Pools are a popular backyard feature for many California residents With sunny weather year-round, pools allow families to take a refreshing dip right in their own backyard. However, pools come at a cost and financing is often needed to make this backyard addition possible. In this article, we’ll explore all you need to know about getting loans for pools in California

Overview of Pool Loans in California

Installing a pool in your backyard can cost anywhere from $25,000 to $80,000 depending on the type, size, and materials. With such a large price tag, most homeowners in California rely on financing to pay for their pool installation

The most common types of loans used for financing pools in California are:

- Home Equity Loans – Allow you to borrow against the equity in your home.

- Home Equity Lines of Credit (HELOCs) – Revolving line of credit secured by your home’s equity.

- Cash-Out Refinance – Allows you to tap equity by refinancing your mortgage.

- FHA 203k Loan – FHA-insured loan that covers renovations like pool installations.

- Personal Loans – Unsecured loans not backed by collateral like your home.

Interest rates, terms, and eligibility requirements can vary significantly between these loan types. Be sure to explore all your options to find the most affordable pool loan for your needs and budget.

What is the Average Cost to Install a Pool in California?

If you’re considering installing a pool, the first thing you’ll want to know is how much it will cost. Pool installation costs can vary dramatically based on the size, type, and features included.

The average cost to install a pool in California ranges from:

- Above-ground pool – $3,000 to $5,000

- Small inground pool – $25,000 to $35,000

- Medium inground pool – $35,000 to $50,000

- Large inground pool with added features – $50,000 to $80,000+

Keep in mind that the pool itself is only part of the total project cost. Other expenses like fencing, landscaping and added features can add $5000 to $20,000+ to your total budget. Get quotes from several pool contractors to compare pricing.

What Credit Score is Needed for Pool Loans?

One of the most important factors lenders consider when approving financing is your credit score. In general, you’ll need good to excellent credit for most pool loans. Here are some credit score guidelines:

- Home Equity Loan – 660+ credit score

- HELOC – 700+ credit score

- Cash-Out Refinance – 620+ credit score

- FHA 203k Loan – 580+ credit score

- Personal Loan – 640+ credit score

The higher your score, the better loan terms and interest rates you can qualify for. Taking some time to improve your credit before applying can pay off.

Comparing Pool Loan Options in California

With so many financing options to choose from, it can be tricky deciding which route to take. Here’s an overview comparing some of the most common pool loan types in California:

Home Equity Loan

- Pros: Low interest rates, fixed payments, can borrow large amounts

- Cons: Home is collateral, closing costs, home appraisal required

HELOC

- Pros: Interest may be tax deductible, flexible borrowing

- Cons: Variable rates, home is collateral

Cash-Out Refinance

- Pros: Low rates, tap home equity, fixed payments

- Cons: Closing costs, home appraisal required

FHA 203k Loan

- Pros: Renovation costs rolled into mortgage, low down payment

- Cons: Must be primary residence, maximum loan limits

Personal Loan

- Pros: Fast funding, no home collateral required

- Cons: Higher interest rates, lower max loan amounts

Be sure to talk to a loan officer to discuss your specific scenario and loan qualifications.

What Interest Rates Can You Expect for Pool Loans?

Interest rates have a significant impact on your total loan cost. Rates for pool loans in California can range from around 3% for a home equity loan or HELOC up to 17% or more for some personal loans.

Here are some average interest rates as of 2022:

- Home Equity Loan – 5% to 8%

- HELOC – 6% to 9%

- Cash-Out Refinance – 4% to 6%

- FHA 203k Loan – Around 5%

- Personal Loan for Pools – 8% to 17%

Rates you qualify for will depend on your credit score, debt-to-income ratio, loan amount, and other factors. Shopping around with multiple lenders can help you secure the most competitive rate.

What Loan Terms Should You Choose?

In addition to interest rate, the loan repayment term is an important consideration. Longer terms come with lower monthly payments, while shorter terms mean you pay less interest over the life of the loan.

Average pool loan terms range from:

- 3-year terms – Higher monthly payments but total interest paid is lower.

- 5-year terms – Allows more time to repay for lower monthly costs.

- 10 to 15-year terms – Keeps payments affordable by extending repayment period.

- HELOCs – Typically 10 to 20-year draw period and separate repayment term.

Think about how quickly you want to pay off your pool loan and what monthly payment fits your budget when choosing a term.

Tips for Getting Approved for a Pool Loan

If you’re hoping to get financing for an inground pool or backyard remodel, there are several steps you can take to improve your chances of approval:

-

Have a good credit score – Aim for a score of 700 or higher. Pay down debts and check for errors on your credit reports.

-

Lower your debt-to-income ratio – Lenders look at your current debts in relation to income. Paying down balances can help.

-

Make a larger down payment – For home equity loans, a 20% down payment is ideal. For personal loans, paying a portion in cash can allow you to borrow less.

-

Use home equity – Loans backed by equity in your home often have lower rates and more flexible terms.

-

Compare lenders – Check rates from banks, credit unions, online lenders, and contractors to find the best financing option.

