As of the time of writing, Fisher managed over $205 billion in assets and provided services to over 135,000 individuals, businesses, and employees worldwide.

But is Fisher Investments worth the fees? Is it the right financial management company for you?

Here are three things to think about before selecting a financial advisor, along with all the information you require about Fisher Investments and how to determine if it’s the best firm for you.

How many clients does Fisher Investments have?

As of March 31, 2024, Fisher Investments manages over $265 billion for clients globally, serving over 150,000 clients across various segments. This includes:

- Private investors: Individuals and families seeking personalized wealth management solutions.

- Institutional investors: Pension funds, endowments, foundations, and other large organizations.

- Small- to mid-sized business retirement plans: 401(k) and other retirement plans for businesses.

What services does Fisher Investments offer?

Fisher Investments offers a range of services tailored to different client needs:

- Personal Wealth Management: Personalized investment portfolios designed to meet individual financial goals.

- Institutional Investing: Investment management solutions for institutional clients, including customized strategies and access to global markets.

- Business 401(k) Services: Comprehensive retirement plan solutions for small and mid-sized businesses.

What is Fisher Investments’ investment philosophy?

Fisher Investments’ investment philosophy is based on the belief that markets are efficient and that long-term investing is the key to achieving financial goals. The firm utilizes a top-down investment process, focusing on macroeconomic trends and global events to identify investment opportunities.

What are the fees associated with Fisher Investments?

Fisher Investments charges a fee-based structure, typically ranging from 1% to 1.5% of assets under management. The exact fee depends on the size of the account and the services provided.

What are the pros and cons of using Fisher Investments?

Pros:

- Experienced and reputable: Fisher Investments has been in business for over 40 years and has a strong track record.

- Personalized service: Clients receive dedicated investment counselors and personalized portfolio management.

- Global reach: Fisher Investments has offices in multiple countries and serves clients worldwide.

Cons:

- High fees: The fee structure is higher than the industry average.

- Limited transparency: Fisher Investments does not publicly disclose its investment strategies or performance data.

- Minimum investment requirement: Fisher Investments requires a minimum investment of $500,000 for individual accounts.

Is Fisher Investments right for you?

Whether Fisher Investments is right for you depends on your individual circumstances and financial goals. Consider the following factors:

- Investment experience: Fisher Investments may be a good fit for experienced investors who are comfortable with a hands-off approach.

- Risk tolerance: Fisher Investments’ investment philosophy emphasizes long-term growth, which may involve higher volatility in the short term.

- Investment goals: Fisher Investments can help clients achieve a variety of financial goals, such as retirement planning, wealth preservation, and estate planning.

Alternatives to Fisher Investments

If you are considering Fisher Investments, you may also want to consider the following alternatives:

- Self-directed investing: You can manage your own investments using online platforms or traditional brokerage firms.

- Robo-advisors: Robo-advisors provide automated investment management services at a lower cost than traditional advisors.

- Local financial advisors: Local financial advisors can provide personalized advice and services, but may charge higher fees.

Fisher Investments is a reputable and experienced investment management firm with a strong track record. However, the firm’s high fees and limited transparency may not be suitable for all investors. Before making a decision, it is important to carefully consider your individual circumstances and financial goals and compare Fisher Investments to other available options.

Three alternatives to Fisher Investments

Here are three recommended alternatives to Fisher Investments:

A truly honest financial advisor will tell you that there is nothing they can do for you that you cannot do on your own.

You just need two things:

- Information and a willingness to learn

- Discipline

If you have these two items, I would advise against using a financial advisor and instead learning how to manage your own finances.

You can plan and manage your own retirement with the help of a wealth of books, articles, videos, and other resources, all of which will cost you significantly less than the 1% that a financial advisor will charge.

One percent may not seem like much, but that’s $5,000 a year on a $500k portfolio; it’s important to note the much higher cost of lost compound interest. One of the most beneficial skills to acquire is managing your own finances, provided you have any interest in doing so. Check out The Barbell Investor if you’re interested in learning how I invest my money.

Regarding where to manage it, you can obtain a clear picture of your assets, returns, and net worth by using a paid or free portfolio tracker.

For instance, you can quickly manage all of your investments in one location and compile your net worth with Empowers’ complimentary Financial Dashboard:

Additionally, Empower provides a free Investment Checkup, Retirement Calculator, and other services.

