Comprehending the typical spending patterns of present retirees can assist in guiding your retirement savings strategy and prevent debt accumulation. Everything you need to know about the most recent trends in retirement spending and budgeting advice to get ready for your golden years will be covered in our guide.

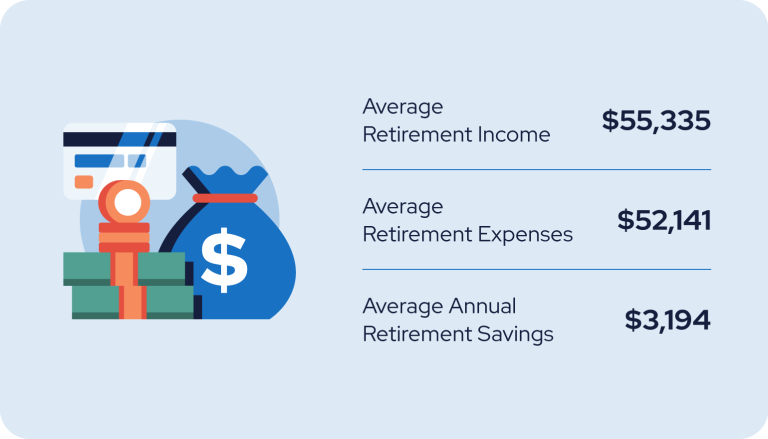

The Bureau of Labor Statistics reports that, on average, individuals 65 and older spent $52,141 in 2021, which is approximately $14,000 less than the $66,928 average spent by the general population. This implies that the amount you spend on retirement expenses after a year of retirement equals 80% of your annual retirement income.

It will be simpler for you to plan for your own retirement the more you know about the spending patterns of today’s retirees. We’ll examine the typical retirement spending patterns of current retirees, their biggest outlays, and provide practical budgeting and savings advice to help guide your savings plan.

Retirement is a time to relax and enjoy the fruits of your labor, but it’s also important to be financially prepared.

So, how much do you need to live comfortably in retirement?

The answer depends on several factors, including your lifestyle, location, and health care costs. However, according to the Bureau of Labor Statistics (BLS), the average income of someone 65 and older in 2021 was $55,335, and the average expenses were $52,141, or $4,345 per month.

This means that the average retired person lives on about $4,345 per month. However, this is just an average, and your individual needs may be higher or lower.

Factors that Affect Retirement Spending

Several factors can affect how much you need to live comfortably in retirement, including:

- Lifestyle: If you have a high-maintenance lifestyle, you will need more money than someone who lives more modestly.

- Location: The cost of living varies significantly from one location to another. For example, living in a major city will be more expensive than living in a rural area.

- Health care costs: Health care costs can be a significant expense in retirement. If you have health problems, you will need to factor in the cost of medication, doctor visits, and other medical expenses.

- Debt: If you have debt, you will need to make monthly payments. This will reduce the amount of money you have available for other expenses.

How to Budget for Retirement

Once you understand the factors that affect your retirement spending, you can start to create a budget. Here are some tips:

- Track your expenses: The first step is to track your expenses for a few months. This will give you a good idea of how much you spend each month.

- Create a budget: Once you know how much you spend, you can create a budget that allocates your money to different categories, such as housing, food, transportation, and healthcare.

- Save for retirement: The best way to ensure you have enough money in retirement is to save early and often. There are many different retirement savings options available, so choose one that fits your needs and goals.

- Consider your Social Security benefits: Social Security benefits can provide a significant source of income in retirement. Be sure to factor in your estimated benefits when creating your budget.

- Plan for unexpected expenses: Unexpected expenses can happen at any time, so it’s important to have an emergency fund. Aim to save at least three to six months’ worth of living expenses.

Tips for Living on a Fixed Income in Retirement

If you’re retired and living on a fixed income, there are a few things you can do to save money and make your money last longer. Here are a few tips:

- Downsize your home: If you have a large home, consider downsizing to a smaller, more affordable one. This will save you money on your mortgage or rent, property taxes, and utilities.

- Cook at home: Eating out can be expensive, so try to cook more meals at home. This will save you money and allow you to control the ingredients in your food.

- Shop around for deals: There are many ways to save money on groceries, clothing, and other expenses. Shop around for the best deals and take advantage of sales and coupons.

- Use public transportation: If you live in a city with good public transportation, consider using it instead of driving. This will save you money on gas, insurance, and parking.

- Get a part-time job: If you’re healthy and able, consider getting a part-time job to supplement your income. This can help you pay for unexpected expenses or save for future travel or other expenses.

Retirement can be a wonderful time of life, but it’s important to be financially prepared. By understanding the factors that affect your retirement spending and creating a budget, you can ensure you have enough money to live comfortably in your golden years.

Frequently Asked Questions

How much does the average retired person spend per month?

The average retired person spends about $4,345 per month. However, this is just an average, and your individual needs may be higher or lower.

What are the biggest expenses in retirement?

The biggest expenses in retirement are typically housing, healthcare, and food.

