Note from the Editor: This article’s content is solely based on the author’s opinions and suggestions. It might not have received approval from any of our network partners through reviews, commissions, or other means.

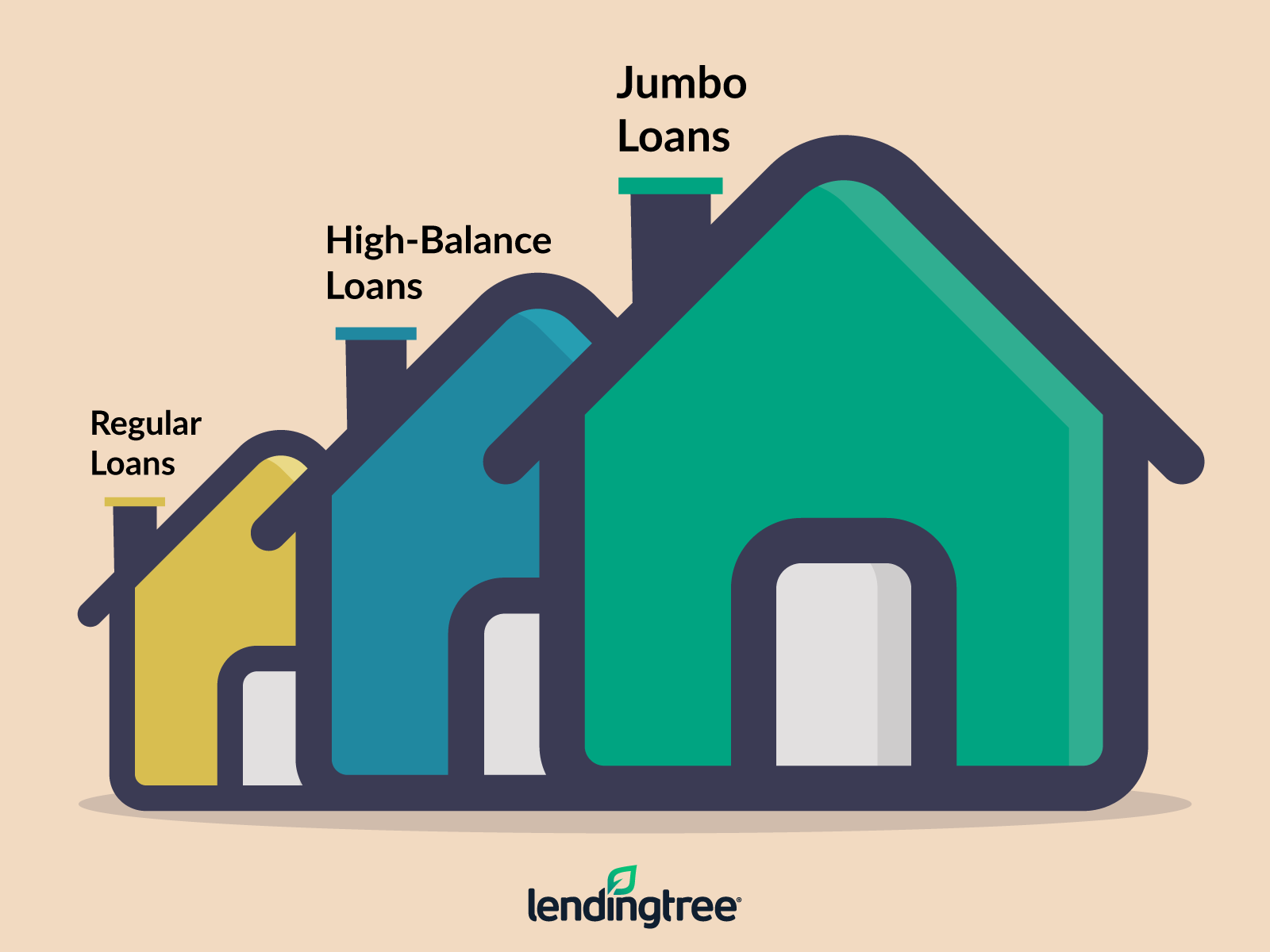

Jumbo loans are even more extreme and give you potentially much more borrowing power if you meet strict criteria. High-balance loans are mortgages that give you more borrowing power. High-balance and jumbo loans can be conventional or non-conventional, which means that they can be backed by private financial institutions like banks or governmental organizations like the Veterans Administration.

