Married student loan borrowers’ tax filing status, whether they are “married, filing jointly” or “married, filing separately,” affects both their tax liability and student loan repayment amounts. However, filing jointly or separately can also affect your ability to qualify for lower healthcare premiums through the Health Insurance Marketplace.

The vast majority of households in the U. S. file a joint tax return. However, as they take into account potential student loan savings, more people who have student loans have started to file their taxes separately.

In the section below, we go over when choosing a filing status of “married filing separately with student loans” makes sense and when it doesn’t.

How filing taxes separately saves money on loan payments

Let’s first examine the relationship between student loans and married individuals who file separately.

When a federal student loan borrower is enrolled in a U.S. Department of Education income-driven repayment (IDR) plan, S. Private student loans are not eligible for the payments, according to the Department of Education. The higher the income, the higher the student loan payments. The lower the income, the lower the payments.

The borrower’s most recent tax return is typically used to determine the income used to calculate the student loan payment. If the borrower is married to a wage earner and they file their taxes jointly, the loan servicer computes the payment based on the combined income of their household.

Pay As You Earn (PAYE) and Income-Based Repayment (IBR) are two student loan repayment plans in particular that permit borrowers to file their taxes separately.

These plans base the income-driven payment solely on the borrower’s income, not the income of their spouse. Why wouldn’t they simply file separately to minimize their payments, you might be asking.

Well, the student loan payment is only one component. The way a couple files their taxes can also have an impact on the total amount of taxes paid for the household.

Tax differences between filing separately versus jointly

When couples file separately, they typically end up owing more in taxes as a household. This is primarily because each spouse’s income falls into different tax brackets when they file as individuals.

Additionally, when filing separately, some tax deductions and credits are lost or are more difficult to obtain, particularly for couples with children. Let’s compare the estimated taxes that were paid in two different scenarios.

Note these are general scenarios with rough estimates. To address your unique financial situation, you must speak with a tax expert.

Scenario 1: Spousal incomes are vastly different

Let’s say a dentist is married to a social worker. The dentist earns $300,000, and the social worker earns $50,000. They have a joint adjusted gross income (AGI) of $350,000.

If they file jointly, they should expect to pay about $66,018 in federal income taxes based on the 2021 tax brackets. The dentist will owe about $75,152 on their tax return, while the social worker will owe about $4,295 if they each file a separate federal income tax return. Together, this totals $79,447.

In comparison to married couples filing jointly, filing separately could result in a household tax bill of over $13,000. In this instance, using joint income has tax advantages.

Scenario 2: Spouses have the same income

Consider a couple of pharmacists and nurse practitioners who earn $110,000 each.

If they filed their taxes jointly, it is predicted that they would each pay about $34,818. They’d each owe roughly $17,409 if they filed separately. Therefore, regardless of how they filed their taxes, their household’s federal tax liability or tax bill would be the same.

Use our calculator to get an idea of your taxes:

Married Filing Separate vs. Married Filing Joint Calculator *Note: Assumes standard deduction Primary Borrower AGI $ Spouse AGI $

(Keep in mind that this is only an estimate and should not be taken as your actual taxes.) To obtain figures for your specific situation, speak with a tax expert. ).

Other important side effects of filing taxes separately

When deciding whether a couple should file jointly or separately, tax brackets are only one factor to consider.

Couples may miss out on certain other tax breaks and credits. By filing separately, they may also miss out on opportunities for subsidies through the Health Insurance Marketplace.

Married filing separately disqualifies you from receiving a premium tax credit for healthcare

People with incomes below certain thresholds can access affordable healthcare coverage through the Health Insurance Marketplace.

For example, your household income must be between 100% and 400% of the federal poverty level (FPL) to qualify for a premium tax credit which lowers your insurance costs.

Premiums and eligibility for subsidized programs like Medicaid or the Children’s Health Insurance Program (CHIP) depend on your state of residence and household size as well.

According to Healthcare. gov, married couples can sign up for a Marketplace healthcare plan jointly even if they file separately. Nevertheless, if you file your taxes separately, you won’t be able to take advantage of the premium tax credit or other savings that would lower your monthly insurance payment.

However, if you intend to file as the head of your household and meet certain requirements (e g. , living apart), or if you’ve experienced domestic violence, abuse, or spousal abandonment.

Low- and moderate-income households who would otherwise be eligible for health insurance subsidies should seriously consider this penalty for filing separately.

According to data from the Centers for Medicare and Medicaid Services, 86% of Marketplace enrollees received advance payments of the premium tax credit (APTC) in February 2021. The average monthly APTC was $485.67, but this number varied widely by state. That’s an average annual benefit of roughly $5,820.

Considering the cost of healthcare in the U. S. , you run the risk of passing up substantial savings that could help your family in multiple ways.