How can I save for retirement?

There are many different ways to save for retirement, including contributing to an employer-sponsored retirement plan, such as a 401(k) or 403(b), or opening an individual retirement account (IRA).

What are some tips for living on a fixed income in retirement?

Some tips for living on a fixed income in retirement include downsizing your home, cooking at home, shopping around for deals, using public transportation, and getting a part-time job.

Additional Resources

- Social Security Administration: https://www.ssa.gov/

- Medicare: https://www.medicare.gov/

- National Council on Aging: https://www.ncoa.org/

- AARP: https://www.aarp.org/

Never Miss Important News or Updates with Our Weekly Newsletter

Check out our free weekly newsletter for strategies for a successful retirement, hard-to-find information, and money-saving advice. Name Email.

Typical Spending in Retirement

People 65 and older typically only spend around $3,000 less annually than their total income.

- In 2021, the average income for those 65 and older was $55,335 per person.

- In 2021, the average annual cost of living for individuals 65 and over was $52,141.

- In 202022, %2048% of retirees surveyed said they spent less than $2,000 per month.

- Among retirees, one in three said they spent between $2,000 and $3,999 each month.

- 18% reported spending more than $3,999 per month.

Recently, more retirees have been able to afford the average monthly cost of retirement. Although the monthly living expenses in retirement were less than $2,000.00 for the 2042 retirees, in 202022 that number rose to 2048.

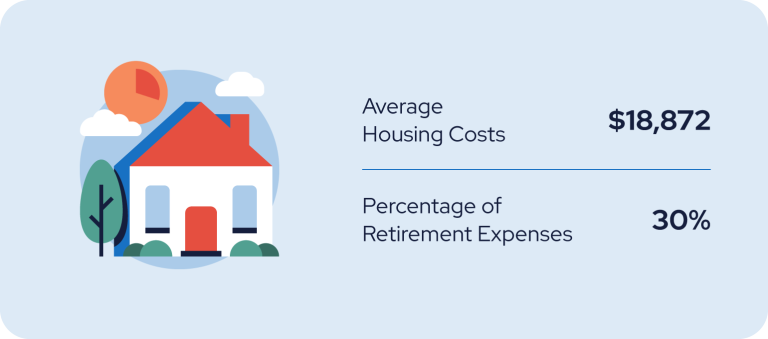

Although approximately 80% of individuals aged 65 and above own their homes, nearly one-third of monthly expenses for retirees is allocated towards housing.

The average housing expense for those 65 and older in 2021 was $18,872. Below is a breakdown of their different housing costs.

| Housing Expense | Average Spending |

|---|---|

| Owned Dwellings | $6,864 |

| Rented Dwellings | $2,759 |

| Other Types of Lodging | $763 |

| Housing Supplies | $820 |

| Household Operations | $1,442 |

| House Furnishings and Equipment | $2,303 |

- In 2021, individuals 65 years of age and above spent $3,921 on fuel, utilities, and public services on average.

- According to reports, housing costs grew at the fastest rate among seniors in 2020–21.

In 2021, housing costs grew at the quickest rate for nearly a quarter of seniors; however, that year also saw the peak of housing appreciation, reaching an all-time high of 17. 8%. Given that housing appreciation was only 5% in 2020–23, it is likely that housing expenses are rising at an accelerated rate today.

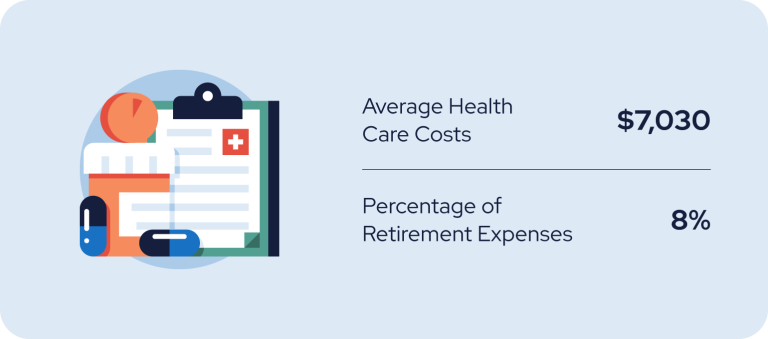

One of the most crucial budgetary categories you must account for is health care expenses. Having the appropriate retirement savings plan will guarantee that you can afford the essential health insurance.

- The average amount of money that retirees reported spending each month was allocated to out-of-pocket medical costs (5%) and medical and health insurance (8%) in 2020–2022.

- In 202021, 65% of adults aged 65 and above reported paying more than $2,000 for medical expenses out of pocket.

- The baseline monthly premium for Medicare Part B is $164. 90 in 2023.

- In 2021, the average amount spent on health care by those 65 and older was $7,030.

- Medical expenses were the expense that grew the fastest among seniors in 202021, according to reports.

You might wind up spending more than 10% of your yearly income overall on medical expenses and insurance.