How Does LendingTree Get Paid?

Companies on this website pay LendingTree, and this pay may have an impact on where and how offers appear on this website (such as the order). Not all lenders, savings products, or loan options are offered by LendingTree in the market.

Note from the Editor: This article’s content is solely based on the author’s opinions and suggestions. It might not have received approval from any of our network partners through reviews, commissions, or other means.

Jumbo loans are even more extreme and give you potentially much more borrowing power if you meet strict criteria. High-balance loans are mortgages that give you more borrowing power. High-balance and jumbo loans can be conventional or non-conventional, which means that they can be backed by private financial institutions like banks or governmental organizations like the Veterans Administration.

How large loans are defined

For loan amounts, the Federal Housing Finance Agency (FHFA) establishes both national and regional standards. By doing this, a line is drawn in the sand that is altered yearly. You can see the current conforming loan limit here. Larger loans are considered to be riskier by the government, which discourages lenders and homebuyers from making excessive loans or taking on excessive debt.

If you are in a high-cost location, such as the Bay Area, you may have trouble finding any home with a selling price under the standard, national conforming loan limit. Instead, if the median home values in your area are at least 115% higher than the national median, you’ll have a higher local conforming limit and you could be eligible for a high-balance loan. Here’s a map of conforming loan limits by county.

High-balance loans are regarded as conforming loans because they still adhere to local limits. But if you want to borrow more money—more than 150% of the national maximum—you’ll need to consider a jumbo loan.

You are permitted to borrow more with jumbo mortgages than the national conforming limit and the high-balance limit in your region. But because they don’t meet either standard, they’re non-conforming loans.

