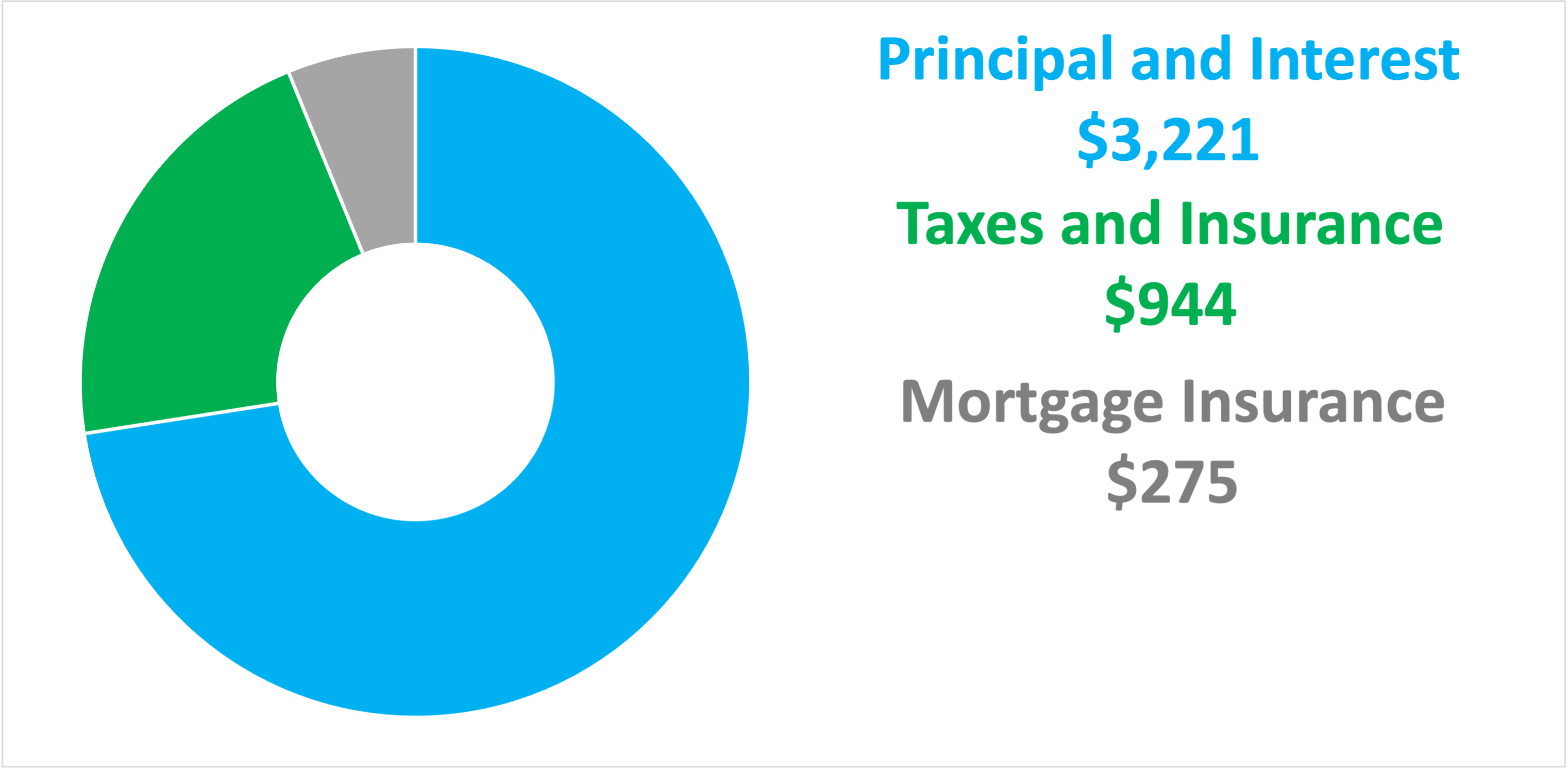

Your mortgage payment for a $667k house will be $4,440. This is predicated on a 10% down payment ($67k) and a 5% interest rate. This includes anticipated home loan insurance premiums, hazard insurance, and property taxes.

How Much Income Do I Need for a 600k Mortgage?

To be able to pay a $600,000 mortgage, you must earn $222,019 per year. We base the amount of monthly income required for a $600,000 mortgage on a payment that is 24% of that amount. In your case, your monthly income should be about $18,502.

You might want to adopt a more cautious or assertive approach. In our how much house can I afford calculator, you can modify this.

Find out how much house I can afford with the help of this fun quiz. It only takes a few minutes, and at the conclusion, you can look over a personalized evaluation.

We’ll make sure you aren’t overextending your budget. After you purchase a home, you will also have a comfortable amount in your bank account.

Don’t Overextend Your Budget

When you purchase a more expensive home, banks and real estate brokers profit more. The majority of the time, banks will pre-approve you for the maximum amount you are able to pay. Your budget will be severely stretched before you even begin looking at houses.

Make sure you are at ease with your monthly payment and the amount of money you will have in your bank account once you have purchased your home.

Before you apply for a mortgage loan, be sure to compare mortgage rates. In the initial years of your mortgage, comparing three lenders could result in thousands of dollars in savings. You can compare mortgage rates on Bundle.

On Bundle, you can view current mortgage rates as well as how they have changed over the past few years. For 15-year and 30-year mortgage products, we continuously track mortgage rates, trends, and discount points.

Bundle is a licensed mortgage broker. NMLS# 1927373.