Tax deductions and credits affected by married filing separately

The Child Dependent Care Tax Credit (CDCTC), which should not be confused with the Child Tax Credit (CTC), is the most pertinent credit. Additionally, the student loan interest deduction goes away.

If a couple files separately, they may incur additional taxes totaling $2,000 to $3,000 as a result of those two items.

The ability to deduct Traditional IRA contributions and qualify for Roth IRA contributions both significantly decrease with separate tax filing. So, the higher taxes and removal of other benefits could offset the lower income-based student loan payments.

The IRS website or a tax expert should be consulted for the most up-to-date information on tax laws in order to understand the differences between filing jointly and separately.

Which filing status will save you the most money paying back student loans?

Married borrowers shouldn’t file separately if both spouses have federal student loan debt that is eligible for IDR. There are a few exceptions, but married couples with only one student loan borrower typically make this choice.

The formula we employ is based on what’s best for the household as a whole, not just one spouse. To determine which approach is preferable, we must examine all household taxes and student loan repayment schedules.

In general, we know that if couples file separately, their student loan payments will be lower, but they’ll likely pay more taxes as a household.

Here’s the equation:

Savings on student loan payments when married filing separately (MFS) results in an increase in taxes

Married individuals filing separately will result in the greatest household savings after taxes if the outcome is positive. If it’s bad, filing jointly will result in the most financial savings for the household.

Keep in mind that households that qualify for subsidized coverage through the Health Insurance Marketplace go through an additional layer of decision-making. The key here is to evaluate what will most benefit your household holistically.

The best IDR plans to keep payments low when filing separately: IBR and PAYE

The person with the student loan can file taxes separately using both IBR and PAYE. In this manner, loan payments are computed based solely on their income.

Additionally, the 10-year standard payment is the maximum for both IBR and PAYE. This means that the fixed payment that would pay off the loan in full in 10 years, similar to a 10-year mortgage payment, will never be exceeded when the monthly payments are calculated based on income.

A “tax bomb” is also included in each plan, though it has been suspended until December 31, 2025. As a result, the federal government will issue a 1099 tax form with the forgiven amount even though the remaining loan balance is forgiven. The forgiven balance will be included as income on the tax return for that year, and the borrower may be subject to significant tax liabilities as a result. It’s definitely something taxpayers should be mindful of.

For those who were “new borrowers” on or after July 1, 2014, both plans are 20-year programs with payments based on 10% of discretionary income.

Before October 1, 2007, borrowers who took out their first student loan were typically ineligible for PAYE. IBR is their best choice if they still want to file taxes separately.

A quick word about Revised Pay As You Earn (REPAYE). Regardless of how a couple files their taxes, REPAYE will take the spouse’s income into account when calculating student loan payments.

Therefore, in order to reduce their student loan payments, those on the REPAYE payment plan shouldn’t file their taxes separately. If someone isn’t qualified for the PAYE plan, it might still be worth comparing.

Borrowers eligible for PAYE: Will filing taxes separately or jointly save you the most money?

Here are two situations where one spouse is the breadwinner and has student loan debt, as well as one where the spouse without student loan debt is the breadwinner.

When filing jointly could make sense

Jamie and Adam got married this year. Jamie is a psychologist with a 6 and a debt of $250,000. 5% interest rate. She has been on PAYE for five years and earns $125,000 from her own practice. Adam works as a teacher and earns $40,000. He has no debt from college. Both anticipate their incomes growing at 3%.

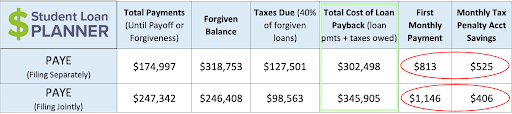

*Assumptions: Tax bomb savings growth rate is 5% per year. Tax rate at time of loan forgiveness is 40%.

The calculations show that if Jamie and Adam filed their taxes separately for the next 15 years while Jamie completes his PAYE period, there would be an estimated $43,000 in savings on the student loans as a whole. The average annual savings on student loan payments would be about $2,866.

Jamie will have to pay $1,338 per month ($813 in student loan payments plus $525 in tax bomb savings) if she files separately this year compared to $1,552 ($1,146 + $406) if she files jointly. The annual benefit of filing their taxes separately is only $2,568.

They filed their taxes both ways, and filing separately is anticipated to cost them $3,000 more in taxes.

Using the equation:

($2,568 in savings from student loan payments MFS) – ($3,000 in additional taxes MFS) = -$432

The best way for Jamie and Adam to save money this year is to file their taxes jointly. Although they can choose their tax filing status again each year, it appears from the numbers that filing jointly will result in the greatest tax savings for them.

When filing separately could make sense

Now let’s switch it. Consider Amber, a chiropractor who earns $40,000 per year while working part-time and has a debt of $250,000. She’s been on PAYE for five years as well. Her husband George works in IT, making $125,000.