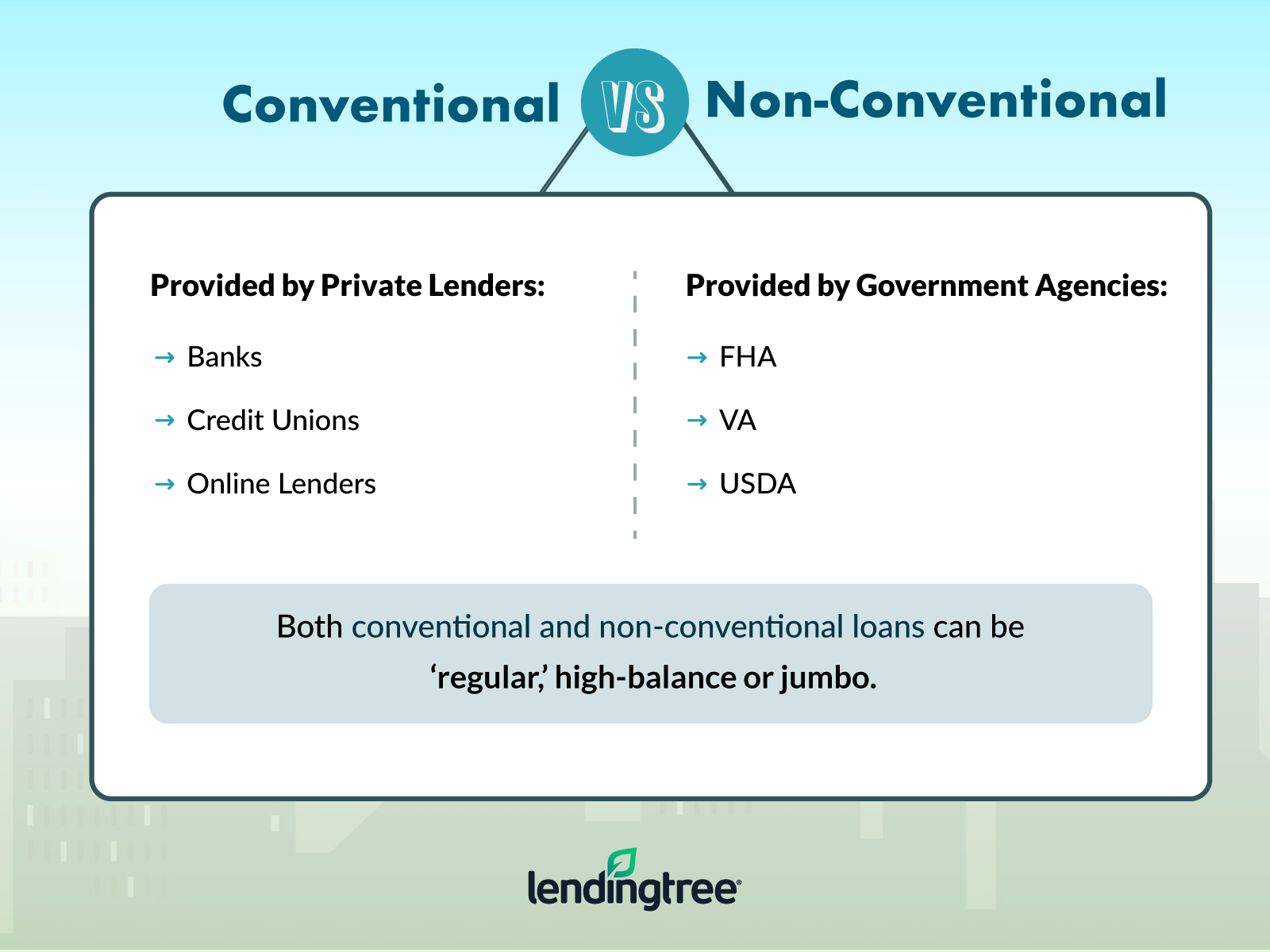

However, they can still be “conventional” or “non-conventional”; both government and private financial institutions offer jumbo loans. Usually, the requirements are more stringent, requiring larger down payments and higher minimum credit scores. The largest personal, residential mortgage available is a jumbo loan.

A conventional lender might allow you to obtain any loan type, including “regular,” high-balance, or jumbo. Mortgages backed by “regular” lenders, or private, non-government organizations, like banks and credit unions, are referred to as conventional loans.

Conversely, government agencies back non-conventional loans. Examples include:

Choosing the right loan for you

In order to prevent homebuyers from taking on more than they can handle and possibly losing their homes to foreclosure, the conforming loan limit is established as a national standard. But homebuying isn’t a one-size-fits-all type of thing. Jumbo loans are available for even more expensive homes, and high-balance mortgages are available to help finance homes in high-cost regions of the nation.

Depending on your creditworthiness, LendingTree will match you with up to five mortgage lenders, whether you’re looking for a conventional or non-conventional loan.

Today’s Mortgage Rates APR as low as

Learn about available bad credit home loans. Conventional and government-backed programs make it possible to obtain a mortgage even with poor credit.

FHA loans are the best option for homebuyers with low down payments or bad credit. Find out the nationwide FHA loan limits for 2022.

Many military borrowers with full VA entitlement are exempt from VA loan limits; however, if you still have eligibility, VA loan limits may still be applicable.

FAQ

What is the difference between conforming and jumbo loans?

Jumbo loans offer a limit that is significantly higher than that of conforming loans, living up to their name. Jumbo loans are made for high earners who want to buy more expensive properties, whereas conforming loans are made for the average homebuyer.

Why is a conforming loan better than a jumbo loan?

Jumbo mortgage rates have historically been higher than conforming loan rates because they are not backed by the government. The lender assumes a little bit more risk because Fannie Mae and Freddie Mac don’t buy these loans.

Is a jumbo loan conforming or non-conforming?

Nonconforming mortgage loans are those that don’t adhere to the guidelines for a conforming loan. Jumbo loans are nonconforming loans that are larger than the area’s maximum loan limit; however, loans may also be nonconforming for reasons other than loan size.

What is the difference between conventional and jumbo?

Do Jumbo Loans Differ From Conventional Loans? Jumbo loans are typically used for large, luxurious homes or properties in competitive markets. The Federal Housing Finance Agency’s (FHFA) limits for conventional loans acquired by Fannie Mae or Freddie Mac are exceeded by jumbo loans.