Starting the loan process with a strong financial foundation will give you the best chance at approval.

Is Pool Loan Interest Tax Deductible in California?

Unfortunately, pool loan interest is generally not tax deductible in California. The one exception is with a home equity loan or HELOC, where the interest may qualify for a tax deduction if you itemize deductions on your tax return.

However, improvements like installing a pool that increase your home’s value can reduce capital gains tax when you eventually sell the home. Consult a tax professional to understand what tax benefits may apply to your specific situation.

How Much Can You Borrow for a Pool with Different Loan Types?

The amount you can qualify to borrow for your pool project depends on several factors, including your income, debts, credit score and equity. Here are some general loan amount guidelines:

Home Equity Loan

- Up to 85% of your home equity

HELOC

- Up to 85% of your home equity

Cash-Out Refinance

- Up to 80% of your home’s value

FHA 203k Loan

- Up to $35,000 – $60,000 based on location

Personal Loan

- $1,000 – $100,000 based on creditworthiness

To receive maximum financing, you’ll need significant equity in your home for secured loans or excellent credit for personal loans.

Are Pool Loans a Good Investment in California?

While a pool can provide years of enjoyment, it’s debatable whether it offers a good return on investment in California in terms of increasing property value. Pools are common in California, so they don’t necessarily set your home apart.

Smaller, more basic above-ground or semi-inground pools may recoup 50% to 75% of their cost. More elaborate inground pools and renovations likely won’t increase your home’s value enough to fully offset the expense.

The best reason to install a pool is if you and your family will get great use and enjoyment out of it for years to come. Just don’t expect it to pay for itself when you sell.

Finding the Best Pool Loan Lenders in California

The lender you choose can significantly impact your loan terms, fees, and overall experience. Here are some places to look for the best pool loan options:

-

Local Banks and Credit Unions – May offer competitive rates and personalized service.

-

Online Lenders – Can provide fast approvals and financing from the convenience of home.

-

Pool Contractors – Some pool companies partner with lenders to offer financing plans.

-

Mortgage Lenders – Can assist with home equity an

Why choose Acorn Finance for comparing personal loans in California?

Dive into the pool loan shopping process at Acorn Finance. Instead of treading water, swim laps as you streamline the loan shopping process. At Acorn, you can check home improvement loan rates in seconds with no credit score impact. Our top national lending partners are ready to keep you afloat by providing some of the best personal loan offers. Check offers up to $100,000, depending on credit score, and receive funding in as little as 1-2 business days, although funding times can vary.

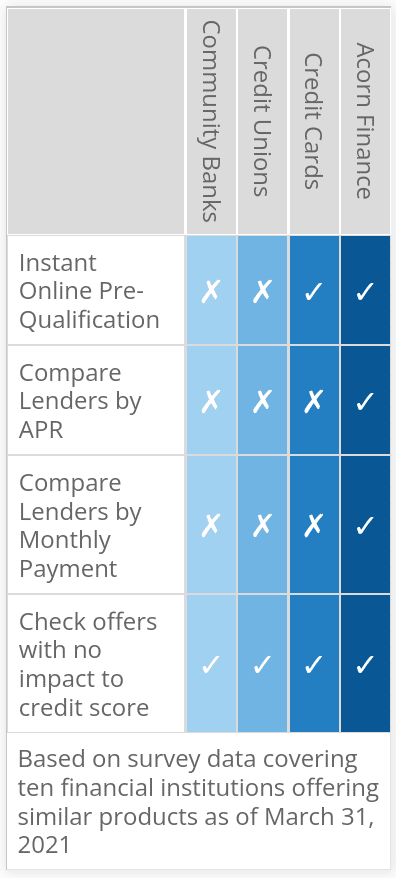

How Does Acorn Finance Compare?

The 3 Best Ways To Finance Your Inground Pool | California Pools & Landscape

FAQ

What credit score do I need for a pool loan?

How long is a typical pool loan?

Is it a good idea to finance a pool?

What are the different types of pool financing options?

Here are some of the most common pool financing options: Personal loan: People often use this all-purpose loan to finance a pool. Personal loans are generally unsecured, so the rates may be higher than for a secured loan like a home equity loan. But on the flipside, it’s usually a more streamlined application process.

What is the best pool financing option?

The best pool financing option depends on the estimated cost as well as your home equity, credit and income. Why Consider This Option: SoFi offers a wide variety of loan amounts, flexible repayment terms, and special features like free financial advising. 1. Personal loans

Can a home equity loan pay for a pool?

If you’re comfortable using your home as collateral for the loan, home equity loans can be a low-rate financing option. Here’s what you can expect if you use a home equity loan to pay for a pool: Maximum loan amount: 80% to 90% of your home’s value, minus what you owe on the mortgage. Repayment term: Up to 30 years.

What are the different types of pool loans?

There are generally three common types of pool loans: personal loans, home equity loans or home equity lines of credit (HELOCs). Many homeowners take out personal loans because they are relatively easy to obtain. However, some prefer to use their home’s equity as collateral for a loan to secure lower rates.