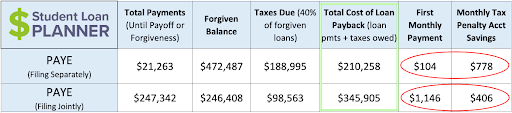

*Assumptions: Tax bomb savings growth rate is 5% per year. Tax rate at time of loan forgiveness is 40%.

It should be noted that while Jamie and Adam filed their PAYE jointly, they did so separately because the breadwinner in that situation was not the one who had student loan debt.

Now, if they filed separately, we’d be looking at a difference of over $135,000 in savings to pay back the student loans. Over a period of 15 years, that amounts to about $9,000 per year. Amber and George would pay $3,000 more in taxes if they filed separately, just like Jamie and Adam.

($9,000 in savings from student loan payments MFS) minus ($3,000 more in taxes MFS) equals $6,000

To save the most money after taxes as a family, Amber and George should file their taxes separately.

The outcome of this equation can fluctuate as income varies from year to year. The good news is that if they’re on PAYE, they can compare taxes to student loan payments and choose how to file their taxes each year. Each year, they can and ought to decide anew on their tax filing status.

In conclusion, it seems that filing separately will be more advantageous if the spouse with student loans earns less money. Regardless of who has the loans, the couple pays the same tax penalty, but the cost of repaying the loans is significantly lower.

Borrowers not eligible for PAYE: REPAYE married filing jointly vs. IBR married filing separately

It gets a little trickier if someone took out loans prior to October 1, 2007, disqualifying them from PAYE. They would have two primary ways to pay back their IDR loans: IBR and REPAYE.

No matter when you took out your loans, REPAYE is unquestionably the better choice for undergraduate loan borrowers because it has a 20-year term. However, graduate borrowers must wait 25 years under REPAYE in order to be eligible for student loan forgiveness, which is the same time period that borrowers who took out their loans prior to October 2007 must wait under IBR.

IBR plan payments are 15% of income, and you can file separately so that only your income is taken into account. REPAYE is based on 10% of income, but it is irrelevant how you file your taxes. It will take the spouse’s income into consideration either way.

Let’s take a look using the same scenarios from PAYE filing separately versus jointly to see if someone would save more by paying only 15% of their income or 10% of the household’s income.

When REPAYE could make sense

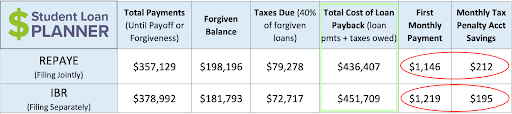

Let’s first go back to Jamie, who owes $250,000 as of 6 o’clock. 5% and is earning $125,000. We’ll pretend she’s not eligible for PAYE now.

She has been on REPAYE for five years, and she recently wed Adam, who makes $40,000 per year.

*Assumptions: Tax bomb savings growth rate is 5% per year. Tax rate at time of loan forgiveness is 40%.

This is a no-brainer REPAYE situation. The payments are lower, and it is anticipated that loan repayment will cost less overall. Since there are no savings from filing separately for taxes and student loan payments, it is unnecessary to do so.

When IBR could make sense

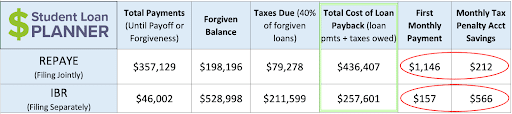

Let’s examine the situation with Amber and George in reverse now. Keep in mind that Amber earns $40,000 per year working part-time and owes $250,000 in loans at age 6. 5%, while George makes $125,000. Now we’ll say that she isn’t eligible for PAYE either.

*Assumptions: Tax bomb savings growth rate is 5% per year. Tax rate at time of loan forgiveness is 40%.

It’s amazing the reversal. This is a no-brainer IBR filing separately scenario. As she completes her IBR, filing separately will save them more than $178,000 over 20 years. That’s about $8,900 per year. They could save $5,900 this year (almost $500 per month after taxes) if they paid only $3,000 more in taxes.

In the event that a borrower changes repayment plans, accrued interest will be capitalized into principal. That means your loan could grow faster. There is no harm in selecting your tax filing status each year with PAYE. However, when it comes to REPAYE and IBR, it’s crucial to project as accurately as you can and stick to the plan unless something unexpected occurs.

Other ideas to save money paying back your student loans when filing separately

If a married couple’s income is relatively similar, they will pay less in taxes when filing separately. If the household files separately, the greater the tax burden will typically be the greater the income gap.

Any and all deductions from Adjusted Gross Income (AGI) could change the person with student loans’ side of the income equation if they have a higher income.

For illustration, suppose Julie makes $70,000 and has no student loans, compared to Doug’s $100,000 and $200,000 in debt. To receive the maximum employer matching contribution to their retirement plan, they both contribute 6% of their income. They still have an additional $1,000 per month to invest in their retirement. Doug is on PAYE, and they’re filing their taxes separately.