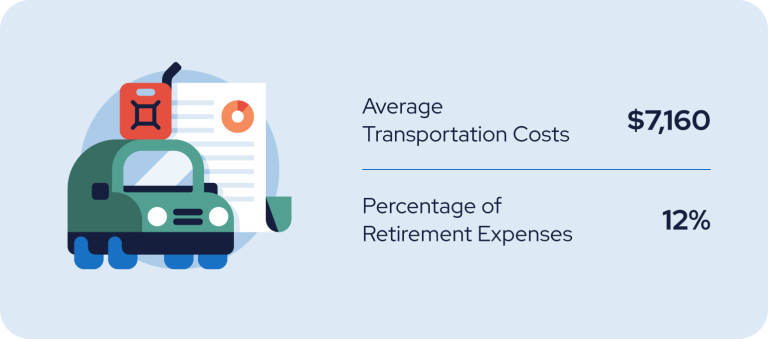

While fewer retirees are licensed to drive than younger individuals, many continue to spend a considerable amount on transportation costs in their golden years. In fact, according to the Federal Highway Administration, in 2020, there were about 31 million licensed drivers ages 70 and older.

In 2021, the average amount spent on transportation by those 65 and over was $7,160. Below is a full breakdown of transportation expenses.

| Transportation Expense | Average Spending |

|---|---|

| Vehicle Purchases | $2,777 |

| Vehicle Purchases | $1,396 |

| Other Vehicle Expenses | $2,707 |

| Public Transportation | $279 |

- On average, retirees stated that in 2020–2022, 12% of their monthly income was allocated to transportation costs.

- Transportation costs were stated by 7% of seniors in 202021 to be the expense that was growing the fastest.

Studies indicate that mobility restrictions have an impact on more than 335 percent of people aged 2070 and above. Setting aside money for accessible transportation services is a smart idea if you want to maintain your social life as you get older.

In 2021, the most frequently reported and fastest-growing expense among seniors was food. About 2030% of the average food budget for people 65 and older was spent on eating out, while %2073% of the budget was spent on food consumed at home.

Generally speaking, retirees stated that in 2020–2022, 25% of their monthly income was allocated to food expenses. Below is a further breakdown of food expenses.

| Food Expense | Average Spending |

|---|---|

| Food at Home | $4,497 |

| Poultry, Fish, Meat and Eggs | $936 |

| Baking Products and Cereal | $594 |

| Dairy Products | $450 |

| Fruits and Vegetables | $884 |

| Other Types of Food at Home | $1,633 |

| Dining Out | $1,994 |

- Generally speaking, retirees stated that in 2020–2022, 25% of their monthly income was allocated to food expenses.

- In 2021, individuals 65 years of age and above spent $439 on alcoholic beverages on average.

- According to a survey conducted in 2019, %20of seniors surveyed said they visited a food pantry or applied for food stamps in 2020–21.

- Food expenses were the fastest-growing expense according to 444 percent of seniors in 2020–21.

Reducing the amount of time you spend eating out is one simple method to keep your food costs down during retirement. Making meals at home can help you save money for retirement and maintain better health.

Credit card debt was the most common type of debt among retirees. Even though the majority of retirees had some debt, more than 80% of them said that their debt was either easily manageable or manageable. ”.

Among retirees, 96% reported having debt in 2022. Below is a full breakdown of senior debt:

| Debt Type | Percentage of Seniors With Debt |

|---|---|

| Credit Card | 40% |

| Mortgage | 30% |

| Car Loan | 23% |

| Medical | 11% |

| Home Equity Loan | 7% |

| Student Loan Debt | 4% |

- A little over 20% of retirees reported that their debt was unmanageable or crushing at the 20%E2%80%9D%20 or 20%E2%80%9D%20level in 2020–2022.

- Of the retirees, %2046%% described their debt as 20%E2%80%9Ceasily manageable 20%E2%80%9D in 202022.

- 43% of retirees described their debt as “manageable” in 2022.

Debt can be easily accumulated but challenging to repay. If your amount of debt is overwhelming you, think about reviewing your spending plan, signing up for a debt management program, or delaying retirement until you have more financial stability.

Other notable retirement expenses include entertainment and clothing. On average, the former requires 8% of a retiree’s monthly budget (E2%80%99), while the latter requires 7%.

- In 2021, the average amount spent by individuals 65 and older on pensions and personal insurance was $2,850.

- In 2021, the average amount spent on entertainment by those 65 and over was $2,889

- On average, retirees stated that in 2020–2022, 8% of their monthly income was allocated to entertainment expenses.

- In 2021, those over 65 spent $986 on clothing and services on average.

- On average, retirees stated that in 2020–2022, 7% of their monthly income was allocated to clothing expenses.

- In 2021, individuals 65 years of age and above spent $138 on reading materials on average.

- In 2021, individuals 65 years of age and above spent $280 on education on average.

Education doesn’t cost as much as housing or food, but if you intend to contribute to your grandchildren’s education in part, it will have a big impact on your budget. To help position your grandchildren for future success, think about contributing to a Roth IRA for them.