Even though I strongly support online investing done on your own, there are good reasons to work with a financial advisor instead:

- Convenience: A competent financial advisor is a great investment if you don’t want to spend the time learning how to manage your money or if you don’t have any interest in doing so.

- Financial advice: It’s beneficial to get regular guidance on all aspects of your financial life, including insurance, charitable giving, estate planning, tax planning, and more, even though you can learn everything your financial advisor knows.

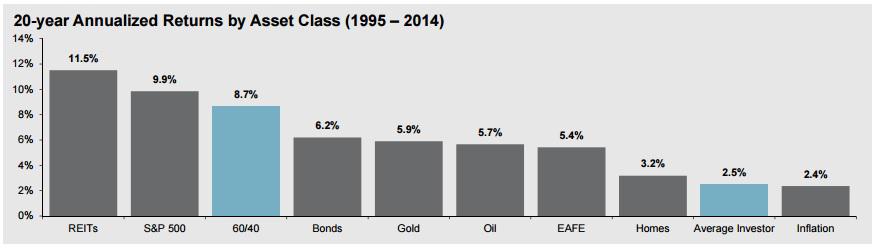

- Emotional barrier: As the chart below illustrates, most investors underperform the market because they are in the habit of switching between different assets, chasing returns, and taking profits when the market is at its lowest. The protection a financial advisor provides between you and your assets can more than offset the fees they charge.

Source: J.P. Morgan Asset Management. This chart shows that the average investor gets returns of 2.5% per year, compared to 9.9% for the S&P500.

Choose a fee-only financial advisor if you plan to use one. After meeting that criteria, find someone you like and trust. I suggest speaking with a local advisor in person, but that’s just my opinion.

Most advisors will charge fees between 0.70–1.20%.

Computer algorithms known as “robo-advisors” build portfolios according to your age, investing horizon, and long-term goals.

Generally speaking, they function as a good financial advisor for significantly lower fees, at least 85% of the time, if not much more. 25–0. 50%.

The one warning, though: You won’t get customized financial guidance regarding your particular circumstances. Although robo-advisors excel at creating investment portfolios, they are unable to provide estate or tax advice or make insurance product recommendations.

So, if youre young and dont want to manage your own money, a robo-advisor is probably the right option for you (I like Betterment). If you have a larger net worth or are nearing retirement and want to take a hands-off approach, you should probably consider using a financial advisor.

Personally, as a former financial advisor, I wouldn’t use Fisher Investments.

Any financial advisor with television advertisements uses a mass-market business model, which makes it difficult for them to provide their clients with the most individualized solutions.

I believe that most people would be better off using a robo-advisor, hiring a local financial advisor, or learning how to manage their own money using free tools like those provided by Empower.

Here are some additional queries that people have concerning Fisher.

Is Fisher Investments worth the fee?

This is a matter of opinion. Although many of Fisher’s clients are more than willing to pay the fees, which are marginally higher than the industry average, I do not personally believe it is worth it.

What Unique Insights Does Fisher Investments Provide Clients?

FAQ

How many private clients does Fisher Investments have?

Who is Fisher Investments biggest competitor?

Does Fisher Investments have a good reputation?

How many people does Fisher Investments employ?

What makes Fisher Investments unique?

Fisher Investments is notable for its tailored portfolios, high-touch customer service, and extensive educational resources. Fisher Investments serves both institutional and private clients within its 4 divisions: Institutional, US Private Client, International Private Client and 401 (k) Solutions.

How many business groups does Fisher Investments have?

Fisher Investments maintains four principal business groups: US Private Client, Institutional, Private Client International and 401 (k) Solutions, which serve a global client base of diverse investors.

How much money does Fisher Investments manage?

While Fisher Investments advises clients across a variety of portfolio sizes, the average client balance is currently $1.4 million. In total, Fisher Investments manages $192.4 billion in assets. What is the historical performance of Fisher Investments?

How do I contact Fisher Investments?

Clients should call their Investment Counselor at 800-550-1071 with questions or requests. Prospective clients can contact us using the Contact Information page. Media professionals can find important facts, figures and background information about Fisher Investments to see how we help out clients achieve their investing goals.