Instead of dividing the $1,000 equally, Doug could only invest the $12,000 per year into his retirement. That would reduce his AGI from $100,000 to $88,000. Julie’s would stay at $70,000.

Doug can now reduce his AGI to $81,000 by contributing $7,000 to his HSA. Their individual incomes are now only $11,000 apart rather than $30,000, which should result in a decrease in the additional taxes associated with filing separately.

Additionally, Doug would profit from decreased student loan payments the following year. Remember that PAYE is based on 10% of discretionary income. Therefore, if Doug’s income is reduced by $19,000, his annual student loan payment will be $1,900 less. Less taxes, lower student loan payments, and awesome extra savings all add up to a win-win situation!

Married filing separately with student loans in a community property state

If a resident of a community property state has student loans, they may be able to reduce their repayment costs even further by filing their taxes separately.

Nine states have different laws governing who is responsible for whose income. California, Idaho, Louisiana, New Mexico, Nevada, Texas, Washington, and Wisconsin are among them.

The gist of it is any salary, wages or other pay received for services performed by either or both spouses while married basically belongs to both spouses equally. There are other nuances that I’ll spare you, but feel free to read this from the IRS website if you’re so inclined.

Couples who reside in a state where community property exists benefit from the fact that, should they choose to file separately, this community income would be split equally between the spouses.

To put it another way, if a doctor earned $300,000 and her psychologist spouse earned $100,000, they would each claim $200,000 on their income if they filed a separate tax return, rather than their individually earned income if it were considered community income.

Usually, this means that a couple would pay less in taxes by filing separately than they would in a state where common law is followed.

If the doctor I mentioned had student loans and applied for Public Service Loan Forgiveness (PSLF), but their PsyD spouse didn’t have loans, then this would be really appealing. This “breadwinner loophole” would lower the doctor’s income dramatically. And that would greatly reduce their overall cost of the PSLF program.

If you’re curious to learn more, listen to episode six of the Student Loan Planner® Podcast, where we discuss the “breadwinner loophole” in greater detail.

Should you file taxes separately on IBR or PAYE if you both have student loans?

It’s difficult to find the correct explanation for how this works, so this is a question that comes up frequently.

Filing taxes separately when both spouses have student loan debt and are on an IDR plan results in very little student loan reduction and typically results in the couple paying more taxes than they would have otherwise.

Suppose they both file their taxes jointly and are on PAYE. One spouse earns $150,000 while the other earns $50,000, constituting 75% and 25% of the household income respectively.

Based on the $200,000 household income, the loan servicer will determine the household payment. 75% of that monthly payment will be used to pay off the $150,000 earner’s loans. The remaining 25% will fund the $50,000 earner’s loans.

This couple might have slightly lower payments if they filed taxes separately and verified their income using their individual tax returns due to an additional deduction from their discretionary income. However, it typically falls short of paying the additional taxes.

More nuance exists here, but I’ll leave it for now. Bottom line: I typically err on the side of filing jointly if the difference is small.

How to save the most money paying back student loans

When it comes to repaying six-figure student loan debt, a lot of money is on the line. It makes sense for a professional to evaluate your particular situation while taking into account factors like family size, career path, household income, repayment amount, forgiveness programs, and financial goals.

This all-encompassing strategy will make sure you’re saving the most money while also taking into account other factors, such as whether you qualify for Health Insurance Marketplace savings.

Our team has assisted thousands of clients in developing effective plans to deal with their student debt. We’d love to assist you in achieving financial independence by helping you feel secure about managing your student loans.

You’ll know the strategy for repaying your loans that will save you the most money by the end of a consultation with us. You will also acquire the clarity necessary for you to feel in control.

Disclaimer: This information is provided solely for educational purposes and is not intended to be tax advice. We strongly advise consulting a tax expert for all tax-related matters. This is particularly valid when deciding whether to file jointly or separately.

FAQ

Can married filing separately take student loan interest?

If you file a separate married return or are claimed as a dependent on another person’s tax return, you cannot claim the student loan interest deduction.

Does my husband’s income affect student loan repayment?

Payments must be calculated based on a combined household income, which includes your spouse’s income if you’re married, in accordance with the laws and regulations governing income-driven repayment (IDR) plans.

What is the student loan forgiveness income limit for married filing separately?

If you filed jointly, both spouses would be qualified if your combined income was under $250,000. Both spouses will be qualified if you are married but did not file jointly and your individual income is less than $125,000 annually.

When you get married does your spouse take on your student loan debt?

For the record, your spouse will not have to follow the same repayment plan for their federal student loans as you do. Here are some examples. Say you and your spouse file a joint income tax return. You don’t have children and reside in one of the 48 contiguous states.