costs Can the Seller Pay With a Concession?

Sellers can use concessions to pay for any closing costs on behalf of the buyer. This includes:

- Down payment (up to the limit)

- Loan origination fees

- Appraisal fees

- Credit report fees

- Lender-paid mortgage insurance premiums

- Prepaids for homeowner’s insurance, mortgage insurance, property taxes

- Title insurance fees

- Recording fees

- Transfer taxes

- HOA fees

- Owner’s title insurance policy

- Survey fees

- Pest inspection fees

The seller concession reduces the amount of cash the buyer needs at closing. But the buyer is still responsible for paying any closing costs that exceed the seller concession.

Pros and Cons of Seller Concessions

Pros

- Reduce cash needed for down payment and closing costs

- Can help buyers qualify for a larger loan

- Make an offer more appealing in a competitive market

Cons

- Appraised value may be reduced

- Less negotiation on purchase price

- Higher tax liability for seller

Tips for Using Seller Concessions

-

Only ask for a concession after your offer is accepted. Don’t include it in your initial offer unless the listing mentions one.

-

Get a solid home appraisal to support the purchase price, even with concessions. A low appraisal could torpedo the deal.

-

Keep expectations realistic. Most sellers will offer 1-3%, especially on homes above $500k.

-

If you don’t end up using the entire concession, ask for unused funds credited towards your principal balance. This will save on interest costs over the life of the loan.

-

Consult a tax advisor about your specific situation. Seller concessions are treated as capital gains for tax purposes, which may have implications for the seller.

Alternatives to Seller Concessions

If the seller won’t budge on closing cost help, here are a few other options to reduce cash needed:

-

Lender credits – Also known as lender concessions. This is where the lender provides a credit toward closing costs. Often seen with higher interest rates.

-

Lower purchase price – Consider negotiating a lower purchase price to get room for closing costs. But appraisal must still support the loan amount.

-

Pay Stub and W2 programs – Some lenders allow you to bring just pay stubs and W2s to closing. This can save $400+ that would go toward employment verification. But underwriting is tougher.

-

Seller-paid closing costs – In some areas, it’s common for the seller to pay a set portion of the buyer’s closing costs, such as 1% or 2%.

-

Gift funds – Receive a gift from a family member to cover some or all of your down payment and closing costs. No repayment needed.

-

Grants and down payment assistance – Check if you qualify for federal, state, or local down payment grant programs based on income limits or location.

-

Lender credits – Negotiate a lender credit to offset origination fees or other lender charges. Often requires paying a higher rate.

The Bottom Line

Seller concessions can be hugely helpful for cash-strapped buyers in competitive housing markets. Just be sure to stay under the max limits for conventional loans – no more than 3% of the purchase price if you put down less than 10%. A savvy Realtor can help you use concessions to put together an appealing offer without derailing your home loan.

Conventional Loan Seller Concession Maximums

Seller concessions, also known as seller-paid closing costs or seller credits, are grouped in with other types of closing assistance called Interested Party Contributions, or IPCs.

IPCs are any funds issued to the buyer from a party that stands to gain from the transaction:

- Seller

- Builder

- Developer

- Real estate agent

- An organization with co-ownership of any of the above

Interestingly, the lender is not considered an interested party and may give you a closing cost credit from its profit margin without affecting IPC maximums.

Total seller concessions plus any other IPCs must not exceed the following:

|

Down Payment |

Primary Residence IPC |

Second Home IPC |

Investment Property IPC |

|

3-9.99% |

3% |

3% |

2% |

|

10-24.99% |

6% |

6% |

2% |

|

25%+ |

9% |

9% |

2% |

The above percentages are based on the home price. For example, you could receive up to $9,000 (3%) in seller concessions for a $300,000 home, assuming its your primary residence.

Keep in mind that the above only applies to conventional loans underwritten by Fannie Mae and Freddie Mac rules.

Other maximum seller concessions are as follows.

- FHA: 6%

- VA loans: All normal closing costs plus an additional 4%

- USDA loans: 6%

If for some reason you receive more seller concessions than conventional loans allow, you might consider changing a different loan type.

What Seller Concessions Can Be Used For

You can use seller concessions and other IPCs toward:

- Loan closing costs like title, escrow, and appraisal charges

- Items the lender requires you to prepay like property taxes and homeowner’s insurance

- Loan origination points

- Discount points

- Up to 12 months of HOA dues

- Most other costs of getting a mortgage

A gift from a relative who is also the seller, such as with a

Lenders do not allow you to use interested party contributions toward your down payment, financial reserves, or to meet minimum contribution rules for the loan. You also may not receive cash back at closing unless it’s a refund of your earnest money.

However, IPCs can indirectly help you qualify for the loan. For example, you have $10,000 in savings. The down payment requirement is $9,000 and closing costs are another $9,000, for a total of $18,000 required to close. A seller credit of $9,000 would lower your cash requirement enough to qualify.

Beware of contributions that are not disclosed to the lender. One extreme example is if the seller “accidentally” leaves a 1966 Ford Mustang in the garage when he moves out as an added bonus for buying the home. In reality, it’s an undisclosed contribution that could make the loan due and payable.

Other examples are undisclosed second mortgages from the seller, covering moving expenses, or any other item of value meant to entice you to buy the home. It’s best to steer clear of these offers.

What are Seller Concessions, What are the Max Concessions on Conventional loan, FHA, VA, USDA

FAQ

What is the most seller can pay in closing costs?

What is the maximum seller contribution Fannie Mae?

What is the maximum seller concessions on Freddie Mac?

What is the seller concession limit for a home loan?

Here are the seller concession limits for some common loans. The limit for conventional loans depends on how much you’re putting down: If your down payment is less than 10%, the seller can contribute up to 3%. If your down payment is 10% – 25%, the seller can contribute up to 6%.

What is a seller concession on a conventional loan?

A ‘seller concession’ refers to any arrangement where closing costs on a home purchase are paid by the seller rather than the buyer. What is the maximum seller concession on a conventional loan? If your down payment is less than 10%, the maximum seller contribution is 3%.

What are the concession limits for conventional loans?

Concession limits for conventional loans depend on the buyer’s down payment: For down payments of less than 10%, concessions are capped at 3% of the purchase price. For down payments between 10% and 25%, concessions are capped at 6% of the purchase price. For down payments of more than 25%, concessions are capped at 9% of the purchase price.

What are FHA seller concessions?

FHA seller concessions have similar rules to conventional loans. For all FHA loans, the seller and other interested parties can contribute up to 6% of the sales price or toward closing costs, prepaid expenses, discount points, and other financing concessions.